Spain

Highlights

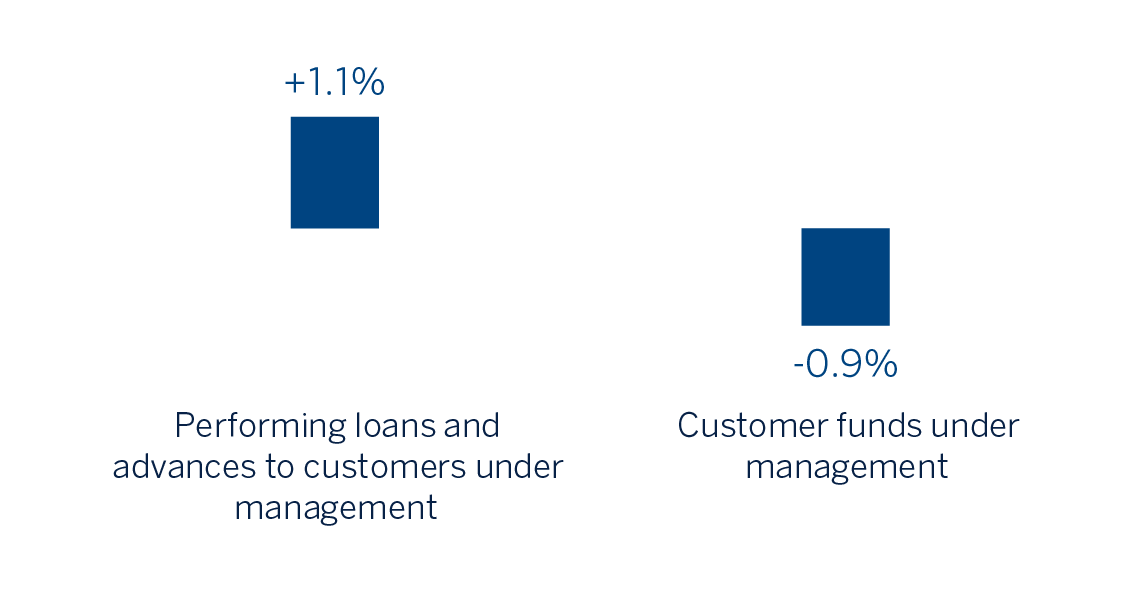

- Growth in lending activity and slight decline in customer funds.

- Improvement in the efficiency ratio and cost of risk.

- Favorable year-on-year evolution of the main margins.

- Decrease in the impairment on financial assets, compared to the first half of 2020 which was strongly affected by the pandemic.

Business activity (1)

(YEAR-TO-DATE CHANGE)

(1) Excluding repos.

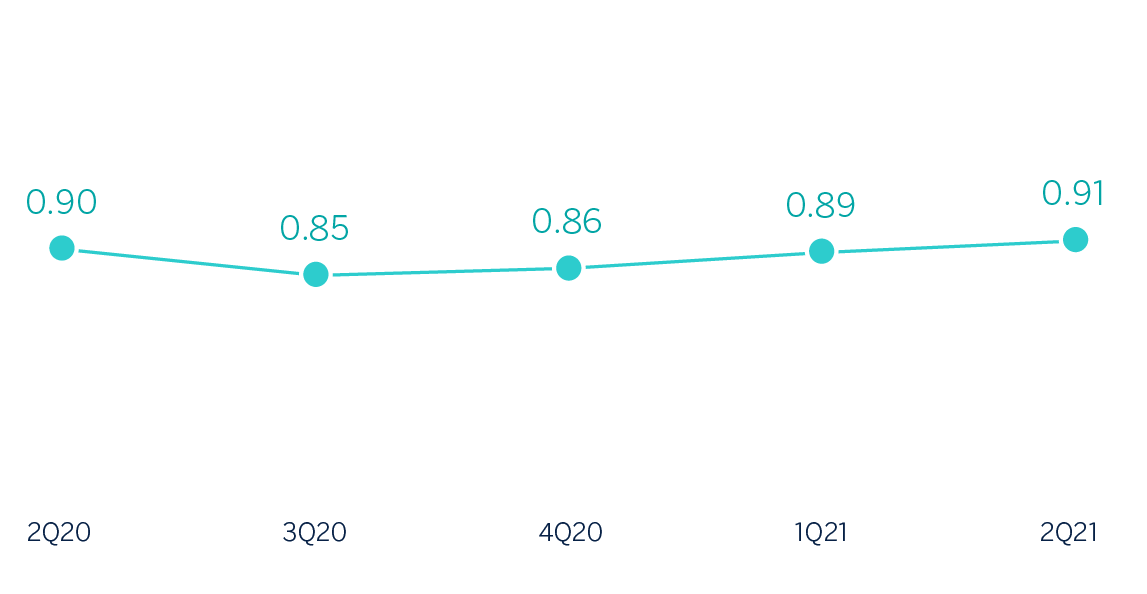

Net interest income/ATAs

(Percentage)

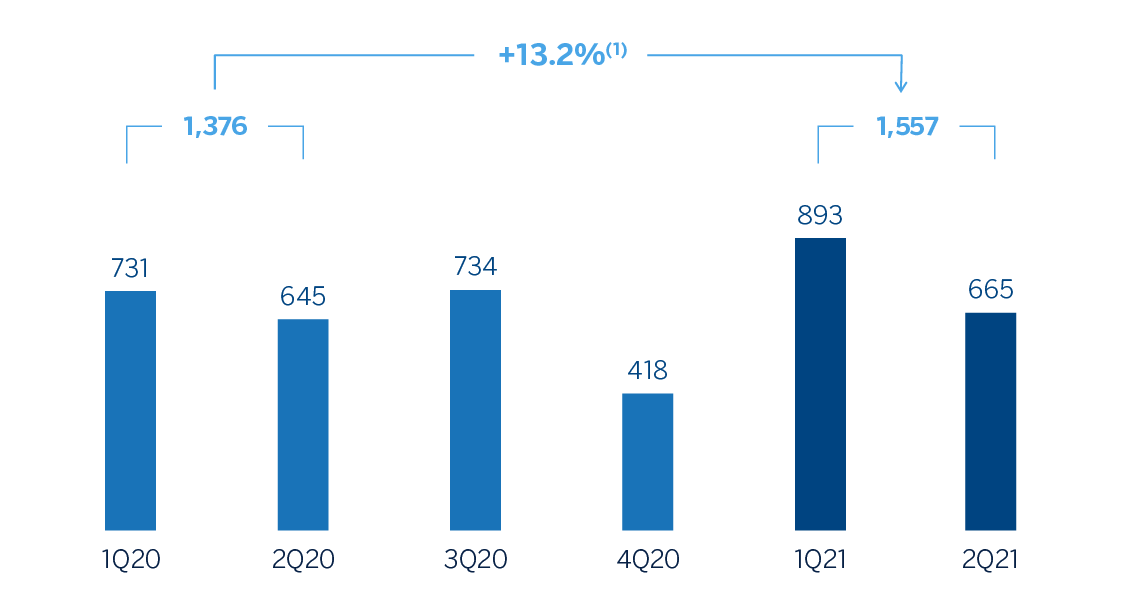

Operating income (Millions of euros)

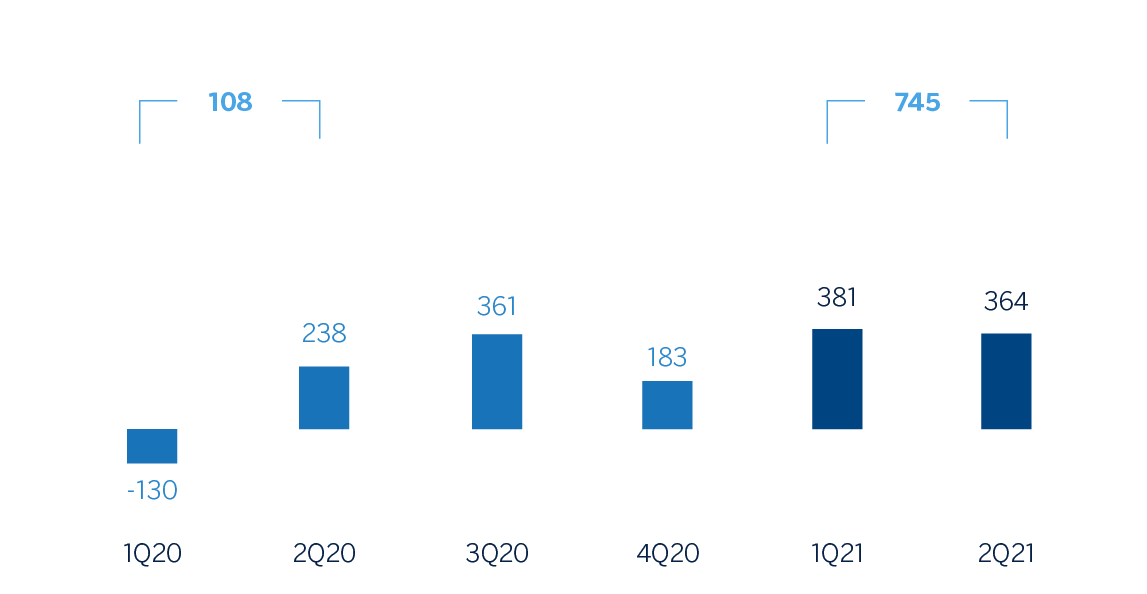

Net attributable profit (Millions of euros)

Financial statements and relevant business indicators (Millions of euros and percentage)

| Income statement | 1H21 | ∆% | 1H20 |

|---|---|---|---|

| Net interest income | 1,762 | (2.2) | 1,801 |

| Net fees and commissions | 1,058 | 16.5 | 908 |

| Net trading income | 283 | 71.3 | 165 |

| Other operating income and expenses | (46) | n.s. | 34 |

| Of which insurance activities (1) | 180 | (23.9) | 237 |

| Gross income | 3,057 | 5.1 | 2,909 |

| Operating expenses | (1,499) | (2.2) | (1,533) |

| Personnel expenses | (852) | (1.6) | (866) |

| Other administrative expenses | (428) | (2.1) | (437) |

| Depreciation | (220) | (4.7) | (230) |

| Operating income | 1,557 | 13.2 | 1,376 |

| Impairment on financial assets not measured at fair value through profit or loss | (343) | (61.1) | (883) |

| Provisions or reversal of provisions and other results | (202) | (44.8) | (365) |

| Profit/(loss) before tax | 1,013 | n.s. | (128) |

| Income tax | (266) | n.s. | 18 |

| Profit/(loss) for the period | 746 | n.s. | 110 |

| Non-controlling interests | (1) | (28.2) | (2) |

| Net attributable profit | 745 | n.s. | 108 |

- (1) Includes premiums received net of estimated technical insurance reserves.

| Balance sheets | 30-06-21 | ∆% | 31-12-20 |

|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 22,583 | (41.1) | 38,356 |

| Financial assets designated at fair value | 140,122 | 1.6 | 137,969 |

| Of which: Loans and advances | 36,526 | 19.1 | 30,680 |

| Financial assets at amortized cost | 198,928 | 0,4 | 198,173 |

| Of which: Loans and advances to customers | 169,948 | 1.2 | 167,998 |

| Inter-area positions | 28,842 | 8.9 | 26,475 |

| Tangible assets | 2,499 | (13.9) | 2,902 |

| Other assets | 6,206 | (5.0) | 6,535 |

| Total assets/liabilities and equity | 399,180 | (2.7) | 410,409 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 71,093 | (3.8) | 73,921 |

| Deposits from central banks and credit institutions | 58,398 | (0.7) | 58,783 |

| Deposits from customers | 200,197 | (3.0) | 206,428 |

| Debt certificates | 36,940 | (9.9) | 41,016 |

| Inter-area positions | - | - | - |

| Other liabilities | 19,375 | 14.3 | 16,955 |

| Regulatory capital allocated | 13,177 | (1.0) | 13,306 |

| Relevant business indicators | 30-06-21 | ∆% | 31-12-20 |

|---|---|---|---|

| Performing loans and advances to customers under management (1) | 167,265 | 1.1 | 165,511 |

| Non-performing loans | 8,243 | (1.2) | 8,340 |

| Customer deposits under management (1) | 199,581 | (3.0) | 205,809 |

| Off-balance sheet funds (2) | 66,399 | 5.9 | 62,707 |

| Risk-weighted assets | 112,030 | 7.3 | 104,388 |

| Efficiency ratio (%) | 49.0 | 54.6 | |

| NPL ratio (%) | 4.2 | 4.3 | |

| NPL coverage ratio (%) | 64 | 67 | |

| Cost of risk (%) | 0.41 | 0.67 |

- (1) Excluding repos.

- (2) Includes mutual funds and pension funds.

Activity

The most relevant aspects related to the area's activity during the first half of 2021 were:

- Lending activity (performing loans under management) increased compared to the close of 2020 (+1.1%) mainly due to growth in consumer loans (including credit cards which increased by 4.6%), small and medium-sized enterprises (+4.4%) and loans to institutions (+14.3%). Mortgage loans, for its part, remained stable during the first half (-0.4%).

- With regard to asset quality, the NPL and NPL coverage ratios stood at 4.2% and 64%, respectively, at the close of March 2021.

- Total customer funds recorded a slight decrease of -0.9% compared to the close of 2020, thanks to the evolution of off- balance sheet funds (+5.9%), which offset the reduction in customer deposits under management (-3.0%).

Results

Spain generated a net attributable profit of €745m during the first half of 2021, considerably higher than the €108m generated in the same period of the previous year, mainly due to provisions for impairment on financial assets made between January and June 2020 due to the outbreak of COVID-19, the increased contribution of fee-based revenues and NTI in 2021, as well as lower operating expenses.

The main highlights of the area's income statement are:

- Net interest income decreased compared to the first half of the previous year (-2.2%), affected by the falling interest rate environment and partially compensated by lower financing costs.

- Net fees and commissions performed well (+16.5% year-on-year), supported by a greater contribution from revenues associated with banking services, asset management and income from insurance activities.

- NTI amounted to €283m between January and June 2021, with year-on-year growth of 71.3%, mainly due to the results of Global Markets.

- The other operating income and expenses line compares negatively to the first half of the previous year, showing a cumulative loss of €-46m at the close of June 2021 compared to a positive cumulative result of €34m at the close of June 2020, mainly due to the higher contribution to the SRF and the lower contribution from the insurance business following the bancassurance operation with Allianz.

- Operating expenses were down (-2.2% year-on-year) as a result of lower personnel expenses, overheads and depreciation. Therefore, the efficiency ratio stood at 49.0% compared to 52,7% in the first half of 2020.

- Impairment on financial assets amounted to €-343m, a significant reduction from the amount recorded in the first half of 2020, mainly due to the negative impact of the worsening macroeconomic scenario caused by pandemic following the outbreak of COVID-19 in March 2020, as well as the improvement of this scenario in 2021. The cumulative cost of risk at the close of June 2021 stood at 0.41%, down from 0.45% at the close of March 2021.

- The provisions and other results line closed at €-202m compared to €-365m in the same period last year, which included provisions for potential claims.

- The costs related to the restructuring process are entirely recorded in the Corporate Center's income statement.