Solvency

Capital base

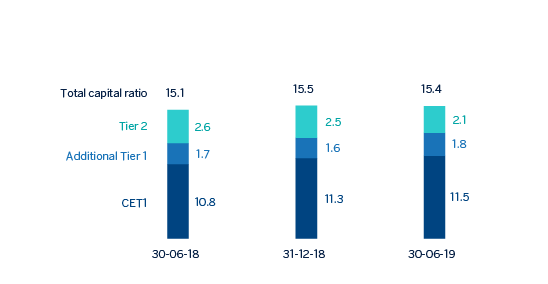

BBVA's fully-loaded CET1 ratio stood at 11.5% as of the end of June 2019, increasing by 17 basis points in the first half of the year, supported by recurring organic capital generation and strong market performance.

Risk-weighted assets (RWAs) increased by more than €11,700m in the first half of the year, as a result of activity growth mainly in emerging markets, the incorporation of regulatory impacts of (IFRS 16 implementation and TRIM - Targeted Review of Internal Models) worth approximately €7,300m (-24 basis points in the CET1 ratio), and a decrease of approximately €1,500m in RWAs (+5 basis points in the CET1 ratio) due to the recognition by the European Commission of Argentina as an equivalent country for the purposes of supervisory and regulatory requirements1.

1 On April 1, 2019, the Official Journal of the European Union published Commission Implementing Decision (EU) 2019/536, which includes Argentina within the list of third countries and territories whose supervisory and regulatory requirements are considered equivalent for the purposes of the treatment of exposures in accordance with Regulation (EU) No 575/2013.

Fully-loaded capital ratios (Percentage)

Capital base (Millions of euros)

| CRD IV phased-in | CRD IV fully-loaded | |||||

|---|---|---|---|---|---|---|

| 30-06-19 (1) (2) | 31-12-18 | 30-06-18 | 30-06-19 (1) (2) | 31-12-18 | 30-06-18 | |

| Common Equity Tier 1 (CET 1) | 42,328 | 40,313 | 39,550 | 41,519 | 39,571 | 38,746 |

| Tier 1 | 48,997 | 45,947 | 45,717 | 48,047 | 45,047 | 44,685 |

| Tier 2 | 7,944 | 8,756 | 9,241 | 7,514 | 8,861 | 9,263 |

| Total Capital (Tier 1 + Tier 2) | 56,941 | 54,703 | 54,958 | 55,561 | 53,907 | 53,947 |

| Risk-weighted assets | 360,069 | 348,264 | 356,887 | 360,563 | 348,804 | 357,107 |

| CET1 (%) | 11.8 | 11.6 | 11.1 | 11.5 | 11.3 | 10.8 |

| Tier 1 (%) | 13.6 | 13.2 | 12.8 | 13.3 | 12.9 | 12.5 |

| Tier 2 (%) | 2.2 | 2.5 | 2.6 | 2.1 | 2.5 | 2.6 |

| Total capital ratio (%) | 15.8 | 15.7 | 15.4 | 15.4 | 15.5 | 15.1 |

- (1) As of June 30, 2019, the difference between the phased-in and fully-loaded ratios arises from the temporary treatment of certain capital items, mainly of the impact of IFRS9, to which the BBVA Group has adhered voluntarily (in accordance with article 473bis of the CRR).

- (2) Provisional data.

In terms of capital issuances, BBVA S.A. conducted two public capital issuances: the issuance of preferred securities that may be converted into ordinary BBVA shares (CoCos), registered with the Spanish Securities Market Commission (CNMV) for an amount of €1,000m, at an annual coupon of 6.0% and with an amortization option after five years of being issued; ; and an issuance of Tier 2 subordinated debt for an amount of €750m, with a 10-year maturity and an amortization option in the fifth year and a coupon of 2.575%2. In the first half of 2019, the Group continued its funding program to meet the MREL (minimum requirement for own funds and eligible liabilities) requirement published in May 2018, by closing two public issuances of senior non-preferred debt for a total amount of €2,000m, one of them of €1,000m in the form of a green bond.

Additionally, the early amortization options on three issuances were exercised: one of CoCos, for €1,500m with a 7% coupon issued in February 2014; another issuance of Tier 2 subordinated debt, for €1,500m with a coupon of 3.5% issued in April 2014 and amortized in April 2019; and another Tier 2 security issued in June 2009 by Caixa d'Estalvis de Sabadell with an outstanding nominal amount of €4,878,000, amortized in June 2019.

Regarding shareholder remuneration, on April 10, 2019, BBVA paid a supplementary gross cash dividend for the financial year 2018 of €0.16 per share, in line with the Group's dividend policy of maintaining a pay-out ratio of 35-40% of recurring profit. This supplementary dividend does not have any impact on the Group's solvency ratio during the first half of the year, as it was already incorporated on December 2018.

The phased-in CET1 ratio stood at 11.8% as of June 30, 2019, taking into account the effect of IFRS 9. Tier 1 stood at 13.6% and Tier 2 at 2.2%, resulting in a total capital ratio of 15.8%.

These levels are above the requirements established by the supervisor in its SREP letter (Supervisory Review and Evaluation Process), applicable in 2019. Since March 1, 2019, at the consolidated level, this requirement has been established at 9.26% for the CET1 ratio and 12.76% for the total capital ratio. Its variation compared to 2018 is explained by the end of the transitional period for the implementation of the capital conservation buffer and the capital buffer applicable to Other Systemically Important Institutions, as well as the progression of the countercyclical capital buffer. For its part, the CET1 Pillar 2 requirement (P2R) remains unchanged at 1.5%.

Finally, the Group's maintained a solid leverage ratio of 6.6% fully-loaded (6.7% phased-in), the highest among its peer group.

2 Royal Decree 309/2019, of April 26, which partially implements Law 5/2019, of March 15, regulating real estate loan agreements and adopting other financial measures, excludes in Spain the obligation for prior approval of the supervisor for additional tier 1 capital and tier 2 capital instruments.

Ratings

During the first six months of the year, Moody's, S&P, DBRS and Scope confirmed BBVA's senior preferred debt (A3, A-, A (high) and A+, respectively) rating. Fitch increased this rating by a notch in July 2019, considering that BBVA's loss-absorbing capital buffers (such as senior non-preferred debt) are sufficient to materially reduce the risk of default. In these actions, the agencies highlighted the Group's diversification and self-sufficient franchise model, with subsidiaries responsible for managing their own liquidity. These ratings, together with their outlook, are detailed in the table below:

Ratings

| Rating agency | Long term (1) | Short term | Outlook |

|---|---|---|---|

| DBRS | A (high) | R-1 (middle) | Stable |

| Fitch | A | F-1 | Negative |

| Moody’s | A3 | P-2 | Stable |

| Scope Ratings | A+ | S-1+ | Stable |

| Standard & Poor’s | A- | A-2 | Negative |

- (1) Ratings assigned to long term senior preferred debt. Additionally, Moody’s and Fitch assign A2 and A rating respectively, to BBVA’s long term deposits.