Relevant events

Results

- Generalized growth in recurrent revenue for almost all geographic areas.

- Operating expenses remain under control.

- Lower amount of impairment on financial assets not measured at fair value through profit or loss (hereinafter, "impairment losses on financial assets").

- The result of corporate operations amounted to €633 million and includes the capital gains (net of taxes) arising from the sale of approximately 68.2% of BBVA's equity stake in BBVA Chile.

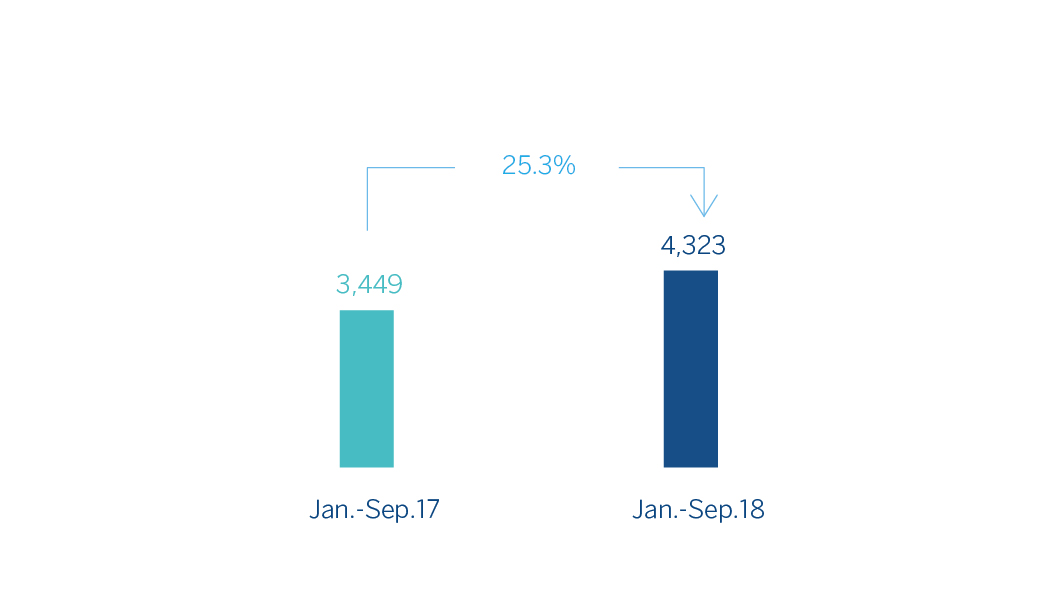

- The net attributable profit was €4,323 million, 25.3% higher than in the first nine months of the previous year. Net attributable profit excluding results from corporate operations stood at €3,689 million or 7.0% higher than in the first nine months of the previous year.

Net attributable profit (Million of Euros)

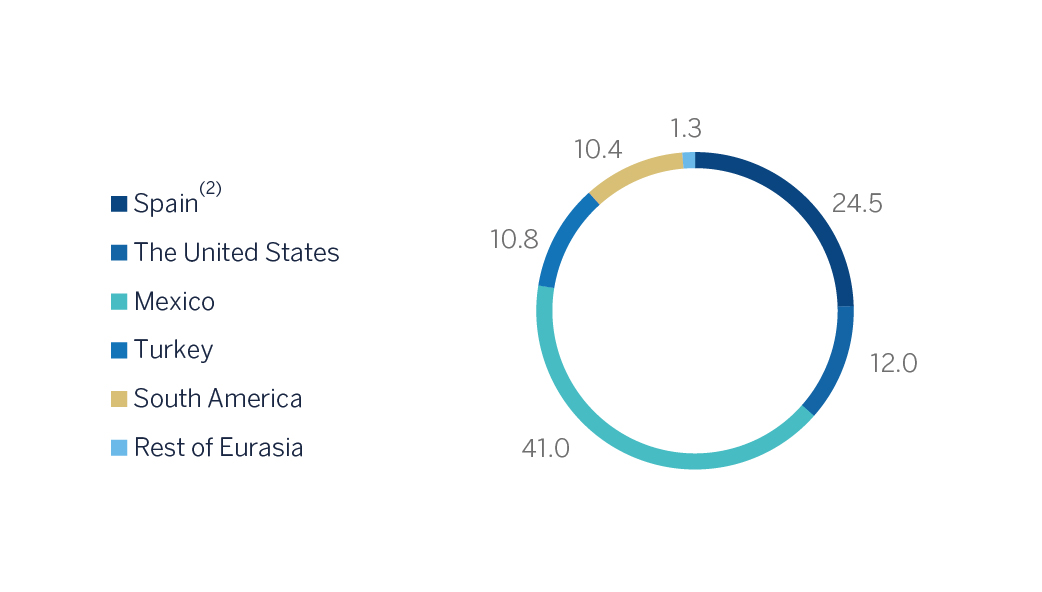

Net attributable profit breakdown (1) (Percentage. January-September 2018)

(1) Excludes the Corporate Center.

(2) Includes the areas Banking activity in Spain and Non Core Real Estate.

Balance sheet and business activity

- Lower volume of loans and advances to customers (gross). However, there was growth in United States, Mexico and South America (excluding BBVA Chile).

- Non-performing loans continue to improve.

- Within the off-balance-sheet funds, mutual funds continue to perform positively.

Hyperinflation in Argentina

- The financial statements of the Group for the third quarter includes, on one hand, the negative impact derived from the accounting for hyperinflation in Argentina (-€190 million) in the net attributable profit, and on the other hand, the positive impact on equity of €104 million.

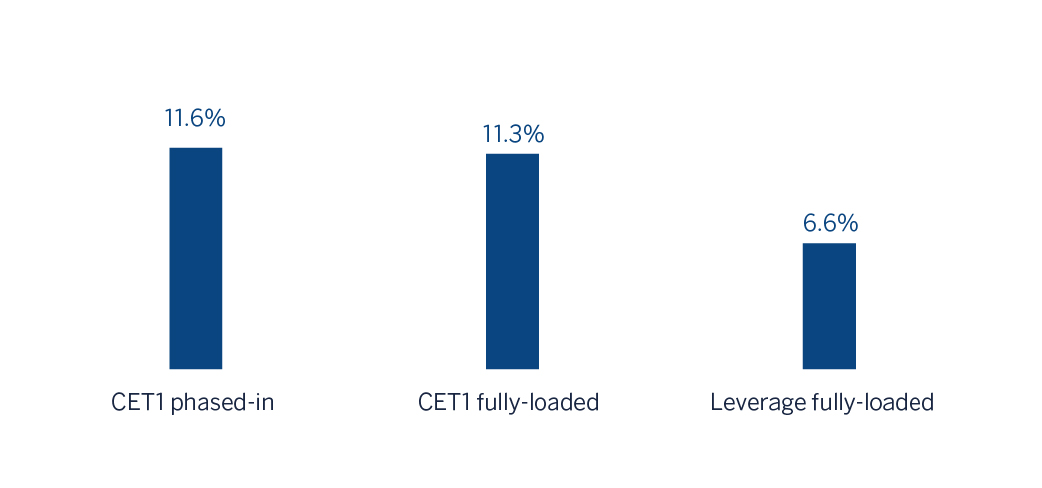

Solvency

- The capital position is above regulatory requirements.

- BBVA has placed an issuance of €1 billion in of preferred securities contingently convertible into newly issued ordinary shares of BBVA. The remuneration has been set at 5.875%, matching the cheapest obtained by BBVA for this type of issuances.

Capital and leverage ratios (Percentage as of 30-09-2018)

Risk management

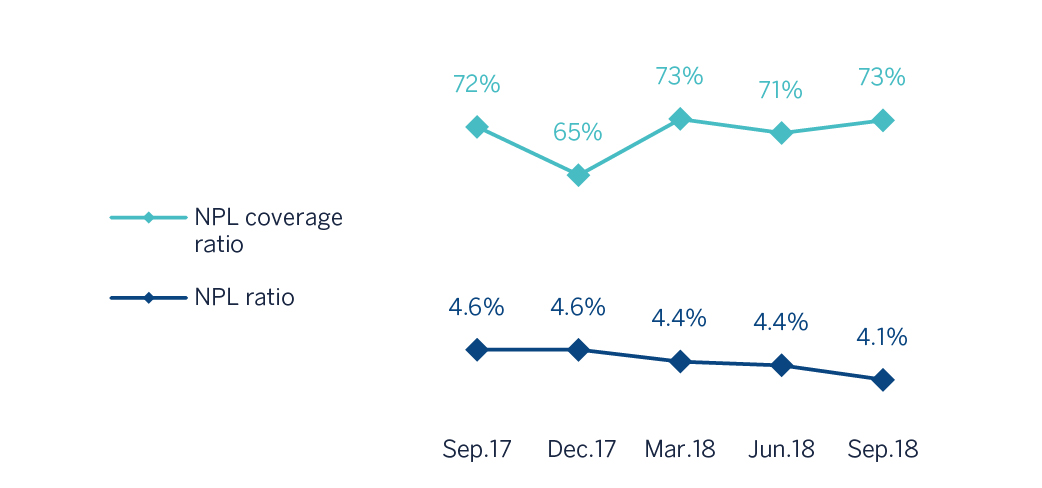

- Solid indicators of the main credit-risk metrics: as of 30-September-2018, the NPL ratio closed at 4.1%, the NPL coverage ratio at 73% and the cumulative cost of risk at 0.90%.

NPL and NPL coverage ratios (Percentage)

Transformation

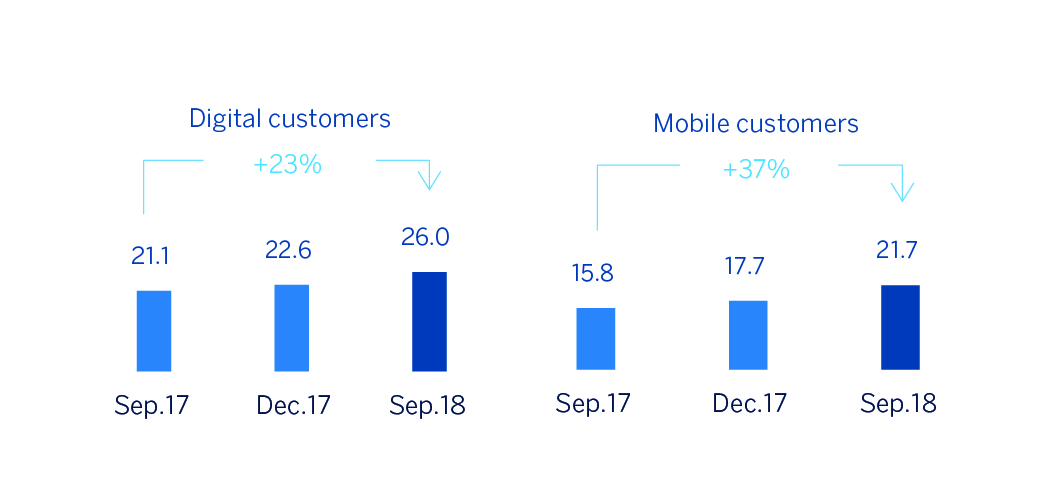

- The Group's digital and mobile customer base and digital sales continue to increase in all the geographic areas where BBVA operates with a positive impact in efficiency.

Digital and mobile customers (Millions)

Other matters of interest

- On October 10, BBVA completed the sale agreement to Cerberus of 80% of the joint venture to which BBVA had transferred its real estate business in Spain. The Group's financial statements for the third quarter of 2018 do not include the impacts of this operation.

- BBVA has signed the sale to Blackstone of its 25.24% stake in Testa, valued at €478m, which is expected to close during the last quarter of the year.

- Regarding shareholder remuneration, on October 10, an amount on account of the 2018 fiscal year was paid in cash for a gross amount of €0.10 per share.

Impact of the initial implementation of IFRS 9

- The figures corresponding to the first nine months of 2018 are prepared under International Financial Reporting Standard 9 (IFRS 9), which entered into force on January 1, 2018. This new accounting standard did not require the comparative information from prior periods, so the comparative figures shown for the year 2017 have been prepared in accordance with the IAS 39 (International Accounting Standard 39) regulation in force at that time.

- The impacts derived from the first application of IFRS 9, as of January 1, 2018, were registered with a charge to reserves of approximately €900m mainly due to the allocation of provisions based on expected losses, compared to the model of losses incurred under the previous IAS 39.

- In capital, the impact derived from the first application of IFRS 9 has been a reduction of 31 basis points with respect to the fully-loaded CET1 ratio of December 2017.