Risk management

Credit risk

As of the end of September 2018, BBVA Group's risk metrics continued to perform well:

- Credit risk decreased by -4.8%, -1.5% isolating the impact of the sale of BBVA Chile during the period (-2.5% and +0.8%, respectively, at constant exchange rates) with positive evolution in all business areas, with the exception of Banking activity in Spain and Non Core Real Estate where a contraction of the activity is observed. During the third quarter credit risk decreased by -5.2% (-3.6% at constant exchange rates). Isolating the sale of BBVA Chile, the credit risk would have fallen by -1.9% (-0.4% in constant terms).

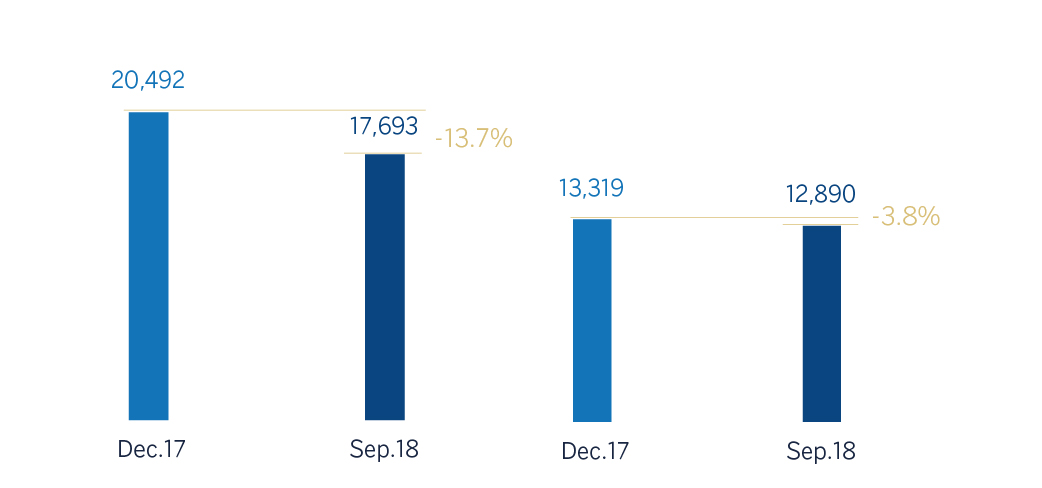

- The balance of non-performing loans decreased during the last nine months by -13.7% (-10.9% in constant terms), highlighting the good behaviour of the Banking activity in Spain and, due to singular portfolio sale operations, of Non Core Real Estate. To a slighter degree, there is a favourable evolution in Mexico and the United States. South America was negatively impacted by some retail portfolios and specific customers that was partially offset by the sale of BBVA Chile, and Turkey deteriorated to some extent, especially in the wholesale- customer segment. During the third quarter the balance of non-performing loans showed a decrease (-10.0% at current exchange rates and of -7.9% in constant terms).

- The NPL ratio stood at 4.1% as of 30-September-2018, a reduction of 22 basis points with respect to June of 2018.

- Allowances decreased by -3.2% during the last 9 months (+1.6% at constant exchange rates) whereas the decrease over the quarter amounted to -7.6% (-4.6% in constant terms).

- NPL coverage ratio closed at 73% with an improvement of 786 basis points during the last 9 months and 185 basis points in the last 3 months.

- The cumulative cost of risk through September 2018 was 0.90%, +1 basis point higher than the figure for 2017.

Non-performing loans and provisions (Millions of Euros)

Credit risk (1) (Millions of Euros)

| 30-09-18 | 30-06-18 (2) | 31-03-18 (2) | 31-12-17 (2) | |

|---|---|---|---|---|

| Credit risk | 428,318 | 451,587 | 442,446 | 450,045 |

| Non-performing loans | 17,693 | 19,654 | 19,516 | 20,492 |

| Provisions | 12,890 | 13,954 | 14,180 | 13,319 |

| NPL ratio (%) | 4.1 | 4.4 | 4.4 | 4.6 |

| NPL coverage ratio (%) | 73 | 71 | 73 | 65 |

- (1) Include gross loans and advances to customers plus guarantees given.

- (2) Figures without considering the classification of non-current assets held for sale.

Non-performing loans evolution (Millions of Euros)

| 3Q 18 (1) | 2Q 18 (2) | 1Q 18 (2) | 4Q 17 (2) | 3Q 17 | |

|---|---|---|---|---|---|

| Beginning balance | 19,654 | 19,516 | 20,492 | 20,932 | 22,422 |

| Additions | 2,163 | 2,596 | 2,065 | 3,757 | 2,268 |

| Recoveries | (1,962) | (1,655) | (1,748) | (2,142) | (2,001) |

| Net variation | 201 | 942 | 317 | 1,616 | 267 |

| Write-offs | (1,607) | (863) | (913) | (1,980) | (1,575) |

| Exchange rate differences and other | (554) | 59 | (380) | (75) | (181) |

| Period-end balance | 17,693 | 19,654 | 19,516 | 20,492 | 20,932 |

| Memorandum item: | |||||

| Non-performing loans | 17,045 | 18,627 | 18,569 | 19,753 | 20,222 |

| Non performing guarantees given | 649 | 1,027 | 947 | 739 | 710 |

- (1) Preliminary data.

- (2) Figures without considering the reclassification of non-current assets held for sale.

Structural risks

Liquidity and funding

Management of liquidity and funding in BBVA aims to finance the recurring growth of the banking business at suitable maturities and costs, using a wide range of instruments that provide access to a large number of alternative sources of financing, always in compliance with current regulatory requirements.

A core principle in BBVA's management of the Group's liquidity and funding is the financial independence of its banking subsidiaries abroad. This principle limits the spread of a liquidity crisis among the Group's different areas and ensures that the cost of liquidity and funding is correctly reflected in the price formation process.

The financial soundness of the Group's banks continues to be based on the funding of lending activity, fundamentally through the use of stable customer funds. During the first nine months of 2018, liquidity conditions remained comfortable across BBVA Group's global footprint:

- In the Eurozone, the liquidity situation is still comfortable and the credit gap stable.

- In the United States, the liquidity situation is adequate. The credit gap increased during the year due to the dynamism of consumer and commercial credit as well as to the cost-containment strategy for deposits, in an environment of competition in prices and rising rates.

- In Mexico, the liquidity position is sound as the environment has improved after the electoral process and the new commercial agreement with the United States. The credit gap has widened year-to-date due to deposits growing less than lending.

- The liquidity situation in Turkey is stable, showing a reduction in the credit gap as a result of deposits growing faster than lending.

- In South America, the liquidity situation remains comfortable in all geographies. There has not been any material change in the liquidity situation of Argentina, despite the volatility of the markets.

On the funding side, the long-term wholesale funding markets in the geographic areas where the Group operates continued to be stable, with the exception of Turkey where the volatility increased during the third quarter, having stabilized at the end of the latter with the renewal of the maturities of syndicated loans of different entities.

During the first nine months of 2018, the companies that form part of BBVA Group carried out the following operations:

- BBVA S.A. completed three operations: an issuance of senior non-preferred debt for €1.5 billion, with a floating coupon at 3-month Euribor plus 60 basis points and a maturity of five years. It also carried out the largest issuance made by a financial institution in the Eurozone of the so-called “green bonds" (€1 billion). It was a 7-year senior non-preferred debt issuance, which made BBVA the first Spanish bank to carry out this type of issuance. The high demand allowed the price to be lowered to mid-swap plus 80 basis points. In the third quarter, BBVA carried out an issue of preferred securities contingently convertible into newly issued ordinary shares of BBVA (CoCos). This transaction was, for the first time, available to Spanish institutional investors and it was registered with the CNMV for an amount of €1 billion, an annual coupon 5.875% for the first five years and amortization option from the fifth year. Additionally, it closed a private issuance of Tier 2 subordinated debt for US$300m, with a maturity of 15 years, with a coupon of 5.25%.

- In the United States, BBVA Compass issued in June a senior debt bond for US$1.15 billion in two tranches, both at three years: US$700m at a fixed rate with a reoffer yield of 3.605%, and US$450m at a floating rate of 3-month Libor plus 73 basis points.

- In Mexico, BBVA Bancomer completed an international issuance of subordinated Tier 2 debt of US$1 billion. The instrument was issued at a price equivalent to Treasury bonds plus 265 basis points at a maturity of 15 years, with a ten-year call (BBVA Bancomer 15NC10). In addition, two new Banking Securities Certificates were issued for 7 billion Mexican pesos in two tranches, one of them being the first green bond issued by a private bank in Mexico (3.5 billion Mexican pesos at three years at TIIE28 + 10 basis points).

- In Turkey, Garanti issued the first private bond in emerging markets for US$75m over six years, to support women's entrepreneurship.

- In South America, in Chile, Forum issued senior debt on the local market for an amount equivalent to €108m. And BBVA Peru issued a three-year senior debt in the local market for an aggregate amount of €53m.

The liquidity coverage ratio (LCR) in BBVA Group remained comfortably above 100% in the period, without including any transfers between subsidiaries; in other words, no kind of excess liquidity levels in the subsidiaries abroad are considered in the calculation of the consolidated ratio. As of September 30, 2018, the LCR stood at 127%. Although this requirement is only established at Group level, the minimum level is widely exceeded in all the subsidiaries (Eurozone, 152%; Mexico, 134%; Turkey, 119%; and the United States, 145%).

Foreign exchange

Foreign-exchange risk management of BBVA’s long-term investments, basically stemming from its franchises abroad, aims to preserve the Group's capital adequacy ratios and ensure the stability of its income statement.

The first nine months of 2018 were notable for the depreciation against the euro of the Turkish lira (down 34.7%) and the Argentine peso (down 50.6%), while the Mexican peso (+8.6%) and the U.S Dollar (+3.6%) appreciated. BBVA has maintained its policy of actively hedging its main investments in emerging countries, covering on average between 30% and 50% of the earnings for the year and around 70% of the excess of CET1 capital ratio (which is not naturally covered by the ratio itself). In accordance with this policy, the sensitivity of the CET1 ratio to a depreciation of 10% of the main emerging currencies (Mexican peso or Turkish lira) against the euro remains at around a negative two basis points for each of these currencies. In the case of the dollar, the sensitivity is approximately a positive eleven basis points to a depreciation of 10% of the dollar against the euro, as a result of RWAs denominated in U.S. Dollar. Given the context of the emerging markets, the coverage level of the expected earnings in Turkey at the beginning of 2018 is maintained at around 50% and, in the case of Mexico, it has been increased to approximately 100% for 2018 and 50% for 2019.

Interest rates

The aim of managing interest-rate risk is to maintain a sustained growth of net interest income in the short and medium-term, irrespective of interest-rate fluctuations, while controlling the impact on capital through the valuation of the portfolio of financial assets at fair value with changes reflected in other accumulated comprehensive income.

The Group's banks have fixed-income portfolios to manage their balance-sheet structure. In the first nine months of 2018, the results of this management were satisfactory, with limited risk strategies in all the Group's banks. Their capacity of resilience to market events has allowed them to face the cases of Italy and Turkey without any relevant impact.

After the formation of the new government in Italy, the reaction of the market to the first proposals on public spending has contributed to the sustained pressure on the Italian debt, however without significant impact on the capital ratio during the quarter.

In Turkey, the high growth rates of recent quarters have given rise to inflationary tensions that, together with the level of current account deficits, have weakened the Turkish Lira. In this context, the Central Bank of Turkey (CBRT) has raised rates to contain the depreciation of the currency. Risk management, and bond portfolio with a high component of inflation-linked bonds, has had a limited impact on the capital ratio.

Finally, it is worth noting the following monetary policies pursued by the different central banks in the main geographical areas where BBVA operates:

- No relevant changes in the Eurozone, where interest rates remain at 0% and the deposit facility rate at -0.40%.

- In the United States the upward trend in interest rates continues. The increases of 25 basis points each in March, June and September left the rate at 2.25%.

- In Mexico, after making two increases in the first half of the year, Banxico maintained the interest rates at 7.75%.

- In Turkey, after the increases in the first semester, in the third quarter the central bank raised interest rates twice for a total of 625 basis points, placing the average interest rate of the CBRT at 24.00%.

- In South America, the monetary authorities of Colombia and Peru have maintained their reference rates flat throughout the quarter, ending the cycle of reductions. In Argentina, the Central Bank has been forced to raise reserve requirements and reference rates as a measure of protection against the strong depreciation of the currency. In this way, the reference rates increased to 65% compared to the 40% at the beginning of this quarter. Bank reserves in local currency also rose by 18 percentage points.

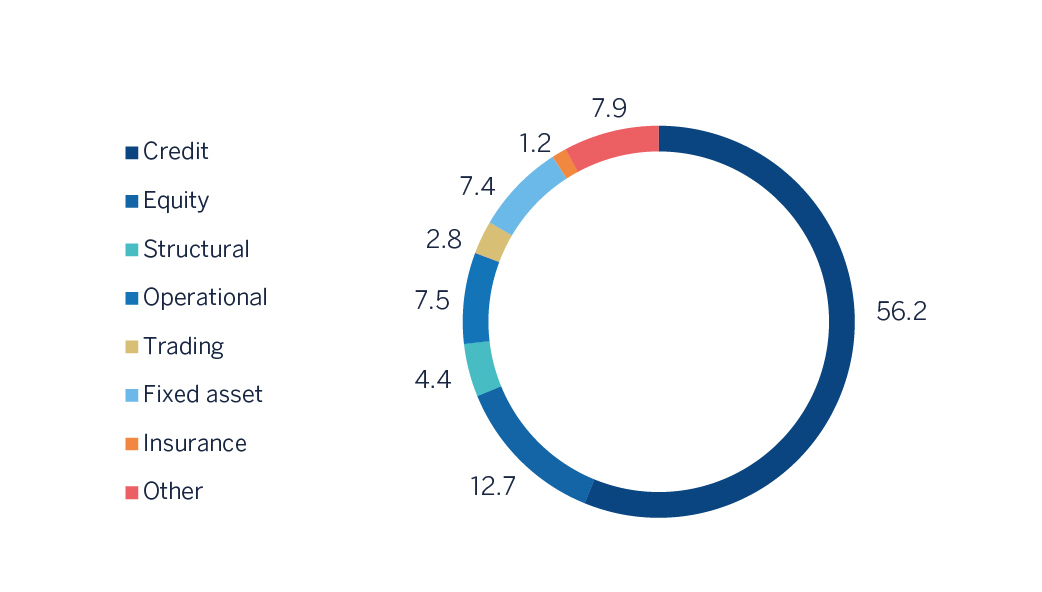

Economic capital

Consumption of economic risk capital (ERC) at the close of August 2018, in consolidated terms, was €31,163m, equivalent to a decline of 4.9% compared to May of 2018. Variation within exact time period and at constant exchange rates was up 0.5%, which is mainly explained by the increase in credit risk due to higher activity levels and even if it is partially offset as well as by the sale of BBVA Chile and the variations in the ERC of goodwill and exchange rates.

Consolidated economic risk capital breakdown

(Percentage as of August 2018)