Risk management

Credit risk

Positive performance of BBVA Group's risk metrics in 2019:

- Credit risk increased by 1.9% in 2019. At constant exchange rates the growth was 1.7%, where the decrease in Spain was offset by growth in the other business areas. In the fourth quarter credit risk increased 0.9% (up 2.1% at constant exchange rates) Growth was particularly strong in Spain and Mexico; and in the United States and Turkey, at constant exchange rates.

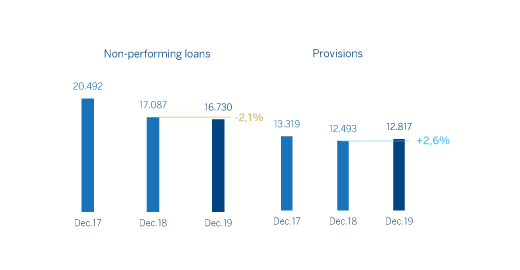

- The balance of non-performing loans fell by 2.1% in 2019 (down 2.2 at constant exchange rates), primarily due to the sale of non-performing loan portfolios in Spain, partially offsetting the growth in Turkey and, to a lesser extent, in Mexico. In the fourth quarter if fell by 2.1% (down 0.7% at constant exchange rates).

- The NPL ratio stood at 3.8% at the end of 2019 a decrease of 12 basis points compared to September and of 15 basis points in t the year.

- Loan-loss provisions increased by 3.2% in the last nine months (up 2.6% at constant exchange rates).

- The NPL coverage ratio closed at 77%, which was an improvement of 349 basis points compared to the close of 2018.

- The cumulative cost of risk stood at 1.04% at the end of 2019, in line with the end of 2018.

Non-performing loans and provisions (Millions of euros)

Credit risk (1) (Millions of euros)

| 31-12-19 (2) | 30-09-19 (2) | 30-06-19 | 31-03-19 | 31-12-18 | |

|---|---|---|---|---|---|

| Credit risk | 441,964 | 438,177 | 434,955 | 439,152 | 433,799 |

| Non-performing loans | 16,730 | 17,092 | 16,706 | 17,297 | 17,087 |

| Provisions | 12,817 | 12,891 | 12,468 | 12,814 | 12,493 |

| NPL ratio (%) | 3.8 | 3.9 | 3.8 | 3.9 | 3.9 |

| NPL coverage ratio (%) | 77 | 75 | 75 | 74 | 73 |

- (1) Include gross loans and advances to customers plus guarantees given.

- (2) Figures without considering the classification of non-current assets held for sale (NCA&L).

- (3) The NPL coverage ratio includes the valuation adjustments for credit risk during the expected residual life of those financial instruments which have been acquired (mainly originated from the acquisition of Catalunya Banc, S.A.,). Excluding these allowances, the NPL coverage ratio would stand at 74% in 2019 and 70% in 2018.

Non-performing loans evolution (Millons of euros)

| 4Q19 (1)(2) | 3Q19 (2) | 2Q19 | 1Q19 | 4Q18 | |

|---|---|---|---|---|---|

| Beginning balance | 17,092 | 16,706 | 17,297 | 17,087 | 17,693 |

| Entries | 2,484 | 2,565 | 2,458 | 2,353 | 3,019 |

| Recoveries | (1,509) | (1,425) | (1,531) | (1,409) | (1,560) |

| Net variation | 975 | 1,139 | 927 | 944 | 1,459 |

| Write-offs | (1,074) | (991) | (958) | (775) | (1,693) |

| Exchange rate differences and other | (262) | 237 | (561) | 41 | (372) |

| Period-end balance | 16,730 | 17,092 | 16,706 | 17,297 | 17,087 |

| Memorandum item: | |||||

| Non-performing loans | 15,954 | 16,337 | 15,999 | 16,559 | 16,348 |

| Non performing guarantees given | 777 | 755 | 707 | 738 | 739 |

- (1) Preliminary data.

- (2) Figures without considering the classification of non-current assets held for sale (NCA&L).

Structural risks

Liquidity and funding

Management of liquidity and funding at BBVA aims to finance the recurring growth of the banking business at suitable maturities and costs, using a wide range of instruments that provide access to a large number of alternative sources of financing, always in compliance with current regulatory requirements.

Due to its subsidiary-based management model, BBVA is one of the few major European banks that follows the Multiple Point of Entry (MPE) resolution strategy: the parent company sets the liquidity policies, but the subsidiaries are self-sufficient and responsible for managing their own liquidity, (taking deposits or accessing the market with their own rating), without fund transfers or financing occurring between either the parent company and the subsidiaries, or between the different subsidiaries. This strategy limits the spread of a liquidity crisis among the Group's different areas, and ensures that the cost of liquidity and financing is correctly reflected in the price formation process.

The financial soundness of the BBVA Group's banking companies continues to be based on the funding of lending activity, fundamentally through the use of stable customer funds. During 2019, liquidity conditions remained strong across all countries in which the BBVA Group operates:

- In the eurozone, the liquidity situation remains strong, with a slight increase in the credit gap over the course of the year. In December, BBVA participated in the second liquidity auction of the European Central Bank's long-term loan program, TLTRO III, due to its favorable conditions in terms of cost and term. In this respect, the corresponding part of the TLTRO II program was amortized.

- In the United States, the liquidity situation is sound. In 2019, there was a decrease in the credit gap, primarily due to the increase in deposits, as a result of deposit-taking campaigns and a slowdown in lending activity. It should be noted that the very short term tensions that occurred in the United States repo market during the second half of the year, which forced the Federal Reserve to act by providing liquidity, had no impact on BBVA USA due to its low dependence on this type of transaction and the maintenance of an adequate liquidity buffer.

- In Mexico, the liquidity situation remains strong, despite a slight increase in the credit gap during the year due to a higher growth in credit investment compared to deposits. The liquidity situation reflects the measures that management carried out during the year to increase deposits, especially in foreign currency, under the pressure of strong competition.

- In Turkey, a good liquidity situation is maintained, despite the wholesale financing maturities recorded during the year, with an adequate buffer in the event of a possible liquidity stress scenario. The credit gap improved during the year on both balance sheets, due to the reduction of loans versus the growth of foreign currency deposits, while in local currency, there is a higher growth of deposits compared to loan growth.

- In South America, the liquidity situation remains strong throughout the region. In Argentina, the high volatility generated in the markets during the mid-year electoral process, resulted in an outflow of US dollar deposits in the banking system. The rate of outflows, however, had been substantially contained by the end of the year, and even experienced slight inflows. In this context, BBVA Argentina successfully dealt with this situation, relying on the solid liquidity position it maintained, as shown by the adequate liquidity ratios.

The BBVA Group's liquidity coverage ratio (LCR) remained well above 100% throughout 2019 and stood at 129% as of December 31, 2019. It comfortably exceeded 100% in all subsidiaries (eurozone 147%, Mexico 147%, the United States 145% and Turkey 206%). For the calculation of this ratio, it is assumed that there is no transfer of liquidity among subsidiaries; i.e. no kind of excess liquidity levels in foreign subsidiaries are considered in the calculation of the consolidated ratio. When considering these excess liquidity levels, the BBVA Group's LCR would stand at 158% (29 percentage points above 129%).

The Net Stable Funding Ratio (NSFR), defined as the ratio between the amount of stable funding available and the amount of stable funding required, is one of the Basel Committee's essential reforms, and requires banks to maintain a stable funding profile in relation to the composition of their assets and off-balance-sheet activities. This ratio should be at least 100% at all times. At the BBVA Group, the NSFR, calculated according to the Basel requirements, remained above 100% throughout 2019 and stood at 120% as of December 31, 2019. It comfortably exceeded 100% in all subsidiaries (eurozone 113%, Mexico 130%, the United States 116% and Turkey 151%).

The wholesale financing markets in which the Group operates remained stable.

The main transactions carried out by companies that form part of the BBVA Group during 2019 were:

- BBVA, S.A. issued three senior non-preferred debt instruments. The first was a €1,000m, five year term bond with a fixed annual coupon of 1.125%, d; the second, in the form of a green bond (second after the inaugural bond issued in May 2018), also amounted to €1,000m, with an annual coupon of 1% and a seven-year term; and the third one was issued in September for €1,000m over a five-year period with a coupon of 0.375%, being the lowest coupon achieved by a senior non-preferential debt issue in Spain and the lowest paid by BBVA for senior debt (preferred and non-preferred). In November, BBVA issued a €1,000m seven-year preferred senior debt instrument with a 0.375% coupon.

- In addition, in January 2020, BBVA, S.A. issued a €1,250m seven-year senior non-preferred debt with a coupon of 0.5%; the lowest achieved by a Spanish issuer of this product with this maturity.

- In regards to capital issuances, BBVA, S.A. conducted three public capital issuances: the issuance of preferred securities that may be converted into ordinary BBVA shares (CoCos), registered with the Spanish Securities Market Commission (CNMV) for €1,000m, with an annual coupon of 6.0% and an amortization option as of the fifth year; another issuance of CoCos, registered with the SEC, for USD 1,000mn and a coupon of 6.5% with an amortization option after five and a half years; and a Tier 2 subordinated debt issuance of €750m, with a maturity period of ten years and an amortization option in the fifth year and a coupon of 2.575%.

- In January 2020, BBVA, S.A. issued €1,000m of Tier 2 subordinated debt over a ten-year period, with an option of early amortization in the fifth year, and a coupon of 1%.

- In addition, during 2019 the early amortization option of the CoCos issuance in the amount of €1,500m with a coupon of 7% and issued in February 2014, was executed, and in February 2020, the amortization of the €1,500m CoCos issued in February 2015 with a coupon of 6.75%, was announced; a Tier 2 subordinated debt issuance for €1,500m with a coupon of 3.5% and issued in April 2014, was also amortized. In June 2019, BBVA, S.A., as the universal successor to Unnim Banc, S.A.U., exercised the early amortization of the issuance of subordinated bonds, originally issued by Caixa d'Estalvis de Sabadell, for an outstanding nominal amount of €4,878,000.

- In the United States, BBVA USA, during the third quarter of the year, issued USD 600 million senior bond with a five-year maturity and 2.5% coupon. The purpose of this issuance was to renew a maturity of the same amount.

- In Mexico, a €471m senior debt instrument was issued in the second quarter of the year in the local market in two tranches: €236m three year maturity at a rate of TIIE +28 basis points and a €236m 8 years maturity referenced to Mbono +80 basis points, obtaining the lowest funding cost in the history of the local market in both maturities. In the third quarter, a Tier 2 issuance was executed in the amount of USD 750 million, with a maturity of 15 years, with an early amortization option in the tenth year and a coupon of 5.875%. The funds obtained were used to carry out a partial repurchase of two subordinated issuances that were no longer being calculated in capital (USD 250 million with maturity in 2020 and USD 500 million with maturity in 2021).

- In Turkey, Garanti BBVA, in the first quarter of the year, issued a Diversified Payment Rights (DPR) securitization for USD 150 million with a five year maturity. It also renewed syndicated loans for USD 784m in the first half of the year and USD 800m in the second half of the year. Garanti obtained financing for an amount of USD 322m through a bilateral loan and issued a USD 50m green bond in December. Additional bilateral funds for USD 110m were also signed in December 2019.

- In South America, during 2019, BBVA Peru issued an equivalent amount of €116m, of which, €66m were issued during the last quarter of the year. While BBVA Argentina issued marketable bonds on the local market for approximately €53m (€29m in the last quarter of the year, after the change of government). In Chile, Forum issued a bond on the local market for an amount equivalent to €107m in the first half of 2019.

Foreign exchange

Foreign exchange risk management of BBVA's long-term investments, principally stemming from its overseas franchises, aims to preserve the Group's capital adequacy ratios and ensure the stability of its income statement.

In 2019, the Argentine peso (-36%) and the Turkish lira (-9%) depreciated against the euro, while the Mexican peso (+6%) and the US dollar (+2%) appreciated on a year-on-year basis.. BBVA has maintained its policy of actively hedging its main investments in emerging markets, covering on average between 30% and 50% of the annual earnings and around 70% of the excess CET1 capital ratio. Based on this policy, the sensitivity of the CET1 ratio to a depreciation of 10% against the euro of the main emerging-market currencies stood at -4 basis points for the Mexican peso and -2 basis points for the Turkish lira. In the case of the US dollar, the sensitivity to a depreciation of 10% against the euro is approximately +11 basis points, as a result of RWAs denominated in US dollars outside the United States. The coverage level for the expected earnings for 2020 is currently 24% for Mexico and 20% for Turkey.

Interest rate

The aim of managing interest-rate risk is to limit the sensitivity of the balance sheets to interest rate fluctuations. BBVA carries out this work through an internal procedure following the guidelines established by the European Banking Authority (EBA), which measures the sensitivity of net interest income and economic value to determine the potential impact of a range of scenarios on the Group's different balance sheets.

The model is based on assumptions intended to realistically mimic the behavior of the balance sheet. Of particular relevance are assumptions regarding the behavior of accounts with no explicit maturity and prepayment estimates. These assumptions are reviewed and adapted at least once a year to take into account any changes in behavior.

BBVA maintains, at the aggregate level, a favorable position in net interest income in the event of an increase in interest rates, as well as a moderate risk profile, in line with its target, through effective management of structural balance sheet risk.

By area, the main aspects of the balance sheets are:

- Spain and the United States have balance sheets characterized by a high proportion of variable-rate loans in the loan portfolio (basically, mortgages in Spain and corporate lending in both countries) and liability composed mainly of customer deposits. The ALCO portfolios act as hedges for the bank's balance sheet, mitigating its sensitivity to interest rate fluctuations. The profile of both balances remained stable during 2019, with a moderate reduction in the sensitivity of net interest income to lower interest rates in the two business areas.

- In Mexico, the balance shown throughout 2019 between the balances referenced at the fixed and variable interest rates was maintained. In terms of the assets most sensitive to interest rate fluctuations, the corporate portfolio stands out, while consumer loans and mortgages are mostly at a fixed rate. The ALCO portfolio is used to neutralize the longer duration of customer deposits. The sensitivity of the interest margin remained limited and stable during 2019.

- In Turkey, the interest rate risk (between the Turkish lira and US dollars) was very limited: on the asset side, the sensitivity of loans, mostly fixed-rate but with relatively short maturities and the ALCO portfolio, including inflation-linked bonds, is balanced by the sensitivity of deposits, which are re-priced in the short term, in liabilities. The evolution of the currency balance sheets was positive in the year, showing a reduction in the sensitivity of the net interest income.

- In South America, the interest rate risk remained low due to the fixed/variable composition and maturities being very similar for assets and liabilities in most countries in the region. In addition, in balance sheets with several currencies, interest rate risk is managed for each of the currencies, showing a very low level of risk. Balance sheet profiles in the countries that make up this business area remain stable, maintaining a bounded and near-constant net interest income sensitivity throughout 2019.

Economic capital

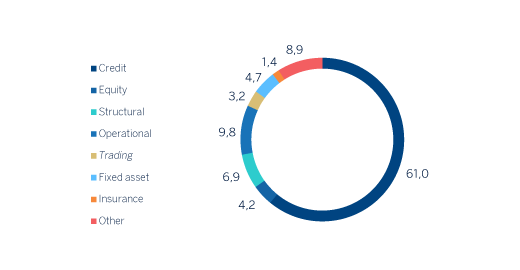

Economic risk capital (ERC) consumption, in consolidated terms, close the year 2019, at €29,918m, a decrease of 4.0% compared to the end of December 2018. The change, in the same period and at constant exchange rates was of -2.8%. This decrease was primarily due to the elimination in the ERC calculation of the goodwill, which became computed as a deduction in the economic patrimony of the Group, in line with the regulatory approach.

Consolidated economic risk capital breakdown

(Percentage. December 19)