Highlights

Invasion of Ukraine

Russia's invasion of Ukraine, the largest military attack on a European state since World War II, has had an immediate impact on geopolitics and the global economy. There has also been an increase in the level of uncertainty, which remains high at the date of elaboration of this report. The European Union, the United States, the United Kingdom and other governments have imposed harsh sanctions against Russia and Russian interests. The impact of these measures, as well as the potential response by Russia, are currently uncertain and could negatively affect the Bank's business, financial position and results, although the Group's direct exposure to Ukraine and Russia is limited.

The Group observes the events with particular concern and unease because of the human tragedy that they entail. In this regard, the Bank has contributed to the response to the humanitarian emergency in Ukraine with a donation of €1m, a campaign among customers and employees that, until June 30, 2022, has raised €2,273,965, in addition to the possibility of free transfers from individuals to Ukraine. Finally, BBVA joined a declaration signed by more than 50 companies from around the world to provide support to people fleeing Ukraine and to attend their immediate needs. Thus, the Group has offered the Ministry of Inclusion, Social Security and Migration of the Government of Spain 200 homes for the reception of refugees and, in order to facilitate the financial inclusion of the refugees, the Basic Payment Account has been made available to them, so that they can have a free account and a card, which allows them to access basic banking services.

Results and business activity

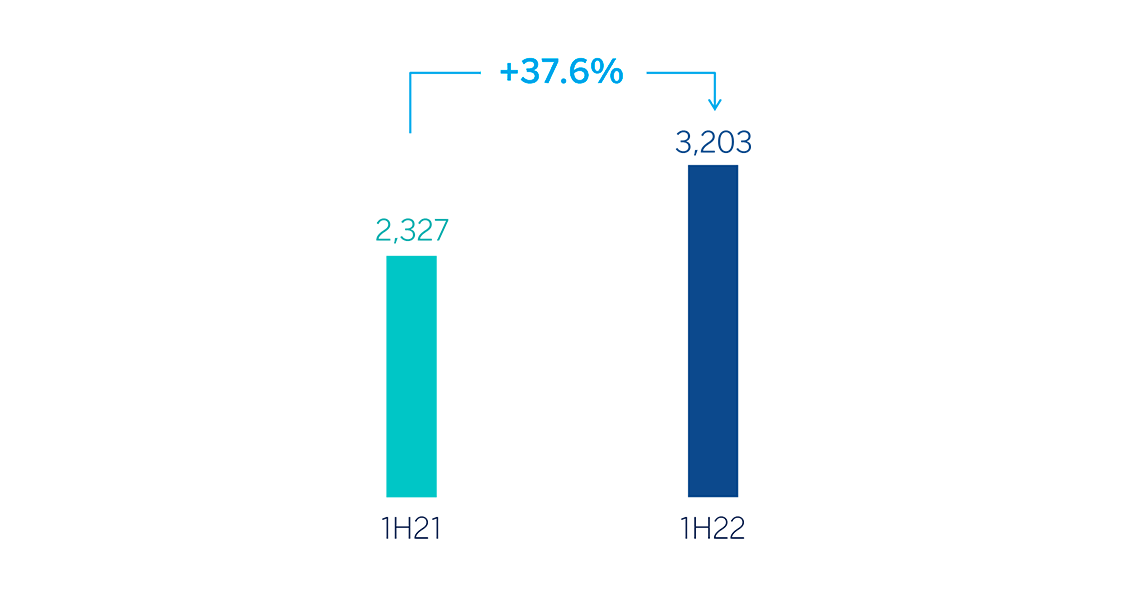

The BBVA Group generated a net attributable profit excluding non-recurring impacts of €3,203m in the first half of 2022, representing a year-on-year variation of +37.6%. Including those non-recurring impacts, i.e. €-201m from the purchase of offices in Spain from Merlin in June 2022 and €-416m from the results of discontinued operations and corresponding to BBVA USA and the rest of the companies sold to PNC on June 1, 2021, together with the net cost related to the restructuring process of the same year, the Group's net attributable profit registered a year-on-year increase of 57.1%. For more information on the operation with Merlin, see Business Areas - Spain, on the next page.

The Group's net attributable profit for the first half of 2022 includes the application of IAS 291 "Financial Reporting in Hyperinflationary Economies" to the Group's entities in Turkey. For more information, see the section Turkey in business areas.

Operating expenses increased at Group level (+12.0% in year-on-year terms and excluding the exchange rate effect), in an environment of high inflation in all countries in which BBVA operates.

Notwithstanding the above, thanks to the remarkable growth in gross income, fostered by the performance of the recurring income from banking activity (net interest income and fees and commissions), the efficiency ratio stood at 43.9% as of June 30, 2022, with an improvement of 203 basis points in constant terms, compared to the ratio at the end of December 2021, placing BBVA, once again, in a leading position among its European peer group2.

The provisions for impairment on financial assets decreased (-9.1% in year-on-year terms and at constant exchange rates), mainly due to decline in the main business areas excluding Turkey.

In the first half of 2022, provisions were lower than in the same period of the previous year.

- Loans and advances to customers grew by 9.8% compared to the end of December 2021, strongly favored by the evolution of business loans in all business areas and, to a lesser extent, by the dynamism of retail loans.

- Customer funds increased by 5.4% compared to the end of December 2021, thanks to the contribution of demand deposits (+6.1%) and time deposits (+17.5%).

LOANS AND ADVANCES TO CUSTOMERS AND TOTAL CUSTOMER FUNDS (VARIATION COMPARED TO 31-12-2021)

Business areas

As for the business areas, excluding the effect of currency fluctuation in those areas where it has an impact, in each of them it is worth mentioning:

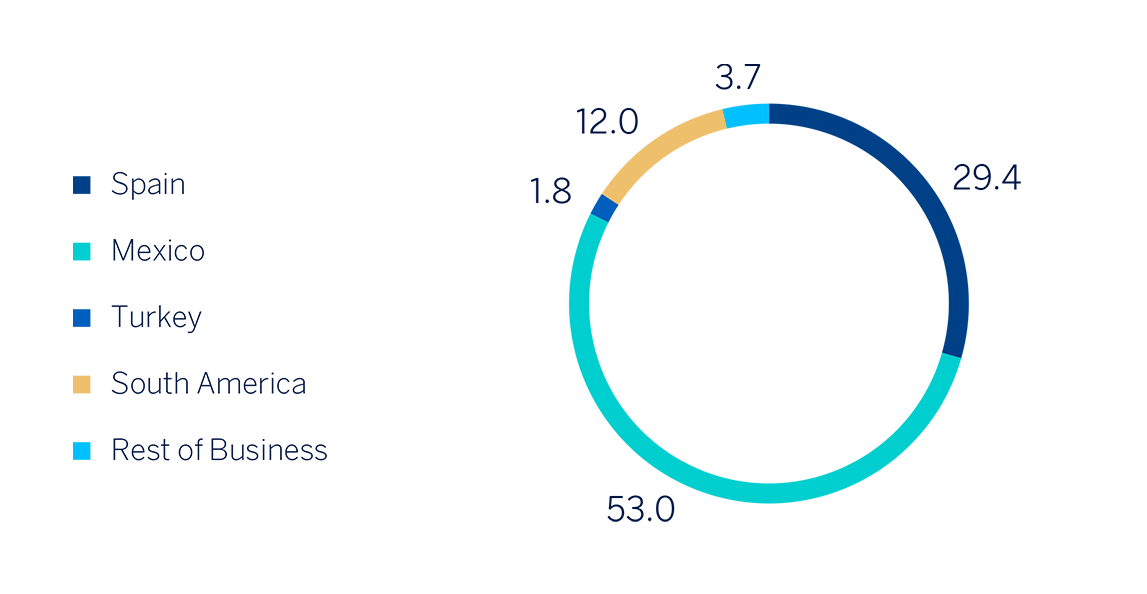

- Spain generated a net attributable profit of €1,010m during the first half of 2022, up 39.2% from the result achieved during the first half of the previous year, due to the strength of the gross income, driven by commissions and the significant reduction in personnel expenses, as well as lower loan-loss provisions and provisions. This result does not include the initial net impact of €-201m from the purchase of Merlin Properties, SOCIMI, S.A. (hereinafter Merlin) of 100% of the shares of Tree Inversiones Inmobiliarias Socimi, S.A. (hereafter Tree), owner of 662 offices leased to BBVA. Including this impact, the area's net attributable profit amounts to €808m, an increase of 11.5% compared to the net attributable profit of the same period of the previous year.

- In Mexico, BBVA achieved a net attributable profit of €1,821m between January and June 2022, representing an increase of 48.3% compared to the first half of 2021, mainly as a result of the good performance of recurring revenues, especially favored by the dynamism of the net interest income and contained loan-loss provisions, which compensated the increase in operating expenses.

-

Turkey generated a net attributable profit of €62m between

January and June 2022. This result includes the impact of the

application of IAS 29 to the Group's entities in Turkey

previously mentioned.

With regard to this business area, after the end on May 18, 2022 of the acceptance period of the voluntary takeover bid, submitted by the BBVA Group for the entire share capital of Garanti BBVA not already owned, the Group's stake increased to 85.97% from the 49.85% prior to the voluntary takeover bid. - South America generated €413m in the first half of 2022, a year-on-year increase of +102.1%, mainly due to the improved performance of recurring income (+41.1%) and lower loan-loss provisions (-23.3%), which more than offset the growth of expenses (+32.6 %) in an environment of high inflation throughout the region.

- Rest of Business achieved a net attributable profit of €128m accumulated at the end of the first half of 2022, 24.0% less than in the first half of the previous year, mainly due to the lower performance of the Group's broker dealer in the United States.

The Corporate Center recorded a net attributable loss of €-230m in the first half of 2022. This result compares positively to €-687m recorded in the same period of the previous year, although it must be taken into account that this figure included the results generated by the Group's businesses in the United States until their sale to PNC on June 1, 2021 and the net costs associated with the restructuring process in Spain carried out by the Group in 2021.

Lastly and for a broader understanding of the Group's activity and results, supplementary information is provided below for the wholesale business carried out by BBVA, Corporate & Investment Banking (CIB), in the countries where it operates. CIB generated a net attributable profit of €904m in the first half of 2022. These results, which do not include the application of hyperinflation accounting, represent an increase of 45.3% on a year-on-year basis, due to the growth in recurring income, NTI and lower loan-loss provisions, which offset the growth in operating expenses. It should also be noted that all business lines of the CIB area recorded growth compared to the first half of 2021, both in revenues and net attributable profit.

NET ATTRIBUTABLE PROFIT (LOSS) (MILLIONS OF EUROS)

General note: 1H22 excludes net impact arisen from the purchase of offices in Spain. 1H21 excludes BBVA USA and the

rest of the companies in the United States sold to PNC on June

1, 2021 and the net cost related to the restructuring process.

NET ATTRIBUTABLE PROFIT BREAKDOWN (1)

(PERCENTAGE. 1Q22)

(1) Excludes the Corporate Center and net impact arisen

from the purchase of offices in Spain.

Solvency

The Group's CET1 Fully-loaded ratio stood at 12.45% as of June 30, 2022, which allows to maintain a large management buffer over the Group's CET1 requirement (8.60%), and also above the Group's established target management range of 11.5-12% of CET1. This CET1 level includes the deduction of the total amount of the share buyback program authorized by the supervisor, amounting to maximum €3,500m that were already registered at the end of December 2021.

Share buyback program

- On October 29, 2021 BBVA announced the execution of the program for the buyback of own shares for a maximum amount of €3,500m to be executed in several tranches.

- On November 19, 2021, BBVA announced that it had decided to execute the first tranche for a maximum amount of 1,500 million euros and with a maximum number of shares to be acquired of 637,770,016 shares, in turn communicating on March 3, 2022 the completion of the program, having reached the maximum monetary amount of €1,500m with the acquisition of 281,218,710 treasury shares which were amortized on June 15, 2022 charged to unrestricted reserves. After the effective amortization of the 281,218,710 own shares for a nominal amount of €137,797,167.90, the share capital of BBVA was set at the amount of €3,129,467,256.30, represented by 6,386,667,870 shares of €0.49 of face value each.

- Likewise, on February 3, 2022, BBVA announced that it had agreed to carry out a second tranche for a maximum amount of 2,000 million euros and a maximum number of shares to be acquired based on the shares finally acquired in execution of the first tranche. In this regard, on March 16, 2022, the Bank announced the execution of the second tranche: (i) through the execution of a first segment for an amount of up to 1,000 million euros and with a maximum number of shares to be acquired of 356,551,306 treasury shares, which ended on May 16, 2022, having reached the maximum monetary amount of 1,000 million euros, having acquired 206,554,498 treasury shares; and (ii) once the execution of the first segment is completed, by executing a second segment that completes the program scheme.

- Finally, on June 28, 2022, BBVA announced that it had agreed to execute the second segment for a maximum amount of 1,000 million euros and a maximum number of shares to be acquired of 149,996,808. As of June 30, 2022, BBVA's best estimate for this maximum amount is 610 million euros. From July 1 to July 21, 2022, Citigroup Global Markets Europe AG, acting as lead manager for the Second Segment, has acquired 63,750,000 BBVA shares.

Sustainability

Channeling sustainable financing

SUSTAINABLE FINANCING BREAKDOWN

(PERCENTAGE. TOTAL AMOUNT MOBILIZED 2018-JUNE 2022)

BBVA has channeled a total of €111,700m in sustainable financing between 2018 and June 2022. Close to €14,500m were channeled this quarter, which represents an increase of 50% compared to the same period in 2021 and the quarter with the highest amount mobilized since 2018.

Thus, for example, the good performance of retail financing related to energy efficiency stands out, which has tripled in this quarter compared to the same quarter last year. The role of Turkey stands out in the second quarter of 2022, doubling its mobilization in energy efficiency compared to the first quarter of this year. The increase of 67% in retail financing related to sustainable mobility has also been relevant, with financing lines for the acquisition of hybrid and electric vehicles, which has already exceeded that of the same quarter of the previous year and where Colombia has been crucial by channeling more than a quarter of the total. Mexico stands out in financing companies in sustainable mobility, multiplying by 7 its mobilization compared to the same quarter of the previous year.

In inclusive growth, great progress has also been made, highlighting the financing of inclusive infrastructures, such as non-polluting public transportation, social housing or healthcare infrastructures, doubling the financing of the latter compared to the same quarter of 2021 and where Spain plays an important role with a contribution of 90% of overall channeling.

Finally, in corporate financing, channeling has also increased by more than 72% compared to the same quarter of the previous year. Likewise, the bond intermediation activity has increased about 65% compared to the same quarter of 2021.

Relevant advances in sustainability matters

- Risks

Beyond financing, BBVA wants to provide a comprehensive support service to its customers, retail and companies, including advice so that they can take advantage of investment opportunities in sustainability and future technologies, and be more efficient and competitive. To this end, different services and tools have been developed, such as the Transition Risk Indicator (TRi). The TRi is a transition risk indicator for corporate clients that allows assessing the client's current emissions profile and its decarbonization strategies. In this way, business can be promoted with well-positioned companies and risk mitigation measures can be applied to clients who are lagging behind. This quarter the steel sector has been incorporated into the sectors already included in the tool (automotive, energy and utilities), thus expanding the portfolio of clients to help in the transition towards low-carbon business models.

- Training

BBVA considers sustainability as a necessary strategic capability to meet the challenges which the society is facing. Therefore, the Entity provides general knowledge to the entire workforce about this topic, and has deployed different specific training itineraries and specific certifications to broaden this knowledge in the positions that require it.

As a result of all these initiatives, 80% of BBVA employees have received training in sustainability and more than 1,000 professionals in Spain have obtained specialized certification such as IASE (International Association For Sustainable Economy, certification recognized worldwide) and EFPA (European Financial Planning Association, certification recognized in Europe).

- Biodiversity and natural capital

BBVA actively participates in the main international working groups and has therefore joined the global initiative promoted by the Taskforce on Nature-related Financial Disclosures ("TNFD"), with BBVA being the first Spanish bank that joins this forum, which already includes more than 400 entities, organizations or regulators from all over the world. The TNFD aims to develop a framework for companies around the world to report and act on the evolution of their impacts, dependencies, as well as risks and opportunities related to nature, with the ultimate goal of supporting a change in global financial flows.

- Investments in innovation to accelerate the technological transition

BBVA wants to support its customers not only by providing financing, but also by investing in companies that are revolutionizing this transition and driving innovation. For this reason, BBVA has announced the first two investments in this field, the first in Lowercarbon Capital, one of the few venture capital funds specializing in innovative companies in the fields of climate change and decarbonization. The second in Fifth Wall, a fund specialized in investing in new green technologies that seek to decarbonize the real estate sector.

1 IAS 29 has not been applied to operations outside Turkey, in particular to the financial statements of Garanti Bank in Romania and Garanti Bank International N.V. in the Netherlands.

2 European peer group: Barclays, BNP Paribas, Crédit Agricole, Commerzbank, Credit Suisse, Deutsche Bank, HSBC, Intesa Sanpaolo, Lloyds Banking Group, Natwest, Banco Santander, Société Générale, UBS and Unicredit, data at the end of March 2022.