1. BBVA in brief

1.1 Who we are

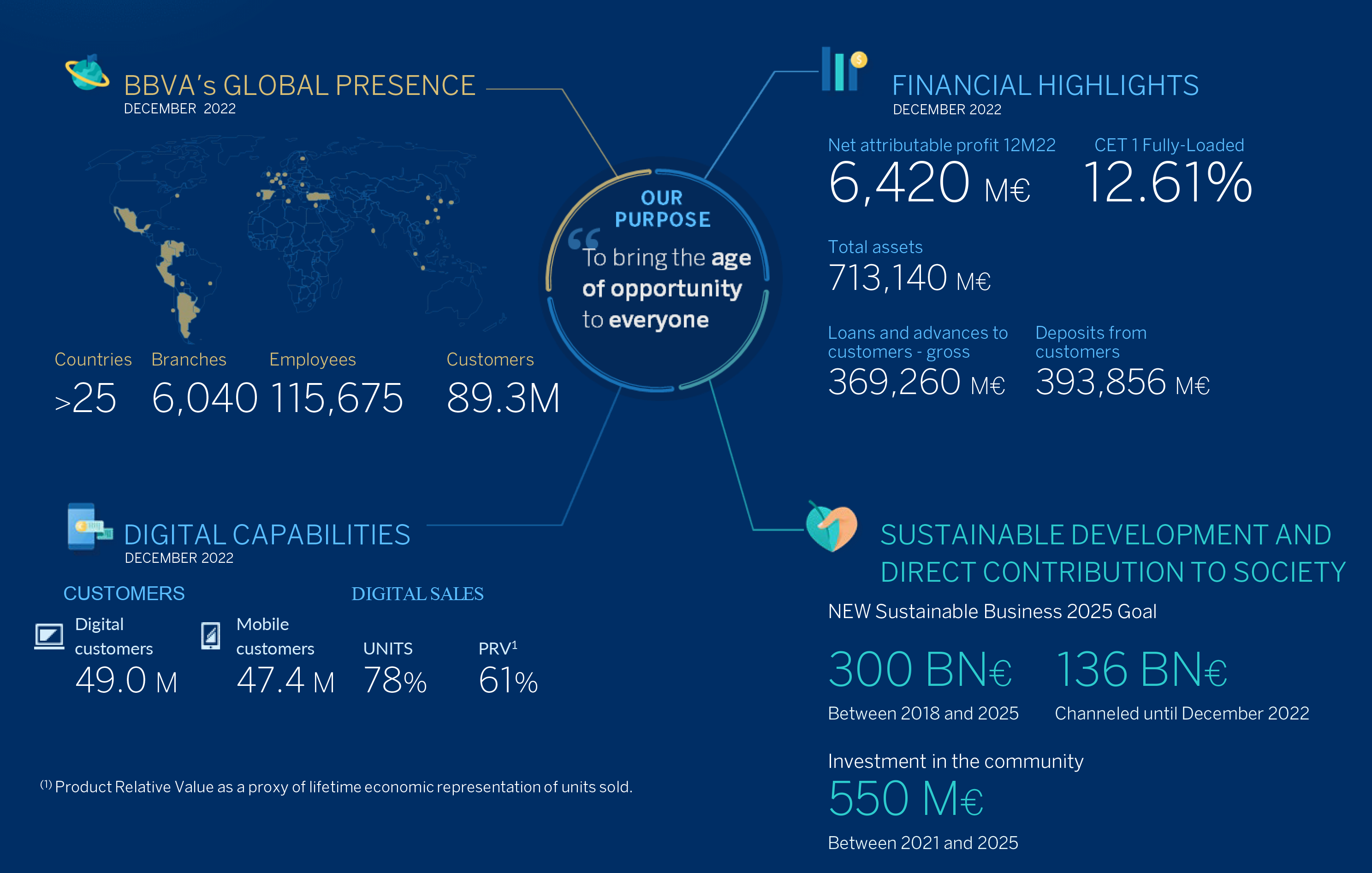

BBVA is a global financial group founded in 1857 with a customer-focused vision, which currently has more than 89 million customers and more than 115,000 employees. BBVA is present in more than 25 countries, has a leading position in the Spanish market, is the largest financial institution in Mexico and has leading franchises in South America and Turkey.

During its 165-year history, BBVA has stood out for its leadership in the transformation of the financial industry, which is clearly reflected in the Group's Purpose: “To bring the age of opportunity to everyone”. BBVA wants to help people, families, entrepreneurs, the self-employed, businessmen, employees and society in general to take advantage of the opportunities provided by innovation and technology.

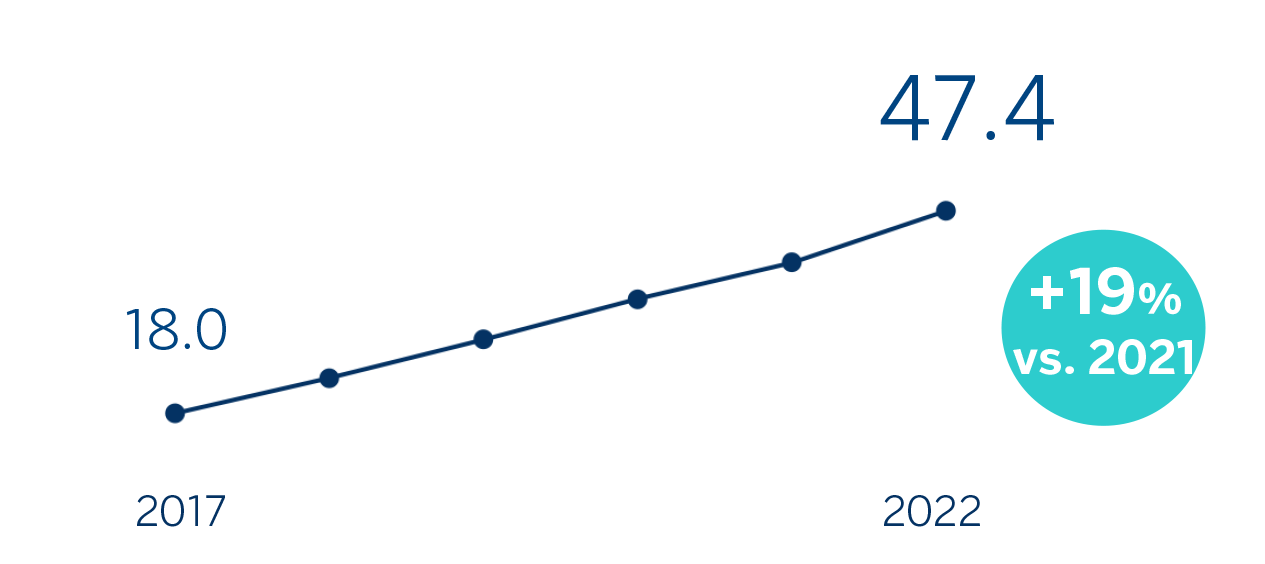

Leadership in innovation is reflected in BBVA's differential digital capacities. More than 47 million Group customers regularly use the mobile channel to interact with BBVA and 78% of sales are made through digital channels.

Likewise, BBVA offers its customers a unique value proposition, leveraged on technology and data, helping them improve their financial health with personalized information on financial decision-making and, also, helping them in their transition towards a more sustainable future.

BBVA is a pioneer in its commitment to sustainability, a key strategic pillar with a very significant impact on the banking business. The Group wants to accompany its customers with financing, advice and innovative solutions in their transition towards a more sustainable and inclusive world. An example of BBVA's growing commitment is the objective of channeling €300,000m in sustainable financing for the 2018-2025 period. Likewise, BBVA through the Commitment to the Community 2025 and through foundations, €550m will be allocated to social initiatives to support inclusive growth in the countries where it is present.

BBVA's results in 2022 confirm the success of its strategy in an environment of high uncertainty. A net attributable profit (loss) excluding non-recurring impacts of €6,621m1 that grows by 30.6% compared to the previous year, together with a solid solvency thanks to a fully-loaded CET1 ratio of 12.61%, allow BBVA to continue advancing in the execution of his Purpose.

1 For more information, see the Alternative Performance Measures at the end of this report.

1.2 Highlights

In 2022, BBVA has made very significant progress in the execution of its strategy focused on profitable growth, at the same time that it has continued to lead the transformation of the banking sector in the field of digitization and sustainability. All this has allowed BBVA to create opportunities for everyone, which is its Purpose, supporting customers, employees, shareholders and society in general.

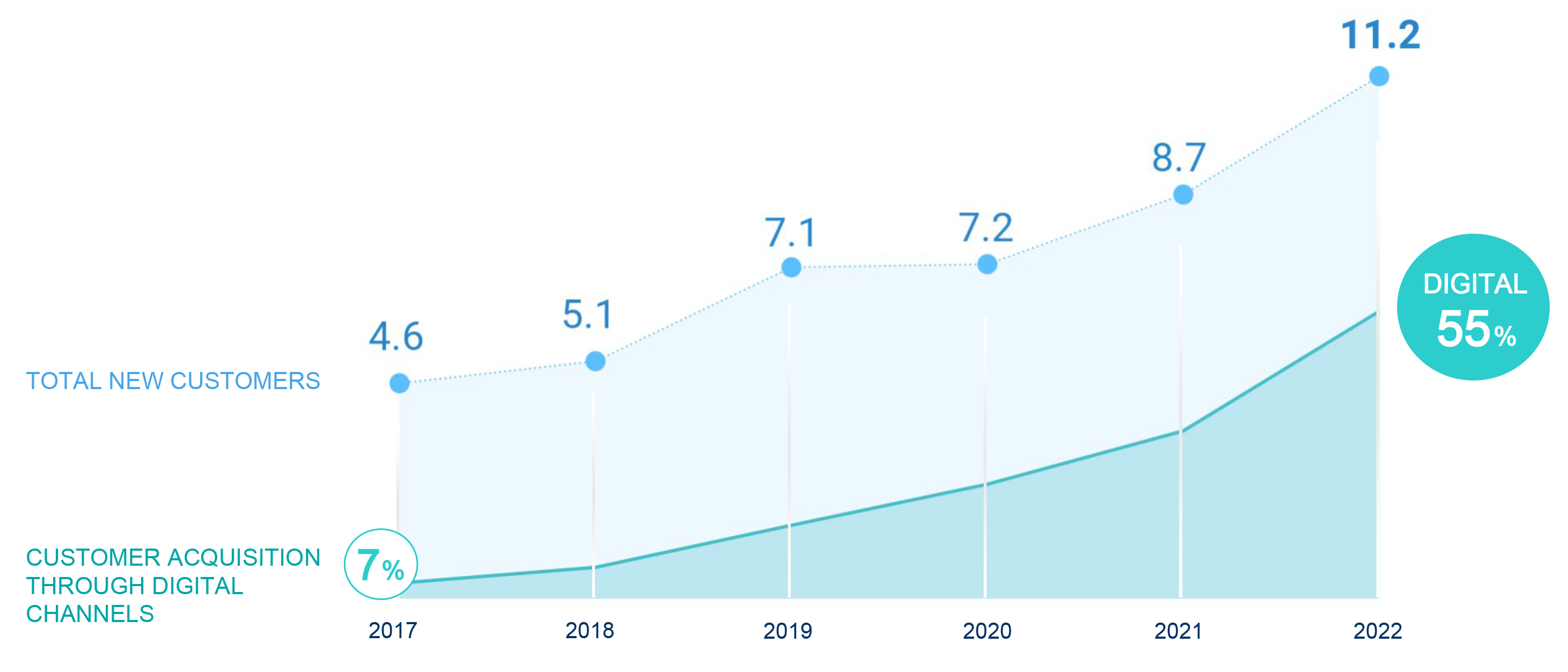

In 2022 the Group has grown reaching a new record in customer acquisition, adding more than 11 million new customers worldwide. This means that the rate of attracting new customers has more than doubled compared to the one in 2017.

In addition, 55% of these new customers arrive through digital channels, while just five years ago, only 7% did. This is the proof that the bank continues to be at the forefront of innovation.

NEW CUSTOMERS(1) (BBVA GROUP, MILLION; PERCENTAGE OF ACQUISITION THROUGH DIGITAL CHANNELS)

(1) Product Relative Value as a proxy of lifetime economic representation of units sold.

BBVA was the first bank to embark on the path of digitization, which today represents an enormous competitive advantage. Digitization makes it possible to improve efficiency and, above all, provide customers with comfortable, simple and accessible channels so that they can interact with the Bank when and how it suits them best.

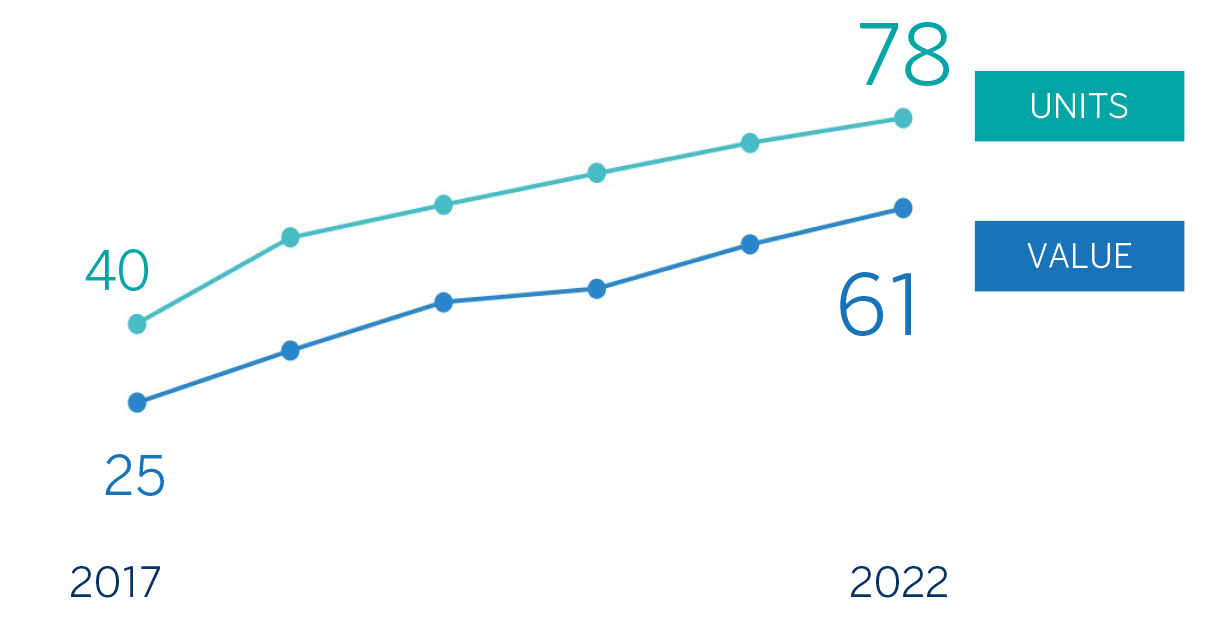

Today there are more than 47 million customers who operate with the bank through mobile phones, almost 20% more compared to the previous year. Compared to 2017, the percentage of customers who use their mobile phones to interact with BBVA has gone from 35% to more than 70% in 2022. Similarly, it should be noted that 78% of total sales in Group units are through digital channels, compared to the figure of 40% reached 5 years ago.

MOBILE CUSTOMERS (BBVA GROUP. MILLION CUSTOMERS)

DIGITAL SALES(BBVA GROUP, PERCENTAGE, UNITS AND VALUE (PRV(1)))

(1) Product Relative Value as a proxy of lifetime economic representation of units sold.

In addition, BBVA's commitment to data and technology in order to help customers make better decisions about their money and improve their financial health, is now a reality. Customers are increasingly satisfied with the service offered and this is demonstrated by the NPS or Net Promoter Score, which has increased 5 percentage points in the last year.

Beyond digitization, innovation is a key factor in BBVA's profitable growth strategy. An example of this is the firm commitment to digital banking solutions to grow in new and attractive markets, such as digital neobanks. As is the creation of BBVA Spark in 2022, which offers a comprehensive proposal of financial services to accompany innovative companies that are defining the future throughout their different stages of growth. Likewise, investment in venture capital funds is a fundamental part of the Group's strategy to learn about new technologies and generate business and financial profitability.

In the same way that digitization has brought an enormous transformation, the decarbonization of the economy represents the greatest disruption in history and an enormous opportunity. Not only because of the magnitude of the challenge, but also because of the limited time to undertake it. To achieve an emission-free economy, an estimated investment of USD275 trillion is necessary until 2050 or what is the same, more than 8% of world GDP until that date2. All companies and industries will be profoundly transformed by this process.

For this reason, BBVA has incorporated sustainability into its day-to-day activities, both in its internal processes and in its relationship with customers. Since 2020 it has been neutral in its own emissions3 and in 2021 it assumed the 'Net Zero 2050' commitment, as a founding member of the Net Zero Banking Alliance, that is, to be neutral in carbon emissions by 2050, also including those of customers and suppliers.

To this end, it has set intermediate targets to decarbonise its portfolio in six CO2 intensive industries by 2030 (electricity generation, automotive, steel, cement, coal, and oil and gas).

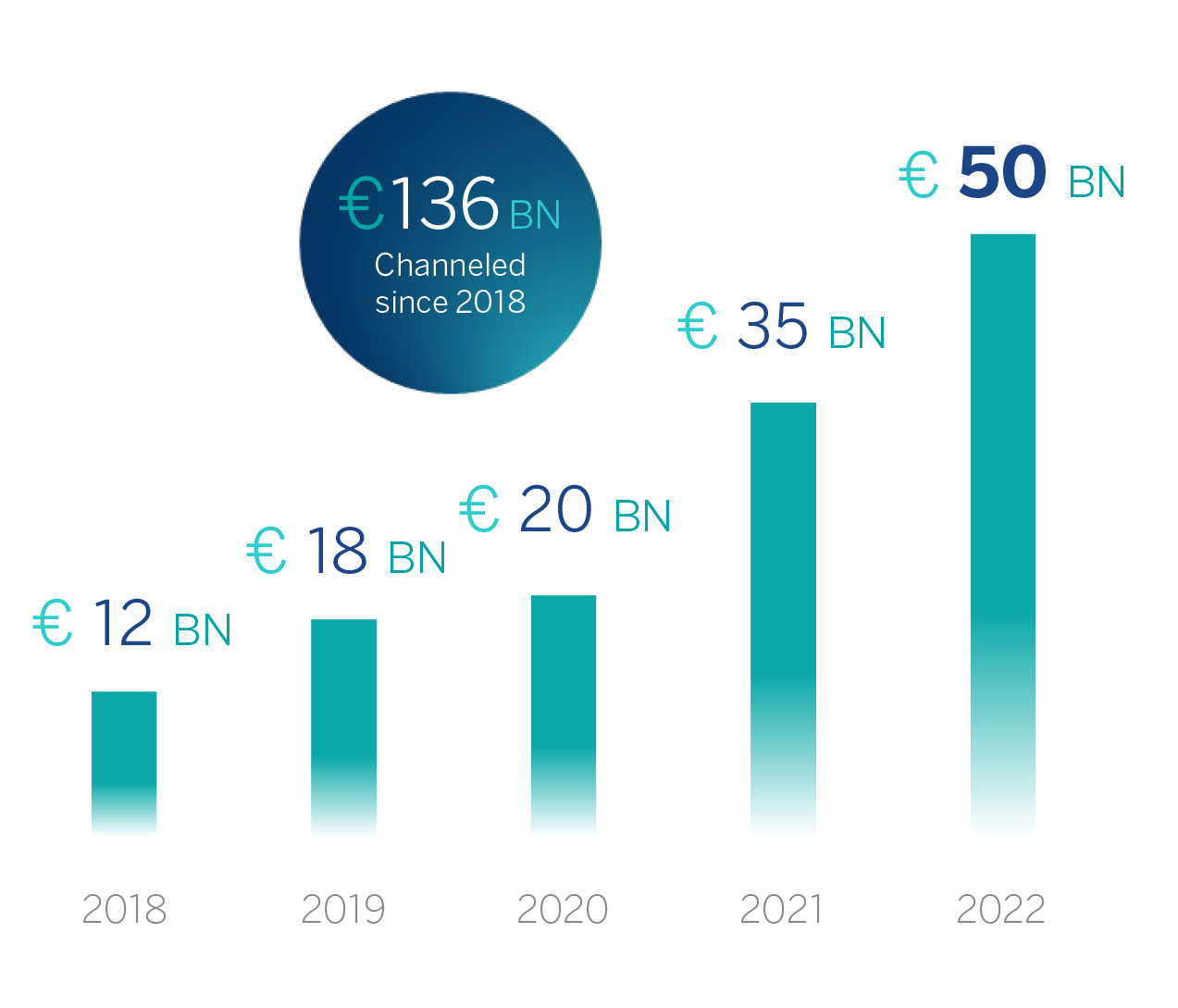

BBVA's priority is to support its customers, with advice and financing, in the preparation and implementation of their transition plans, which require a large investment. For this reason, sustainable business multiplies exponentially year after year. As of December 31, 2022, the Group has channelled4 €50bn in the year, making a total of €136bn allocated to sustainable activities5 since 2018.

Given this rate of growth, in 2022 BBVA has once again raised its goal of channelling sustainable business by 2025 to €300,000m, thus tripling the initial goal of €100,000m that was proposed in 2018.

SUSTAINABLE BUSINESS ANNUAL GROWTH (BBVA GROUP, CLIMATE CHANGE AND INCLUSIVE GROWTH)

For all these reasons, once again this year, BBVA has obtained the best score in the category of banks in the European region in the latest Dow Jones Sustainability Index, the world reference index in terms of sustainability. The recognition as the most sustainable bank in Europe for the third consecutive year reaffirms the success of the strategy for a greener and more inclusive future.

This pioneering strategy, based on booming trends such as innovation and sustainability, has allowed BBVA to achieve excellent results in 2022. Recurring profit was €6,621m6, which represents a record figure and 31% higher than the previous year; and earnings per share growth is 48%, thanks to the share buyback program. In reported terms, the benefit has risen to €6,420m.

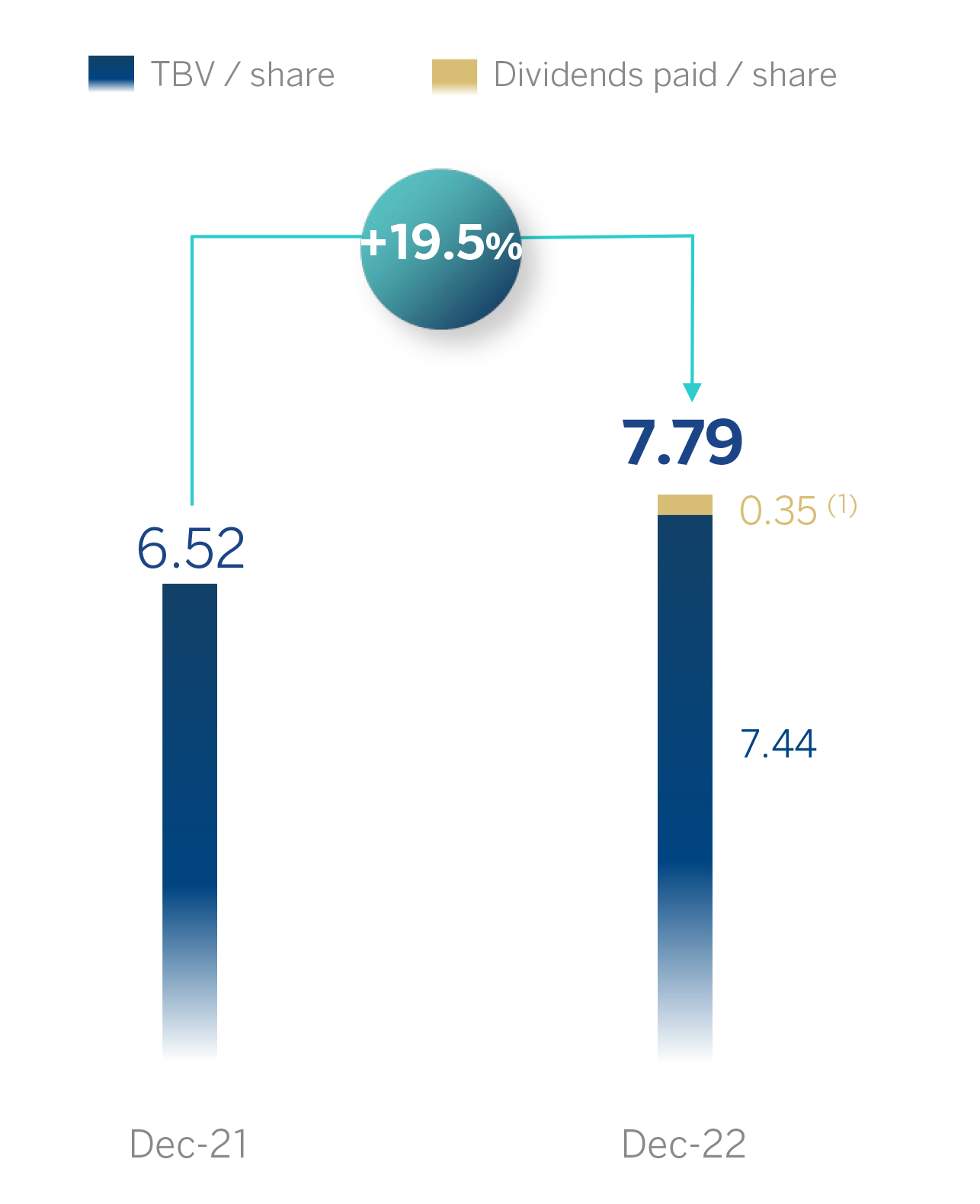

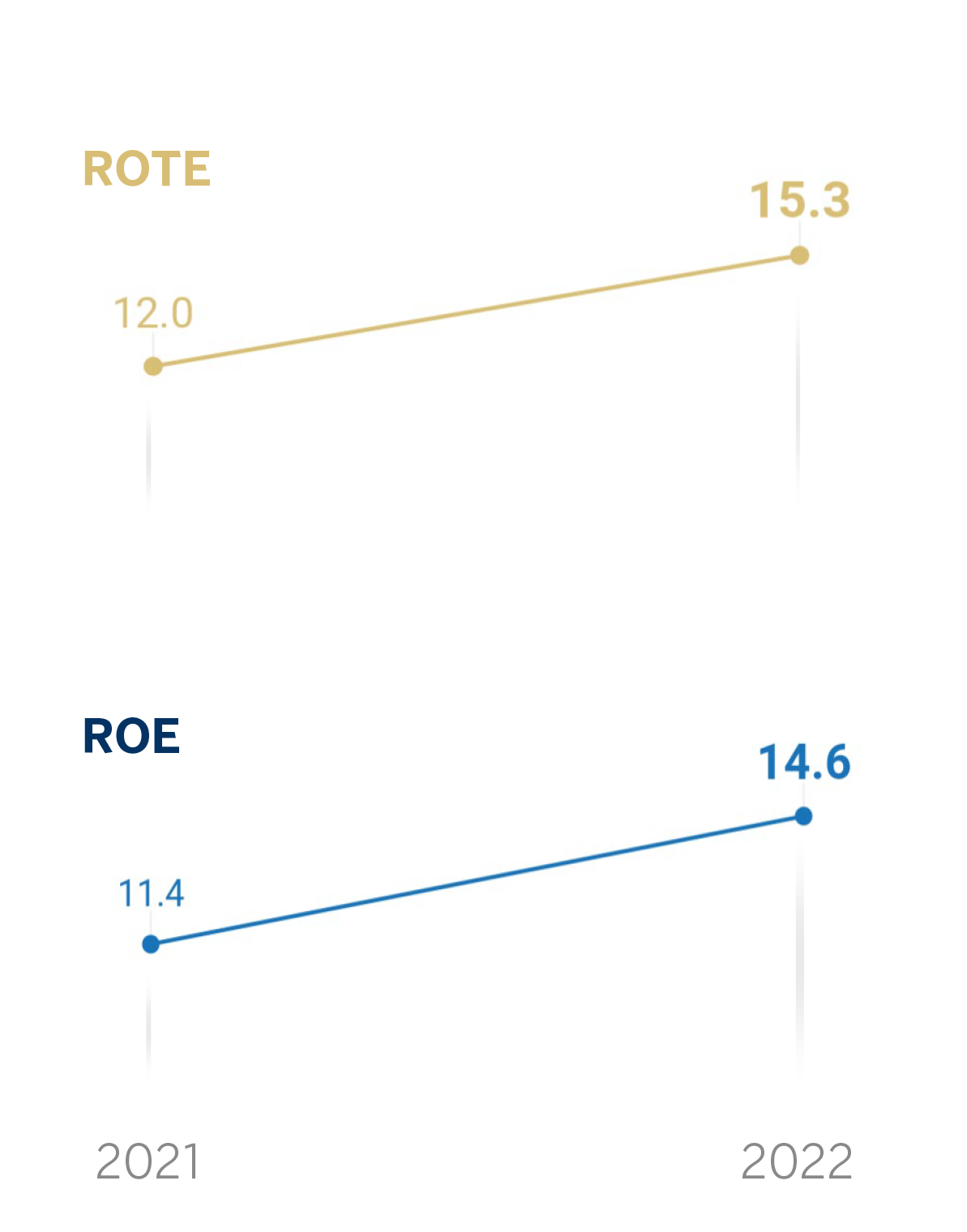

In 2022, the bank has promoted profitable growth and value creation for the shareholder, as evidenced by the return on tangible equity or ROTE, which stands at 15% and the growth of tangible book value per share plus dividends paid, which is close to 20% in the year.

TBV + DIVIDENDS (BBVA GRUP. € / SHARE)

PROFITABILITY METRICS(2) (BBVA GRUP, PORCENTAGE)

(1) April 2022 dividend per share 0.23 € (gross) and October 2022 dividend per share 0.12 € (gross).

(2) Profitability metrics excluding discontinued operations and non-recurring results.

At the same time, BBVA maintains a solid capital position at the end of the year. The Group's fully-loaded CET1 ratio stood at 12.61% as of December 31, 2022, well above the Group's CET1 regulatory requirement (8.60%) and the Group's target management range established on 11 0.5-12.0% of CET1.

All of this allows BBVA to significantly increase shareholder remuneration, allocating more than €3,000m of these results (47% of the reported attributable profit). This remuneration is consistent with the Group's shareholder remuneration policy, which contemplates distributing annually between 40% and 50% of the profit for the year.

On the one hand, the Bank proposes raising the cash dividend for the year to 43 euro cents gross per share (the highest in 14 years and 39% higher than in 2021). Following the gross 12 euro cents per share paid in October 2022, the bank plans to submit a final dividend of 31 gross euro cents per share for approval by the Shareholders' Meeting, which is expected to be paid in April 2023.

In addition, after having completed in 2022 the execution of one of the largest share buyback programs of European banks, BBVA plans to launch a new share buyback plan worth €422m, subject to the approval of the governing bodies and supervisory authorizations.

All these advances in 2022, position BBVA on the right path to achieve the ambitious goals for 2024 and continue on the path of profitable growth. These advances also allow BBVA to fulfil its Purpose "To bring the age of opportunity to everyone".

In the first place, through the bank's transactional services, with the provision of credit to individuals and businesses, boosting economic activity and supporting short and long term challenges such as digitization and sustainability.

During 2022, the Group has mobilized more than €9bn in inclusive growth, through financing, sustainable infrastructures, social mortgages or social insurance. Additionally, last year BBVA made public its Commitment to the Community, which means allocating, together with foundations, €550m to social initiatives until 2025. At the end of 2022, it has already allocated more than €230m, 43% of the total, which has benefited more than 62 million people.

BBVA works to create opportunities for its customers, shareholders, team, and above all, to achieve a more sustainable and inclusive society that leaves no one behind.

2 Source: “The net-zero transition: What it would cost, what it could bring”, McKinsey & Company, 2022.

3 The direct emissions mentioned include scope 1, 2 and part of scope 3: waste, emissions from business trips and the displacement of employees of central services (see section "2.3.6 Management of direct and indirect impacts” of this report).

4 For the purposes of the 2025 Objective, the channelling of sustainable business of the entities that are part of the BBVA Group as of 12/31/2022 as well as the BBVA Microfinance Foundation is included.

5 For the purposes of the Goal 2025, channelling is considered to be any mobilization of funds, cumulatively, towards activities or clients considered to be sustainable in accordance, fundamentally, with existing regulations, internal standards inspired by existing regulations, market standards such as the Green Bond Principles, the Social Bond Principles and the Sustainability Linked Bond Principles of the International Capital Markets Association, as well as the Green Loan Principles, Social Loan Principles and the Sustainability Linked Loan Principles of the Loan Market Association and best market practices. The foregoing is understood without prejudice to the fact that said mobilization, both at an initial stage or at a later time, may not be registered on the balance sheet. To determine the funds channelled to sustainable business, internal criteria is used based on both internal and external information, either from public sources, provided by customers or by a third party (mainly data providers and independent experts). BBVA does not assume any responsibility for the opinions expressed by third parties or for any errors or omissions in the information coming from external sources.

6 For more information, see the Alternative Performance Measures at the end of this report.