Highlights

- Sound economic growth in a complex and volatile environment.

- Strong activity continues, focused on loans in Turkish lira to the retail segment and foreign-currency deposits.

- Good performance of recurring revenue.

- Outstanding asset quality indicators.

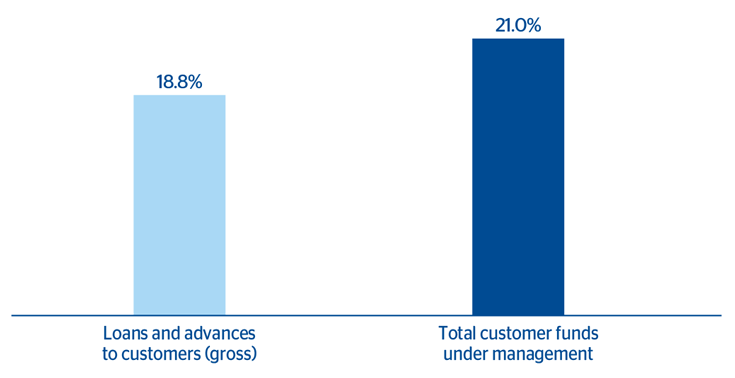

Business activity. Turkey presented on an ongoing basis

(Year-on-year change at constant exchange rate. Data as of 31-12-2015)

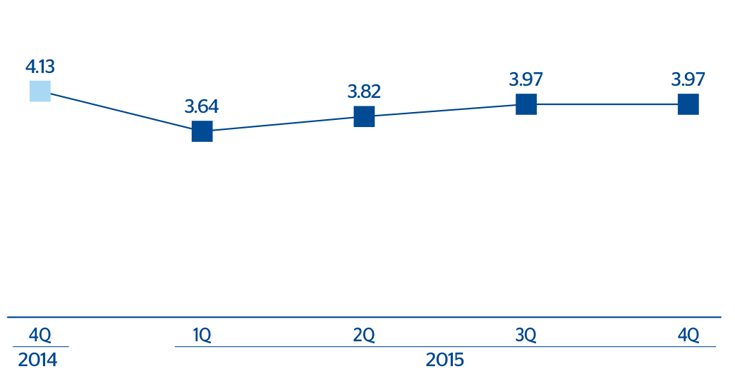

Net interest income/ATA

(Percentage. Constant exchange rate)

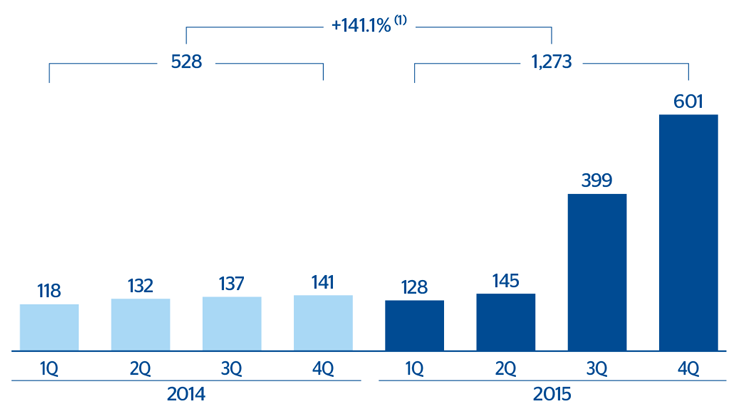

Operating income

(Million euros at constant exchange rate)

Net attributable profit

(Million euros at constant exchange rate)

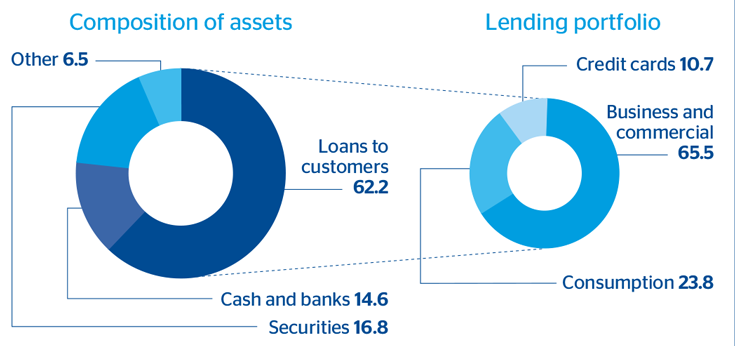

Garanti. Composition of assets and lending portfolio (1)

(Percentage as of 31-12-2015)

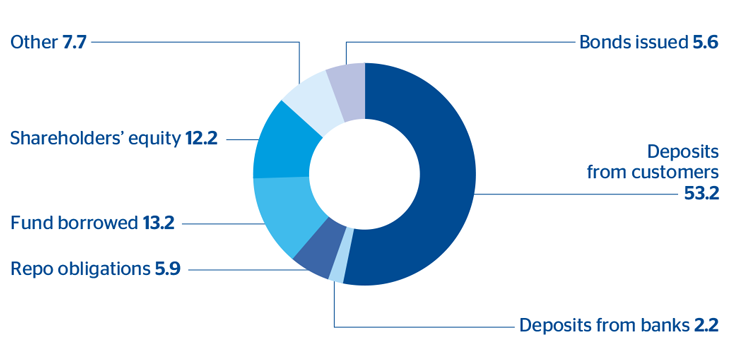

Garanti. Composition of liabilities (1)

(Percentage as of 31-12-2015)

Financial statements and relevant business indicators

Download Excel

Download Excel

|

|

Million euros and percentage | ||||

|---|---|---|---|---|---|

|

|

Turkey (1) | Turkey en continuidad (2) | |||

| Income statement | 2015 | 2015 | Δ% | Δ% (3) | 2014 |

| Net interest income | 2,194 | 850 | 15.7 | 20.4 | 735 |

| Net fees and commissions | 471 | 187 | (1.8) | 2.2 | 191 |

| Net trading income | (273) | (84) | n.m. | n.m. | 1 |

| Other income/expenses | 42 | 17 | (4.7) | (0.8) | 18 |

| Gross income | 2,434 | 971 | 2.8 | 7.0 | 944 |

| Operating expenses | (1,160) | (448) | 13.5 | 18.0 | (395) |

| Personnel expenses | (565) | (221) | 9.4 | 13.8 | (202) |

| General and administrative expenses | (478) | (184) | 16.9 | 21.7 | (158) |

| Depreciation and amortization | (118) | (43) | 21.0 | 25.9 | (35) |

| Operating income | 1,273 | 523 | (4.9) | (1.0) | 550 |

| Impairment on financial assets (net) | (422) | (156) | 6.5 | 10.9 | (146) |

| Provisions (net) and other gains (losses) | 2 | 1 | n.m. | n.m. | (11) |

| Income before tax | 853 | 368 | (6.3) | (2.4) | 392 |

| Income tax | (166) | (73) | (11.2) | (7.5) | (82) |

| Net income | 687 | 295 | (5.0) | (1.1) | 310 |

| Non-controlling interests | (316) | - | - | - | - |

| Net attributable profit | 371 | 295 | (5.0) | (1.1) | 310 |

Download Excel

Download Excel

|

|

Million euros and percentage | ||||

|---|---|---|---|---|---|

| Balance sheet | 31-12-15 | 31-12-15 | Δ% | Δ% (3) | 31-12-14 |

| Cash and balances with central banks | 9,089 | 2,272 | (8.3) | 2.8 | 2,478 |

| Financial assets | 15,006 | 3,751 | (16.8) | (6.7) | 4,508 |

| Loans and receivables | 60,702 | 15,175 | 4.9 | 17.7 | 14,464 |

| Loans and advances to customers | 55,182 | 13,795 | 5.3 | 18.1 | 13,098 |

| Loans and advances to credit institutions and other | 5,520 | 1,380 | 1.0 | 13.3 | 1,366 |

| Tangible assets | 1,406 | 352 | 80.8 | 102.8 | 194 |

| Other assets | 2,801 | 697 | (0.0) | 12.2 | 697 |

| Total assets/liabilities and equity | 89,003 | 22,248 | (0.4) | 11.7 | 22,342 |

| Deposits from central banks and credit institutions | 16,823 | 4,206 | (3.8) | 7.9 | 4,374 |

| Deposits from customers | 47,148 | 11,787 | 1.4 | 13.7 | 11,626 |

| Debt certificates | 7,954 | 1,989 | 53.3 | 71.9 | 1,297 |

| Subordinated liabilities | 51 | 13 | (45.2) | (38.6) | 23 |

| Financial liabilities held for trading | 843 | 211 | 9.9 | 23.3 | 192 |

| Other liabilities | 14,521 | 3,004 | (23.2) | (13.9) | 3,913 |

| Economic capital allocated | 1,663 | 1,039 | 13.2 | 27.0 | 918 |

Download Excel

Download Excel

|

|

Million euros and percentage | ||||

|---|---|---|---|---|---|

| Relevant business indicators | 31-12-15 | 31-12-15 | Δ% | Δ% (3) | 31-12-14 |

| Loans and advances to customers (gross) (4) | 57,768 | 14,442 | 5.9 | 18.8 | 13,635 |

| Customer deposits under management (4) | 43,393 | 10,848 | 8.4 | 21.5 | 10,011 |

| Off-balance sheet funds (5) | 3,620 | 905 | 2.7 | 15.1 | 882 |

| Efficiency ratio (%) | 47.7 | 46.1 |

|

|

41.8 |

| NPL ratio (%) (2) | 2.8 | 2.8 |

|

|

2.8 |

| NPL coverage ratio (%) (2) | 129 | 129 |

|

|

115 |

| Cost of risk (%) (2) | 1.24 | 1.09 |

|

|

1.16 |

Macro and industry trends

Turkey maintains strong economic growth, improving the outlook of market forecasts, which in 2015 could have been 3.6%, in a very complex and volatile geopolitical setting, but with the support that the fall in oil prices provides to disposable income in an energy-dependent economy.

Inflation is very high (8.8% in December 2015), exceeding the price stability target set by the Central Bank of Turkey (CBRT), which should tighten the monetary policy to abort the risk of an unanchoring of expectations, of an additional weakening of the Turkish lira and of a deterioration of the capital account. These measures are more necessary insofar as the fiscal policy will further support growth in 2016.

The Turkish financial sector is maintaining the moderate rate of credit growth (especially loans to individuals) that started in the summer, although it is still at double-digit year-on-year rates (up 20% as of December, measured in local currency; adjusted for the effect of the depreciation of the Turkish lira, the increase would be closer to 14%). Growth in customer fund gathering has also slowed in 2015, although it remains at double digit rates year-on-year (17.4%), according to the latest figures as of December 2015. The NPL ratio increases slightly but continues at around 3%. The sector has sound levels of capitalization. In terms of profitability, the banks continue to focus on repricing loans to protect their net interest income, since the cost of finance is high as a result of strong competition and tight liquidity conditions. The stability of the NPL ratio at relatively low levels continues to be one of the sector’s main strengths.

Activity

All the comments below on rates of change will be expressed at a constant exchange rate, unless expressly stated otherwise.

The acquisition of the additional 14.89% of Garanti’s share capital was completed in the third quarter of 2015 after receiving the relevant authorizations. In accordance with applicable accounting rules and as a result of the agreements reached, BBVA Group has valued the initial shareholding (25.01%) at fair value and consolidated its entire current stake (39.9%) by the full integration method. In order to facilitate comparison with the historical figures, the variations presented below are given on an ongoing basis, i.e. at 25.01% and integrated in the proportion corresponding to this percentage stake, unless expressly stated otherwise.

As of December 2015, Turkey registered an increase in gross lending to customers of 18.8%, as a result of the area’s strategy focused on selective growth in more profitable products. Consequently, the performance of the loan portfolio is strongly supported by loans in Turkish lira to the retail segment, specifically mortgage loans, lending to companies and credit cards (up 23.3%, 20.3% and 15.3%, respectively, since 31-Dec-2014). Foreign-currency loans have contracted, if we compare the figure for December 2015 with that for the same date the previous year. This is the result of uncertainty and volatility leading to delays in the execution of some project finance deals.

In the last quarter of the year, in line with a prudent approach to the changes in the global environment, Garanti has reclassified certain loans as subjective non-performing, which explains why the NPL ratio closed at 2.8%, although it remains below the sector average. The coverage ratio increased to reach 129%.

On the liabilities side, customer deposits under management continue to perform strongly. They closed 2015 with a year-on-year rate of growth of 21.5%, boosted particularly by the strong performance of those denominated in foreign currency.

Lastly, Garanti has a comfortable liquidity position, thanks to two factors: the growing contribution from customer deposits (accounting for around 55% of total liabilities); and access to alternative, longer-term sources of finance.

Earnings

Turkey ended 2015 with a net attributable profit of €371m (€295m on an ongoing basis), 24.4% more than in the same period in 2014. The most notable items in this area’s income statement are:

- Excellent performance of net interest income (up 20.4% year-on-year), thanks to strong new loan production and maintenance of customer spreads, supported by adequate management of the repricing of asset products and the diversification of sources of finance.

- Fees and commissions performed better in the last three months of 2015, which is reflected in the year-on-year rise in the cumulative figure through December (up 2.2%). Outstanding are those originated by collection and payment services and those from project finance customers, as well as the growing contribution from the effective use of digital channels. The above, along with greater diversification of this revenue, has offset the negative impact of the regulation approved at the end of 2014 limiting the fees charged for consumer loans and credit cards.

- NTI has been adversely affected by volatility in the wholesale financial markets, particularly in the second half of the year.

- Operating expenses have been impacted by the effect of the depreciation of the Turkish lira on costs denominated in other currencies and the impact of high inflation rates.

- Lastly, impairment losses on financial assets are up, mainly due to the effect of the depreciation of the Turkish lira. However, the cumulative cost of risk through 31-Dec-2015 (1.09%) stands at levels below those registered the previous year (1.16%).