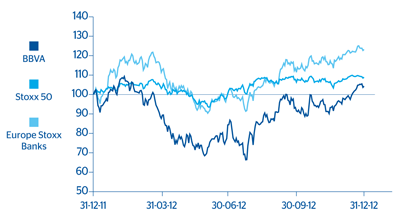

Sovereign risk continued to ease in the final quarter of 2012, initially due to the ECB’s announcement of the sovereign bond buyback program, subject to conditionality and a previous request by the country. Also, additional tranches of aid granted to Greece have been paid and measures designed to strengthen the Economic and Monetary European Union have been announced, such as making the ECB the sole supervisor for most of the European financial system. These factors have helped stock markets enjoy a positive trend (the Stoxx 50 has gained 2.4% over the quarter), and have benefited peripheral countries in particular (the Ibex 35 rose 6.0% over the same period).

As far as the fundamentals of the financial sector are concerned, although the trends seen in previous quarters have continued (pressures on margins and deterioration in asset quality, more significant in peripheral countries), there have been no significant negative surprises. As a result, the financial sector has reported a better relative performance (the Stoxx Banks and Euro Stoxx Banks indices have performed similarly, with quarter-on-quarter gains of 10.5% and 10.6%, respectively).

BBVA’s results in the third quarter of 2012 were slightly above consensus. They were favourable perceived by analysts even if they did not translate into a change in analyst recommendations. At the operating level, analysts took a positive view of the Bank’s strong revenue figures, even though costs and provisions grew more than expected. The Group once more surprised observers by its capacity to generate earnings in its international businesses and its solvency and liquidity levels. In Spain, net interest income was particularly strong. Analysts have also underlined the strength of earnings in South America and Mexico, and in particular the trend in recurring revenue. Furthermore, reaction to the announcement of the agreement reached for the sale of Administradora de Fondos para el Retiro, Bancomer S.A. de CV in Mexico and BBVA Horizonte Sociedad Administradora de Fondos de Pensiones y Cesantías S.A. in Colombia, has largely been positive. Analysts consider that the sale of the pension business makes strategic sense and has an attractive valuation. It has limited synergies with the core business of the Group and investors have shown a strong buying interest.

Taking all these factors into account, BBVA’s share price gained 13.9% over the quarter, closing at €6.96 per share, a market capitalization of €37,924m. This represents a price/ book value ratio of 0.9, a P/E of 21.5 (calculated on the Group’s net attributable profit for 2012) and a dividend yield of 6.0%(calculated according to the average dividend per share estimated for 2012 by a consensus of Bloomberg analysts and the share price as of December 31). The improvement in the BBVA share is much greater than the increase in the Ibex 35 (up 6.0%) and than that of the sector in the euro zone (Euro Stoxx Banks: +10.6%). Against the current backdrop, the market takes a positive view of the Group’s sound capital position and its recurrent earnings.

The average daily volume of shares traded in the fourth quarter of 2012 was 53 million and the average daily amount was €339m.

As regards shareholder remuneration, on December 19 the Group announced it would be paying an interim dividend against 2012 results of €0.10 per share. The payment was made on 10-Jan-2013.