Both Garanti and CNCB continued to perform well in the fourth quarter. They helped Eurasia post a cumulative gross income in 2012 of €2,210m, a rise of 12.7% year-on-year, through their capacity to generate recurring revenue.

Operating expenses increased by 20.0% in the same period, as a result of continued investments (mainly in emerging countries) and continue to slow the year-on-year rate of increase compared with previous quarters. As a result, operating income increased by 9.0% on the figure posted 12 months previously to €1,432m.

Impairment losses on financial assets and provisions reduced the area’s income statement by €328m. In fact, this heading rose significantly in the fourth quarter of 2012 due to one-off provisions made in Portugal.

As a result, Eurasia generated a cumulative net attributable profit of €950m, with a year-on-year fall of 7.8% on the same period in 2011.

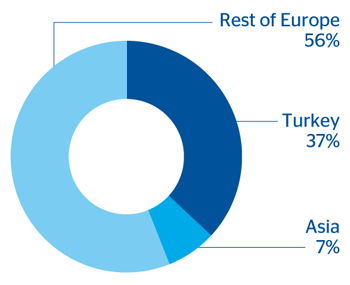

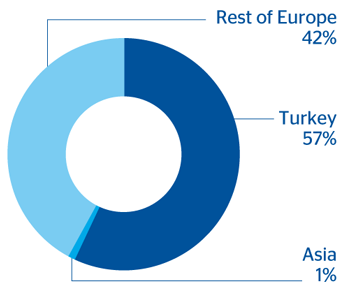

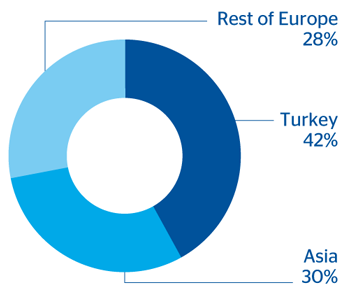

Europe has contributed 34.8% to the above result, i.e. €331m (down 28.8% year-on-year). Of particular note is the continued excellent performance of Turkey, whose earnings stand at €314m, a rise of 62.8% on the previous year (partly because Garanti contributed for the 12 months in 2012, while in 2011 it began to contribute at the end of March). In the rest of Europe, the net attributable profit fell 93.9% in the same period to €17m. This is due to reduced activity with wholesale customers, turbulence in the markets and the aforementioned loan-loss provisions made in Portugal.

Garanti is a bank that serves 11.5 million customers with a workforce of 20,318 people. It has a network of 936 branches and 3,508 ATMs. The following are worth highlighting with respect to the 2012 evolution of Garanti (data here refer to Garanti Bank unless stated otherwise):

- Continued progress in lending (up 9.4% year-on-year), particularly in the local currency (up 16.0%). There has been a notable boost in the retail portfolio, with positive growth rates that are above the sector average, in highly profitable products such as loans to the automobile sector and mortgages.

- Customer deposits have continued to rise (up 1.4% in the year) thanks to the strong growth in Turkish lira-denominated deposits (up 4.3%).

- Excellent management of customer spreads, thanks mainly to a reduction in the cost of liabilities. In the fourth quarter of 2012 this cost fell once more, leading to an additional increase in the spread and thus an improvement in the bank’s profitability ratios.

- The above, together with the high yield generated by inflation-linked bonds has helped strengthen the bank’s gross income.

- In addition, Garanti Group is notable for its high core Tier I capital ratio (16.3%) under Basel II, where it leads the field among its peers.

- To sum up, increased activity, a diversified revenue base and disciplined cost management have allowed the Garanti Group to generate a net attributable profit of €1,453m in 2012.

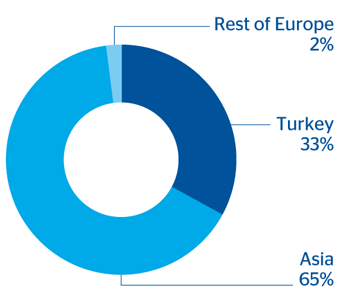

Finally, Asia has posted a cumulative net attributable profit of €620m, accounting for 65.2% of earnings in the area. Most of this amount comes from the contribution from CNCB. According to the latest data published as of September 2012, the bank’s cumulative net attributable profit increased by 12.4% year-on-year. With respect to activity, deposit gathering stands out, with a bigger increase than that of lending (up 19.7% and up 15.3% in year-on-year terms, respectively). Finally, CNCB improved its capital ratio to 13.7% at the close of the third quarter of 2012 (under local criteria).