Risk management

Credit risk

In 2020, following the outbreak of the pandemic, the local authorities of the countries in which the Group operates initiated economic support measures for the management of the COVID-19 crisis, including the granting of relief measures in terms of temporary payment deferrals to customers affected by the pandemic, as well as the granting of loans covered by public guarantees, especially to companies and self-employed workers.

These measures were supported by the rules issued by the authorities of the geographical areas where the Group operates, as well by certain industry agreements, and were intended to ease the temporary liquidity needs of the customers. By the end of the year, the temporary deferral measures had been completed in all the geographical areas.

For the purposes of classifying exposures based on their credit risk, the Group has maintained a rigorous application of IFRS 9 at the time of granting the moratoriums and has reinforced the procedures to monitor credit risk both during their tern and upon their maturity. In this regard, additional indicators were introduced to identify the significant increase in risk that may have occurred in some operations or a set of them and, where appropriate, proceed to classify it in the corresponding risk stage.

Likewise, the indications provided by the European Banking Authority (EBA) have been taken into account, to not consider as refinancing the moratoriums that meet a series of requirements and that have been requested before March 31, 2021, without prejudice to keep the exposure classified in the corresponding risk stage or its consideration as refinancing if it was previously so classified.

In relation to the temporary payment deferrals for customers affected by the pandemic and with the goal of mitigating as much as possible the impact of these measures in the Group, due to the high concentration of its maturities over time, continuous monitoring of the effectiveness of these measures has been carried out in order to verify their compliance and to adapt dynamically to the evolution of the crisis. As of December 31, 2021, the payment deferrals granted by the Group following EBA criteria amounted to €189m.

Calculation of expected losses due to credit risk

To respond to the circumstances generated by the COVID-19 pandemic in the macroeconomic environment, characterized by a high level of uncertainty regarding its intensity, duration and speed of recovery, forward-looking information was updated in the IFRS 9 models to incorporate the best information available at the date of the publication of this report. The estimation of the expected losses was calculated for the different geographical areas in which the Group operates, with the best information available for each of them, considering both the macroeconomic perspectives and the effects on specific portfolios, sectors or specific debtors. The scenarios used consider the various economic measures that have been announced by governments as well as monetary, supervisory and macroprudential authorities around the world.

The classification of vulnerable activities to COVID-19 was established at the outbreak of the pandemic, in order to identify activities susceptible to further deterioration in the Group’s portfolio. Based on this classification, management measures were taken, with preventive rating adjustments and restrictive definition of risk appetite. Given the progress made during the course of the pandemic, which has led to the almost complete elimination of restrictions on mobility and the subsequent recovery from these restrictions, consideration is now being given to the specific characteristics of each client over and above their belonging to a particular sector.

As of December 31, 2021, in order to incorporate those aspects not included in the impairment models, there are management adjustments to the expected losses amounting to €311m for the entire Group, €226m in Spain, €18m in Peru and €68m in Mexico. As of September 30, 2021 this concept amounted to €304m in total, of which €272m were allocated to Spain and €32m to Peru. The variation in the last quarter is due to the provisions in Spain and Peru, as well as the aforementioned additional provision in Mexico due to the anticipation of the potential impairment associated with support products after the expiry date of the deferrals.

BBVA Group's credit risk indicators

The situation generated by the pandemic continued to affect BBVA Group's main risk indicators in 2021. In addition, in the fourth quarter of 2021, the Group incorporated additional impairment indicators into its credit risk management processes to be consistent with the new definition of default (NDoD) in accordance with Article 178 of Regulation (EU) No 575/2013 (CRR) that applies in the prudential area. The incorporation of these complementary indicators has led to a one-off increase in the balance of non-performing loans and thus an effect on the NPL ratio and the NPL coverage ratio. In view of the above and the recurring trend, the Group’s main credit risk indicators behaved as follows:

- Credit risk has increased by 1.2% in the quarter (+3.5% at constant exchange rates). At constant exchange rates and at the Group level, there was a generalized increase in this metric during the quarter, led by Spain and Rest of Business (originating from certain wholesale operations), with increases in Mexico, Turkey and South America (highlighting Argentina and Colombia). Compared to the end of December 2020, credit risk increased by 2.5% (+5.3% at constant exchange rates, with growth in all geographical areas except Chile and Peru).

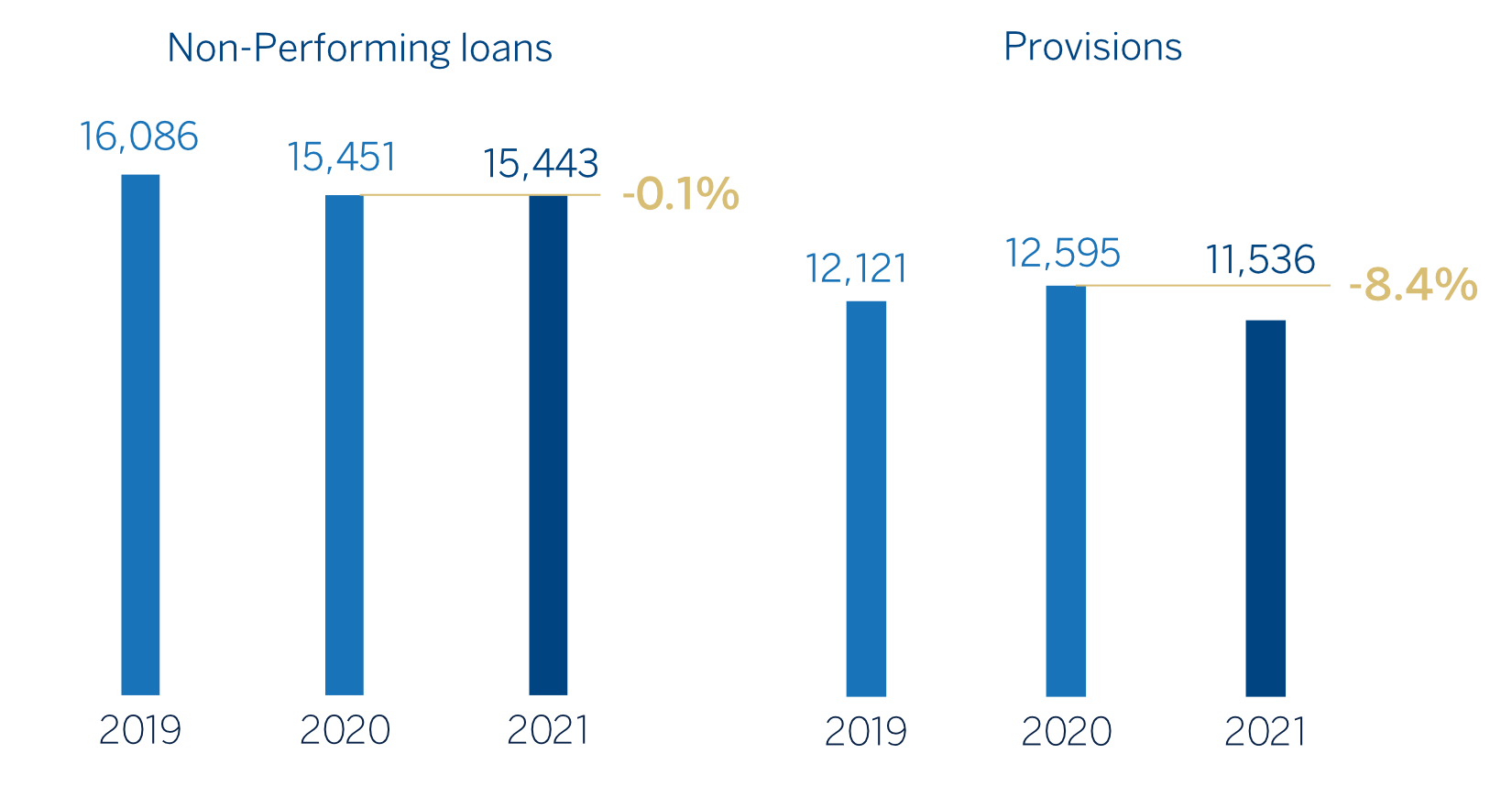

- The balance of non-performing loans (NPL) increased in the fourth quarter of the year (+3.9% in current terms and 5.8% at constant rates) in practically all geographical areas, as a result of the aforementioned implementation of the new definition of default. Compared to the end of 2020, the balance decreased by 0.1% (+3.6% at constant exchange rates) with decreasing NPL flows in the first three quarters of the year supported by contained inflows and positive recoveries, and a fourth quarter impacted by the implementation of the aforementioned new definition of default.

NON-PERFORMING LOANS(1) AND PROVISIONS(1) (MILLIONS OF EUROS)

(1) Excludes BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021.

- The NPL ratio stood at 4.1% as of December 31, 2021 (4.0% in September 2021), 10 basis points below the figure recorded in December 2020. Excluding the effect of introduction of the new definition of default, the NPL ratio would have been around 3.8% as of December 2021, which is 45 basis points below the figure recorded at the end of 2020.

- Loan-loss provisions decreased by 8.4% compared to December 2020 (-3.0% in the quarter) as a result of the NPL management carried out during the year coupled with an increase in write-offs.

- The NPL coverage ratio amounted to 75%, -682 basis points in contrast with the end of 2020. Compared to the previous quarter, the NPL coverage ratio was -533 basis points lower.

- The cumulative cost of risk as of December 30, 2021 stood at 0.93% (62 basis points below the end of 2020 and +1 basis point compared to September 2021).

NPL(1) AND NPL COVERAGE(1) RATIOS AND COST OF RISK(1) (PERCENTAGE)

(1) Excluding BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021.

CREDIT RISK(1) (MILLIONS OF EUROS)

| 31-12-21 | 30-09-21 | 30-06-21 | 31-03-21 | 31-12-20 | |

|---|---|---|---|---|---|

| Credit risk | 376,011 | 371,708 | 370,348 | 365,292 | 366,883 |

| Non-performing loans | 15,443 | 14,864 | 15,676 | 15,613 | 15,451 |

| Provisions | 11,536 | 11,895 | 12,033 | 12,612 | 12,595 |

| NPL ratio (%) | 4.1 | 4.0 | 4.2 | 4.3 | 4.2 |

| NPL coverage ratio (%)(2) | 75 | 80 | 77 | 81 | 82 |

- General note: figures excluding BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021, for the periods of 2021 and December 2020, and the classification of BBVA Paraguay as non-current assets and liabilities held for sale for December 2020.

- (1) Includes gross loans and advances to customers plus guarantees given.

- (2) The NPL coverage ratio includes the valuation adjustments for credit risk during the expected residual life of those financial instruments which have been acquired (mainly originated from the acquisition of Catalunya Banc, S.A.). Excluding these allowances, the NPL coverage ratio would stand at 73% as of December 31, 2021 and 79% as of December 31, 2020.

NON-PERFORMING LOANS EVOLUTION (MILLIONS OF EUROS)

| 4Q21 (1) | 3Q21 | 2Q21 | 1Q21 | 4Q20 | |

|---|---|---|---|---|---|

| Beginning balance | 14,864 | 15,676 | 15,613 | 15,451 | 15,006 |

| Entries | 2,875 | 1,445 | 2,321 | 1,915 | 2,579 |

| Recoveries | (1,235) | (1,330) | (1,065) | (921) | (1,016) |

| Net variation | 1,640 | 115 | 1,256 | 994 | 1,563 |

| Write-offs | (832) | (848) | (1.138) | (796) | (1,149) |

| Exchange rate differences and other | (228) | (80) | (55) | (36) | 31 |

| Period-end balance | 15,443 | 14,864 | 15,676 | 15,613 | 15,451 |

| Memorandum item: | |||||

| Non-performing loans | 14,657 | 14,226 | 15,013 | 14,933 | 14,709 |

| Non performing guarantees given | 786 | 637 | 663 | 681 | 743 |

- General note: figures excluding BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021, for the periods of 2021 and the fourth quarter of 2020, and the classification of BBVA Paraguay as non-current assets and liabilities held for sale for the the fourth quarter of 2020.

- (1) Preliminary data.

Structural risks

Liquidity and funding

Liquidity and funding management at BBVA aims to finance the recurring growth of the banking business at suitable maturities and costs, using a wide range of instruments that provide access to a large number of alternative sources of financing. In this context, it is important to notice that, given the nature of BBVA's business, the funding of lending activity is fundamentally carried out through the use of stable customer funds.

Due to its subsidiary-based management model, BBVA is one of the few major European banks that follows the Multiple Point of Entry (MPE) resolution strategy: the parent company sets the liquidity policies, but the subsidiaries are self-sufficient and responsible for managing their own liquidity and funding (taking deposits or accessing the market with their own rating), without fund transfers or financing occurring between either the parent company and the subsidiaries or between the different subsidiaries. This strategy limits the spread of a liquidity crisis among the Group's different areas and ensures that the cost of liquidity and financing is correctly reflected in the price formation process.

In view of the initial uncertainty caused by the outbreak of COVID-19 in March 2020, different central banks provided a joint response through specific measures and programs, some of which have been extended into 2021 to facilitate the financing of the real economy and the provision of liquidity in the financial markets, supporting the soundness of liquidity buffers in all geographical areas.

The BBVA Group maintains a solid liquidity position in every geographical area in which it operates, with liquidity ratios well above the minimum required:

- The BBVA Group's liquidity coverage ratio (LCR) remained comfortably above 100% throughout 2021, and stood at 165% as of December 31, 2021. For the calculation of this ratio, it is assumed that there is no transfer of liquidity among subsidiaries; i.e. no type of excess liquidity levels in foreign subsidiaries are considered in the calculation of the consolidated ratio. When considering these excess liquidity levels, the BBVA Group's LCR would stand at 213%.

- The net stable funding ratio (NSFR), defined as the ratio between the amount of stable funding available and the amount of stable funding required, demands banks to maintain a stable funding profile in relation to the composition of their assets and off-balance sheet activities. This ratio should be at least 100% at all times. The BBVA Group's NSFR ratio, calculated based on the criteria established in the Regulation (UE) 2019/876 of the European Parliament and of the Council of May 20, 2019, with entry into force in June 2021, stood at 135% as of December 31, 2021.

The breakdown of these ratios in the main geographical areas in which the Group operates is shown below:

LCR AND NSFR RATIOS (PERCETANGE. 31-12-21)

| Eurozone (1) | Mexico | Turkey | South America | |

|---|---|---|---|---|

| LCR | 190 | 245 | 211 | All countries >100 |

| NSFR | 126 | 149 | 162 | All countries >100 |

- (1) Perimeter: Spain + the rest of the Eurozone where BBVA has presence.

One of the key elements in BBVA's Group liquidity and funding management is the maintenance of large high quality liquidity buffers in all the geographical areas where the Group operates. In this respect, the Group has maintained for the last 12 months an average volume of high quality liquid assets (HQLA) accounting to €138,2 billion, among which, 93% correspond to maximum quality assets (LCR Tier 1).

The most relevant aspects related to the main geographical areas are the following:

- In the Eurozone, BBVA has continued to maintain a sound position with a large high-quality liquidity buffer. During 2021, commercial activity has drawdown liquidity amounting to approximately €9 billion due to the increase in lending activity,especially in the last quarter of the year, as well as the decrease in the volume of deposits, mainly wholesale. It should also be noted that in the second quarter of 2021, the payment of the BBVA USA sale transaction was collected. In addition, in March 2021, BBVA S.A. took part in the TLTRO III liquidity window program to take advantage of the improved conditions announced by the European Central Bank (ECB) in December 2020, with an amount drawn of €3.5 billion that, together with the €with an amount drawn of €3.5 billion that, together with the €34.9 billion available at the end of December 2020, amount to €38.4 billion at the end of December 2021.

- In BBVA Mexico, commercial activity has provided liquidity between January and December 2021 in the amount of approximately 73 billion Mexican pesos, derived from a higher growth in customer funds compared to the growth in lending activity. This increased liquidity is expected to be reduced due to the recovery in lending activity expected in 2022. This solid liquidity position has allowed to carry out an efficient policy in the cost of funding, in an environment of higher interest rates. In terms of wholesale issuances, there was no need to refinance any maturities in 2021, having matured in 2021 a subordinated issue amounting to USD 750m and a senior issue amounting to 4,500 million Mexican pesos.

- In the fourth quarter, the Central Bank of the Republic of Turkey made a series of cuts in benchmark rates, despite the increases in the inflation rate, for a total of 400 basis points to 14%, triggering an adverse reaction from the markets and severe currency depreciation. In order to alleviate the depreciation of the currency, during the month of December, the Turkish government implemented a new mechanism to encourage local currency deposits. During 2021, the lending gap in local currency has widened, with a higher increase in loans than in deposits, while the lending gap in foreign currency has narrowed, due to a decline in loans and an increase in deposits. Garanti BBVA continues to maintain a stable liquidity position with comfortable ratios.

- In South America, the liquidity situation remains adequate throughout the region, despite the fact that central banks in the region have started rate hike cycles and withdrawal of stimulus programs that mitigate the impact of the COVID-19 crisis. In Argentina, liquidity in the system and in BBVA continues to increase due to the higher growth in deposits than in loans in local currency. In BBVA Colombia, activity picks up accompanied by the growth in deposits. BBVA Peru maintains solid levels of liquidity, while reducing excess liquidity due to growth in lending activity, combined with a contraction of deposits, following a costs control strategy.

The main wholesale financing transactions carried out by the companies of the BBVA Group are listed below:

- In March 2021, BBVA S.A. issued a senior preferred debt for an amount of €1 billion, with a maturity of 6 years and an option for early redemption after five years. In September 2021, BBVA S.A. issued a floating rate senior preferred bond totaling €1 billion and maturing in 2 years, the fifth issue made by BBVA linked to environmental, social and governance (ESG) criteria. Additionally, in January 2022, BBVA S.A. issued a €1 billion senior non-preferred bond, with a maturity of 7 years and an option for early redemption in the sixth year, with a coupon of 0.875%.

- In Turkey, there have been no issuances in 2021. The Bank renewed its syndicated loans in June and November, indexed to sustainability criteria. On June 2, BBVA Garanti renewed 100% of a syndicated loan, formed by two separate tranches, amounting to USD 279m and €294m, with a 1-year maturity and a cost of Libor +2.50% and Euribor +2.25%, respectively. In November, the Bank renewed 100% of the second tranche of the mentioned loan, for USD 365m and €247m, at a cost of Libor + 2.15% and Euribor + 1.75% respectively.

- In South America, BBVA Uruguay issued in February 2021 the first sustainable bond on the Uruguayan financial market for USD 15m at an initial interest rate of 3.854%.

Foreign exchange

Foreign exchange risk management of BBVA's long-term investments, principally stemming from its overseas franchises, aims to preserve the Group's capital adequacy ratio and ensure the stability of its income statement.

The U.S. dollar accumulated a 8.3% appreciation against the euro in 2021, thus reversing a large part of the depreciation which occurred in 2020 after the outbreak of the pandemic. Among the emerging currencies, it is worth highlighting the strong depreciation of the Turkish lira in 2021 (-40.2%), severely penalized in recent months by rate reductions. The positive aspect came from the good performance of the Mexican peso, which registered an appreciation of 5.5% against the euro since the end of 2020. With regard to South American currencies, Peruvian sol finally closed the year with a very moderate depreciation against the euro (-1.3%), while Chilean peso (-8.8%) and Colombian peso (-6.6%) depreciated slightly more. For its part, Argentine peso registered a moderate depreciation (-11.3%) compared to previous years.

EXCHANGE RATES (EXPRESSED IN CURRENCY/EURO)

| Year-end exchange rates | Average exchange rates | ||||

|---|---|---|---|---|---|

31-12-21 |

∆% on 31-12-20 |

∆% on 30-09-20 |

2021 |

∆% on 2020 |

|

| U.S. dollar | 1.1326 | 8.3 | 2.2 | 1.1827 | (3.5) |

| Mexican peso | 23.1438 | 5.5 | 2.6 | 23.9842 | 2.3 |

| Turkish lira | 15.2335 | (40.2) | (32.4) | 10.5067 | (23.4) |

| Peruvian sol | 4.5045 | (1.3) | 6.2 | 4.5867 | (13.0) |

| Argentine peso (1) | 116.37 | (11.3) | (1.8) | - | - |

| Chilean peso | 956.70 | (8.8) | (2.7) | 897.78 | 0.6 |

| Colombian peso | 4,509.06 | (6.6) | (1.5) | 4,427.36 | (4.8) |

- (1)According to IAS 29 "Financial information in hyperinflationary economies", the year-end exchange rate is used for the conversion of the Argentina income statement.

BBVA maintains its policy of actively hedging its main investments in emerging markets, covering on average between 30% and 50% of annual earnings and around 70% of the CET1 capital ratio surplus. The closing of the sale of BBVA USA in June has modified the Group's CET1 fully-loaded ratio sensitivity to changes in the currencies. The most affected sensitivity by this change has been the U.S. dollar, which stands at around +18 basis points in the face of a 10% depreciation in the currency. The sensitivity of the Mexican peso is estimated at -7 basis points at the end of December 2021 and -1 basis point in the case of the Turkish lira, both currencies estimated against a depreciation of 10%. With regard to coverage levels of the expected results for 2022 is close to 65% in the case of Mexico, 20% in Turkey and 100% in Peru and Colombia.

Interest rate

Interest rate risk management seeks to limit the impact that BBVA may suffer, both in terms of net interest income (short-term) and economic value (long-term), from adverse movements in the interest rate curves in the various currencies in which the Group operates. BBVA carries out this work through an internal procedure, pursuant to the guidelines established by the European Banking Authority (EBA), in order to analyze the potential impact that could derive from a range of scenarios on the Group's different balance sheets.

The model is based on assumptions intended to realistically mimic the behavior of the balance sheet. Of particular relevance are assumptions regarding the behavior of accounts with no explicit maturity and prepayment estimates. These assumptions are reviewed and adapted at least once a year to take into account any changes in observed behavior.

At the aggregate level, BBVA continues to maintain a moderate risk profile, in accordance with the established objective, showing positive sensitivity toward interest rate increases in the net interest income. Effective management of structural balance sheet risk has mitigated the negative impact of the downward trend in interest rates and the volatility experienced as a result of the effects of COVID-19, and is reflected in the soundness and recurrence of net interest income.

At the market level, the fourth quarter of 2021, has seen flattening of the main sovereign curves in developed countries (mainly due to higher increases in the short sections of the curve), resulting from biases towards more restrictive monetary policies of central banks in the face of higher inflation levels (especially in the United States). With regard to the emerging world, similar flattening moves, continuing with the rate hike cycle, even accelerating the pace in many of the countries (with the exception of Turkey, which dropped 400 basis points in total at the October, November and December meetings).

By area, the main features are:

-

Spain has a balance sheet characterized by a high proportion of variable-rate loans (basically mortgages and corporate lending) and liabilities composed mainly of customer demand deposits. The ALCO portfolio acts as a management lever and hedging for the bank's balance sheet, mitigating its sensitivity to interest rate fluctuations. The balance sheet interest rate risk profile remained stable during the year, showing a positive net interest income sensitivity to 100 basis points increases by the interest rates slightly above 20%.

-

On the other hand, the ECB held the marginal deposit facility rate unchanged at -0.50% during the year and maintained the extraordinary support programs created due to the COVID-19 crisis (in December it announced the end in March 2022 of its Pandemic Emergency Purchase Program, which was launched at the outbreak of the pandemic). This has created stability in European benchmark interest rates (Euribor) throughout 2021. In this sense, customer spread keeps pressured by the low interest rates environment.

- Mexico continues to show a balance between fixed and variable interest rates balances. In terms of assets that are most sensitive to interest rate fluctuations, the commercial portfolio stands out, while consumer loans and mortgages are mostly at a fixed rate. The ALCO portfolio is invested primarily in fixed-rate sovereign bonds with limited maturities. Net interest income sensitivity continues to be limited, registering a positive impact against 100 basis points increases in the Mexican peso, which is around 2%. The monetary policy rate stands at 5.50%, higher that at the end of 2020 (4.25%), after a 25 basis points reduction during the first quarter of 2021 and increases of 150 basis points since the June meeting. Regarding the consumer spread, an improvement can be appreciated during 2021, a trend which should continue due to the higher interest rates environment.

- In Turkey, the sensitivity of loans, which are mostly fixed-rate but with relatively short maturities, and the ALCO portfolio balance the sensitivity of deposits on the liability side. The interest rate risk is thus limited, both in Turkish lira and in foreign currencies. With regard to benchmark rates, there was an increase of 200 basis points in the first quarter compared to the level seen in December 2020; during the second quarter the benchmark rates remained unchanged; and, in the third and fourth quarters saw a reversal of the trend, with reductions of 100 and 400 basis points, respectively. The customer spread in Turkish lira has improved in 2021 in a volatile environment.

- In South America, the interest rate risk profile remains low as most countries in the area have a fixed/variable composition and maturities that are very similar for assets and liabilities, with limited net interest income sensitivity. In addition, in balance sheets with several currencies, interest rate risk is managed for each of the currencies, showing a very low level of risk. Regarding the benchmark rates of the central banks of Peru and Colombia, a rising trend in rates began in the third quarter of 2021, with increases of 225 and 125 basis points, respectively, throughout the second half of the year. There has been little change in customer spreads during the year, which are expected to improve in an environment of higher interest rates.

INTEREST RATES (PERCENTAGE)

| 31-12-21 | 30-09-21 | 30-06-21 | 31-03-21 | 31-12-20 | 30-09-20 | 30-06-20 | 31-03-20 | |

|---|---|---|---|---|---|---|---|---|

| Official ECB rate | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Euribor 3 months (1) | (0.58) | (0.55) | (0.54) | (0.54) | (0.54) | (0.49) | (0.38) | (0.42) |

| Euribor 1 year (1) | (0.50) | (0.49) | (0.48) | (0.49) | (0.50) | (0.41) | (0.15) | (0.27) |

| USA Federal rates | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 |

| TIIE (Mexico) | 5.50 | 4.75 | 4.25 | 4.00 | 4.25 | 4.25 | 5.00 | 6.50 |

| CBRT (Turkey) | 14.00 | 18.00 | 19.00 | 19.00 | 17.00 | 10.25 | 8.25 | 9.75 |

- (1) Calculated as the month average.