Solvency

Capital base

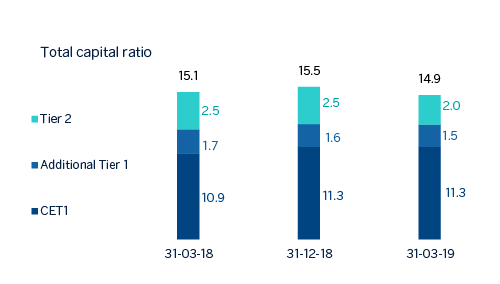

BBVA's fully-loaded CET1 ratio stood at 11.3% at the end of March 2019. This ratio includes the impact of -11 basis points for the first application of the IFRS 16 standard, which entered into force on January 1, 2019. Excluding this effect, the ratio increased by +12 basis points, supported by the recurring organic capital generation and the positive evolution of the markets.

Risk-weighted assets (RWAs) fully-loaded increased in the quarter by €12,368m, due to the implementation of IFRS 16, the evolution of foreign currencies, mainly the appreciation of the US dollar and the growth of the activity in emerging economies.

Evolution of fully-loaded capital ratios (Percentage)

Capital base (Million euros)

| CRD IV phased-in | CRD IV fully-loaded | |||||

|---|---|---|---|---|---|---|

| 31-03-19 (1) | 31-12-18 | 31-03-18 | 31-03-19 (1) | 31-12-18 | 31-03-18 | |

| Common Equity Tier 1 (CET 1) | 41,756 | 40,313 | 39,858 | 40,983 | 39,571 | 38,899 |

| Tier 1 | 47,427 | 45,947 | 45,987 | 46,511 | 45,047 | 44,795 |

| Tier 2 | 7,336 | 8,756 | 8,397 | 7,288 | 8,861 | 8,423 |

| Total Capital (Tier 1 + Tier 2) | 54,764 | 54,703 | 54,384 | 53,799 | 53,907 | 53,218 |

| Risk-weighted assets | 360.689 | 348.264 | 358.941 | 361.173 | 348.804 | 358.315 |

| CET1 (%) | 11.6 | 11.6 | 11.1 | 11.3 | 11.3 | 11.3 |

| Tier 1 (%) | 13.1 | 13.2 | 12.8 | 12.9 | 12.9 | 12.5 |

| Tier 2 (%) | 2.0 | 2.5 | 2.3 | 2.0 | 2.5 | 2.4 |

| Total capital ratio (% | 15.2 | 15.7 | 15.2 | 14.9 | 15.5 | 14.9 |

- General note: the main difference between the phased-in and fully loaded ratios arises from the temporary treatment of the impact of IFRS9, to which the BBVA Group has adhered voluntarily (in accordance with Article 473bis of the CRR).

- (1) Preliminary data.

Regarding capital issuances, BBVA S.A. conducted two capital issuances: the issuance of preferred securities that may be converted into ordinary BBVA shares (CoCos), registered in the Spanish Securities Market Commission (CNMV) for €1,000m, with an annual coupon of 6.0% and an amortization option from the fifth year; and a Tier 2 subordinated debt issue of €750m, with a maturity period of 10 years, amortization option in the fifth year, and a coupon of 2.575%. These issuances, pending receipt of ECB computability authorization, are not included in the capital ratios as of March 2019, but would have an impact of +28 basis points in Tier 1 and +21 basis points in Tier 2.

In the first quarter of 2019, the Group continued with its program to meet the minimum requirement for own funds and eligible liabilities (MREL) published in May 2018, closing the public issuance of senior non-preferred debt for a total of €1,000m. BBVA estimates that complies with the MREL requirement.

In addition, early amortization options were implemented for two issuances: the issuance of contingent convertible bond (CoCos) for €1,500m with a coupon of 7% issued in February 2014, and another Tier 2 subordinated debt issuance for €1,500m with a coupon of 3.5% issued in April 2014 and amortized in April 2019.

Regarding shareholder remuneration, on April 10, 2019, BBVA paid a final cash dividend of €0.16 per share for the fiscal year 2018, in line with the Group’s dividend policy of maintaining a pay-out ratio of 35-40% of recurring profit. During the first quarter, this final dividend does not have any impact on the solvency ratio of the Group, as it is already incorporated as of December 2018.

The phased-in CET1 ratio stood at 11.6% as of March 31, 2019, taking into account the impact of the IFRS 9 standard. Tier 1 capital stood at 13.1% and Tier 2 at 2.0%, resulting in a total capital ratio of 15.2%.

These levels are above the requirements established by the supervisor in its SREP letter, applicable in 2019. Since March 1, 2019, at a consolidated level, this requirement has been established at 9.26% for the CET1 ratio and 12.76% for the total capital ratio. Its variation compared to 2018 is explained by the end of the transitional period for implementation of capital conservation buffers and the capital buffer applicable to Other Systemically Important Institutions, as well as the progression of the countercyclical capital buffer. For its part, the CET1 of Pillar 2 (P2R) requirement remains unchanged at 1.5%.

Finally, the Group's leverage ratio maintained a solid position, at 6.4% fully-loaded (6.6% phased-in), which is still the highest among its peer group.

Ratings

At present, all agencies assign to BBVA a category “A” rating, with no variation in the first three months of 2019. These ratings are detailed in the following table:

Ratings

| Rating agency | Long term | Short term | Outlook |

|---|---|---|---|

| DBRS | A (high) | R-1 (middle) | Stable |

| Fitch | A- | F-2 | Negative |

| Moody’s (1) | A3 | P-2 | Stable |

| Scope Ratings | A+ | S-1+ | Stable |

| Standard & Poor’s | A- | A-2 | Negative |

- (1) Additionally, Moody’s assigns an A2 rating to BBVA’s long term deposits.