The United States franchise encompasses the Group’s business in the United States. As of 31-Dec-2012, BBVA Compass accounted for 95% of the volume of business and 81% of earnings in the area. It also includes the BBVA branch in New York, which specializes in transactions with large corporations. Due to the relative contribution of BBVA Compass, most of the comments below refer to this business unit. It should be noted that the Bank successfully concluded the sale of the Puerto Rico business as of 16-Dec-2012.

At the close of December 2012, gross customer lending in BBVA Compass was up 4.1% to €33,753m. The bank continues to focus on the portfolios within its targeted profile. Construction real estate fell again over the quarter, with a year-on-year decline of 48.2%. On the contrary, exposure to commercial loans increased 24.5% year-on-year, and residential real estate grew 19.0% over the same period.

Asset quality in the area improved considerably during the year. Total nonperforming loans decreased by 39.5% when compared with 2011 (at current exchange rate). Thus, the NPA ratio improved 114 basis points over the year and 8 points over the quarter, closing at 2.4%. The coverage ratio reached 90% and the accumulated risk premium at the close of December was 0.23% (0.30% as of September 2012, and 0.89% at the close of 2011).

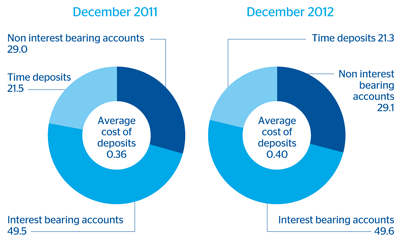

Customer deposits in BBVA Compass also grew by 11.7% over the last 12 months and 3.8% during the quarter. As of 31-Dec-2012 they stood at €37,097m. Of this total, 29.1% are non-interest bearing deposits, which performed best over the year, with a growth of 12.3%.