5. Other information

- 5.1 Alternative Performance Measures (APMs)

-

5.2 Compliance tables

- 5.2.1 Index of contents of Law 11/2018

- 5.2.2 Index of contents of Law 07/2021

- 5.2.3 GRI standards content index

- 5.2.4 Index of contents of the Principles of Responsible Banking UNEP-FI

- 5.2.5 Alignment of BBVA Group's non-financial information to WEFIBC and SASB standards

- 5.2.6 Contribution to the Sustainable Development Goals

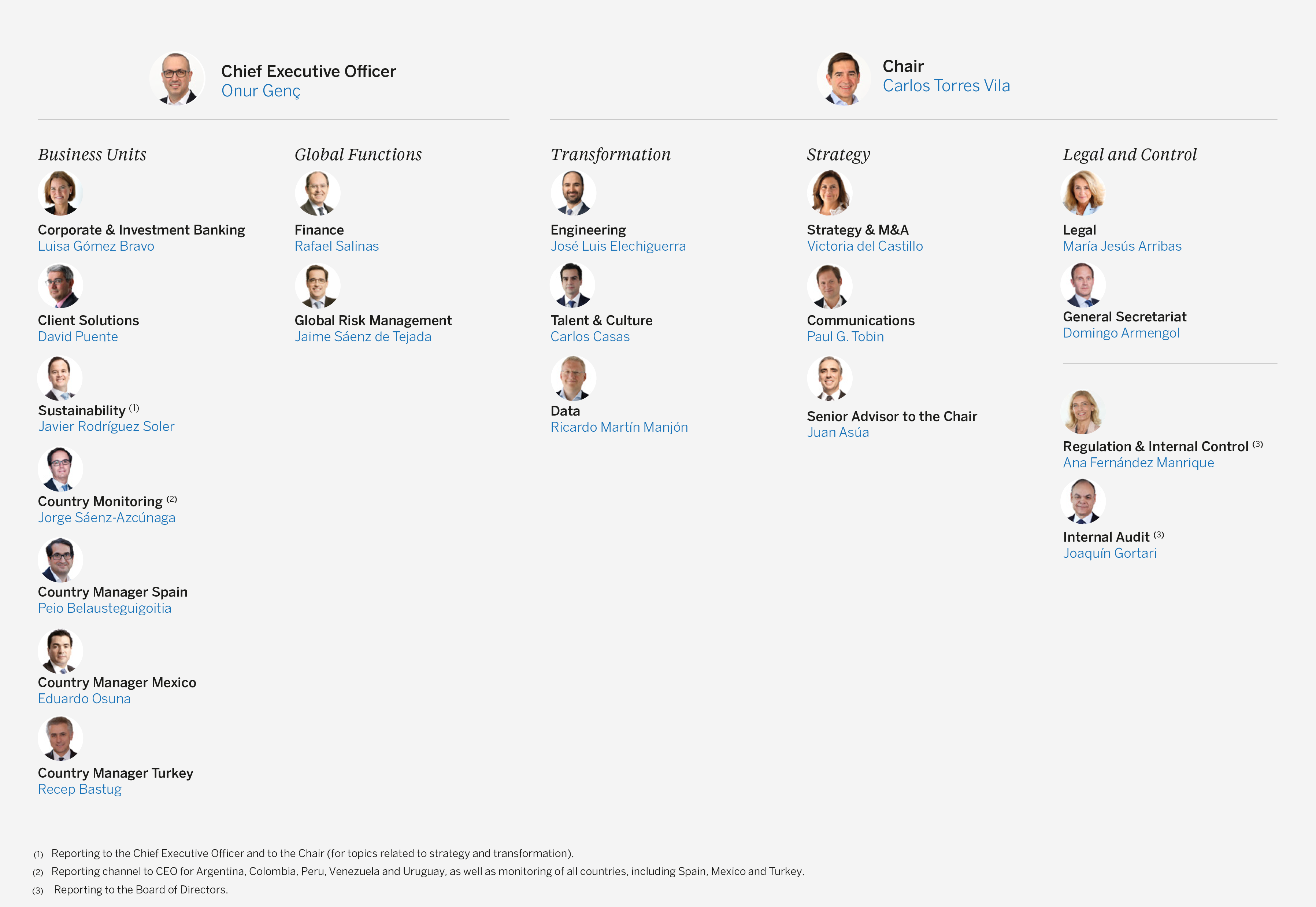

- 5.3 Organizational Chart

5.1 Alternative Performance Measures (APMs)

BBVA presents its results in accordance with the International Financial Reporting Standards (EU-IFRS). However, it also considers that some Alternative Performance Measures (hereinafter APMs) provide useful additional financial information that should be taken into account when evaluating performance. These APMs are also used when making financial, operational and planning decisions within the Entity. The Group firmly believes that they give a true and fair view of its financial information. These APMs are generally used in the financial sector as indicators for monitoring the assets, liabilities and economic and financial situation of entities.

BBVA Group's APMs are given below. They are presented in accordance with the European Securities and Markets Authority (ESMA) guidelines, published on October 5, 2015 (ESMA/2015/1415en) as well as the statement published by the ESMA on May 20, 2020 (ESMA 32-63-972), about implications of the COVID-19 outbreak on the half-yearly financial reports. The first guideline mentioned before are aimed at promoting the usefulness and transparency of APMs included in prospectuses or regulated information in order to protect investors in the European Union. In accordance with the indications given in the aforementioned guideline, BBVA Group's APMs:

- Include clear and readable definitions of the APMs.

- Disclose the reconciliations to the most directly reconcilable line item, subtotal or total presented in the financial statements of the corresponding period, separately identifying and explaining the material reconciling items.

- Are standard measures generally used in the financial industry, so their use provides comparability in the analysis of performance between issuer.

- Do not have greater preponderance than measures directly stemming from financial statements.

- Are accompanied by comparatives for previous periods.

- Are consistent over time.

Constant exchange rates

When comparing two dates or periods in this management report, the impact of changes in the exchange rates against the euro of the currencies of the countries in which BBVA operates is sometimes excluded, assuming that exchange rates remain constant. This is done for the amounts in the income statement by using the average exchange rate against the euro1 in the most recent period for each currency of the geographical areas in which the Group operates, and applying it to both periods; for amounts in the balance sheet and activity, the closing exchange rates in the most recent period are used.

1 With the exception of those countries whose economies have been considered hyperinflationary, for which the closing exchange rate of the most recent period will be used.

Reconciliation of the Financial Statements of the BBVA Group

Below is the reconciliation between the income statements of the Consolidated Financial Statements and the consolidated management income statement, for the years 2022, 2021 and 2020.

In 2022, the main difference between the two accounts is in the treatment of the impact of the purchase from Merlin of 100% of the shares of Tree, which in turn owns 662 offices in Spain. For management purposes, this impact is included in a single line, net of taxes, of the income statement called "Discontinued operations and Other", compared to the treatment in the Consolidated Financial Statements, which record the gross impact and its tax effect under the corresponding headings that are applicable to them.

In 2021, the main difference between them is the treatment of the cost related to the restructuring process carried out by the Group in 2021 which, for management purposes, are included in a single line, net of taxes, of the income statement called "Discontinued operations and Other", compared to the treatment in the consolidated Financial Statements, which record the gross impacts and their tax effect in the corresponding headings.

In 2020, the main difference between the two of them derives from the capital gains from the materialization of the agreement with Allianz in that year which, for management purposes, are included in a single line, net of taxes, of the income statement called "Discontinued operations and Other", compared to the treatment in the consolidated Financial Statements, which record the gross impacts and their tax effect in the corresponding headings that are applicable to them.

In addition, in both 2021 and 2020, there is a difference in the positioning of the results generated in 2021 and 2020 by BBVA USA and the rest of the companies sold to PNC on June 1, 2021. In the Consolidated Financial Statements, these results are included in the line "Profit (loss) after tax from discontinued operations" and are taken into account both for the calculation of the "Profit (loss) for the period" and for the profit (loss) "Attributable to the owners of the parent" whereas, for management purposes, they are not included in the "Profit (loss) for the period", as they are included below it, in the line "Discontinued operations and others", together with the aforementioned net restructuring costs for the year 2021 and the net capital gains from the agreement with Allianz for the year 2020, as can be seen in the reconciliation table for the years 2021 and 2020.

CONCILIATION OF THE BBVA GROUP'S INCOME STATEMENTS (MILLIONS OF EUROS)

| CONSOLIDATED INCOME STATEMENT | ADJUSTMENTS | MANAGEMENT INCOME STATEMENT | ||

|---|---|---|---|---|

| 2022 | 2022 | |||

| NET INTEREST INCOME | 19,153 | — | 19,153 | Net interest income |

| Dividend income | 123 | (*) | ||

| Share of profit or loss of entities accounted for using the equity method | 21 | (*) | ||

| Fee and commission income | 8,261 | 8,261 | Fees and commissions income | |

| Fee and commission expense | (2,907) | (2,907) | Fees and commissions expenses | |

| 5,353 | — | 5,353 | Net fees and commissions | |

| Gains (losses) on derecognition of financial assets and liabilities not measured at fair value through profit or loss, net | 64 | |||

| Gains (losses) on financial assets and liabilities held for trading, net | 562 | |||

| Gains (losses) on non-trading financial assets mandatorily at fair value through profit or loss, net | (67) | |||

| Gains (losses) on financial assets and liabilities designated at fair value through profit or loss, net | 150 | |||

| Gains (losses) from hedge accounting, net | (45) | |||

| Exchange differences, net | 1,275 | |||

| 1,938 | — | 1,938 | Net trading income | |

| Other operating income | 528 | |||

| Other operating expense | (3,438) | |||

| Income from insurance and reinsurance contracts | 3,103 | |||

| Expense from insurance and reinsurance contracts | (1,892) | |||

| (1,555) | — | (1,555) | Other operating income and expenses | |

| GROSS INCOME | 24,890 | — | 24,890 | Gross income |

| Administration costs | (9,432) | (10,760) | Operating expenses (**) | |

| Personnel expense | (5,612) | — | (5,612) | Personnel expenses |

| Other administrative expense | (3,820) | — | (3,820) | Other administrative expenses |

| Depreciation and amortization | (1,328) | — | (1,328) | Depreciation |

| 14,130 | — | 14,130 | Operating income | |

| Provisions or reversal of provisions | (291) | — | (291) | Provisions or reversal of provisions |

| Impairment or reversal of impairment on financial assets not measured at fair value through profit or loss or net gains by modification | (3,379) | — | (3,379) | Impairment on financial assets not measured at fair value through profit or loss |

| NET OPERATING INCOME | 10,460 | — | 10,460 | |

| Impairment or reversal of impairment of investments in joint ventures and associates | 42 | |||

| Impairment or reversal of impairment on non-financial assets | (27) | |||

| Gains (losses) on derecognition of non - financial assets and subsidiaries, net | (11) | |||

| Gains (losses) from non-current assets and disposal groups classified as held for sale not qualifying as discontinued operations | (108) | |||

| (104) | 134 | 30 | Other gains (losses) | |

| PROFIT (LOSS) BEFORE TAX FROM CONTINUING OPERATIONS | 10,356 | 134 | 10,490 | Profit (loss) before tax |

| Tax expense or income related to profit or loss from continuing operations | (3,529) | 67 | (3,462) | Income tax |

| PROFIT (LOSS) AFTER TAX FROM CONTINUING OPERATIONS | 6,827 | 201 | 7,028 | Profit (loss) for the period |

| Profit (loss) after tax from discontinued operations | — | — | ||

| PROFIT (LOSS) FOR THE PERIOD | 6,827 | 201 | 7,028 | Profit (loss) for the period |

| ATTRIBUTABLE TO MINORITY INTEREST (NON-CONTROLLING INTERESTS) | (407) | — | (407) | Non-controlling interests |

| ATTRIBUTABLE TO OWNERS OF THE PARENT | 6,420 | 201 | 6,621 | Net attributable profit (loss) excluding non-recurring impacts |

| (201) | (201) | Discontinued operations and Others | ||

| ATTRIBUTABLE TO OWNERS OF THE PARENT | 6,420 | — | 6,420 | Net attributable profit (loss) |

(*) Included within the Other operating income and expenses of the Management Income Statements.

(**) Depreciations included.

CONCILIATION OF THE BBVA GROUP'S INCOME STATEMENTS (MILLIONS OF EUROS)

| CONSOLIDATED INCOME STATEMENT | ADJUSTMENTS | MANAGEMENT INCOME STATEMENT | ||

|---|---|---|---|---|

| 2021 | 2021 | |||

| NET INTEREST INCOME | 14,686 | — | 14,686 | Net interest income |

| Dividend income | 176 | (*) | ||

| Share of profit or loss of entities accounted for using the equity method | 1 | (*) | ||

| Fee and commission income | 6,997 | 6,997 | Fees and commissions income | |

| Fee and commission expense | (2,232) | (2,232) | Fees and commissions expenses | |

| 4,765 | — | 4,765 | Net fees and commissions | |

| Gains (losses) on derecognition of financial assets and liabilities not measured at fair value through profit or loss, net | 134 | |||

| Gains (losses) on financial assets and liabilities held for trading, net | 341 | |||

| Gains (losses) on non-trading financial assets mandatorily at fair value through profit or loss, net | 432 | |||

| Gains (losses) on financial assets and liabilities designated at fair value through profit or loss, net | 335 | |||

| Gains (losses) from hedge accounting, net | (214) | |||

| Exchange differences, net | 883 | |||

| 1,910 | — | 1,910 | Net trading income | |

| Other operating income | 661 | |||

| Other operating expense | (2,041) | |||

| Income from insurance and reinsurance contracts | 2,593 | |||

| Expense from insurance and reinsurance contracts | (1,685) | |||

| (295) | — | (295) | Other operating income and expenses | |

| GROSS INCOME | 21,066 | — | 21,066 | Gross income |

| Administration costs | (8,296) | (9,530) | Operating expenses (**) | |

| Personnel expense | (5,046) | — | (5,046) | Personnel expenses |

| Other administrative expense | (3,249) | — | (3,249) | Other administrative expenses |

| Depreciation and amortization | (1,234) | — | (1,234) | Depreciation |

| 11,536 | — | 11,536 | Operating income | |

| Provisions or reversal of provisions | (1,018) | 754 | (264) | Provisions or reversal of provisions |

| Impairment or reversal of impairment on financial assets not measured at fair value through profit or loss or net gains by modification | (3,034) | — | (3,034) | Impairment on financial assets not measured at fair value through profit or loss |

| NET OPERATING INCOME | 7,484 | 754 | 8,238 | |

| Impairment or reversal of impairment of investments in joint ventures and associates | — | |||

| Impairment or reversal of impairment on non-financial assets | (221) | |||

| Gains (losses) on derecognition of non - financial assets and subsidiaries, net | 24 | |||

| Gains (losses) from non-current assets and disposal groups classified as held for sale not qualifying as discontinued operations | (40) | |||

| (237) | 240 | 2 | Other gains (losses) | |

| PROFIT (LOSS) BEFORE TAX FROM CONTINUING OPERATIONS | 7,247 | 994 | 8,240 | Profit (loss) before tax |

| Tax expense or income related to profit or loss from continuing operations | (1,909) | (298) | (2,207) | Income tax |

| PROFIT (LOSS) AFTER TAX FROM CONTINUING OPERATIONS | 5,338 | 696 | 6,034 | Profit (loss) for the period |

| Profit (loss) after tax from discontinued operations | 280 | (280) | ||

| PROFIT (LOSS) FOR THE PERIOD | 5,618 | 416 | 6,034 | Profit (loss) for the period |

| ATTRIBUTABLE TO MINORITY INTEREST (NON-CONTROLLING INTERESTS) | (965) | — | (965) | Non-controlling interests |

| ATTRIBUTABLE TO OWNERS OF THE PARENT | 4,653 | 416 | 5,069 | Net attributable profit (loss) excluding non-recurring impacts |

| (416) | (416) | Discontinued operations and Others | ||

| ATTRIBUTABLE TO OWNERS OF THE PARENT | 4,653 | — | 4,653 | Net attributable profit (loss) |

(*) Included within the Other operating income and expenses of the Management Income Statements.

(**) Depreciations included.

CONCILIATION OF THE BBVA GROUP'S INCOME STATEMENTS (MILLIONS OF EUROS)

| CONSOLIDATED INCOME STATEMENT | ADJUSTMENTS | MANAGEMENT INCOME STATEMENT | ||

|---|---|---|---|---|

| 2020 | 2020 | |||

| NET INTEREST INCOME | 14,592 | — | 14,592 | Net interest income |

| Dividend income | 137 | (*) | ||

| Share of profit or loss of entities accounted for using the equity method | (39) | (*) | ||

| Fee and commission income | 5,980 | 5,980 | Fees and commissions income | |

| Fee and commission expense | (1,857) | (1,857) | Fees and commissions expenses | |

| 4,123 | — | 4,123 | Net fees and commissions | |

| Gains (losses) on derecognition of financial assets and liabilities not measured at fair value through profit or loss, net | 139 | |||

| Gains (losses) on financial assets and liabilities held for trading, net | 777 | |||

| Gains (losses) on non-trading financial assets mandatorily at fair value through profit or loss, net | 208 | |||

| Gains (losses) on financial assets and liabilities designated at fair value through profit or loss, net | 56 | |||

| Gains (losses) from hedge accounting, net | 7 | |||

| Exchange differences, net | 359 | |||

| 1,546 | — | 1,546 | Net trading income | |

| Other operating income | 492 | |||

| Other operating expense | (1,662) | |||

| Income from insurance and reinsurance contracts | 2,497 | |||

| Expense from insurance and reinsurance contracts | (1,520) | |||

| (95) | — | (95) | Other operating income and expenses | |

| GROSS INCOME | 20,166 | — | 20,166 | Gross income |

| Administration costs | (7,799) | (9,088) | Operating expenses (**) | |

| Personnel expense | (4,695) | — | (4,695) | Personnel expenses |

| Other administrative expense | (3,105) | — | (3,105) | Other administrative expenses |

| Depreciation and amortization | (1,288) | — | (1,288) | Depreciation |

| 11,079 | — | 11,079 | Operating income | |

| Provisions or reversal of provisions | (746) | — | (746) | Provisions or reversal of provisions |

| Impairment or reversal of impairment on financial assets not measured at fair value through profit or loss or net gains by modification | (5,179) | — | (5,179) | Impairment on financial assets not measured at fair value through profit or loss |

| NET OPERATING INCOME | 5,153 | — | 5,153 | |

| Impairment or reversal of impairment of investments in joint ventures and associates | (190) | |||

| Impairment or reversal of impairment on non-financial assets | (153) | |||

| Gains (losses) on derecognition of non - financial assets and subsidiaries, net | (7) | |||

| Gains (losses) from non-current assets and disposal groups classified as held for sale not qualifying as discontinued operations | 444 | |||

| 94 | (435) | (341) | Other gains (losses) | |

| PROFIT (LOSS) BEFORE TAX FROM CONTINUING OPERATIONS | 5,248 | (435) | 4,813 | Profit (loss) before tax |

| Tax expense or income related to profit or loss from continuing operations | (1,459) | 130 | (1,328) | Income tax |

| PROFIT (LOSS) AFTER TAX FROM CONTINUING OPERATIONS | 3,789 | (304) | 3,485 | Profit (loss) for the period |

| Profit (loss) after tax from discontinued operations | (1,729) | 1,729 | ||

| PROFIT (LOSS) FOR THE PERIOD | 2,060 | 1,424 | 3,485 | Profit (loss) for the period |

| ATTRIBUTABLE TO MINORITY INTEREST (NON-CONTROLLING INTERESTS) | (756) | — | (756) | Non-controlling interests |

| ATTRIBUTABLE TO OWNERS OF THE PARENT | 1,305 | 1,424 | 2,729 | Net attributable profit (loss) excluding non-recurring impacts |

| (1,424) | (1,424) | Discontinued operations and Others | ||

| ATTRIBUTABLE TO OWNERS OF THE PARENT | 1,305 | — | 1,305 | Net attributable profit (loss) |

(*) Included within the Other operating income and expenses of the Management Income Statements.

(**) Depreciations included.

Profit (loss) for the period

Explanation of the formula: the profit (loss) for the period is the profit (loss) for the period from the Group’s consolidated income statement, which comprises the profit (loss) after tax from continued operations and the profit (loss) after tax from discontinued operations which, for the periods of 2021 and 2020, includes the results generated by BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021. If the described metric is presented on a date prior to the end of the year, it will be presented on an annualized basis.

Relevance of its use: this measure is commonly used, not only in the banking sectors, for homogeneous comparison purposes.

Profit (loss) for the period

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | |||

|---|---|---|---|---|---|

| (Millions of euros) | + | Profit (loss) after tax from continued operations | 6,827 | 5,338 | 3,789 |

| (Millions of euros) | + | Profit (loss) after tax from discontinued operations (1) | — | 280 | (1,729) |

| = | Profit (loss) for the period | 6,827 | 5,618 | 2,060 |

(1) January-December 2021 only includes the results generated by BBVA USA and the rest of the companies in the United States included in the agreement until its sale to PNC as of June 1, 2021.

Adjusted profit (loss) for the period (excluding non-recurring impacts)

Explanation of the formula: the adjusted profit (loss) for the period is the profit (loss) from continued operations for the period from the Group’s consolidated income statement, excluding those non-recurring impacts that, for management purposes, are defined at any given moment. If the described metric is presented on a date prior to the end of the year, it will be presented on an annualized basis.

Relevance of its use: this measure is commonly used, not only in the banking sector, for homogeneous comparison purposes.

Adjusted profit (loss) for the period

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | |||

|---|---|---|---|---|---|

| (Millions of euros) | + | Profit (loss) after tax from continued operations | 6,827 | 5,338 | 3,789 |

| (Millions of euros) | — | Net capital gains from the bancassurance transaction | — | — | 304 |

| (Millions of euros) | — | Net cost related to the restructuring process | — | (696) | — |

| (Millions of euros) | — | Net impact arisen from the purchase of offices in Spain | (201) | — | — |

| = | Adjusted profit (loss) for the period | 7,028 | 6,034 | 3,485 |

Net attributable profit (loss)

Explanation of the formula: the net attributable profit (loss) is the net attributable profit (loss) of the Group’s consolidated income statement from continued operations and the profit (loss) after tax from discontinued operations which, for the periods of 2021 and 2020, includes the results generated by BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021. If the described metric is presented on a date prior to the end of the year, it will be presented on an annualized basis.

Relevance of its use: this measure is commonly used, not only in the banking sector, for homogeneous comparison purposes.

Net attributable profit (loss)

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | |||

|---|---|---|---|---|---|

| (Millions of euros) | + | Net attributable profit (loss) from continued operations | 6,420 | 4,373 | 3,033 |

| (Millions of euros) | + | Net attributable profit (loss) from discontinued operations (1) | — | 280 | (1.729) |

| = | Net attributable profit (loss) | 6,420 | 4,653 | 1,305 |

(1) January-December 2021 only includes the results generated by BBVA USA and the rest of the companies in the United States included in the agreement until its sale to PNC as of June 1, 2021.

Adjusted net attributable profit (loss) (excluding non-recurring impacts)

Explanation of the formula: the adjusted net attributable profit (loss) is the net attributable profit (loss) of the Group’s consolidated income statement from continued operations excluding those non-recurring impacts that, for management purposes are defined at any given moment. If the described metric is presented on a date prior to the end of the year, it will be presented on an annualized basis.

Relevance of its use: This measure is commonly used, not only in the banking sector, for comparison purposes.

Adjusted net attributable profit (loss)

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | |||

|---|---|---|---|---|---|

| (Millions of euros) | + | Net attributable profit (loss) from continued operations | 6,420 | 4,373 | 3,033 |

| (Millions of euros) | — | Net capital gains from the bancassurance transaction | — | — | 304 |

| (Millions of euros) | — | Net cost related to the restructuring process | — | (696) | — |

| (Millions of euros) | — | Net impact arisen from the purchase of offices in Spain | (201) | — | — |

| = | Adjusted net attributable profit (loss) | 6,621 | 5,069 | 2,729 |

Net attributable profit (loss) excluding corporate operations for AVR

Explanation of the formula: the result is calculated excluding the Group’s non-recurring results amounts of the net attributable profit of the Group’s consolidated Income Statement. In addition, in 2022, the net attributable profit associated with the 36.12% acquired in the voluntary takeover bid of Garanti BBVA is deducted. In 2021, the impact, after tax, resulting from the restructuring process carried out at BBVA S.A., is deducted.

Relevance of its use: This metric is commonly used in the banking sector. In addition, it is one of the metrics used for the purposes of the Group’s AVR (Annual Variable Remuneration).

Net attributable profit (loss) excluding corporate operations for AVR

| Jan.-Dec.2022 | Jan.-Dec.2021 | |||

|---|---|---|---|---|

| (Millions of euros) | + | Net attributable profit (loss) | 6,420 | 4,653 |

| (Millions of euros) | — | BBVA USA and the rest of the Companies in the United States sold to PNC adjustments (1) | — | 280 |

| (Millions of euros) | — | Net impact of the restructuring process | — | (655) |

| (Millions of euros) | — | Net impact from the purchase from offices in Spain | (201) | — |

| (Millions of euros) | — | Impact generated by the voluntary takeover bid of Garanti BBVA | 240 | — |

| = | Net attributable profit (loss) excluding corporate operations for AVR | 6,381 | 5,028 |

- (1) Include the results generated by BBVA USA and the rest of the companies in the United States until its sale to PNC on June 1, 2021.

ROE

The ROE (return on equity) ratio measures the return obtained on an entity's shareholders' funds plus accumulated other comprehensive income. It is calculated as follows:

| Net attributable profit (loss) |

| Average shareholders' funds + Average accumulated other comprehensive income |

Explanation of the formula: the numerator is the net attributable profit (loss) previously defined in these alternative performance measures, If the metric is presented on a date before the close of the fiscal year, the numerator will be annualized.

Average shareholders' funds are the weighted moving average of the shareholders' funds at the end of each month of the period analyzed, adjusted to take into account the execution of the "dividend-option" at the closing dates on which it was agreed to deliver this type of dividend prior to the publication of the Group ́s results.

Average accumulated other comprehensive income is the moving weighted average of "Accumulated other comprehensive income", which is part of the equity on the Entity's balance sheet and is calculated in the same way as average shareholders’ funds (above).

Relevance of its use: this ratio is very commonly used not only in the banking sector but also in other sectors to measure the return obtained on shareholders' funds.

ROE

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | ||

|---|---|---|---|---|

| Numerator (Millions of euros) | = Net attributable profit (loss) | 6,420 | 4,653 | 1,305 |

| Denominator (Millions of euros) | + Average shareholder's funds | 61,370 | 60,030 | 57,626 |

| + Average accumulated other comprehensive income | (15.928) | (15.396) | (12.858) | |

| = ROE | 14.1% | 10.4% | 2.9% |

Adjusted ROE

The adjusted ROE (return on equity) ratio measures the return obtained on an entity's shareholders' funds plus accumulated other comprehensive income. It is calculated as follows:

| Adjusted net attributable profit (loss) |

| Average shareholders' funds + Average accumulated other comprehensive income |

Explanation of the formula: the numerator is the adjusted net attributable profit (loss) previously defined in these alternative performance measures. If the metric is presented on a date before the close of the fiscal year, the numerator will be annualized. The denominator items "Average shareholders' funds" and "Average accumulated other comprehensive income" are the same and they are calculated in the same way as that explained for ROE.

Relevance of its use: this ratio is very commonly used not only in the banking sector but also in other sectors to measure the return obtained on shareholders' funds.

Adjusted ROE

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | ||

|---|---|---|---|---|

| Numerator (Millions of euros) | = Adjusted net attributable profit (loss) | 6,621 | 5,069 | 2,729 |

| Denominator (Millions of euros) | + Average shareholder's funds | 61,370 | 60,030 | 57,626 |

| + Average accumulated other comprehensive income | (15,928) | (15,396) | (12,858) | |

| = Adjusted ROE | 14.6% | 11.4% | 6.1% |

ROTE

The ROTE (return on tangible equity) ratio measures the return on an entity's shareholders' funds, plus accumulated other comprehensive income, and excluding intangible assets. It is calculated as follows:

| Net attributable profit (loss) |

| Average shareholders' funds + Average accumulated other comprehensive income - Average intangible assets |

Explanation of the formula: the numerator "Net attributable profit (loss)" and the items in the denominator "Average intangible assets" and "Average accumulated other comprehensive income" are the same items and are calculated in the same way as explained for ROE.

Average intangible assets are the intangible assets on the balance sheet, including goodwill and other intangible assets. The average balance is calculated in the same way as explained for shareholders funds in ROE.

Relevance of its use: this metric is generally used not only in the banking sector but also in other sectors to measure the return obtained on shareholders' funds, not including intangible assets.

ROTE

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | ||

|---|---|---|---|---|

| Numerator (Millions of euros) | = Net attributable profit (loss) | 6,420 | 4,653 | 1,305 |

| Denominator (Millions of euros) | + Average shareholder's funds | 61,370 | 60,030 | 57,626 |

| + Average accumulated other comprehensive income | (15,928) | (15,396) | (12,858) | |

| - Average intangible assets | 2,119 | 2,265 | 2,480 | |

| - Average intangible assets from BBVA USA and BBVA Paraguay (1) | — | 897 | 2,528 | |

| = ROTE | 14.8% | 11.2% | 3.3% |

(1) BBVA Paraguay includes 4 millions of euros as of January-December 2020.

Adjusted ROTE

The adjusted ROTE (return on tangible equity) ratio measures the return on an entity's shareholders' funds, plus accumulated other comprehensive income, and excluding intangible assets. It is calculated as follows:

| Adjusted net attributable profit (loss) |

| Average shareholders' funds + Average accumulated other comprehensive income - Average intangible assets |

Explanation of the formula: the numerator [adjusted net attributable profit (loss)] and the items of the denominator "Average shareholders' funds" and " Average accumulated other comprehensive income" are the same and calculated in the same way as explained for ROE.

Average intangible assets are the intangible assets on the balance sheet, excluding for the periods of 2021 and 2020 the assets from BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021. The average balance is calculated in the same way as explained for shareholders' funds in the ROE.

Relevance of its use: this metric is generally used not only in the banking sector but also in other sectors to measure the return obtained on shareholders' funds, not including intangible assets.

Adjusted ROTE

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | ||

|---|---|---|---|---|

| Numerator (Millions of euros) | = Adjusted net attributable profit (loss) | 6,621 | 5,069 | 2,729 |

| Denominator (Millions of euros) | + Average shareholder's funds | 61,370 | 60,030 | 57,626 |

| + Average accumulated other comprehensive income | (15,928) | (15,396) | (12,858) | |

| - Average intangible assets | 2,119 | 2,265 | 2,480 | |

| - Average intangible assets from BBVA Paraguay | — | — | 4 | |

| = Adjusted ROTE | 15.3% | 12.0% | 6.5% |

RORC for AVR

The RORC (return on regulatory capital) measures the return on manageable regulatory capital that should be maintained to reach the CET1 fully-loaded target ratio. It is calculated as follows:

| Net attributable profit (loss) excluding corporate transactions for AVR |

| Average assigned regulatory capital |

Explanation of the formula: The numerator is the net attributable profit (loss) excluding corporate transactions for AVR, described above. The denominator is the average assigned regulatory capital, defined as the manageable capital that should be held at Group level to reach the CET1 fully-loaded target ratio. If the described metric is presented on a date prior to the end of the year, the numerator will be presented on an annualized basis.

Relevance of its use: This metric is commonly used in the banking sector. In addition, it is one of the metrics used for the purposes of the Group’s AVR (Annual Variable Remuneration).

RORC for AVR

| Jan.-Dec.2022 | Jan.-Dec.2021 | ||

|---|---|---|---|

| Numerator (Millions of euros) | = Net attributable profit (loss) excluding corporate transactions for AVR | 6,381 | 5,028 |

| Denominator (Millions of shares) | = Average assigned regulatory capital | 41,815 | 35,837 |

| = RORC for AVR | 15.26% | 14.03% |

ROA

The ROA (return on assets) ratio measures the return obtained on an entity's assets. It is calculated as follows:

| Profit (loss) for the period |

| Average total assets |

Explanation of the formula: the numerator is the profit (loss) for the period, previously defined in these alternative performance measures. If the metric is presented on a date before the close of the fiscal year, the numerator must be annualized.

Average total assets are taken from the Group’s consolidated balance sheet. The average balance is calculated as explained for average shareholders' funds in the ROE.

Relevance of its use: this ratio is generally used not only in the banking sector but also in other sectors to measure the return obtained on assets.

ROA

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | |||

|---|---|---|---|---|---|

| Numerator (Millions of euros) | Profit (loss) for the period | 6,827 | 5,618 | 2,060 | |

| Denominator (Millions of euros) | Average total assets | 701,709 | 678,563 | 727,014 | |

| = | ROA | 0.97% | 0.83% | 0.28% |

Adjusted ROA

The adjusted ROA (return on assets) ratio measures the return obtained on an entity's assets. It is calculated as follows:

| Adjusted profit (loss) for the period |

| Average total assets |

Explanation of the formula: the numerator is the adjusted profit (loss) for the period previously defined in these alternative performance measures. If the metric is presented on a date before the close of the fiscal year, the numerator will be annualized.

Average total assets are taken from the Group's consolidated balance sheet, excluding for the periods of 2021 and 2020 the assets from BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021. The average balance is calculated in the same way as explained for average equity in the ROE.

Relevance of its use: this ratio is generally used not only in the banking sector but also in other sectors to measure the return obtained on assets.

Adjusted ROA

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | |||

|---|---|---|---|---|---|

| Numerator (Millions of euros) | Adjusted profit (loss) for the period | 7,028 | 6,034 | 3,485 | |

| Denominator (Millions of euros) | Average total assets | 701,709 | 640,142 | 639,943 | |

| = | Adjusted ROA | 1.00% | 0.94% | 0.54% |

RORWA

The RORWA (return on risk-weighted assets) ratio measures the accounting return obtained on average risk-weighted assets. It is calculated as follows:

| Profit (loss) for the period |

| Average risk - weighted assets |

Explanation of the formula: the numerator [profit (loss) for the period] is the same and is calculated in the same way as explained for ROA.

Average risk-weighted assets (RWA) are the moving weighted average of the risk-weighted assets at the end of each month of the period under analysis.

Relevance of its use: this ratio is generally used in the banking sector to measure the return obtained on RWA.

RORWA

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | |||

|---|---|---|---|---|---|

| Numerator (Millions of euros) | Profit (loss) for the period | 6,827 | 5,618 | 2,060 | |

| Denominator (Millions of euros) | Average RWA | 327,999 | 324,819 | 358,675 | |

| = RORWA | 2.08% | 1.73% | 0.57% |

Adjusted RORWA

The adjusted RORWA (return on risk-weighted assets) ratio measures the return obtained on an entity's assets. It is calculated as follows:

| Adjusted profit (loss) for the period |

| Average risk - weighted assets |

Explanation of the formula: the numerator [adjusted profit (loss) for the period] is the same and is calculated in the same way as explained for adjusted ROA.

Average risk-weighted assets (RWA) are the moving weighted average of the risk-weighted assets at the end of each month of the period under analysis, excluding for the periods of 2021 and 2020 those from BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021.

Relevance of its use: this ratio is generally used not only in the banking sector but also in other sectors to measure the return obtained on assets.

Adjusted RORWA

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | |||

|---|---|---|---|---|---|

| Numerator (Millions of euros) | Adjusted profit (loss) for the period | 7.028 | 6,034 | 3,485 | |

| Denominator (Millions of euros) | Average RWA | 327,999 | 300,276 | 300,518 | |

| = | Adjusted RORWA | 2.14% | 2.01% | 1.16% |

Earning (loss) per share

The earning (loss) per share is calculated in accordance to the criteria established in the IAS 33 “Earnings per share”.

Earnings (loss) per share

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | ||

|---|---|---|---|---|

| (Millions of euros) | + Net attributable profit (loss) | 6,420 | 4,653 | 1,305 |

| (Millions of euros) | + Remuneration related to the Additional Tier 1 securities (CoCos) | 313 | 359 | 387 |

| Numerator (millions of euros) | = Net attributable profit (loss) ex.CoCos remuneration | 6,107 | 4,293 | 917 |

| Denominator (millions) | + Average number of shares issued | 6,424 | 6,668 | 6,668 |

| - Average treasury shares of the period | 9 | 12 | 13 | |

| - Share buyback program (average) (1) | 225 | 255 | — | |

| = Earning (loss) per share (euros) | 0.99 | 0.67 | 0.14 |

- (1) The period January-December 2021 includes 112 million shares acquired from the start of the share buyback program to December 31, 2021 and the estimated number of shares pending from buyback as of December 31, 2021 of the first tranche, in process at the end of that period.

Additionally, for management purposes, earning (loss) per share is presented excluding: (I) the profit (loss) after tax from discontinued operations, that is, the results generated by BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021, for the periods of 2021 and 2020; (II) the capital gain net of taxes from the bancassurance operation with Allianz recorded in the fourth quarter of 2020; (III) the net cost related to the restructuring process recorded in the second quarter of 2021; and (IV) the net impact from the purchase of offices in Spain in the second quarter of 2022.

Adjusted earning (loss) per share

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | ||

|---|---|---|---|---|

| (Millions of euros) | + Net attributable profit (loss) ex. CoCos remuneration | 6,107 | 4,293 | 917 |

| (Millions of euros) | - Discontinued operations | — | 280 | (1,729) |

| (Millions of euros) | - Net capital gains from the bancassurance transaction | — | — | 304 |

| (Millions of euros) | - Net cost related to the restructuring process | — | (696) | — |

| (Millions of euros) | - Net impact arisen from the purchase of offices in Spain | (201) | — | — |

| Numerator (millions of euros) | = Net Attributable profit (loss) ex.CoCos and non-recurring impacts | 6,308 | 4,709 | 2,342 |

| Denominator (millions) | + Average number of shares issued (1) | 6,030 | 6,668 | 6,668 |

| - Average treasury shares of the period | 9 | 12 | 13 | |

| = Adjusted earning (loss) per share (euros) | 1.05 | 0.71 | 0.35 |

(1) In the period January-December 2022, the number of shares issued takes into account the total redemption of the share buyback program.

Efficiency ratio

This measures the percentage of gross income consumed by an entity's operating expenses. It is calculated as follows:

| Operating expenses |

| Gross income |

Explanation of the formula: both "Operating expenses" and "Gross income" are taken from the Group’s consolidated income statement. Operating expenses are the sum of the administration costs (personnel expenses plus other administrative expenses) plus depreciation. Gross income is the sum of net interest income, net fees and commissions, net trading income dividend income, share of profit or loss of entities accounted for using the equity method, and other operating income and expenses. For a more detailed calculation of this ratio, the graphs on "Results" section of this report should be consulted, one of them with calculations with figures at current exchange rates and another with the data at constant exchange rates.

Relevance of its use: this ratio is generally used in the banking sector. In addition, it is the metric for one of the six Strategic Priorities of the Group.

Efficiency ratio

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | ||

|---|---|---|---|---|

| Numerator (Millions of euros) | Operating expenses | 10,760 | 9,530 | 9,088 |

| Denominator (Millions of euros) | Gross income | 24,890 | 21,066 | 20,166 |

| = Efficiency ratio | 43.2% | 45.2% | 45.1% |

Efficiency ratio for AVR

Explanation of the formula: The numerator used to calculate the efficiency ration excludes, In 2021, savings generated by the employee departures subject to the restructuring process since their departure from the BBVA Group, amounting to approximately €58m gross.

Relevance of its use: This metric is commonly used in the banking sector. In addition, it is one of the metrics used for the purposes of the Group’s AVR (Annual Variable Remuneration).

Efficiency ratio for AVR

| Jan.-Dec.2022 | Jan.-Dec.2021 | ||

|---|---|---|---|

| Numerator (Millions of euros) | = Operating expenses for AVR | 10,760 | 9,587 |

| Denominator (Millions of euros) | = Gross income | 24,890 | 21,066 |

| = Efficiency ratio for AVR | 43.2% | 45.5% |

Dividend yield

This is the remuneration given to the shareholders in the last twelve calendar months, divided by the closing price for the period. It is calculated as follows:

| ∑ Dividend per share over the last twelve months |

| Closing price |

Explanation of the formula: the remuneration per share takes into account the gross amounts per share paid out over the last twelve months, both in cash and through the flexible remuneration system called "dividend option".

Relevance of its use: this ratio is generally used by analysts, shareholders and investors for companies that are traded on the stock market. It compares the dividend paid out by a company every year with its market price at a specific date.

Dividend yield

| 31-12-22 | 31-12-21 | 31-12-20 | ||

|---|---|---|---|---|

| Numerator (Euros) | ∑ Dividends | 0.35 | 0.14 | 0.16 |

| Denominator (Euros) | Closing price | 5.63 | 5.25 | 4.04 |

| = Dividend yield | 6.2% | 2.6% | 4.0% |

Book value per share

The book value per share determines the value of a company on its books for each share held. It is calculated as follows:

| Shareholders' funds + Accumulated other comprehensive income |

| Number of shares outstanding - Treasury shares |

Explanation of the formula: the figures for both "Shareholders' funds" and "Accumulated other comprehensive income" are taken from the balance sheet. Shareholders' funds are adjusted to take into account the execution of the "dividend-option" at the closing dates on which it was agreed to deliver this type of dividend prior to the publication of the Group ́s results. The denominator includes the final number of outstanding shares excluding own shares (treasury shares). In addition, the denominator is also adjusted to include the capital increase resulting from the execution of the dividend options explained above. Both the numerator and the denominator take into account period-end balances.

Relevance of its use: it shows the company's book value for each share issued. It is a generally used ratio, not only in the banking sector but also in others.

Book value per share

| 31-12-22 | 31-12-21 | 31-12-20 | ||

|---|---|---|---|---|

| Numerator (Millions of euros) |

+ Shareholders' funds | 64,422 | 60,383 | 58,904 |

| + Accumulated other comprehensive income | (17,432) | (16,476) | (14,356) | |

| Denominator (Millions of shares) |

+ Number of shares issued | 6,030 | 6,668 | 6,668 |

| - Treasury shares | 5 | 15 | 14 | |

| - Share buyback program (1) | — | 255 | — | |

| = Book value per share (euros / share) | 7.80 | 6.86 | 6.70 |

(1) As of 31-12-21, 112 million shares acquired from the start of the share buyback program to the end of the period and the estimated number of shares pending from buyback as of December 31, 2021 of the first tranche, in process at the end of that date, were included.

Tangible book value per share

The tangible book value per share determines the value of the company on its books for each share held by shareholders in the event of liquidation. It is calculated as follows:

| Shareholders' funds + Accumulated other comprehensive income - Intangible assets |

| Number of shares outstanding - Treasury shares |

Explanation of the formula: the figures for "Shareholders' funds", "Accumulated other comprehensive income" and "Intangible assets" are all taken from the balance sheet. Shareholders' funds are adjusted to take into account the execution of the "Dividend-option" at the closing dates on which it was agreed to deliver this type of dividend prior to the publication of the Group ́s results. The denominator includes the final number of shares outstanding excluding own shares (treasury shares). In addition, the denominator is also adjusted to include the result of the capital increase resulting from the execution of the dividend options explained above. Both the numerator and the denominator take into account period-end balances.

Relevance of its use: It shows the company's book value for each share issued, after deducting intangible assets. It is a generally used ratio, not only in the banking sector but also in others.

Tangible book value per share

| 31-12-22 | 31-12-21 | 31-12-20 | ||

|---|---|---|---|---|

| Numerator (Millions of euros) |

+ Shareholders' funds | 64,422 | 60,383 | 58,904 |

| + Accumulated other comprehensive income | (17,432) | (16,476) | (14,356) | |

| - Intangible assets | 2,156 | 2,197 | 2,345 | |

| - Intangible assets from BBVA USA and BBVA Paraguay (1) | — | — | 1,952 | |

| Denominator (Millions of shares) |

+ Number of shares issued | 6,030 | 6,668 | 6,668 |

| - Treasury shares | 5 | 15 | 14 | |

| - Share buyback program (2) | — | 255 | — | |

| = Tangible book value per share (euros / share) | 7.44 | 6.52 | 6.05 |

(1) BBVA Paraguay includes 3 millions of euros as of 31-12-20.

(2) As of 31-12-21, 112 million shares acquired from the start of the share buyback program to the end of the period and the estimated number of shares pending from buyback as of December 31, 2021 of the first tranche, in process at the end of that date, were included.

Tangible book value per share for AVR

Explanation of the formula: for the purposes of its calculation, and based on the metric "Tangible book value per share" described above, the following items are adjusted in order not to consider the results of non-recurring operations: the capital gain from the voluntary takeover bid of Garanti BBVA in 2022 and the estimated net savings of the BBVA restructuring plan in BBVA S.A. in 2021.

Tangible book value for AVR: in 2022, both, the aforementioned capital gain from the voluntary takeover bid of Garanti BBVA and the net impact arisen from the purchase of offices in Spain from Merlin on the tangible book value are excluded. In 2021, both the net impact related to the restructuring process of BBVA S.A. and the impact of the sale of BBVA USA and the rest of companies in the United States on the tangible book value are excluded. On the other hand, on the concepts related to the system of remuneration to shareholders, the amounts distributed to them (which include the amounts distributed under the items “Share premium”, as well as the “Interim dividends”) are adjusted. Likewise, the amount executed as of December 31, 2021 (112 million shares acquired for an amount of €569m) corresponding to the first share buyback tranche (€1,500m) approved by the BBVA Board of Directors in October 2021.

Relevance of its use: This indicator is commonly used in the banking sector. In addition, it is one of the indicators used for the purposes of the Group’s AVR (Annual Variable Remuneration).

Tangible book value per share for AVR

| 31-12-22 | 31-12-21 | ||

|---|---|---|---|

| Numerator (Millions of euros) | + Tangible book value for AVR | 46,054 | 42,832 |

| Denominator (Millions of shares) | + Number of shares issued | 6,030 | 6,668 |

| + Dividend-option | — | — | |

| - Treasury shares | 5 | 15 | |

| - Share buyback program (1) | — | 112 | |

| = Tangible book value per share for AVR (euros) | 7.64 | 6.55 |

(1) Considering 112 million shares acquired within the share buyback program in 2021.

Non-performing loan (NPL) ratio

It is the ratio between the risks classified for accounting purposes as non-performing loans and the total credit risk balance. It is calculated as follows:

| Non-performing loans |

| Total credit risk |

Explanation of the formula: non-performing loans and the credit risk balance are gross, meaning they are not adjusted by associated accounting provisions.

Non-performing loans are calculated as the sum of “loans and advances at amortized cost” and the “contingent risk” in stage 32 and the following counterparties:

- other financial entities

- public sector

- non-financial institutions

- households

The credit risk balance is calculated as the sum of "Loans and advances at amortized cost" and "Contingent risk" in stage 1 + stage 2 + stage 3 of the previous counterparts.

This indicator is shown, as others, at a business area level.

Relevance of its use: this is one of the main indicators used in the banking sector to monitor the current situation and changes in credit risk quality, and specifically the relationship between risks classified in the accounts as non-performing loans and the total balance of credit risk, with respect to customers and contingent liabilities.

Non-Performing Loans (NPLs) ratio

| 31-12-22 | 31-12-21 | 31-12-20 | ||

|---|---|---|---|---|

| Numerator (Millions of euros) | NPLs | 14,463 | 15,443 | 15,451 |

| Denominator (Millions of euros) | Credit Risk | 424,341 | 376,011 | 366,883 |

| = Non-Performing Loans (NPLs) ratio | 3.4% | 4.1% | 4.2% |

General note: excludes BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021.

2 IFRS 9 classifies financial instruments into three stages, which depend on the evolution of their credit risk from the moment of initial recognition. The stage 1 includes operations when they are initially recognized, stage 2 comprises operations for which a significant increase in credit risk has been identified since their initial recognition and,stage 3, impaired operations.

NPL coverage ratio

This ratio reflects the degree to which the impairment of non-performing loans has been covered in the accounts via allowances. It is calculated as follows:

| Provisions |

| Non-performing loans |

Explanation of the formula: it is calculated as "Provisions" from stage 1 + stage 2 + stage 3, divided by non-performing loans, formed by “credit risk” from stage 3.

This indicator is shown, as others, at a business area level.

Relevance of its use: this is one of the main indicators used in the banking sector to monitor the situation and changes in the quality of credit risk, reflecting the degree to which the impairment of non-performing loans has been covered in the accounts via value adjustments.

NPL coverage ratio

| 31-12-22 | 31-12-21 | 31-12-20 | ||

|---|---|---|---|---|

| Numerator (Millions of euros) | Provisions | 11,764 | 11,536 | 12,595 |

| Denominator (Millions of euros) | NPLs | 14,463 | 15,443 | 15,451 |

| = NPL coverage ratio | 81% | 75% | 82% |

General note: excludes BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021.

Cost of risk

This ratio indicates the current situation and changes in credit-risk quality through the annual cost in terms of impairment losses (accounting loan-loss provisions) of each unit of loans and advances to customers (gross). It is calculated as follows:

| Loan-loss provisions |

| Average loans and advances to customers (gross) |

Explanation of the formula: "Loans to customers (gross)" refers to the "Loans and advances at amortized cost" portfolios with the following counterparts:

- other financial entities

- public sector

- non-financial institutions

- households, excluding central banks and other credit institutions.

Average loans to customers (gross) is calculated by using the average of the period-end balances of each month of the period analyzed plus the previous month. "Annualized loan-loss provisions" are calculated by accumulating and annualizing the loan-loss provisions of each month of the period under analysis.

Loan-loss provisions refer to the aforementioned loans and advances at amortized cost portfolios.

This indicator is shown, as others, at a business area level.

Relevance of its use: this is one of the main indicators used in the banking sector to monitor the situation and changes in the quality of credit risk through the cost over the year.

Cost of risk

| Jan.-Dec. 2022 | Jan.-Dec. 2021 | Jan.-Dec. 2020 | ||

|---|---|---|---|---|

| Numerator (Millions of euros) | Loan-loss provisions | 3,252 | 3,026 | 5,160 |

| Denominator (Millions of euros) | Average loans to customers (gross) | 356,597 | 325,013 | 332,096 |

| = Cost of risk | 0.91% | 0.93% | 1.55% |

General note: excludes BBVA USA and the rest of the companies in the United States sold to PNC on June 1, 2021.

5.2 Compliance tables

5.2.1 Index of contents of Law 11/201849

Non-financial Information Report. Contents index of the Law 11/2018

| Page / Section BBVA's Management Report 2022 | GRI reporting criteria | Page(s) | ||

|---|---|---|---|---|

| General information | ||||

| Business model | Brief description of the group’s business model | NFIS/Strategy |

GRI 2-6 GRI 2-7 |

8-17 |

| Geographical presence and Organization and Structure |

BBVA in brief/ Who we are Other information/Organizational Chart |

GRI 2-1 GRI 2-6 |

2 265 |

|

| Objectives and strategies of the organization | NFIS/Strategy/Purpose, values and strategic priorities, Our objectives | GRI 2-22 | 8-17 | |

| Main factors and trends that may affect your future evolution |

NFIS/Strategy/Main advances in the execution of the strategy

Financial information/BBVA Group/Macroeconomic and regulatory environment |

GRI 2-6 |

12-17 127-132 |

|

| General | Reporting framework | Non-financial information | GRI 1 | 7 |

| Principle of materiality |

NFIS/Our stakeholders

NFIS/Additional information/Additional information on materiality analysis |

GRI 3-1

GRI 3-2 |

18-19 107-115 |

|

| Management approach | Description of the applicable policies |

NFIS/Our stakeholders/Customers/Customer security and protection

NFIS/Our stakeholders/Society/Community Commitment/Volunteer work NFIS/Our stakeholders/Society/Community Commitment/Commitment to Human Rights NFIS/Report on climate change and other environmental and social issues Risk management |

GRI 3-3

GRI 2-25 |

21-23 60-61 73-74 78-106 171-192 |

| The results of these policies |

NFIS/Our stakeholders/Customers/Customer security and protection

NFIS/Our stakeholders/Society/Community Commitment/Volunteer work NFIS/Our stakeholders/Society/Community Commitment/Commitment to Human Rights NFIS/Report on climate change and other environmental and social issues Risk management |

GRI 3-3

GRI 2-25 |

21-23 60-61 73-74 78-106 171-192 |

|

| The main risks related to these issues involving the activities of the group |

NFIS/Our stakeholders/Customers/Customer security and protection

NFIS/Our stakeholders/Society/Community Commitment/Volunteer work NFIS/Our stakeholders/Society/Community Commitment/Commitment to Human Rights NFIS/Additional information/Other non financial risks Risk management |

GRI 2-16 |

21-23 60-61 73-74 78-106 171-192 |

|

| Environmental questions | ||||

| Environmental management | Detailed information on the current and foreseeable effects of the company's activities on the environment and, where appropriate, health and safety |

NFIS/Report on climate change and other environmental and social

issues Risk management/General risk management and control mode |

GRI 3-3 |

78-106 171-179 |

| Environmental assessment or certification procedures | NFIS/Report on climate change and other environmental and social issues/Management of direct and indirect impacts |

GRI 3-3

GRI 2-25 |

99-104 | |

| Resources dedicated to the prevention of environmental risks |

NFIS/Report on climate change and other environmental and social

issues/Governance model

NFIS/Report on climate change and other environmental and social issues/Metrics and goals: Channeling sustainable business |

GRI 3-3

GRI 2-25 |

79 95-98 |

|

| Application of the precautionary principle |

NFIS/Report on climate change and other environmental and social

issues Risk management/General risk management and control model |

GRI 2-23

GRI 3-3 GRI 2-25 |

78-106 171-179 |

|

| Amount of provisions and guarantees for environmental risks | NFIS/Report on climate change and other environmental and social issues/Management of direct and indirect impacts/Management of direct environmental impacts |

GRI 3-3

GRI 2-25 |

99-102 | |

| Contamination | Measures to prevent, reduce or repair emissions that seriously affect the environment; taking into account any form of activity-specific air pollution, including noise and light pollution | NFIS/Report on climate change and other environmental and social issues/Metrics and goals: Channeling sustainable business |

GRI 3-3

GRI 2-25 |

95-98 |

| Circular economy and waste prevention and management | Prevention, recycling, reuse, other forms of recovery and types of waste disposal | NFIS/Report on climate change and other environmental and social issues/Management of direct and indirect impacts |

GRI 3-3

GRI 2-25 GRI 306-2 with respect to recycling and reusing |

99-104 |

| Actions to combat food waste | BBVA Group considers this indicator not to be material |

GRI 3-3

GRI 2-25 |

||

| Sustainable use of resources | Water consumption and water supply according to local constraints | NFIS/Report on climate change and other environmental and social issues/Management of direct and indirect impacts | GRI 303-5 (2018) with respect total water consumption | 99-104 |

| Use of raw materials and measures taken to improve the efficiency of their utilization | NFIS/Report on climate change and other environmental and social issues/Management of direct and indirect impacts | GRI 301-1 with respect to renewable materials used | 99-104 | |

| Energy use, direct and indirect | NFIS/Report on climate change and other environmental and social issues/Management of direct and indirect impacts |

GRI 302-1

GRI 302-3 |

99-104 | |

| Measures taken to improve energy efficiency | NFIS/Report on climate change and other environmental and social issues/Management of direct and indirect impacts |

GRI 3-3

GRI 2-25 GRI 302-4 |

99-104 | |

| Use of renewable energies | NFIS/Report on climate change and other environmental and social issues/Management of direct and indirect impacts | GRI 302-1 with respect to renewable energies consumption | 99-104 | |

| Climate change | Greenhouse gas emissions generated as a result of the company's activities, including the use of the goods and services it produces | NFIS/Report on climate change and other environmental and social issues |

GRI 305-1

GRI 305-2 GRI 305-3 GRI 305-4 |

78-106 |

| Measures taken to adapt to the consequences of climate change | NFIS/Report on climate change and other environmental and social issues |

GRI 3-3

GRI 2-25 GRI 201-2 |

78-106 | |

| Reduction goals established voluntarily in the medium and long term to reduce greenhouse gas emissions and measures implemented for that purpose | NFIS/Report on climate change and other environmental and social issues | GRI 305-5 | 78-106 | |

| Protection of biodiversity | Measures taken to protect or restore biodiversity | The metric describes the size of the protected or restored areas of habitats and BBVA's financial activity, as well as the activity of its offices, has no impact in this regard. This metric and its various breakdowns are currently considered non-material. | GRI 304-3 | |

| Impacts caused by activities or operations in protected areas | The operations centers and / or offices owned, leased or managed by BBVA are located in urban areas, so the impacts of the entity's activities on biodiversity are considered not significant. Although the products and services commercialised can potentially have an impact on it, they are managed according to the regulations and criteria applicable to the nature of the financed activities, and nowadays there are no defined and comparable metrics for their monitoring and reporting in relation with BBVA's value chain. However, the entity undertakes to follow up on regulatory developments regarding biodiversity for future reporting if necessary. | GRI 304-1 GRI 304-2 |

||

| Social and personnel questions | ||||

| Employees | Total number and distribution of employees according to country, gender, age, country and professional classification | NFIS/Our stakeholders/Employees/Professional development/Diversity, inclusion and different capacities |

GRI 2-7 GRI 2-8 GRI 405-1 |

34-36 |

| Total number and distribution of work contract modalities | NFIS/Our stakeholders/Employees/Professional development/Diversity, inclusion and different capacities |

GRI 2-7 GRI 2-8 |

34-36 | |

| Annual average of work contract modalities (permanent, temporary and part-time) by sex, age, and professional classification | NFIS/Our stakeholders/Employees/Professional development/Diversity, inclusion and different capacities |

GRI 2-7 GRI 2-8 |

34-36 | |

| Number of dismissals by sex, age, and professional classification | NFIS/Our stakeholders/Employees/Professional development/Diversity, inclusion and different capacities |

GRI 3-3 GRI 2-25 GRI 401-1 with respect to staff turn-over by sex, age and country |

34-36 | |

| The average remunerations and their evolution disaggregated by sex, age, and professional classification or equal value | NFIS/Our stakeholders/Employees/Remuneration |

GRI 3-3 GRI 2-25 GRI 405-2 with respect to women remuneration compared to men's by professional category |

53-57 | |

| The average remuneration of directors and executives, including variable remuneration, allowances, compensation, payment to long-term forecast savings and any other perception broken down by gender | NFIS/Our stakeholders/Employees/Remuneration |

GRI 3-3 GRI 2-25 GRI 405-2 with respect to women remuneration compared to men's by professional category |

53-57 | |

| Salary gap | NFIS/Our stakeholders/Employees/Remuneration/Wage gap |

GRI 3-3 GRI 2-25 GRI 405-2 with respect to women remuneration compared to men's by professional category |

56 | |

| Implementation of employment termination policies | NFIS/Our stakeholders/Employees/Work environment/Work organization |

GRI 3-3 GRI 2-25 |

47-48 | |

| Employees with disabilities | NFIS/Our stakeholders/Employees/Professional development/ Diversity, inclusion and different capacities | GRI 405-1 | 34-36 | |

| Work organization | Work schedule organization | NFIS/Our stakeholders/Employees/Work environment/Work organization |

GRI 3-3 GRI 2-25 |

47-48 |

| Number of hours of absenteeism | NFIS/Our stakeholders/Employees/Work environment/Occupational safety and health | GRI 403-9 | 49-52 | |

| Measures designed to facilitate access to mediation resources and encourage the responsible use of these by both parents | NFIS/Our stakeholders/Employees/Work environment/Work organization |

GRI 3-3 GRI 2-25 |

47-48 | |

| Health and safety | Work health and safety conditions | NFIS/Our stakeholders/Employees/Work environment/Occupational safety and health |

GRI 3-3 GRI 2-25 GRI 403-1 GRI 403-2 GRI 403-3 GRI 403-7 (2018) |

49-52 |

| Work accidents, in particular their frequency and severity, disaggregated by gender | NFIS/Our stakeholders/Employees/Work environment/Occupational safety and health | GRI 403-10 (2018) with respect to labor accident injuries | 49-52 | |

| Occupational diseases, disaggregated by gender | NFIS/Our stakeholders/Employees/Work environment/Occupational safety and health | GRI 403-9 (2018) with respect to labor accident injuries | 49-52 | |

| Social relationships | Organization of social dialog, including procedures to inform and consult staff and negotiate with them | NFIS/Our stakeholders/Employees/Work environment/Freedom of association and representation | GRI 3-3 GRI 2-25 |

48 |

| Mechanisms and procedures that the company has to promote the involvement of workers in the management of the company, in terms of information, consultation and participation |

NFIS/Our stakeholders/Employees/Culture & Values

NFIS/Our stakeholders/Employees/Work environment/Freedom of association and representation |

GRI 3-3 GRI 2-25 |

30 48 |

|

|

Percentage of employees covered by collective agreement by

country The balance of collective agreements, particularly in the field of health and safety at wo |

NFIS/Our stakeholders/Employees/Work environment/Freedom of

association and representation NFIS/Our stakeholders/Employees/Work environment/Occupational safety and health |

GRI 2-30 GRI 303-4 (2018) |

48 49-52 |

|

| Training | Policies implemented for training activities | NFIS/Our stakeholders/Employees/Professional development/Training |

GRI 3-3 GRI 2-25 GRI 404-2 |

32-34 |

| The total amount of training hours by professional category | NFIS/Our stakeholders/Employees/Professional development/Training | GRI 404-1 | 32-34 | |

| Accessibility | Integration and universal accessibility of people with disabilities | NFIS/Our stakeholders/Employees/Professional development/ Diversity, inclusion and different capacities |

GRI 3-3 GRI 2-25 |

34-36 |

| Equality | Measures taken to promote equal treatment and opportunities between women and men | NFIS/Our stakeholders/Employees/Professional development/ Diversity, inclusion and different capacities | GRI 3-3 GRI 2-25 |

34-36 |

| Equality plans (Section III of Organic Law 3/2007, of March 22, for effective equality of women and men) | NFIS/Our stakeholders/Employees/Professional development/ Diversity, inclusion and different capacities | GRI 3-3 GRI 2-25 |

34-36 | |

| Measures adopted to promote employment, protocols against sexual and sex-based harassment. | NFIS/Our stakeholders/Employees/Professional development/ Diversity, inclusion and different capacities | GRI 3-3 GRI 2-25 |

34-36 | |

| Policy against any type of discrimination and, where appropriate, diversity management | NFIS/Our stakeholders/Employees/Professional development/ Diversity, inclusion and different capacities |

GRI 3-3 GRI 2-25 |

34-36 | |

| Information about the respect for human rights | ||||

| Human rights | Application of due diligence procedures in the field of human rights; prevention of the risks of violation of human rights and, where appropriate, measures to mitigate, manage, and repair possible abuses committed | NFIS/Our stakeholders/Society/Commitment to Human Rights | GRI 2-23 GRI 2-26 |

73-74 |

| Claims regarding cases of human rights violations | NFIS/Our stakeholders/Society/Commitment to Human Rights |

GRI 3-3 GRI 2-25 GRI 406-1 |

73-74 | |

| Promotion and compliance with the provisions contained in the related fundamental Conventions of the International Labor Organization with respect for freedom of association and the right to collective bargaining; the elimination of discrimination in employment and occupation; the elimination of forced or compulsory labor; and the effective abolition of child labor |

NFIS/Our stakeholders/Employees/Work environment/Freedom of

association and representation NFIS/Our stakeholders/Society/Commitment to Human Rights |

GRI 3-3 GRI 2-25 GRI 407-1 GRI 408-1 GRI 409-1 |

48 73-74 |

|

| Information about anti-bribery and anti-corruption measures | ||||

| Corruption and bribery | Measures adopted to prevent corruption and bribery | NFIS/Our stakeholders/Society/Compliance and conduct |

GRI 3-3 GRI 2-25 GRI 2-23 GRI 2-26 GRI 205-2 GRI 205-3 |

61-67 |

| Measures adopted to fight against anti.money laundering | NFIS/Our stakeholders/Society/Compliance and conduct |

GRI 3-3 GRI 2-25 GRI 2-23 GRI 2-26 GRI 205-2 GRI 205-3 |

61-67 | |

| Contributions to foundations and non-profit-making bodies | NFIS/Our stakeholders/Society/Contribution to society |

GRI 2-28 GRI 201-1 with respect to community investment |

58-60 | |

| Information about the society | ||||

| Commitment by the company to sustainable development | Impact of the company’s activities on employment and local development |

NFIS/Our stakeholders/Society/ Contribution to society

NFIS/Report on climate change and other environmental and social issues/Management of direct and indirect impacts/Management of indirect environmental and social impacts/Equator Principles |

GRI 3-3 GRI 2-25 GRI 203-2 with respect to significant indirect economic impacts GRI 204-1 |

58-60 103-104 |

| The impact of company activity on local populations and on the territory |

NFIS/Our stakeholders/Society/ Contribution to society NFIS/Report on climate change and other environmental and social issues/Management of indirect environmental and social impacts/Equator Principles |

GRI 413-1 GRI 413-2 |

56-80 103-104 |

|

| The relationships maintained with representatives of the local communities and the modalities of dialog with these |

NFIS/Strategy/Main advances in the execution of the strategy

NFIS/Our stakeholders NFIS/Additional information/Additional information on materiality analysis NFIS/Our stakeholders/Employees/Work environment/Freedom of association and representation NFIS/Our stakeholders/Society/Contribution to society |

GRI 2-29 GRI 413-1 |

12-17 18-19 107-115 48 58-60 |

|

| Actions of association or sponsorship | NFIS/Our stakeholders/Society/Contribution to society |

GRI 3-3 GRI 2-25 GRI 201-1 with respect to investments in the community |

58-60 | |

| Subcontractors and suppliers | The inclusion of social, gender equality and environmental issues in the purchasing policy | NFIS/Our stakeholders/Suppliers |

GRI 3-3 GRI 2-25 |

75-77 |

| Consideration of social and environmental responsibility in relations with suppliers and subcontractors | NFIS/Our stakeholders/Suppliers |

GRI 2-6 GRI 308-1 GRI 414-1 |

75-77 | |

| Supervision systems and audits, and their results | NFIS/Our stakeholders/Suppliers |

GRI 2-6 GRI 308-1 GRI 308-2 GRI 414-2 |

75-77 | |

| Consumers | Customer health and safety measures |

NFIS/Our stakeholders/Customers/Customer experience

NFIS/Our stakeholders/Customers/Customer security and protection NFIS/Our stakeholders/Society/Commitment to Human Rights |

GRI 3-3 GRI 2-25 GRI 416-1 |

20-21 21-23 73-74 |

| Claims systems, complaints received and their resolution |

NFIS/Our stakeholders/Customers/Customer care

NFIS/Additional information/Additional information on customer complaints |

GRI 3-3 GRI 2-25 GRI 418-1 |

24-26 123-124 |

|

| Tax information | Benefits obtained by country | NFIS/Our stakeholders/Society/Fiscal transparency |

GRI 201-1 GRI 207-4 (2019) with respect to corporate income tax paid and corporate income tax accrued on profit/loss. |

67-73 |

| Taxes on paid benefits | NFIS/Our stakeholders/Society/Fiscal transparency |

GRI 201-1 GRI 207-4 (2019) with respect to corporate income tax paid and corporate income tax accrued on profit/loss. |

67-73 | |

| Public subsidies received | NFIS/Our stakeholders/Society/Fiscal transparency | GRI 201-4 | 70 | |

| Requirements of the Taxonomy regulation | NFIS/Additional information/Information related to article 8 of the European Taxonomy | 116-117 | ||

49 Law 5/2021 once again modifies article 49 of the Commercial Code on social and personnel issues. Those modifications are included in this content index.

5.2.2 Index of contents of Law 07/2021

Under Law 7/2021, of May 20, on climate change and energy transition, BBVA has submitted the Climate Change Report, which includes the following matters: the organization's governance structure, the strategic focus, both in terms of adaptation and mitigation of the entity to manage the financial risks associated with climate change, the real and potential impacts of the risks and opportunities associated with climate change, the processes of identification, evaluation, control and management of the risks related to the climate and the metrics, scenarios and objectives used to evaluate and manage the relevant risks and opportunities associated with climate change.

In this context, BBVA has incorporated the Climate Change Report into the Group's Management Report, which is attached to the Consolidated Financial Statements for 2022, as covered in the article 32 of Law 7/2021.

Non-financial Information Report. Contents index of the Law 7/2021, of May 20, about climate change and energetic transition

| Topic | Reporting criteria | Response included in BBVA Group's consolidated management report |

|---|---|---|

| Govern | Governance structure of organization, including the role that its various bodies perform, in relation to the identification, evaluation and management of risks and opportunities related to climate change. | Other information/Organizational Chart |

| NFIS/Report on climate change and other environmental and social issues | ||

| Strategy | Strategic approach, in terms of adaptation and mitigation of the entities to manage the financial risks associated with climate change, taking into account the current risks at the time of writing the report, and those that may arise in the future, identifying the actions necessary at that time to mitigate such risks. | NFIS/Purpose, values and strategic priorities |

| NFIS/Report on climate change and other environmental and social issues | ||

| Impacts | The real and potential impacts of risks and opportunities associated with climate change on the organization's activities and its strategy, as well as on its financial planning. | NFIS/Report on climate change and other environmental and social issues |

| Risk management | The processes for identifying, evaluating, controlling and managing climate-related risks and how these are integrated into its global business risk analysis and its integration into the organization's global risk management. | NFIS/Purpose, values and strategic priorities |

| NFIS/Report on climate change and other environmental and social issues | ||

| Metrics and goals | Metrics, scenarios and objectives used to assess and manage important risks and opportunities related to climate change and, if calculated, the scope 1, 2 and 3 of its carbon footprint and how its reduction is addressed. | NFIS/Report on climate change and other environmental and social issues |

5.2.3 GRI standards content index

At the end of 2021, GRI has made adjustments to the standards for developing sustainability reports. The sections to be reported have been developed and expanded and the old GRI 101 (2016 version) have been replaced by GRI 1: Fondation; GRI 2 (version 2106) by GRI 2: General disclosure; and GRI 103 (2016 version) for GRI 3: Material topics. In this way, modifications have been applied in terms of the structure of the BBVA Group's content index with respect to that reported in fiscal year 2021 to adjust to the new requirements.

The BBVA Group has reported in accordance with the GRI Standards for the period between January 1 and December 31, 2022.

| Indicator | Chapter | |

|---|---|---|

| GRI 1: FOUNDATION | ||

| Reporting in accordance with the GRI Standards | ||

| Publish a GRI content index | GRI standards content index | |

| Provide a statement of use | Non-financial information report | |

| GRI 2: GENERAL DISCLOSURE | ||

| The organization and its reporting practices | ||

| 2-1 | Organizational details |

BBVA in brief Group financial information Annual Corporate Governance Report (Section A) Consolidated Financial Statements (Note 1) |

| 2-2 | Entities included in the organization’s sustainability reporting | Non-financial information report/Introduction |

| 2-3 | Reporting period, frequency and contact point |

Annual. From January 1 to December 31, 2022. For contacts regarding sustainability and responsible banking see https://accionistaseinversores.bbva.com/contacto/ |

| 2-4 | Restatements of information |