Risk management

Credit risk

BBVA Group's risk metrics show the following evolution in the first quarter of 2019:

- Credit risk increased by 1.2% in the quarter at current exchange rates (up 0.6% at constant exchange rates), with generalized growth in all areas except Turkey, which remains flat, impacted by the exchange rate evolution (up 2.1% at constant rates). The United States, which was positively impacted by the dollar evolution, grew 1.0% at current exchange rates and contracted 0.9% at constant exchange rates.

- Balance of non-performing loans registered a decrease of 11.4% year-on-year, although they increased by 1.2% in the quarter (0.6% in constant terms). Good performance in Spain during the first quarter (down 2.8%) which does not offset the increase of NPLs in other areas, especially the United States and Turkey.

- The NPL ratio stood at 3.9% as of March 31, 2019, stable with respect to the ratio registered at the end of December 2018. However, it decreased by 47 basis points compared to the end of March 2018.

- Loan-loss provisions increased by 2.6% in the quarter (2.4% at constant exchange rates).

- The NPL coverage ratio stood at 74% at the end of the quarter, an improvement of 97 basis points in the first three months of 2019 and 142 basis points higher than the end of March 2018.

- The accumulated cost of risk as of March 31, 2019 was 1.06%, which is a slight increase of 5 basis points compared to the end of 2018.

Non-performing loans and provisions (Millions of euros)

Credit risk (1) (Millions of euros)

| 31-03-19 | 31-12-18 | 30-09-18 | 30-06-18 (2) | 31-03-18 (2) | |

|---|---|---|---|---|---|

| Credit risks | 439,152 | 433,799 | 428,318 | 451,587 | 442,446 |

| Non-performing loans | 17,297 | 17,087 | 17,693 | 19,654 | 19,516 |

| Provisions | 12,814 | 12,493 | 12,890 | 13,954 | 14,180 |

| NPL ratio (%) | 3.9 | 3.9 | 4.1 | 4.4 | 4.4 |

| NPL coverage ratio (%) | 74 | 73 | 73 | 71 | 73 |

- (1) Include gross loans and advances to customers plus guarantees given.

- (2) Figures without considering the classification of non-current assets held for sale.

Non-performing loans evolution (Millons of euros)

| 1Q 19 (1) | 4Q 18 | 3Q 18 | 2Q 18 (2) | 1Q 18 (2) | |

|---|---|---|---|---|---|

| Beginning balance | 17,087 | 17,693 | 19,654 | 19,516 | 20,492 |

| Entries | 2,342 | 3,019 | 2,168 | 2,596 | 2,060 |

| Recoveries | (1,408) | (1,560) | (1,946) | (1,655) | (1,748) |

| Net variation | 934 | 1,459 | 222 | 942 | 311 |

| Write-offs | (769) | (1,693) | (1,606) | (863) | (923) |

| Exchange rate differences and other | 45 | (372) | (576) | 59 | (365) |

| Period-end balance | 17,297 | 17,087 | 17,693 | 19,654 | 19,516 |

| Memorandum item: | |||||

| Non-performing loans | 16,559 | 16,348 | 17,045 | 18,627 | 18,569 |

| Non performing guarantees given | 738 | 739 | 649 | 1,027 | 947 |

- (1) Preliminary data.

- (2) Figures without considering the classification of non-current assets held for sale.

Structural risks

Liquidity and funding

Management of liquidity and funding in BBVA aims to finance the recurring growth of the banking business at suitable maturities and costs, using a wide range of instruments that provide access to a large number of alternative sources of financing, always in compliance with current regulatory requirements.

Due to its subsidiary-based management model, BBVA is one of the few major European banks that follows the Multiple Point of Entry (MPE) resolution strategy: the parent company sets the liquidity and risk policies, but the subsidiaries are self-sufficient and responsible for managing their own liquidity (taking deposits or accessing the market with their own rating), without fund transfer or financing occurring between either the parent company and the subsidiaries, or between different subsidiaries. This strategy limits the spread of a liquidity crisis among the Group's different areas, and ensures that the cost of liquidity and financing is correctly reflected in the price formation process.

The financial soundness of the Group's banks continues to be based on the funding of lending activity, fundamentally through the use of stable customer funds. During the first quarter of 2019, liquidity conditions remained comfortable across all countries in which the BBVA Group operates:

- In the Eurozone, the liquidity situation remains comfortable, and the credit gap was stable throughout the first quarter.

- In the United States, the liquidity situation is adequate. The credit gap decreased in the quarter, due mainly to the increase in deposits as a result of the deposit growth campaigns launched and seasonal fluctuations in the first quarter of the year.

- In Mexico, a solid liquidity position has been maintained. The credit gap increased slightly in the first quarter of the year, affected by the seasonal outflow of deposits, while the loan portfolio remained virtually flat in the quarter.

- In Turkey, positive liquidity situation, with an adequate buffer against a possible liquidity stress scenario. The overall credit gap remained virtually flat, with the larger gap in Turkish lira due to the increase in loans being offset by a reduction in the credit gap in foreign currency, due to an increase in deposits.

- In South America, the liquidity situation remains comfortable throughout the region. In Argentina, despite market volatility, the liquidity situation remains adequate.

The BBVA Group’s liquidity coverage ratio (LCR) remained comfortably above 100% throughout the first quarter of 2019, and stood at 127% as of March 31, 2019. All subsidiaries remained comfortably above 100% (Eurozone, 144%; Mexico, 151%; Turkey, 208%; and the United States, 145%). For the calculation of the ratio, it is assumed that there is no transfer of liquidity among subsidiaries; i.e. no kind of excess liquidity levels in foreign subsidiaries are considered in the calculation of the consolidated ratio. When considering these excess liquidity levels, the ratio would stand at 155% (28 percentage points above 127%).

Wholesale financing markets in which the Group operates remained stable, even in the case of Turkey, where the higher volatility at the end of March due to the local elections did not affect its financing.

The main transactions carried out by the entities of the BBVA Group during the first quarter of 2019 were as follows:

- BBVA S.A. issued senior non-preferred debt for €1 billion, with a fixed-rate coupon of 1.125% over a five-year period; an issue of preferred securities which may be converted into ordinary BBVA shares (CoCos), registered in the Spanish Securities Market Commission (CNMV) for €1 billion, with an annual coupon of 6.0% and an amortization option from the fifth year; and a Tier 2 subordinated debt issue for €750m, with a maturity period of 10 years, amortization option in the fifth year and a coupon of 2.575%.

- In addition, early amortization options have been implemented for the issue of CoCos for €1.5 billion with a coupon of 7% issued in February 2014, and another for Tier 2 subordinated debt for €1.5 billion with a 3.5% coupon issued in April 2014 and amortized in April 2019.

- In Turkey, Garanti issued a five-year Diversified Payment Rights (DPR) for US$150m.

- Finally, BBVA in Argentina issued negotiable instruments on the local market for an amount equivalent to €33m, while in Chile, Forum issued a bond on the local market for an amount equivalent to €108m.

Foreign exchange

Foreign-exchange risk management of BBVA’s long-term investments, principally stemming from its overseas franchises, aims to preserve the Group's adequacy capital ratios and to ensure the stability of its income statement.

In the first quarter of 2019, the Turkish lira (down 4.5%) and the Argentine peso (down 11.6%) depreciated against the euro, while the Mexican peso (up 3.7%) and the US dollar (up 1.9%) appreciated compared to the end of 2018. BBVA has maintained its policy of actively hedging its main investments in emerging markets, covering on average between 30% and 50% of annual earnings and around 70% of the CET1 capital ratio excess. Based on this policy, the sensitivity of the CET1 ratio to the depreciation of 10% against the euro by the main emerging-market currencies stood at -3 basis points for the Mexican peso and -2 basis points for the Turkish lira. In the case of the US dollar, the sensitivity is approximately +11 basis points to a depreciation of 10% against the euro, as a result of RWAs denominated in US dollars outside the United States. At the end of March 2019, the coverage level for expected earnings in 2019 stood at 75% for Mexico and 30% for Turkey.

Interest rates

The aim of managing interest-rate risk is to maintain sustained growth of net interest income in the short- and medium-term, irrespective of interest rate fluctuations, while controlling the impact on capital through the valuation of the portfolio of financial assets at fair value through profit or loss.

The Group's banks maintain fixed-income portfolios to manage their balance sheet structure. In the first quarter of 2019, the results of this management were satisfactory, with limited risk strategies maintained in all the Group's banks.

In Turkey, there was an increase in market volatility prior to the local elections held on March 31, which led the Central Bank of the Republic of Turkey (CBRT) to raise the cost of financing to stabilize the Turkish lira. However, this did not have any impact on the balance sheet structure. In this context, the management of the customer spread was very positive, thanks to the efforts made to reduce the cost of funding, which enabled good net interest income growth in the quarter, despite a lower contribution of inflation-linked bonds compared to previous quarters.

Finally, with regard to the monetary policies pursued by central banks in the main countries where BBVA operates, in the first quarter of 2019, it should be noted that:

- The interest rate of 0% and deposit facility rate of -0.40% were maintained in the Eurozone. The ECB indicated at its meeting in March that it would delay rate increases until at least December 2019, lowering its growth and inflation forecasts for the year. In addition, it announced a new round of liquidity injections (TLDRO III) starting from September.

- In the United States, the Fed decided to pause the normalization process in the face of increased downside risks, mainly due to the weakness of the global economy, and the absence of inflationary pressures, keeping interest rates stable at 2.5% at its March meeting.

- In Mexico, Banxico decided to maintain its monetary policy rate at 8.25%, considering that this position is consistent with meeting its target inflation rate.

- In Turkey, the Central Bank of the Republic of Turkey (CBRT) maintained rates at 24.00% during the first quarter, raising the average cost of financing to 25.50% at the end of March to stabilize the Turkish lira, before returning to 24.00% at the beginning of April.

- In South America, the monetary authorities of Colombia and Peru maintained their respective reference rates during the quarter the same as at the end of 2018, while in Argentina, interest rates rose to 68.16% at the end of the quarter, with the aim of avoiding an increase in the monetary base and halting the rise in inflation.

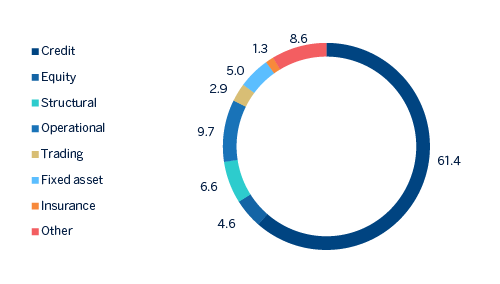

Economic capital

Economic risk capital (ERC) consumption at the end of February 2019, in consolidated terms, stood at €28,722 million, a decrease of 7.9% compared to the end of December 2018 (down 8.4% at constant exchange rates). This decrease is mainly focused on eliminating ERC consumption through goodwill and equity, as this will be considered a deduction of assets used in the calculation of the Group’s solvency.

Consolidated economic risk capital breakdown

(Percentage. Feb 19)