BBVA Group’s year-on-year figures for its business activity and balance sheet as of 31-Dec-2015 are influenced by the incorporation of the balances from CX and by the integration of Garanti, after closing the purchase of an additional 14.89% of this Turkish bank. Considering Turkey on an ongoing basis, i.e. with the 25.01% initial stake and with its balances integrated in the proportion corresponding to this percentage stake, trends are summarized below:

- Recovery in the last quarter of 2015 of part of the general depreciation accumulated by the exchange rates of the currencies of emerging countries against the euro. However, a comparison of the year-end exchange rates against the euro on 31-Dec-2015 against those on the same date in 2014 shows that the effect on the year-on-year rates of change is negative.

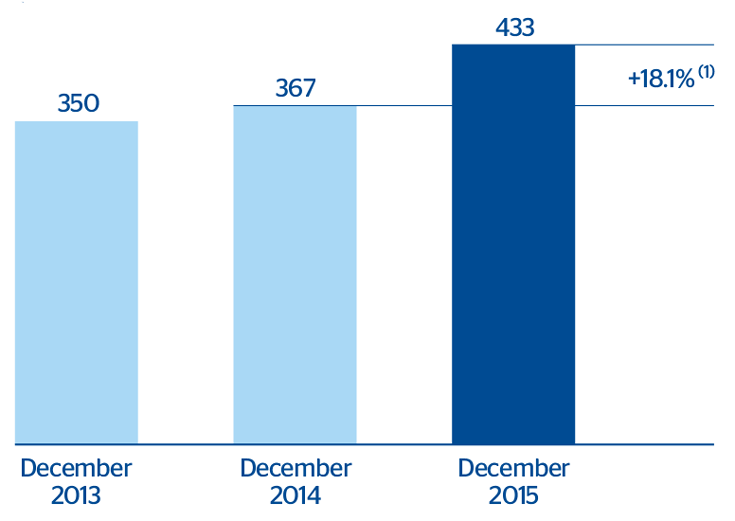

- Growth in gross lending to customers (not including repurchase agreements –repos–) picks up speed: up 7.5% since December 2014, up 11.4% at constant exchange rates. This better performance is due to the increase in loans across all geographical areas. In Spain, this rise is explained by the incorporation of the balances from CX (up 13.1%), but also by the excellent performance of the production of new loans in all the segments, which has resulted in the stock of these products registering positive year-on-year rates of change (except for mortgages, which is a portfolio with a high degree of redemptions, and public sector lending).

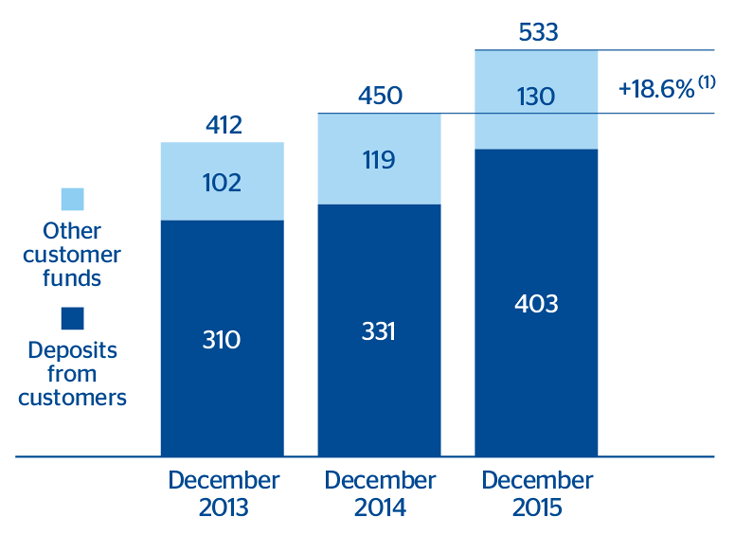

- Favorable performance of deposits from customers (excluding repurchase agreements –repos–: up 10.9% year-on-year at current exchange rates and 18.5% at constant rates).

- Reduction in non-performing loans, thanks to lower additions to NPL and the good performance of recoveries. The increase in this figure compared to that registered twelve months earlier is explained by the aforementioned incorporation of the balances from CX.

- Off-balance-sheet funds (mutual and pension funds and other off-balance-sheet funds) have also accelerated their year-on-year rate of growth compared to that in the first nine months of the year: up 6.6% taking into consideration the impact of currencies and up 8.1% at constant exchange rates.

Loans and advances to customers (gross)

(Billion euros)

Customer funds

(Billion euros)

Download Excel

Download Excel

|

|

Million euros | |||

|---|---|---|---|---|

| Consolidated balance sheet (1) | 31-12-15 | Δ% | 31-12-14 | 30-09-15 |

| Cash and balances with central banks | 43,467 | 28.2 | 33,908 | 36,128 |

| Financial assets held for trading | 78,326 | (6.1) | 83,427 | 83,662 |

| Other financial assets designated at fair value | 2,311 | (28.6) | 3,236 | 4,968 |

| Available-for-sale financial assets | 113,426 | 14.9 | 98,734 | 117,567 |

| Loans and receivables | 457,644 | 18.3 | 386,839 | 451,658 |

| Loans and advances to credit institutions | 32,962 | 16.7 | 28,254 | 33,042 |

| Loans and advances to customers | 414,165 | 17.7 | 351,755 | 407,454 |

| Debt securities | 10,516 | 54.0 | 6,831 | 11,162 |

| Held-to-maturity investments | - | - | - | - |

| Investments in entities accounted for using the equity method | 879 | 32.9 | 661 | 779 |

| Tangible assets | 9,944 | 24.1 | 8,014 | 9,349 |

| Intangible assets | 10,275 | 16.2 | 8,840 | 9,797 |

| Other assets | 33,807 | 21.4 | 27,851 | 32,569 |

| Total assets | 750,078 | 15.1 | 651,511 | 746,477 |

| Financial liabilities held for trading | 55,203 | (3.1) | 56,990 | 58,352 |

| Other financial liabilities designated at fair value | 2,649 | (26.2) | 3,590 | 4,767 |

| Financial liabilities at amortized cost | 606,113 | 18.9 | 509,974 | 598,206 |

| Deposits from central banks and credit institutions | 108,630 | 11.1 | 97,735 | 115,154 |

| Deposits from customers | 403,069 | 21.9 | 330,686 | 388,856 |

| Debt certificates | 66,165 | 11.4 | 59,393 | 65,860 |

| Subordinated liabilities | 16,109 | 14.1 | 14,118 | 16,140 |

| Other financial liabilities | 12,141 | 51.0 | 8,042 | 12,196 |

| Liabilities under insurance contracts | 9,407 | (10.2) | 10,471 | 10,192 |

| Other liabilities | 21,267 | 12.7 | 18,877 | 21,360 |

| Total liabilities | 694,638 | 15.8 | 599,902 | 692,876 |

| Non-controlling interests | 8,149 | 224.6 | 2,511 | 7,329 |

| Valuation adjustments | (3,349) | n.m. | (348) | (3,560) |

| Shareholders’ funds | 50,639 | 2.4 | 49,446 | 49,832 |

| Total equity | 55,439 | 7.4 | 51,609 | 53,601 |

| Total equity and liabilities | 750,078 | 15.1 | 651,511 | 746,477 |

| Memorandum item: |

|

|

|

|

| Contingent liabilities | 49,876 | 34.5 | 37,070 | 48,545 |

Download Excel

Download Excel

|

|

Million euros | |||

|---|---|---|---|---|

| Loans and advances to customers | 31-12-15 | Δ% | 31-12-14 | 30-09-15 |

| Domestic sector | 176.093 | 8,3 | 162.652 | 177.935 |

| Public sector | 21.471 | (8,1) | 23.362 | 22.596 |

| Other domestic sectors | 154.623 | 11,0 | 139.290 | 155.340 |

| Secured loans | 97.852 | 12,0 | 87.371 | 99.240 |

| Other loans | 56.771 | 9,3 | 51.920 | 56.100 |

| Non-domestic sector | 231.429 | 28,1 | 180.719 | 222.613 |

| Secured loans | 103.007 | 41,4 | 72.836 | 102.408 |

| Other loans | 128.422 | 19,0 | 107.883 | 120.204 |

| Non-performing loans | 25.333 | 9,4 | 23.164 | 25.747 |

| Domestic sector | 19.499 | 5,0 | 18.563 | 20.181 |

| Non-domestic sector | 5.834 | 26,8 | 4.601 | 5.566 |

| Loans and advances to customers (gross) | 432.855 | 18,1 | 366.536 | 426.295 |

| Loan-loss provisions | (18.691) | 26,5 | (14.781) | (18.841) |

| Loans and advances to customers | 414.165 | 17,7 | 351.755 | 407.454 |

Download Excel

Download Excel

|

|

Milliones de euros | |||

|---|---|---|---|---|

| Customer funds | 31-12-15 | Δ% | 31-12-14 | 30-09-15 |

| Deposits from customers | 403,069 | 21.9 | 330,686 | 388,856 |

| Domestic sector | 175,142 | 20.6 | 145,251 | 172,110 |

| Public sector | 15,368 | 44.3 | 10,651 | 12,843 |

| Other domestic sectors | 159,774 | 18.7 | 134,600 | 159,267 |

| Current and savings accounts | 78,502 | 31.9 | 59,509 | 74,044 |

| Time deposits | 69,326 | 14.1 | 60,783 | 71,807 |

| Assets sold under repurchase agreement and other | 11,947 | (16.5) | 14,308 | 13,416 |

| Non-domestic sector | 227,927 | 22.9 | 185,435 | 216,746 |

| Current and savings accounts | 123,854 | 8.8 | 113,795 | 117,056 |

| Time deposits | 98,596 | 57.2 | 62,705 | 94,531 |

| Assets sold under repurchase agreement and other | 5,477 | (38.7) | 8,935 | 5,159 |

| Other customer funds | 130,104 | 9.5 | 118,851 | 128,141 |

| Spain | 79,181 | 11.4 | 71,077 | 76,667 |

| Mutual funds | 33,676 | 13.6 | 29,656 | 32,434 |

| Pension funds | 22,897 | 4.7 | 21,879 | 22,397 |

| Other off-balance sheet funds | 123 | (29.1) | 174 | 119 |

| Customer portfolios | 22,485 | 16.1 | 19,368 | 21,717 |

| Rest of the world | 50,923 | 6.6 | 47,773 | 51,474 |

| Mutual funds and investment companies | 22,930 | (0.9) | 23,126 | 24,271 |

| Pension funds | 8,645 | 57.6 | 5,484 | 7,959 |

| Other off-balance sheet funds | 3,663 | 7.7 | 3,403 | 3,683 |

| Customer portfolios | 15,685 | (0.5) | 15,761 | 15,561 |

| Total customer funds | 533,173 | 18.6 | 449,537 | 516,996 |