Relevant events

Results

- In the first half of 2019, the overall growth in recurring revenue items is maintained, with a positive evolution in terms of net interest income in most business areas.

- The trend of containing operating expenses and improving the efficiency ratio compared to the same period of the previous year continues.

- As a result of the above, operating income increased 2.5% year-on-year.

- Impairment on financial assets increased 10.6% year-on-year as a result of the higher loan-loss provisions due to the deterioration of specific portfolios and the update of macroeconomic scenarios in the United States, Mexico and Turkey, especially in the first quarter of the year. The second quarter registered one of the lowest levels of impairment in recent years, thanks to lower needs in Spain, including the positive impact of the sale of non-performing and written-off loan portfolios.

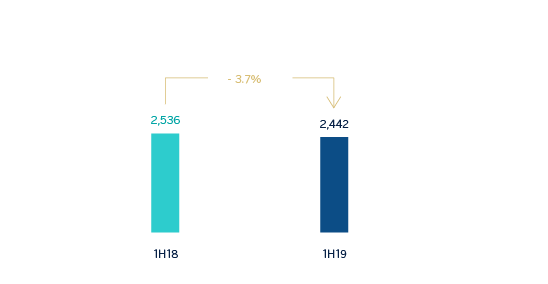

- Finally, the net attributable profit stood at €2,442m, a 3.7% lower than in the same period of 2018, but increased 9.8% in the second quarter of 2019 compared to the first quarter of the year.

Net attributable profit (Millions of euros)

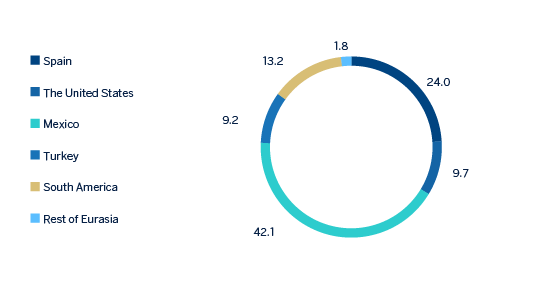

Net attributable profit breakdown (1) (Percentage. 1H19)

(1) Excludes the Corporate Center.

Balance sheet and business activity

- As of June 30, 2019, loans and advances to customers (gross) grew 0.8% compared to December 31, 2018, with improved levels of activity in all business areas.

- Strong performance of customer funds (up 1.0% compared to December 31, 2018). Noteworthy is the strong performance of demand deposits, mutual funds and pension funds.

- Issuance in June of a green bond of €1,000m in a senior non-preferred debt format (the second in this category issued by BBVA).

Solvency

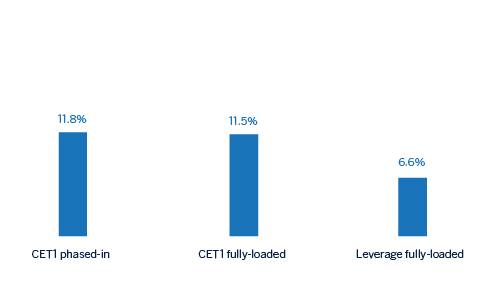

- The CET1 fully-loaded ratio reached 11.5%, up 17 basis points in the first half of the year due to recurring organic capital generation and supported by the positive evolution of the markets. Thus, this ratio is positioned within the range of this capital target defined for the Group.

Capital and leverage ratios (Percentage as of 30-06-19)

Risk management

- Positive performance of risk metrics in the first half of 2019: non-performing loans fell by 2.2% in the first six months of the year. As of June 30, 2019, the NPL ratio stood at 3.8%, the NPL coverage ratio 75%, and the cost of risk 0.91%.

- In the second quarter of 2019, the great majority of the credits that composed the loans from a non-performing and written-off mortgages loan portfolio, with a gross amount of €1,162m, were transferred to Anfora Investing UK Limited Partnership, an entity belonging to Canada Pension Plan Investment Board, has taken place. The positive impact of this transaction in the net attributable profit was €130m, and on the fully loaded CET1 it’s slightly positive. The transfer of the remainder of the portfolio took place in mid-July, with a slightly positive result which will be accounted in the third quarter of 2019.

NPL and NPL coverage ratios (Percentage)

Transformation

- In the second quarter of 2019, the Group changed its brand name to BBVA in the countries in which it operates, discontinuing the local brand names in Argentina (Francés), the United States (Compass), Mexico (Bancomer) and Peru (Continental). The franchise in Turkey has changed its name to Garanti BBVA. As a result of this rebranding, BBVA has updated its logo and corporate identity.

- The new corporate identity reinforces BBVA's aim of offering a unique value proposition and a homogeneous customer experience which, leveraged on technology and data, will help customers manage their finances. In addition, it has a better design for the growing digital world in which BBVA operates and it’s an example of the Group's values, in particular "We are one team" value, which emphasizes the importance of its employees and their commitment to the BBVA project. The new brand also reflects the Bank's purpose: to bring the age of opportunity to everyone.

- While the new logo retains key elements already known by BBVA - especially the color and the use of capital letters- it introduces a new font and design that provides it with more versatility and functionality on digital channels and platforms.

- This change emphasises the Group's digital transformation and BBVA's commitment to offer its customers global products and services with the aim of being a global digital financial advisor, with a value proposition that helps people and companies in their real needs, lives and businesses in order to make better financial decisions.

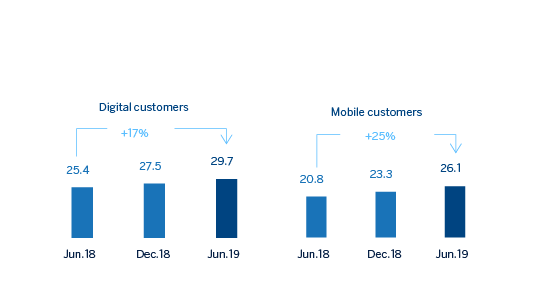

- In addition, the Group's digital and mobile customer base continues to grow, as well as its digital sales.

Digital and mobile customers (Millions)

Dividends

- On April 10, 2019, there was a gross cash payment of €0.16 per share, corresponding to the supplementary dividend for 2018 that was approved at the General Shareholders' Meeting held on March 15.

Other matters of interest

- IFRS 16 “Leases” came into effect on January 1, 2019, which requires lessees to recognize the assets and liabilities arising from the rights and obligations of lease agreements. The main impacts are the recognition of an asset through the right of use and a liability based on future payment obligations. The impact of the first implementation was €3,419m and €3,472m, respectively, resulting in a decrease of 11 basis points of the CET1 capital ratio.

- In order to ensure that the information for 2019 is comparable to that of 2018, the balance sheets, income statements and ratios of the first three quarters of 2018 financial year for the Group and the South America business area have been restated to reflect the impact of the hyperinflation in Argentina as a result of the application of IAS 29 “Financial Reporting in Hyperinflationary Economies”. This impact was first registered in the third quarter of 2018, but with accounting effects as of January 1, 2018.