Highlights

- Double-digit growth in both lending and deposits continues.

- Improved performance of the retail portfolio.

- Resilience of the area’s earnings, in a moderate economic environment.

- Adequate asset quality that compares favorably with the banking system as a whole.

Business activity

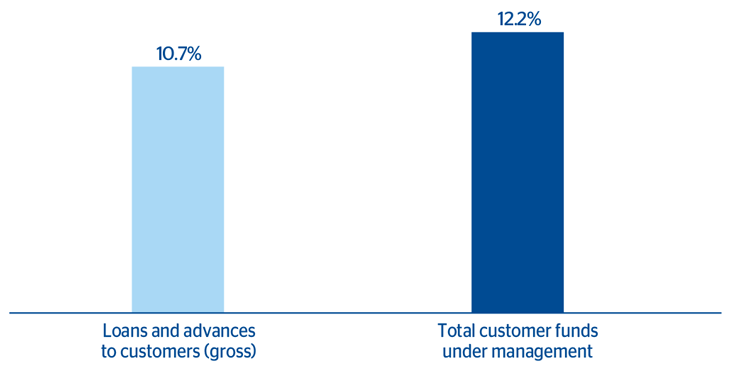

(Year-on-year change at constant exchange rate. Data as of 31-12-2015)

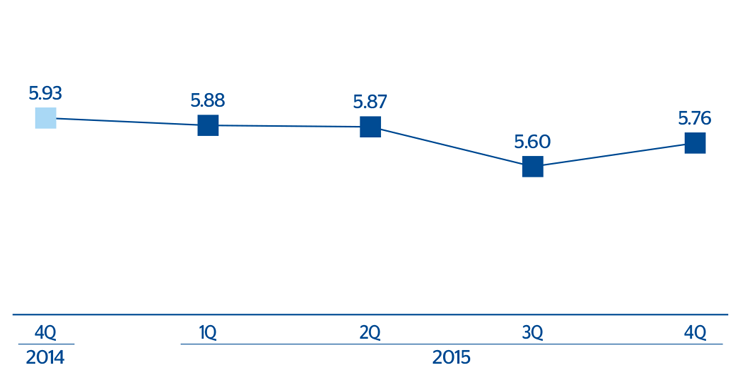

Net interest income/ATA

(Percentage. Constant exchange rate)

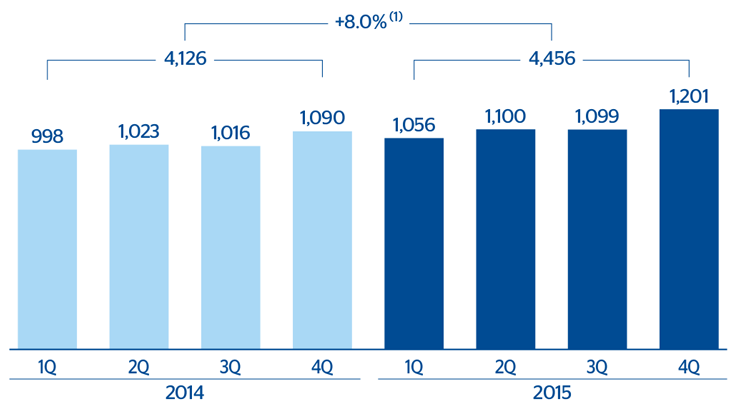

Operating income

(Million euros at constant exchange rate)

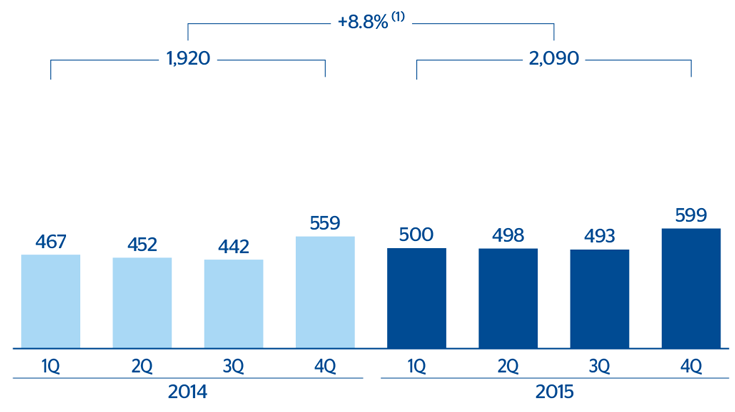

Net attributable profit

(Million euros at constant exchange rate)

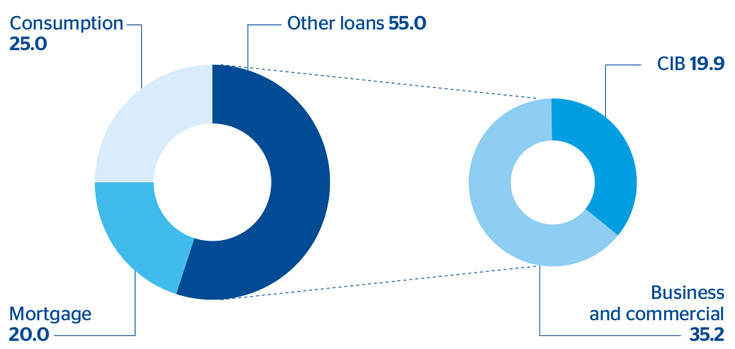

Breakdown of loans and advances to customers (gross) excluding repos

(Percentage as of 31-12-2015)

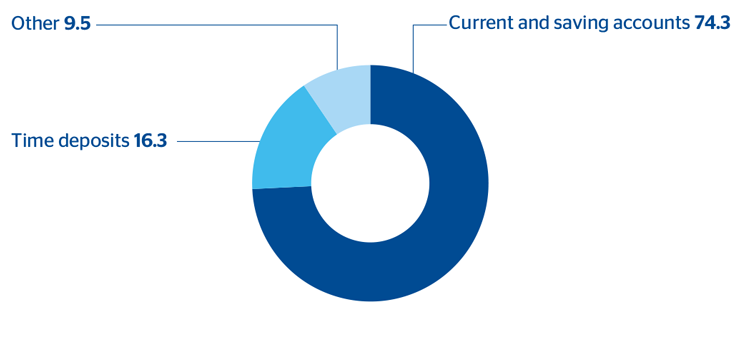

Breakdown of customer deposits under management

(Percentage as of 31-12-2015)

Financial statements and relevant business indicators

Download Excel

Download Excel

|

|

|

Million euros and percentage | ||

|---|---|---|---|---|

| Income statement | 2015 | Δ% | Δ% (1) | 2014 |

| Net interest income | 5,393 | 9.8 | 9.5 | 4,910 |

| Net fees and commissions | 1,223 | 4.9 | 4.6 | 1,166 |

| Net trading income | 196 | 0.5 | 0.2 | 195 |

| Other income/expenses | 257 | 2.6 | 2.3 | 250 |

| Gross income | 7,069 | 8.4 | 8.1 | 6,522 |

| Operating expenses | (2,613) | 8.6 | 8.3 | (2,406) |

| Personnel expenses | (1,121) | 9.8 | 9.5 | (1,020) |

| General and administrative expenses | (1,273) | 6.2 | 5.9 | (1,199) |

| Depreciation and amortization | (219) | 17.1 | 16.8 | (187) |

| Operating income | 4,456 | 8.3 | 8.0 | 4,115 |

| Impairment on financial assets (net) | (1,633) | 7.7 | 7.4 | (1,517) |

| Provisions (net) and other gains (losses) | (53) | (32.3) | (32.5) | (79) |

| Income before tax | 2,769 | 9.9 | 9.6 | 2,519 |

| Income tax | (678) | 12.4 | 12.1 | (604) |

| Net income | 2,091 | 9.1 | 8.8 | 1,916 |

| Non-controlling interests | (1) | 10.6 | 10.3 | (1) |

| Net attributable profit | 2,090 | 9.1 | 8.8 | 1,915 |

Download Excel

Download Excel

|

|

|

Million euros and percentage | ||

|---|---|---|---|---|

| Balance sheet | 31-12-15 | Δ% | Δ% (1) | 31-12-14 |

| Cash and balances with central banks | 6,363 | 6.0 | 12.2 | 6,004 |

| Financial assets | 32,986 | (3.9) | 1.8 | 34,311 |

| Loans and receivables | 53,262 | 11.4 | 18.0 | 47,800 |

| Loans and advances to customers | 47,513 | 5.1 | 11.2 | 45,224 |

| Loans and advances to credit institutions and other | 5,748 | 123.1 | 136.2 | 2,576 |

| Tangible assets | 2,126 | 27.9 | 35.4 | 1,662 |

| Other assets | 4,735 | 19.8 | 26.8 | 3,953 |

| Total assets/liabilities and equity | 99,472 | 6.1 | 12.3 | 93,731 |

| Deposits from central banks and credit institutions | 12,817 | 10.3 | 16.8 | 11,617 |

| Deposits from customers | 49,539 | 7.8 | 14.2 | 45,937 |

| Debt certificates | 5,204 | 3.4 | 9.5 | 5,033 |

| Subordinated liabilities | 4,425 | 7.2 | 13.5 | 4,128 |

| Financial liabilities held for trading | 7,134 | (6.3) | (0.8) | 7,616 |

| Other liabilities | 14,993 | 4.0 | 10.1 | 14,421 |

| Economic capital allocated | 5,360 | 7.7 | 14.0 | 4,979 |

Download Excel

Download Excel

|

|

|

Million euros and percentage | ||

|---|---|---|---|---|

| Relevant business indicators | 31-12-15 | Δ% | Δ% (1) | 31-12-14 |

| Loans and advances to customers (gross) (2) | 48,757 | 4.6 | 10.7 | 46,630 |

| Customer deposits under management (2) | 43,321 | 10.8 | 3.3 | 39,091 |

| Off-balance sheet funds (3) | 21,557 | (2.4) | 3.3 | 22,094 |

| Efficiency ratio (%) | 37.0 |

|

|

36.9 |

| NPL ratio (%) | 2.6 |

|

|

2.9 |

| NPL coverage ratio (%) | 120 |

|

|

114 |

| Cost of risk (%) | 3.28 |

|

|

3.45 |

Macro and industry trends

Economic growth in Mexico in 2015 has approached 2.5%, 0.4 percentage points more than in 2014, thanks to the improvement in domestic demand (with the increase in employment and the anchoring of inflation at low levels) and stronger industrial activity in the United States in the first half of the year. Keeping inflation at low levels (2.7% a year on average in 2015) will help make the expected increase in interest rates very gradual and limited. In December, the Bank of Mexico increased the reference rate by 25 basis points to 3.25%, in line with the Federal Reserve’s strategy, and this synchronization is expected to be maintained in 2016.

In 2015, the Mexican peso depreciated year-on-year against the euro by 5.5% in terms of the year-end exchange rate, which means a practically flat performance in terms of average exchange rates. Unless expressly stated otherwise, all the comments below on rates of change will be expressed at a constant exchange rate.

The country’s financial system maintains high levels of solvency, with a total capital adequacy ratio of 15.0% as of November 2015, according to the latest information available from the Bank of Mexico. The NPL ratio has declined slightly over the year (2.8% as of November, according to the public information released by the National Securities Banking Commission, Comisión Nacional Bancaria de Valores –CNBV–). In terms of activity, and despite the loan portfolio has posted double-digit percentage increases driven by the wholesale segments, a slight slowdown was registered in November 2015 due to some repayments in the companies segment. However, consumer finance and mortgage lending continue to grow above 10%. Fund gathering has also performed strongly, in both demand and time deposits. The increase in reference rates could have a positive impact on the system’s earnings, as a result of the positive sensitivity of net interest income to rate increases.

Activity

Double-digit growth of the loan book: up 10.7% year-on-year, with data as of 31-Dec-2015. Thus, more moderate performance than in previous quarters due to significant pre-payments from the public sector portfolio.

Despite the above, the wholesale portfolio is notably strong, with a year-on-year increase of 12.7%. This has allowed BBVA in Mexico to increase its market share by 50 basis points since December 2014, according to the public information released by the CNBV at the end of November 2015. Within this portfolio, one highlight for the second consecutive quarter, is the good performance of real-estate developers, which ended the year with a year-on-year growth of 26.4%. Commercial lending (corporations and SMEs) finished the year with a balance 15.1% higher than on the same date in 2014.

The retail portfolio registers a slight improvement toward the end of 2015, closing the year with year-on-year growth of 10.3%, boosted by lending to small businesses (SMEs) and consumer finance. SMEs show the greatest strength, with a year-on-year rate of growth of 24.0%. Consumer loans grow by 21.9%, thanks to the strategy of pre-approved loans for the bank’s customer base. This has enabled BBVA in Mexico to register a gain in market share of 80 basis points in this category compared to the figure for December 2014, according to the public information released by the CNBV for November 2015. A high rate of pre-payments is still happening in the credit card and mortgage portfolios. However, new production of bank credit cards has performed well, with year-on-year growth of 10.2%. Thus, the credit card portfolio showed a year-on-year increase through December 2015 of 2.2%. New mortgage loans have risen by 7.9% over the same period, and as a consequence the balance of this portfolio stands at 3.9% above the volume at the end of 2014.

This trend in lending has been parallel to an adequate asset quality. The NPL ratio (2.6% as of December 2015) remains at levels similar to those at the end of the third quarter but below those of the closing of 2014 (2.9%), while the coverage ratio has improved by 633 basis points over the year to 120% (121% as of 30-Sep-2015 and 114% as of 31-Dec-2014). It is worth noting that, in local terms, the figures continue to compare positively with the market.

Total customer funds ended the year with year-on-year growth of 12.2%. Fund gathering maintains its positive trend (up 17.3%), heavily influenced by the good performance of both current and savings accounts (up 21.6%) and time deposits (up 16.1%). The above also enables BBVA in Mexico to maintain a profitable funding mix, with a greater weight of low-cost funds. Off-balance-sheet funds ended 2015 with year-on-year growth of 3.3%.

Earnings

BBVA in Mexico registered strong earnings in 2015. The net attributable profit stands at €2,090m, which means a year-on-year rise of 8.8%, due to:

- Good performance of net interest income, which is up 9.5% in year-on-year terms. Its performance has been heavily influenced by a growth in activity more biased toward wholesale segments, as well as by a lower contribution from the Global Markets unit.

- Improved performance of income from fees and commissions mainly in the last part of the year, thanks to the revenue from Corporate & Investment Banking, with accumulated growth of 4.6%.

- NTI heavily influenced by the negative trend in the markets, although due to the positive effect from the exchange rate market, this heading ends the year with figures very similar to those registered in 2014.

- The other income/expenses item is slightly up (2.3% in year-on-year terms), due to an increased contribution to the Deposit Guarantee Fund as a result of a larger volume of liabilities. Earnings from the insurance business, which are included under this heading, continue to improve and closed the year with year-on-year growth of 10.9%.

- Operating expenses are up 8.3%, partly due to the impact of the investment plans being executed in Mexico since 2013.

- Lastly, impairment losses on financial assets are up year-on-year by 7.4%, below the increase registered by the loan portfolio. Thus, the cumulative cost of risk through December has declined to 3.28% (3.45% in 2014).