As of 31-Dec-2012, customer funds total €452 billion. This heading is up 6.0% year-on-year and 0.7% quarter-on-quarter.

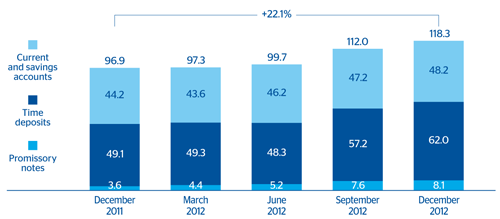

The most relevant aspect is still the positive performance of on-balance-sheet customer funds, i.e. customer deposits plus promissory notes, in practically all geographical areas where BBVA operates, and above all from the retail segment.

As of 31-Dec-2012, BBVA managed a volume of €293 billion in customer deposits, excluding promissory notes, which means growth of 3.7% year-on-year and 1.4% quarter-on-quarter. These balances have grown quarter-to-quarter in both the domestic and non-domestic sectors, fueled by the strong performance in the typical headings of the retail segment, i.e. current and saving accounts and time deposits. Consequently, and despite the difficult economic environment, BBVA continues to demonstrate its great capacity to gather customer funds thanks to the high capillarity of its commercial network.

Off-balance-sheet customer funds stood at €159 billion at the end of December, up 10.4% year-on-year and practically at the same level as the end of September 2012.

In Spain, BBVA still holds the leading position in assets under management, in both pension and mutual funds. In pension funds, its market share stands at 19.1%, according to the latest information available as of September 2012. Its market share in mutual funds stands at 17.5%, according to November data, i.e. 48 basis points above the figure for the same date in 2011. In the non-domestic sector, there continues to be widespread increases in assets under management in mutual funds and customer portfolios.

Customer funds

(Million euros)

Download table in Excel

|

31-12-12 |

Δ % |

31-12-11 |

30-09-12 |

| Deposits from customers |

292,716 |

3.7 |

282,173 |

288,709 |

|

Domestic sector

|

141,169

|

3.4

|

136,519

|

142,561

|

| Public sector |

21,807 |

(22.9) |

28,302 |

27,800 |

| Other domestic sectors |

119,362 |

10.3 |

108,217 |

114,761 |

| Current and savings accounts |

48,208 |

9.0 |

44,215 |

47,188 |

| Time deposits |

61,973 |

26.2 |

49,105 |

57,236 |

| Assets sold under repurchase agreement and other |

9,181 |

(38.4) |

14,897 |

10,337 |

|

Non-domestic sector

|

151,547

|

4.0

|

145,655

|

146,148

|

| Current and savings accounts |

98,169 |

15.2 |

85,204 |

91,413 |

| Time deposits |

48,691 |

(8.8) |

53,399 |

50,016 |

| Assets sold under repurchase agreement and other |

4,688 |

(33.5) |

7,051 |

4,719 |

| Other customer funds |

159,285 |

10.4 |

144,291 |

160,113 |

| Mutual funds |

41,371 |

5.3 |

39,294 |

41,404 |

| Pension funds |

89,776 |

14.1 |

78,648 |

91,081 |

| Customer portfolios |

28,138 |

6.8 |

26,349 |

27,629 |

| Total customer funds |

452,001 |

6.0 |

426,464 |

448,823 |

Other customer funds

(Million euros)

Download table in Excel

|

31-12-12 |

Δ % |

31-12-11 |

30-09-12 |

| Spain |

51,915 |

3.0 |

50,399 |

50,492 |

| Mutual Funds |

19,116 |

(2.5) |

19,598 |

18,987 |

| Pension Funds |

18,313 |

6.3 |

17,224 |

17,695 |

| Individual pension plans |

10,582 |

6.6 |

9,930 |

10,075 |

| Corporate pension funds |

7,731 |

6.0 |

7,294 |

7,620 |

| Customer portfolios |

14,486 |

6.7 |

13,578 |

13,810 |

| Rest of the world |

107,370 |

14.4 |

93,892 |

109,622 |

| Mutual funds and investment companies |

22,255 |

13.0 |

19,697 |

22,417 |

| Pension Funds |

71,463 |

16.3 |

61,424 |

73,386 |

| Customer portfolios |

13,652 |

6.9 |

12,771 |

13,819 |

| Other customer funds |

159,285 |

10.4 |

144,291 |

160,113 |

Customer funds

(Billion euros)

(1) At constant exchange rates: +4.3%.

On-balance sheet customer funds. Other domestic sectors (1)

(Billion euros)

(1) Including promissory notes sold by the retail network and excluding repos and other.