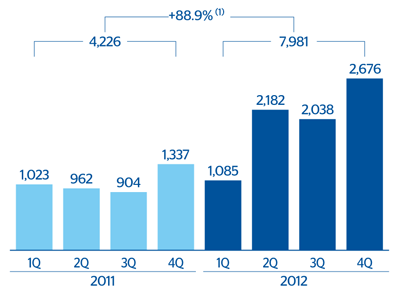

Cumulative impairment losses on financial assets in 2012 totaled €7,981m, 88.9% higher than those posted 12 months earlier.

Provisions amounted to €650m (€508m 12 months earlier). They basically cover early retirement costs and, to a lesser extent, transfers to provisions for contingent liabilities, allocations to pension funds and other commitments to staff.

The heading Other gains/losses amounted to a negative €1,365m, basically consisting of the provisions made for real estate and foreclosed or acquired assets in Spain, and the badwill generated with the Unnim operation.

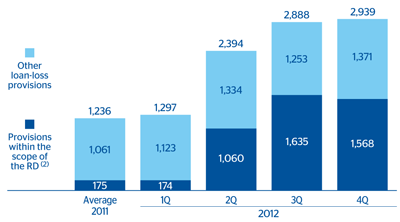

In conclusion, if we add the provisions made to cover the impairment of the assets related to the real estate sector in Spain, accounted for under the headings “Impairment losses on financial assets” and “Other gains (losses)”, the total amount allocated by BBVA in 2012 totals €4.4 billion, which means that the Bank complies with the requirements set out in the Royal Decree-Laws 02/2012 and 18/2012.

After announcing in the second quarter of 2012 that it was studying strategic alternatives for its pension business in Latin America, BBVA has already signed sale agreements for Afore Bancomer in Mexico and for AFP Horizonte in Colombia (having concluded the sale of Afore Bancomer in January 2013). The results of this activity are therefore classified as discontinued operations. The historical series have also been reconstructed to ensure they are homogeneous.