- Loading...

1. Introduction, basis for the presentation of the Consolidated Financial Statements, Internal Control over Financial Reporting and other information

1.1 Introduction

Banco Bilbao Vizcaya Argentaria, S.A. (hereinafter “the Bank”, “BBVA" or “BBVA, S.A.”) is a private-law entity subject to the laws and regulations governing banking entities operating in Spain. It carries out its activity through branches and agencies across the country and abroad.

The Bylaws and other public information are available for inspection at the Bank’s registered address (Plaza San Nicolás, 4 Bilbao) as noted on its web site (www.bbva.com).

In addition to the activities it carries out directly, the Bank heads a group of subsidiaries, joint ventures and associates which perform a wide range of activities and which together with the Bank constitute the Banco Bilbao Vizcaya Argentaria Group (hereinafter the “Group” or the “BBVA Group”). In addition to its own separate financial statements, the Bank is required to prepare Consolidated Financial Statements comprising all consolidated subsidiaries of the Group.

As of December 31, 2022, the BBVA Group had 203 consolidated entities and 43 entities accounted for using the equity method (see Notes 3 and 16 and Appendix I to V).

The Consolidated Financial Statements of the BBVA Group for the year ended December 31, 2021 were approved by the shareholders at the Annual General Meeting (“AGM”) held on March 18, 2022.

BBVA Group’s Consolidated Financial Statements and the Financial Statements for the Bank and the majority of the remaining entities within the Group have been prepared for the year ended December 31, 2022, and are pending approval by their respective AGMs. However, the Board of Directors of the Bank believes that said financial statements will be approved without changes.

1.2 Basis for the presentation of the Consolidated Financial Statements

The BBVA Group’s Consolidated Financial Statements are presented in compliance with IFRS-IASB (International Financial Reporting Standards as issued by the International Accounting Standards Board), as well as in accordance with the International Financial Reporting Standards endorsed by the European Union (hereinafter “EU-IFRS”) applicable as of December 31, 2022, considering the Bank of Spain Circular 4/2017, as well as its successive amendments, and with any other legislation governing financial reporting which is applicable and with the format and mark-up requirements established in the EU Delegated Regulation 2019/815 of the European Commission.

The BBVA Group’s Consolidated Financial Statements for the year ended December 31, 2022 were prepared by the Group’s Directors (through the Board of Directors meeting held on February 9, 2023) by applying the principles of consolidation, accounting policies and valuation criteria described in Note 2, so that they present fairly the Group’s total consolidated equity and financial position as of December 31, 2022, together with the consolidated results of its operations and cash flows generated during the year ended December 31, 2022.

These Consolidated Financial Statements were prepared on the basis of the accounting records kept by the Bank and each of the other entities in the Group. Moreover, they include the adjustments and reclassifications required to harmonize the accounting policies and valuation criteria used by the Group (see Note 2.2).

All effective accounting standards and valuation criteria with a significant effect on the Consolidated Financial Statements were applied in their preparation.

The amounts reflected in the Consolidated Financial Statements are presented in millions of euros, unless it is more appropriate to use smaller units. Some items that appear without a balance in these Consolidated Financial Statements are due to how the units are expressed. Also, in presenting amounts in millions of euros, the accounting balances have been rounded up or down. It is therefore possible that the totals appearing in some tables are not the exact arithmetical sum of their component figures.

The percentage changes in amounts have been calculated using figures expressed in thousands of euros.

1.3 Comparative information

The information included in the consolidated financial statements for the years ended December 31, 2021 and 2020, is presented in accordance with the applicable regulation, for the purpose of comparison with the information for the year ended December 31, 2022.

1.4 Seasonal nature of income and expense

The nature of the most significant activities carried out by the BBVA Group’s entities is mainly related to typical activities carried out by financial institutions, and are not significantly affected by seasonal factors within the same year.

1.5 Responsibility for the information and for the estimates made

The information contained in the BBVA Group’s Consolidated Financial Statements is the responsibility of the Group’s Directors.

Estimates were required to be made at times when preparing these Consolidated Financial Statements in order to calculate the recorded or disclosed amount of some assets, liabilities, income, expense and commitments. These estimates relate mainly to the following:

- Loss allowances on certain financial assets (see Notes 7, 13, 14 and 16).

- The assumptions used to quantify certain provisions (see Notes 23 and 24) and for the actuarial calculation of post-employment benefit liabilities and commitments (see Note 25).

- The useful life and impairment losses of tangible and intangible assets (see Notes 17, 18, and 21).

- The valuation of goodwill and price allocation of business combinations (see Note 18).

- The fair value of certain unlisted financial assets and liabilities (see Notes 7, 8, 10, 11, 12, 13 and 15).

- The recoverability of deferred tax assets (see Note 19).

The great macroeconomic and geopolitical uncertainty (see Note 7.1) has resulted in greater complexity in developing reliable estimates and applying judgment. Therefore, while these estimates have been made on the basis of the best available information on the matters analyzed, as of December 31, 2022, it is possible that events may take place in the future which could make it necessary to amend these estimations (upward or downward), which would be carried out prospectively, recognizing the effects of the change in estimation in the consolidated financial statements.

During 2022 there have been no other significant changes in the estimates made as of December 31, 2021 and 2020, other than those indicated in these Consolidated Financial Statements.

1.6 BBVA Group’s Internal Control over Financial Reporting

BBVA Group’s Consolidated Financial Statements are prepared under an Internal Control over Financial Reporting Model (ICFR). It provides reasonable assurance with respect to the reliability and the integrity of the consolidated financial statements. It is also aimed to ensure that the transactions are processed in accordance with the applicable laws and regulations.

The ICFR model is compliant with the control framework established in 2013 by the Committee of Sponsoring Organizations of the Treadway Commission (hereinafter "COSO"). The COSO 2013 framework sets out five components that constitute the basis of the effectiveness and efficiency of the internal control systems:

- The establishment of an appropriate control framework.

- The assessment of the risks that could arise during the preparation of the financial information.

- The design of the necessary controls to mitigate the identified risks.

- The establishment of an appropriate system of information to detect and report system weaknesses.

- The monitoring over the controls to ensure they perform correctly and are effective over time.

The ICFR model is a dynamic model that continuously evolves over time to reflect the reality of the BBVA Group’s businesses and processes, as well as the risks and controls designed to mitigate them. It is subject to a continuous evaluation by the internal financial control units located in the different entities of BBVA Group.

In order to guarantee the necessary independence of the aforementioned internal financial control units, they are integrated within the Regulation & Internal Control area, whose head reports to the Board of Directors through its Committees, and defines and coordinates the Group's entire internal control model, based on two pillars:

- A control system organized into three lines of defense that has been updated and strengthened, as described below:

- The first line of defense (1LoD) is located within the business and support units, which are responsible for identifying risks associated with their processes, as well as for implementing and executing the necessary controls to mitigate them. The Risk Control Assurer (RCA) role was created to reinforce the adequate risk management in each area’s processes

- The second line of defense (2LoD) comprises the specialized control units for each type of risk (Risk Control Specialists - RCS- among others Finance, Legal, IT, Third Party, Compliance or Processes). This second line defines the mitigation and control frameworks for their areas of responsibility across the entire organization and performs challenge to the control model (supervises the implementation and design of the controls and assesses their effectiveness).

- The third line of defense (3LoD) is the Internal Audit unit, which conducts an independent review of the model, verifying the compliance and effectiveness of the control model, both the first and second line of defense functions.

- A committee structure in the Group, called Corporate Assurance, which enables the escalation of possible weaknesses to the Management as well as the management of issues related to internal control, both at a consolidated level and also in each of the countries where the Group operates.

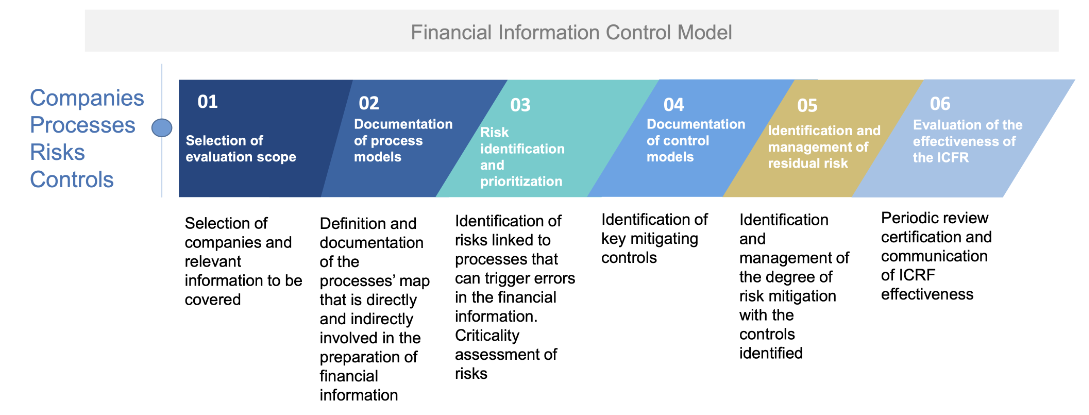

The RCA and RCS Finance (Internal Financial Control) units comply with a common and standard methodology established at the Group level, as set out in the following diagram:

The ICFR model is subject to evaluation on a regular basis by the Control areas (RCAs and RCSs), and annually by the Group’s Internal Audit Unit. It is also supervised by the Audit Committee of the Bank’s Board of Directors.

The BBVA Group also complies with the requirements of the Sarbanes-Oxley Act (hereafter, “SOX”) for the preparation of the consolidated Financial Statements, as a company with securities registered with the U.S. Securities and Exchange Commission (“SEC”). The main senior executives of the Group are involved in the design and implementation of the internal control model with the aim of making it effective and to ensure the quality and accuracy of the financial information.

The description of the ICFR model is included in the Corporate Governance Annual Report within the Management Report accompanying the Consolidated Financial Statements for the year ended December 31, 2022.

2. Principles of consolidation, accounting policies and measurement bases applied and recent IFRS pronouncements

The Glossary includes the definition of some of the financial and economic terms used in Note 2 and subsequent Notes of the Consolidated Financial Statements.

2.1 Principles of consolidation

In terms of its consolidation, in accordance with the criteria established by IFRS, the BBVA Group is made up of four types of entities: subsidiaries, joint ventures, associates and structured entities, defined as follows:

- Subsidiaries

- Subsidiaries are entities controlled by the Group (for definition of control, see Glossary). The financial statements of the subsidiaries are fully consolidated with those of the Bank. The share of non-controlling interests from subsidiaries in the Group’s consolidated total equity is presented under the heading “Minority interests (Non-controlling interests)” in the consolidated balance sheet. Their share in the profit or loss for the period or year is presented under the heading “Attributable to minority interest (non-controlling interests)” in the consolidated income statement (see Note 31).

- Note 3 includes information related to the main subsidiaries in the Group as of December 31, 2022. Appendix I includes other significant information on all entities.

- Joint ventures

- Joint ventures are those entities for which there is a joint control arrangement with third parties other than the Group (for definitions of joint arrangement, joint control and joint venture, refer to Glossary).

- The investments in joint ventures are accounted for using the equity method (see Note 16). Appendix II shows the main figures for joint ventures accounted for using the equity method as of December 31, 2022.

- Associates

- Associates are entities in which the Group is able to exercise significant influence (for definition of significant influence, see Glossary). Significant influence is deemed to exist when the Group owns 20% or more of the voting rights of an investee directly or indirectly, unless it can be clearly demonstrated that this is not the case.

- Certain entities in which the Group owns 20% or more of the voting rights are not included as Group associates, since the Group does not have the ability to exercise significant influence over these entities. Investments in these entities, which do not represent material amounts for the Group, are classified as “Financial assets at fair value through other comprehensive income” or “Non-trading financial assets mandatorily at fair value through profit or loss”.

- In contrast, some investments in entities in which the Group holds less than 20% of the voting rights are accounted for as Group associates, as the Group is considered to have the ability to exercise significant influence over these entities. As of December 31, 2022, these entities are not significant to the Group.

- Appendix II shows the most significant information related to the associates (see Note 16), which are accounted for using the equity method.

- Structured entities

- A structured entity is an entity that has been designed so that voting or similar rights are not the dominant factor in deciding who controls the entity, such as when the voting rights relate to administrative matters only and the relevant activities are directed by means of contractual arrangements (see Glossary).

- In those cases where the Group sets up entities or has a holding in such entities, in order to allow its customers access to certain investments, to transfer risks or for other purposes, in accordance with internal criteria and procedures and with applicable regulations, the Group determines whether control over the entity in question actually exists and therefore whether it should be subject to consolidation.

- Such methods and procedures determine whether there is control by the Group, considering how the decisions are made about the relevant activities, assessing whether the Group has control over the relevant elements, exposure to variable returns from involvement with the investee and the ability to use control over the investee to affect the amount of the investor’s returns.

Structured entities subject to consolidation

To determine if a structured entity is controlled by the Group, and therefore should be consolidated into the Group, the existing contractual rights (different from the voting rights) are analyzed. For this reason, an analysis of the structure and purpose of each investee is performed and, among others, the following factors will be considered:

- Evidence of the current ability to manage the relevant activities of the investee according to the specific business needs (including any decisions that may arise only in particular circumstances).

- Potential existence of a special relationship with the investee.

- Implicit or explicit Group commitments to support the investee.

- The ability to use the Group´s power over the investee to affect the amount of the Group’s returns.

- These types of entities include cases where the Group has a high exposure to variable returns and retains decision-making power over the investee, either directly or through an agent.

- The main structured entities of the Group are the asset securitization funds, to which the BBVA Group transfers loans and advances, and other vehicles, which allow the Group’s customers to gain access to certain investments or to allow for the transfer of risks or for other purposes (see Appendices I and V). The BBVA Group maintains the decision-making power over the relevant activities of these vehicles and financial support through securitized market standard contracts. The most common ones are: investment positions in equity note tranches, funding through subordinated debt, credit enhancements through derivative instruments or liquidity lines, management rights of defaulted securitized assets, “clean-up” call derivatives, and asset repurchase clauses by the grantor.

- For these reasons, the loans and receivable portfolios related to the vast majority of the securitizations carried out by the Bank or Group subsidiaries are not derecognized in the books of said entity and the issuances of the related debt securities are recorded as liabilities within the Group’s consolidated balance sheet.

- For additional information on the accounting treatment for the transfer and derecognition of financial instruments, see Note 2.2.2. “Transfers and derecognition of financial assets and liabilities”.

- Non-consolidated structured entities

- The Group owns other vehicles also for the purpose of allowing customers access to certain investments, to transfer risks, and for other purposes, but without the Group having control of the vehicles, which are not consolidated in accordance with IFRS 10 – “Consolidated Financial Statements”. The balance of assets and liabilities of these vehicles is not material in relation to the Group’s Consolidated Financial Statements.

- As of December 31, 2022, there was no material financial support from the Bank or its subsidiaries to unconsolidated structured entities.

- The Group does not consolidate any of the mutual funds it manages since the necessary control conditions are not met. Particularly, the BBVA Group does not act as arranger but as agent since it operates the mutual funds on behalf and for the benefit of investors or parties (arranger or arrangers) and, for this reason it does not control the mutual funds when exercising its authority for decision making.

- The mutual funds managed by the Group are not considered structured entities (generally, retail funds without corporate identity over which investors have participations which gives them ownership of said managed equity). These funds are not dependent on a capital structure that could prevent them from carrying out activities without additional financial support, being in any case insufficient as far as the activities themselves are concerned. Additionally, the risk of the investment is absorbed by the fund participants, and the Group is only exposed when it becomes a participant, and as such, there is no other risk for the Group.

In all cases, the operating results of equity method investees acquired by the BBVA Group in a particular period only include the period from the date of acquisition to the financial statements date. Similarly, the results of entities disposed of during any year only include the period from the start of the year to the date of disposal.

The consolidated financial statements of subsidiaries, associates and joint ventures used in the preparation of the Consolidated Financial Statements of the Group have the same presentation date as the Consolidated Financial Statements. If financial statements at those same dates are not available, the most recent will be used, as long as these are not older than three months, and adjusted to take into account the most significant transactions. As of December 31, 2022, financial statements as of December 31 of all Group entities were utilized except in the case of the consolidated financial statements of five associates deemed non-significant for which financial statements as of November 30, 2022 were used.

Separate financial statements

The separate financial statements of the parent company of the Group are prepared under Spanish regulations (Circular 4/2017 of the Bank of Spain, and following other regulatory requirements of financial information applicable to the Bank). The Bank uses the cost method to account in its separate financial statements for its investments in subsidiaries, associates and joint venture entities, which are consistent with the requirements of Bank of Spain Circular 4/2017.

Appendix IX shows BBVA’s separate financial statements as of and for the years ended December 31, 2022 and 2021.

2.2 Accounting principles and policies and applied valuation methods

The accounting principles and policies and the valuation methods applied in the preparation of the consolidated financial statements may differ from those used, at the individual level, by some of the entities that are part of the BBVA Group; This is why, in the consolidation process, the necessary adjustments and reclassifications are made to standardize such principles and criteria among themselves and bring them into line with the EU-IFRS.

In preparing the Consolidated Financial Statements, the following accounting principles and policies and assessment criteria have been applied:

2.2.1 Financial instruments

IFRS 9 became effective as of January 1, 2018 and replaced IAS 39 regarding the classification and measurement of financial assets and liabilities, the impairment of financial assets and hedge accounting. However, the Group has chosen to continue applying IAS 39 for accounting for hedges as permitted by IFRS 9.

Classification and measurement of financial assets

Classification of financial assets

IFRS 9 contains three main categories for financial assets classification: measured at amortized cost, measured at fair value with changes through other comprehensive income, and measured at fair value through profit or loss.

The classification of financial instruments in the categories of amortized cost or fair value depends on the business model with which the entity manages the assets and the contractual characteristics of the cash flows, commonly known as the "solely payments of principal and interest" criterion (hereinafter the "SPPI").

The assessment of the business model should reflect the way the Group manages groups of financial assets and does not depend on the intention for an individual instrument. Thus, for each entity within the BBVA Group there are different business models for managing assets.

In order to determine the business model, the following aspects are taken into account:

- The way in which the performance of the business model (and that of the assets which comprise such business model) is evaluated and reported to the entity's key personnel;

- The risks and their management, which affect the performance of the business model;

- The way in which business model managers are remunerated;

- The frequency, amount and timing of sales in previous years, the reasons for such sales and expectations regarding future sales.

- In this sense, the Group has established policies and has developed procedures in each geographical area to determine when the sales of financial assets classified in the amortized cost category are considered infrequent (even when significant), or are insignificant (even when frequent), to ensure compliance with such business model.

- Furthermore, it is considered that any sales that may occur because the financial asset is close to maturity, due to an increase in credit risk, or to satisfy liquidity needs, are compatible with the amortized cost model.

Regarding the SPPI test, the analysis of the cash flows aims to determine whether the contractual cash flows of the assets correspond only to payments of principal and interest on the principal amount outstanding at the beginning of the transaction. Interest is understood here as the consideration for the time value of money; and for the credit risk associated with the principal amount outstanding during a specific period; and for financing and structure costs, plus a profit margin.

The most significant judgments used by the Group in evaluating compliance with the conditions of the SPPI test are the following:

- Modified time value: in the event that a financial asset includes a periodic interest rate adjustment but the frequency of this adjustment does not coincide with the term of the reference interest rate (for example, the interest rate reset every six months to a one-year rate), the Group assesses, at the time of the initial recognition, this mismatch to determine whether the contractual cash flows (undiscounted) differ significantly or not from the cash flows (undiscounted) of a benchmark financial asset, for which there would be no change in the time value of money. The defined tolerance thresholds are 10% for the differences in each period and 5% for the analysis accumulated throughout the financial asset life.

- Contractual clauses: The contractual clauses that can modify the calendar or the amount of the contractual cash flows are analyzed to verify if the contractual cash flows that would be generated during the life of the instrument due to the exercise of those clauses are only payments of principal and interest on the principal amount outstanding. To do this, the contractual cash flows that may be generated before and after the modification are analyzed.

- The main criteria taken into account in the analysis are:

- Early termination clauses: generally a contractual clause that permits the debtor to prepay a debt instrument before maturity is consistent with SPPI when the prepayment amount substantially represents unpaid amounts of principal and interest on the principal amount outstanding (which may include reasonable additional compensation for the early termination of the contract).

- Instruments with an interest rate linked to contingent events:

- An instrument whose interest rate is reset to a higher rate if the debtor misses a particular payment may meet the SPPI criterion because of the relationship between missed payments and an increase in credit risk.

- An instrument with contractual cash flows that are indexed to the debtor’s performance – e.g. net income or is adjusted based on a certain index or stock market value would not meet the SPPI criterion.

- Perpetual instruments: to the extent that they can be considered instruments with continuous (multiple) extension options, they meet the SPPI test if the contractual flows meet it. When the issuer can defer the payment of interest, if such payment would affect their solvency, they would meet the SPPI test if the deferred interest accrues additional interest, while if they do not, they would not meet the test.

- Non-recourse financial instruments: In the case of debt instruments that are repaid primarily with the cash flows of specific assets or projects and the debtor has no legal responsibility, the underlying assets or cash flows are evaluated to determine whether the contractual cash flows of the instrument are consistent with payments of principal and interest on the principal amount outstanding.

- If the contractual terms do not give rise to additional cash flows to payments of principal and interest on the amount of principal outstanding or limitations to these payments, the SPPI test is met.

- If the debt instrument effectively represents an investment in the underlying assets and its cash flows are inconsistent with principal and interest (because they depend on the performance of a business), the SPPI test is not met.

- Contractually linked instruments: a look-through analysis is carried out in the case of transactions that are set through the issuance of multiple financial instruments forming tranches that create concentrations of credit risk in which there is an order of priority that specifies how the flows of cash generated by the underlying set of financial instruments are allocated to the different tranches. The debt tranches of the instrument will comply with the requirement that their cash flows represent only payment of principal and interest on the outstanding principal if:

- The contractual terms of the tranche being assessed for classification (without looking through to the underlying pool of financial instruments) give rise to cash flows that are solely payments of principal and interest on the principal amount outstanding,

- The underlying pool of financial instruments comprises instruments with cash flow that are solely payments of principal and interest on the principal amount outstanding, and

- The exposure to credit risk in the underlying pool of financial instruments inherent in the tranche is equal to or lower than the exposure to credit risk of the underlying pool of financial instruments (for example, the credit rating of the tranche being assessed for classification is equal to or higher than the credit rating that would apply to a single tranche that funded the underlying pool of financial instruments).

In any event, the contractual conditions that, at the time of the initial recognition, have a minimal effect on cash flows or depend on the occurrence of exceptional and highly unlikely events do not prevent compliance with the conditions of the SPPI test.

Based on the above characteristics, financial assets will be classified and valued as described below.

A debt instrument will be classified in the amortized cost portfolio if the two following conditions are fulfilled:

- The financial asset is managed within a business model whose purpose is to maintain the financial assets to maturity, to receive contractual cash flows; and

- The contractual conditions of the financial asset give rise to cash flows that are only payments of principal and interest.

A debt instrument will be classified in the portfolio of financial assets at fair value with changes through other comprehensive income if the two following conditions are fulfilled:

- The financial asset is managed with a business model whose purpose combines collection of the contractual cash flows and sale of the assets, and

- The contractual characteristics of the instrument generate cash flows which only represent the return of the principal and interest.

A debt instrument will be classified at fair value with changes in profit and loss provided that the entity's business model for their management or the contractual characteristics of its cash flows do not require classification into one of the portfolios described above.

In general, equity instruments will be measured at fair value through profit or loss. However the Group may make an irrevocable election, at initial recognition to present subsequent changes in the fair value through “other comprehensive income”.

Financial assets will only be reclassified when BBVA Group decides to change the business model. In this case, all of the financial assets assigned to this business model will be reclassified. The change of the objective of the business model should occur before the date of the reclassification.

Measurement of financial assets

All financial instruments are initially recognized at fair value, plus, those transaction costs which are directly attributable to the issue of the particular instrument, with the exception of those financial assets which are classified at fair value through profit or loss.

All changes in the value of financial assets due to the interest accrual and similar items are recorded in the headings "Interest and other income" or "Interest expense", of the consolidated income statement of the year in which the accrual occurred (see Note 37), except for trading derivatives that are not economic and accounting hedges.

The changes in fair value after the initial recognition, for reasons other than those mentioned in the preceding paragraph, are treated as described below, according to the categories of financial assets.

“Financial assets held for trading”, “Non-trading financial assets mandatorily at fair value through profit or loss” and “Financial assets designated at fair value through profit or loss”

Financial assets are recorded under the heading “Financial assets held for trading” if the objective of the business model is to generate gains by buying and selling these financial instruments or generate short-term results. The financial assets recorded in the heading “Non-trading financial assets mandatorily at fair value through profit or loss” are derived from a business model which objective is to obtain the contractual cash flows and / or to sell those instruments but its contractual cash flows do not comply with the requirements of the SPPI test. Financial assets are classified in “Financial assets designated at fair value through profit or loss” only if it eliminates or significantly reduces a measurement or recognition inconsistency that would otherwise arise from recognizing or measuring such financial assets on different bases.

The assets recognized under these headings of the consolidated balance sheet are measured upon acquisition at fair value and changes in the fair value (gains or losses and foreign exchange differences) are recognized as their net value, when applicable, under the headings “Gains (losses) on financial assets and liabilities held for trading, net”, “Gains (losses) on non-trading financial assets mandatorily at fair value through profit or loss, net” and “Gains (losses) on financial assets designated at fair value through profit or loss, net” in the consolidated income statement (see Note 41).

”Financial assets at fair value through other comprehensive income”

- Debt instruments

Assets recognized under this heading in the consolidated balance sheets are measured at their fair value. This category of valuation implies the recognition of the information in the income statement as if it were an instrument valued at amortized cost, while the instrument is valued at fair value in the balance sheet. Thus, both interest income on these instruments and the exchange differences and impairment that arise in their case are recorded in the profit and loss account, while subsequent changes in its fair value (gains or losses) are recognized temporarily (by the amount net of tax effect) under the heading “Accumulated other comprehensive income (loss) - Items that may be reclassified to profit or loss - Fair value changes of debt instruments measured at fair value through other comprehensive income” in the consolidated balance sheets (see Note 30).

The amounts recognized under the headings “Accumulated other comprehensive income (loss) - Items that may be reclassified to profit or loss - Fair value changes of debt instruments measured at fair value through other comprehensive income” continue to form part of the Group's consolidated equity until the corresponding asset is derecognized from the consolidated balance sheet or until a loss allowance is recognized on the corresponding financial instrument. If these assets are sold, these amounts are derecognized and included under the headings “Gains (losses) on derecognition of financial assets and liabilities not measured at fair value through profit or loss, net” in the consolidated income statements (see Note 41).

The net loss allowances in “Financial assets at fair value through other comprehensive income” over the year are recognized under the heading “Impairment or reversal of impairment on financial assets not measured at fair value through profit or loss or net gains by modification - Financial assets at fair value through other comprehensive income” (see Note 47) in the consolidated income statement for the year. Interest income on these instruments is recorded in the consolidated profit and loss account (see Note 37). Changes in foreign exchange rates are recognized under the heading “Exchange differences, net" in the consolidated income statements (see Note 41).

- Equity instruments

At the time of initial recognition of specific investments in equity instruments, the BBVA Group may make the irrevocable decision to present subsequent changes in fair value in other comprehensive income. Subsequent changes in this valuation will be recognized in "Accumulated other comprehensive income - Items that will not be reclassified to profit or loss - Fair value changes of equity instruments measured at fair value through other comprehensive income" (see Note 30). Dividends received from these investments are recorded in the heading "Dividend income" in the consolidated income statement (see Note 38). These instruments are not subject to the impairment model of IFRS 9.

“Financial assets at amortized cost”

The assets under this category are subsequently measured at amortized cost, after initial recognition, using the "effective interest rate" method. In the case of floating rate instruments, including inflation-linked bonds, the periodic updates of cash flows to reflect the movement of interest rates and inflation impact the effective interest rate prospectively.

Net loss allowances of assets recorded under these headings arising in each year, calculated using the IFRS 9 model, are recognized under the heading “Impairment or reversal of impairment on financial assets not measured at fair value through profit or loss or net gains by modification – Financial assets measured at amortized cost” in the consolidated income statement for such year (see Note 47).

Classification and measurement of financial liabilities

Classification of financial liabilities

Financial liabilities are classified in the following categories:

- Financial liabilities at amortized cost;

- Financial liabilities that are held for trading, including derivatives, are financial instruments which are recorded in this category when the Group’s objective is to generate gains by buying and selling these financial instruments or generate short-term results;

- Financial liabilities that are designated at fair value through profit or loss on initial recognition under the Fair Value Option. The Group has the option to designate irrevocably, on the initial moment of recognition, a financial liability at fair value through profit or loss provided that doing so results in the elimination or significant reduction of measurement or recognition inconsistency, or if a group of financial liabilities, or a group of financial assets and financial liabilities, has to be managed, and its performance evaluated, on a fair value basis in accordance with a documented risk management or investment strategy.

Measurement of financial liabilities

Financial liabilities are initially recorded at fair value, less transaction costs that are directly attributable to the issuance of instruments, except for financial instruments that are classified at fair value through profit or loss.

Variations in the value of financial liabilities due to the interest accrual and similar items are recorded in the headings “Interest and other income” or “Interest expense”, of the consolidated income statement for the year in which the accrual occurred (see Note 37), except for trading derivatives that are not economic and accounting hedges.

The changes in fair value after the initial recognition, for reasons other than those mentioned in the preceding paragraph, are treated as described below, according to the categories of financial liabilities.

“Financial liabilities held for trading” and “Financial liabilities designated at fair value through profit or loss“

The subsequent changes in the fair value (gains or losses) of the liabilities recognized under these headings of the consolidated balance sheets are recognized as their net value under the headings “Gains (losses) on financial assets and liabilities held for trading, net” and “Gains (losses) on financial assets and liabilities designated at fair value through profit or loss, net” in the consolidated income statements (see Note 41). The changes in the own credit risk of the liabilities designated under the fair value option is presented in “Accumulated other comprehensive income (loss) – Items that will not be reclassified to profit or loss – Fair value changes of financial liabilities at fair value through profit or loss attributable to changes in their credit risk”, unless this treatment brings about or increases an asymmetry in the income statement. Changes in fair value resulting from variations in foreign exchange rates are recognized under the heading “Exchange differences, net” in the consolidated income statements (Note 41).

“Financial liabilities at amortized cost”

The liabilities under this category are subsequently measured at amortized cost, using the “effective interest rate” method.

Hybrid financial liabilities

When a financial liability contains an embedded derivative, the Group analyzes whether the economic characteristics and risks of the embedded derivative and the host instrument are closely related.

If the characteristics and risks of the host and the derivative are closely related, the instrument as a whole will be classified and measured according to the general rules for financial liabilities. If, on the other hand, the economic characteristics and risks of the embedded derivative are not closely related to the economic characteristics and risks of the host, its terms meet the definition of a derivative and the hybrid contract is not measured at fair value with changes in fair value recognized in profit or loss, the embedded derivative shall be separated from the host and accounted for as a derivative separately at fair value with changes in profit and loss and the host instrument classified and measured according to its nature.

“Derivatives-Hedge Accounting” and “Fair value changes of the hedged items in portfolio hedges of interest-rate risk”

The Group uses financial derivatives as a tool for managing financial risks, mainly interest rates and exchange rates (See Note 7).

When these transactions meet certain requirements, they are considered "hedging instruments".

Hedging financial derivatives are used to hedge changes in the value of assets and liabilities, changes in cash flows, or the net investment in a foreign business. Fair value hedging is established for fixed rate financial instruments, and cash flow hedges are used for variable rate financial instruments. The Group also carries out exchange risk hedging operations.

Hedging accounting follows IAS 39, and the effectiveness of hedges is evaluated both retrospectively and prospectively, so that they remain within a range between 80% and 125%. The ineffectiveness of hedges, defined as the difference between the change in value of the hedging instrument and the hedged item in each period, attributable to the hedged risk, is recognized in the income statement. This includes both the amount of the ineffectiveness of the hedges established to manage interest rate risk in the period, as well as the ineffectiveness of the hedges established to manage exchange risk, which is mainly attributable to the temporary value of hedges established to manage exchange rate risk (see Notes 15 and 41).

Changes occurring subsequent to the designation of the hedging relationship in the measurement of financial instruments designated as hedged items as well as financial instruments designated as hedge accounting instruments are recognized as follows:

- In fair value hedges, the changes in the fair value of the derivative and the hedged item attributable to the hedged risk are recognized under the heading “Gains (losses) from hedge accounting, net” in the consolidated income statement, with a corresponding offset under the headings where hedging items ("Hedging derivatives") and the hedged items are recognized, as applicable, except for interest-rate risks hedges (which are almost all of the hedges used by the Group), for which the valuation changes are recognized under the headings “Interest and other income” or “Interest expense”, as appropriate, in the consolidated income statement (see Note 37).

- In fair value hedges of interest rate risk of a portfolio of financial instruments (portfolio-hedges), the gains or losses that arise in the measurement of the hedging instrument are recognized in the consolidated income statement, with the corresponding offset on the headings “Derivatives-Hedge Accounting” and the gains or losses that arise from the change in the fair value of the hedged item (attributable to the hedged risk) are also recognized in the consolidated income statement (in both cases under the heading “Gains (losses) from hedge accounting, net”, using, as a corresponding offset, the headings "Fair value changes of the hedged items in portfolio hedges of interest rate risk" in the consolidated balance sheets, as applicable).

- In cash flow hedges, the gain or loss on the hedging instruments relating to the effective portion is recognized temporarily under the heading “Accumulated other comprehensive income (loss) - Items that may be reclassified to profit or loss - Hedging derivatives. Cash flow hedges (effective portion)” in the consolidated balance sheets, with a corresponding offset under the heading “Hedging derivatives” of the assets or liabilities of the consolidated balance sheets as applicable. These differences are recognized in the consolidated income statement at the time the gains or losses of the hedged item are recorded in the income statement, at the time the forecast transaction is executed or at the maturity date of the hedged item. Almost all of the cash flow hedges carried out by the Group relate to interest rate risk and inflation risk of financial instruments, so their valuation changes are recognized under the heading "Interest and other income" or "Interest expense” in the consolidated income statement (see Note 37).

- The changes in value of the hedging items corresponding to the ineffective portions of cash flow hedges are recognized directly in the heading “Gains (losses) from hedge accounting, net” in the consolidated income statement (see Note 41).

- In hedges of net investments in foreign businesses, the valuation changes attributable to the effective portions of hedging items are recognized temporarily under the heading "Accumulated other comprehensive income (loss) - Items that may be reclassified to profit or loss – Hedging of net investments in foreign operations (effective portion)" in the consolidated balance sheets with a corresponding offset under the heading “Hedging derivatives” of the assets or liabilities of the consolidated balance sheets, as applicable. These valuation changes will be recognized in the consolidated income statement when the investment in a foreign business is disposed of or derecognized (see Note 41).

Loss allowances on financial assets

The “expected losses” impairment model is applied to financial assets valued at amortized cost, debt instruments valued at fair value with changes in accumulated other comprehensive income, financial guarantee contracts and other commitments. All financial instruments valued at fair value through profit or loss are excluded from the impairment model.

The standard classifies financial instruments into three categories, which depend on the evolution of their credit risk from the moment of initial recognition and which establish the calculation of the credit risk allowance.

- Stage 1– without significant increase in credit risk

Financial assets which are not considered to have significantly increased in credit risk have loss allowances measured at an amount equal to the expected credit loss that arises from all possible default events within 12 months following the presentation date of the financial statements (12 month expected credit losses).

- Stage 2– significant increases in credit risk

When the credit risk of a financial asset has increased significantly since the initial recognition, the loss allowances of that financial instrument is calculated as the expected credit loss during the entire life of the asset. That is, they are the expected credit losses that result from all possible default events during the expected life of the financial instrument.

- Stage 3 – Impaired

When there is objective evidence that the instrument is credit-impaired, the financial asset is transferred to this category in which the provision for losses of that financial instrument is calculated, as in stage 2, as the expected credit loss during the entire life of the asset.

When the recovery of any recognized amount is considered remote, such amount is written-off on the consolidated balance sheet, without prejudice to any actions that may be taken in order to collect the amount until the rights extinguish in full either because it is time-barred debt, the debt is forgiven, or other reasons.

The BBVA Group has applied the following definitions:

- Credit-impaired asset

An asset is credit-impaired (stage 3) if one or more events have occurred and they have a detrimental impact on the estimated future cash flows of the asset.

Historically, the definition of credit-impaired asset under IFRS 9 has been substantially aligned with the definition of default used by the Group for internal credit risk management, which is also the definition used for regulatory purposes. In 2021 the Group updated its definition of default to conform to that set forth in the European Banking Authority (hereinafter EBA) Guidelines, in compliance with article 178 of Regulation (EU) No 575/2013 (CRR). The Group consequently updated the definition of credit-impaired asset (stage 3), considering it a change in accounting estimates, re-establishing the consistency with the definition of default and guaranteeing the integration of both definitions in credit risk management.

The determination of an asset as impaired and its classification in stage 3 is based exclusively on the risk of default, without considering the effects of credit risk mitigating measures such as guarantees and collaterals. Specifically, the following financial assets are classified in stage 3:

Impaired assets for objective reasons or delinquency: when there are unpaid amounts of principal or interest for more than 90 days.

According to IFRS 9, the 90-days past due default is a presumption that can be rebutted in those cases where the entity considers, based on reasonable and supportable information, that it is appropriate to use a longer term. As of December 31, 2022, the Group has not used terms exceeding 90 days past due.

- Impaired assets for subjective reasons (other than delinquency): when circumstances are identified that show, even in the absence of defaults, that it is not probable that the debtor will fully comply with its financial obligations. For this purpose, the following indicators are considered, among others:

- Significant financial difficulties of the issuer or the borrower.

- Granting by the lender or lenders to the borrower, for economic or contractual reasons related to the latter's financial difficulties, of concessions or advantages that they would not have otherwise granted.

- Breach of contractual clauses, such as events of default or default.

- Increasing probability that the borrower will go into bankruptcy or some other situation of financial reorganization.

- Disappearance of an active market for the financial asset due to financial difficulties.

- Others that may affect the committed cash flows such as the loss of the debtor's license or that it has committed fraud.

- Generalized delay in payments. In any case, this circumstance exists when, during a continuous period of 90 days prior to the reporting date, a material amount has remained unpaid.

- Sales of credit exposures of a client with a significant economic loss will imply that the rest of its operations are considered impaired.

Relating to the granting of concessions due to financial difficulties, it is considered that there is an indicator of unlikeliness to pay, and therefore the client must be considered impaired, when the refinancing or restructuring measures may result in a diminished financial obligation caused by a forgiveness or material deferral of principal, interest or fees. Specifically, unless proven otherwise, transactions that meet any of the following criteria will be reclassified to the category of impaired assets:

- Irregular repayment schedule.

- Contractual clauses that delay the repayment of the loan through regular payments. Among others, grace periods of more than two years for the amortization of the principal will be considered clauses with these characteristics.

- Amounts of principal or interest written off from the balance sheet as its recovery is considered remote.

In any case, a restructuring will be considered impaired when the reduction in the net present value of the financial obligation is greater than 1%, in accordance with the management criteria introduced during 2021.

Credit risk management for wholesale counterparties is carried out at the customer (or group) level. For this reason, the classification of any of a client's material exposures as impaired, whether due to more than 90 days of default or due to any of the subjective criteria, implies the classification as impaired of all the client's exposures.

Regarding retail clients, which are managed at the individual loan level, the scoring systems review their score, among other factors, in the event of a breach in any of their operations or incurring generalized delays in payments, which also triggers the necessary recovery actions. Among them are the refinancing measures that, where appropriate, may lead to all the client's operations being considered impaired. Furthermore, given the granularity of the retail portfolios, the differential behavior of these clients in relation to their products and collateral provided, as well as the time necessary to find the best solution, the Group has established as an indicator that when a transaction of a retail client is in default in excess of 90 days or shows a general delay in payments and this represents more than 20% of the client's total balance, all its transactions are considered impaired.

When operations by entities related to the client fall into stage 3, including both entities of the same group and those with which there is a relationship of economic or financial dependence, the transactions of the holder will also be classified as stage 3 if after the analysis it is concluded that there are reasonable doubts about the full payment of the loans.

The stage 3 classification will be maintained for a cure period of 3 months from the disappearance of all indicators of impairment during which the client must demonstrate good payment behavior and an improvement in their credit quality in order to corroborate the disappearance of the causes that motivated the classification of the debt as impaired. In the case of refinancing and restructuring, the cure period is one year (see Note 7.2.7 for more details).

These criteria are aligned in all the geographical areas of the Group, maintaining only minor differences to facilitate the integration of management at the local level.

- Significant increase in credit risk

The objective of the impairment requirements is to recognize lifetime expected credit losses for financial instruments for which there have been significant increases in credit risk since initial recognition considering all reasonable and supportable information, including that which is forward-looking.

The model developed by the Group for assessing the significant increase in credit risk has a two-prong approach that is applied globally (for more detail on the methodology used, see Note 7.2.1):

- Quantitative criterion: the Group uses a quantitative analysis based on comparing the current expected probability of default over the life of the transaction with the original adjusted expected probability of default, so that both values are comparable in terms of expected default probability for their residual life.

- Qualitative criterion: most indicators for detecting significant risk increase are included in the Group's systems through rating and scoring systems or macroeconomic scenarios, so the quantitative analysis covers the majority of circumstances. The Group uses additional qualitative criteria to identify significant increase in credit risk and thus, to include circumstances that are not reflected in the rating/score systems or macroeconomic scenarios used. Such qualitative criteria are the following:

- More than 30 days past due. According to IFRS 9, default of more than 30 days is a presumption that can be rebutted in those cases in which the entity considers, based on reasonable and documented information, that such non-payment does not represent a significant increase in risk. As of December 31, 2022, the Group has not considered periods higher than 30 days.

- Watch list: They are subject to special watch by the Risk units because they show negative signs in their credit quality, even though there may be no objective evidence of impairment.

- Refinance or restructuring that does not show evidence of impairment, or that, having been previously identified, the existence of significant increase in credit risk may still exist.

Although the standard introduces a series of operational simplifications, also known as practical solutions, for analyzing the increase in significant risk, the Group does not use them as a general rule. However, for high-quality assets, mainly related to certain government institutions and bodies, the standard allows for considering that their credit risk has not increased significantly because they have a low credit risk at the presentation date. This possibility is limited to those financial instruments that are classified as having high credit quality and high liquidity to comply with the liquidity coverage ratio (hereinafter, "LCR"). This does not prevent these assets from being assigned the credit risk coverage that corresponds to their classification as stage 1 based on their credit rating and macroeconomic expectations.

Method for calculating Expected Credit Loss (ECL)

Method for calculating expected loss

The measurement of expected losses must reflect:

- A considered and unbiased amount, determined by evaluating a range of possible results;

- The time value of money, and

- Reasonable and supportable information that is available without undue cost or effort and that reflects current conditions and forecasts of future economic conditions.

Expected losses are measured both individually and collectively.

The individualized estimate of credit losses results from calculating the difference between the expected cash flows discounted at the effective interest rate of the transaction and the carrying amount of the instrument (see Note 7.2.1).

For the collective measurement of expected losses the instruments are classified into groups of assets based on their risk characteristics. Exposure within each group is grouped according to credit risk common characteristics, which indicate the payment capacity of the borrower according to the contractual conditions. These risk characteristics have to be relevant in estimating the future flows of each group. The characteristics of credit risk may consider, among others, the following factors (see Note 7.2.1):

- Type of instrument.

- Rating or scoring tools.

- Credit risk scoring or rating.

- Type of collateral.

- Amount of time at default for stage 3.

- Segment.

- Qualitative criteria which can have a significant increase in risk.

- Collateral value if it has an impact on the probability of a default event.

The estimated losses are derived from the following parameters:

- PD: estimate of the probability of default in each period.

- EAD: estimate of the exposure in case of default at each future period, taking into account the changes in exposure after the closing date of the financial statements.

- LGD: estimate of the loss in case of default, calculated as the difference between the contractual cash flows and receivables, including guarantees. For these purposes, the probability of executing the guarantee, the moment until its ownership and subsequent realization are achieved, the expected cash flows and the acquisition and sale costs, are considered in the estimation.

- CCF: cash conversion factor is the estimate made on off-balance sheet contractual arrangements to determine the exposure subject to credit risk in the event of a default.

At the BBVA Group, the calculated expected credit losses are based on internal models developed for all portfolios within the IFRS 9 scope, except for the cases that are subject to individual analysis.

The calculation and recognition of expected credit losses includes exposures with governments and credit institutions, for which, despite having a reduced number of defaults in the information databases, internal models have been developed, considering, as sources of information, the data provided by external rating agencies or other observed in the market, such as changes in bond yields, prices of credit default swaps or any other public information on them.

Use of present, past and future information

IFRS 9 requires incorporation of present, past and future information to detect any significant increase in risk and measure expected loss, which must be carried out on a weighted probability basis.

The standard does not require identification of all possible scenarios for measuring expected loss. However, the probability of a loss event occurring and the probability it will not occur have to be considered, even though the possibility of a loss may be very low. To achieve this, the Group generally evaluates the linear relationship between its estimated loss parameters (PD, LGD and EAD) with the historical and future forecasts of the macroeconomic scenarios.

Additionally, when there is no linear relation between the different future economic scenarios and their associated expected losses, more than one future economic scenario must be used for the measurement.

The approach taken by the Group consists of using a methodology based on the use of three scenarios. The first is the most probable scenario (base scenario) that is consistent with that used in the Group's internal management processes, and two additional ones, one more positive and the other more negative. The combined outcome of these three scenarios is calculated considering the weight given to each of them. The main macroeconomic variables that are valued in each of the scenarios for each of the geographies in which the Group operates are the Gross Domestic Product (GDP), the real estate price index, interest rates and the unemployment rate. The main goal of the Group's approach is seeking the greatest predictive capacity with respect to the first two variables (see Note 7.2.1).

Derecognition of the balance due to impairment on financial assets (write-offs)

Debt instruments are classified as written-off once, after being analyzed, it is reasonably considered that their recovery is remote due to the notorious and irrecoverable deterioration of the solvency of the holder of the operation.

Based on their procedures and particularities, the Group entities recognize operations as a write-off where, following their analysis, there are no reasonable expectations of recovery of the debt, taking into account aspects such as: the time elapsed since the classification as doubtful operations due to delinquency, the coverage levels achieved, type of portfolio or product, bankruptcy status of the holder and the existence of guarantees, their valuation and execution capacity. In those cases where the guarantee is significant, there is the possibility of making partial write-offs on the non-guaranteed portion.

The classification of an operation as written-off, entails the recognition of losses for the carrying amount of the related debt and results in a derecognition in the same amount from the balance sheet (see Note 7.2.5).

2.2.2 Transfers and derecognition of financial assets and liabilities

The accounting treatment of transfers of financial assets is determined by the form in which risks and benefits associated with the financial assets involved are transferred to third parties. Financial assets are only derecognized from the consolidated balance sheet when the cash flows that they generate are extinguished, when their implicit risks and benefits have been substantially transferred to third parties or when the control of financial asset is transferred even in case of no physical transfer or substantial retention of such assets. In the latter case, the financial asset transferred is derecognized from the consolidated balance sheet, and any right or obligation retained or created as a result of the transfer is simultaneously recognized.

Similarly, financial liabilities are derecognized from the consolidated balance sheet only if their obligations are extinguished or acquired (with a view to subsequent cancellation or renewed placement).

The Group is considered to have transferred substantially all the risks and benefits if such risks and benefits account for the majority of the risks and benefits involved in ownership of the transferred financial assets. If substantially all the risks and benefits associated with the transferred financial asset are retained:

- The transferred financial asset is not derecognized from the consolidated balance sheet and continues to be measured using the same criteria as those used before the transfer.

- A financial liability is recognized at the amount equal to the amount received, which is subsequently measured at amortized cost or fair value with changes in the income statement, whichever the case.

- Both the income generated on the transferred (but not derecognized) financial asset and the expense of the new financial liability continue to be recognized.

Treatment of securitizations

The securitizations funds to which the Group entities transfer their credit portfolios are consolidated entities of the Group. For more information, refer to Note 2.1 “Principles of consolidation”.

The Group considers that the risks and benefits of the securitizations are substantially retained if the subordinated bonds are held and/ or if subordination funding has been granted to those securitization funds, which means that the credit loss risk of the securitized assets will be assumed. Consequently, the Group is not derecognizing those transferred loan portfolios.

Synthetic securitizations are transactions where risk is transferred through derivatives or financial guarantees and in which the exposure of these securitizations remains in the balance sheet of the Group. The Group has established the synthetic securitizations through received financial guarantees. As for the commissions paid, they are accrued during the term of the financial guarantee.

2.2.3 Financial guarantees

Financial guarantees are considered to be those contracts that require their issuer to make specific payments to reimburse the holder of the financial guarantee for a loss incurred when a specific borrower breaches its payment obligations on the terms – whether original or subsequently modified – of a debt instrument, irrespective of the legal form it may take. Financial guarantees may take the form of a deposit, bank guarantee, insurance contract or credit derivative, among others.

In their initial recognition, financial guarantees are recognized as liabilities in the consolidated balance sheet at fair value, which is generally the present value of the fees, commissions and interest receivable from these contracts over the term thereof, and the Group simultaneously recognizes a corresponding asset in the consolidated balance sheet for the amount of the fees and commissions received at the inception of the transactions and the amounts receivable at the present value of the fees, commissions and interest outstanding.

Financial guarantees, irrespective of the guarantor, instrumentation or other circumstances, are reviewed periodically so as to determine the credit risk to which they are exposed and, if appropriate, to consider whether a provision is required for them. The credit risk is determined by application of criteria similar to those established for quantifying loss allowances on debt instruments measured at amortized cost (see Note 2.2.1).

The provisions recognized for financial guarantees are recognized under the heading “Provisions - Provisions for contingent risks and commitments” on the liability side in the consolidated balance sheets (see Note 24). These provisions are recognized and reversed with a charge or credit, respectively to “Provisions or reversal of provision” in the consolidated income statements (see Note 46).

Income from financial guarantees is recorded under the heading “Fee and commission income” in the consolidated income statement and is calculated by applying the rate established in the related contract to the nominal amount of the guarantee (see Note 40).

Synthetic securitizations made by the Group to date meet the requirements of the accounting regulations for accounting as guarantees.

2.2.4 Non-current assets and disposal groups classified as held for sale and liabilities included in disposal groups classified as held for sale

The heading “Non-current assets and disposal groups classified as held for sale” in the consolidated balance sheet includes the carrying amount of individual items or items integrated in a group ("disposal group") or that form part of a significant business line or geographical area that is intended to be disposed of (“discontinued operation”) whose sale is highly probable to take place under the current conditions within a period of one year from the date to which the financial statements refer. Additionally, assets that were expected to be disposed of within a year but which disposal is delayed due to events and circumstances beyond the control of the Group can be classified as held for sale (see Note 21).

Symmetrically, the heading “Liabilities included in disposal groups classified as held for sale” in the consolidated balance sheet reflects the balances payable arising from disposal groups and discontinued operations.

With respect to the subsidiaries of the BBVA Group, the heading "Non-current assets and disposal groups classified as held for sale" includes the assets received by the subsidiaries for the satisfaction, in whole or in part, of the payment obligations of their debtors (foreclosed or received in payment of debt or recoveries from financial leasing transactions, unless the Group has decided to make continued use of those assets). The BBVA Group has specific units focused on real estate management and sale of these types of assets.

Non-current assets and disposal groups classified as held for sale are measured, at the acquisition date and at any later date deemed necessary, at either their carrying amount or the fair value of the property (less costs to sell), whichever is lower. An impairment or reversal of impairment for the difference is recognized if applicable. When the amount of the sale less estimated costs of sale is higher than the carrying value, the gain is not recognized until the moment of disposal and derecognition from the balance sheet.

Non-current assets and disposal groups classified as held for sale are not depreciated while included under the heading “Non-current assets and disposal groups classified as held for sale”.

In the case of real estate assets foreclosed or received in payment of debts, they are initially recognized at the lower of: the restated carrying amount of the financial asset and the fair value at the time of the foreclosure or receipt of the asset less estimated sales costs. The carrying amount of the financial asset is updated at the time of the foreclosure, treating the real property received as a secured collateral and taking into account the credit risk coverage that would correspond to it according to its classification prior to the delivery. For these purposes, the collateral will be valued at its current fair value (less sale costs) at the time of foreclosure. This carrying amount will be compared with the previous carrying amount and the difference will be recognized as a provision increase, if applicable. On the other hand, the fair value of the foreclosed assets is based mainly on appraisals or valuations carried out by independent experts on an annual basis or more frequently if there are indications of impairment by appraisal, evaluating the need to apply a discount on the asset derived from the specific conditions of the asset or the market situation for these assets and in any case, deducting the company’s estimated sale costs.

Gains and losses generated on the disposal of assets and liabilities classified as non-current held for sale, and liabilities included in disposal groups classified as held for sale as well as impairment losses and, where pertinent, the related recoveries, are recognized in “Gains (losses) from non-current assets and disposal groups classified as held for sale not qualifying as discontinued operations” in the consolidated income statement (see Note 50). The remaining income and expense items associated with these assets and liabilities are classified in the consolidated income statement according to their nature.

Income and expense for discontinued operations, whatever their nature, generated during the year, even if they have occurred before their classification as discontinued operations, are presented net of the tax effect as a single amount under the heading “Profit (loss) after tax from discontinued operations” in the consolidated income statement (see Notes 3 and 21). This heading includes the earnings from their sale or other disposal (net of tax effects).

2.2.5 Tangible Assets

Property, plant and equipment for own use

This heading includes the assets under ownership or acquired under lease terms (right to use), intended for future or current use by the BBVA Group and that it expects to hold for more than one year. It also includes tangible assets received by the consolidated entities in full or partial settlement of financial assets representing receivables from third parties which are expected to be held for continuing use.

For more information regarding the accounting treatment of right to use assets under lease terms, see Note 2.2.18 "Leases".

Property, plant and equipment for own use are presented in the consolidated balance sheets at acquisition cost, less any accumulated depreciation and, where appropriate, any estimated impairment losses resulting from comparing the net carrying amount of each item with its corresponding recoverable amount (see Note 17).

Depreciation is calculated using the straight-line method, during the useful life of the asset, on the basis of the acquisition cost of the assets less their residual value; the land is considered to have an indefinite life and is therefore not depreciated.

The tangible asset depreciation charges are recognized in the consolidated income statements under the heading "Depreciation and Amortization" (see Note 45) and are based on the application of the following depreciation rates (determined on the basis of the average years of estimated useful life of the various assets):

Depreciation rates for tangible assets

| Type of assets | Annual Percentage |

|---|---|

| Buildings for own use | 1% - 4% |

| Furniture | 8% - 10% |

| Fixtures | 6% - 12% |

| Office supplies and hardware | 8% - 25% |

| Lease use rights | The lesser of the lease term or the useful life of the underlying asset |

At each reporting date, the Group entities analyze whether there are internal or external indicators that a tangible asset may be impaired. When there is evidence of impairment, the Group analyzes whether this impairment actually exists by comparing the asset’s net carrying amount with its recoverable amount (defined as the higher between its recoverable amount less disposal costs and its value in use). When the carrying amount exceeds the recoverable amount, the carrying amount is written down to the recoverable amount and depreciation charges going forward are adjusted to reflect the asset’s remaining useful life.

Similarly, if there is any indication that the value of a previously impaired tangible asset is now recoverable, the consolidated entities will estimate the recoverable amounts of the asset and recognize it in the consolidated income statement, recording the reversal of the impairment loss recognized in previous years and thus adjusting future depreciation charges. Under no circumstances may the reversal of an impairment loss on an asset raise its carrying amount above that which it would have if no impairment losses had been recognized in prior years.

In the BBVA Group, most of the buildings held for own use are assigned to the different Cash Generating Units (CGU) to which they belong. The corresponding impairment analyses are performed for these CGU to check whether sufficient cash flows are generated to support the value of the assets comprised within.

Operating and maintenance expense relating to tangible assets held for own use are recognized as an expense in the year they are incurred and recognized in the consolidated income statements under the heading "Administration costs - Other administrative expense - Property, fixtures and materials" (see Note 44.2).

Other assets leased out under an operating lease

The criteria used to recognize the acquisition cost of assets leased out under operating leases, to calculate their depreciation and their respective estimated useful lives and to recognize the impairment losses on them, are the same as those described in relation to tangible assets for own use.

Investment properties