Positive performance in income from fees and commissions which totaled €4,353m, an increase of 8.0% on the figure for 2011. This result is underpinned by expanding activity in emerging economies and also the incorporation of Garanti. It is worth noting that this good result came despite new regulatory limitations in some geographical areas and the economic weakness in developed countries.

NTI for the twelve months of 2012 amounted to €1,767m, up 19.3% year-on-year, due mainly to the inclusion of capital gains from buybacks of securitization bonds and subordinated debt in the second and fourth quarters, respectively.

Revenue from dividends amounted to €390m, 30.6% down on the figure posted 12 months earlier. This heading basically includes the remuneration from the Group’s stake in Telefónica (temporarily suspended until November 2013) and, to a lesser extent, the dividends collected in the Global Markets area.

The good results from CNCB have boosted the performance of income by the equity method. This heading amounts to a total of €727m, 22.1% up on the figure for the same period in 2011.

Other operating income and expenses amounted to €82m. This heading continues to benefit from the positive performance of the insurance business in all the geographical areas. However, as it also includes the increased allocations to the deposit guarantee funds in the different regions where BBVA operates, it fell 60.3% over the last twelve months.

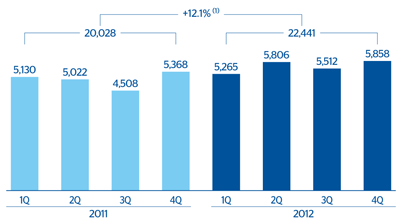

Finally, gross income, which has been growing quarter to quarter, stood at €22,441m in 2012 with growth of 12.1% year-on-year. Without taking into account the less recurrent items from NTI and dividends, this figure would be €20,284m, with growth of 12.8% over the same period.