The BBVA share

The main stock market indexes performed strongly during the first nine months of 2019, thanks particularly to the positive start in the first quarter. In Europe, the Stoxx Europe 600 index increased by 12.9% between January and September, although it fell slightly in the third quarter (-1.3% compared to June 2019). In Spain, the rise of the Ibex 35 during the same period was more moderate at 8.3%, remaining practically flat in the third quarter (+0.5%). In the United States, the main stock indexes maintain the high growth rates observed throughout the year. The S&P 500 Index rose 18.7% in the first nine months of the year, although this increase has slowed in the third quarter (+ 1.2%).

With regard to the European banking sector indexes, particularly in Europe, its performance in the first nine months of the year was worse than the general market indexes, and the positive start of the first quarter was offset by the decline in the second and third quarters of the year. The Stoxx Europe 600 Banks index, which includes banks in the United Kingdom and the Euro Stoxx Banks index for the Eurozone remained flat during the year (-0.4% and +0.8% respectively, as of September 2019), while in the United States, the S&P Regional Banks Select Industry Index upgraded 12.9% compared to the close of the 2018 financial year.

For its part, the BBVA share registered a better performance compared to the European banking sector during the first nine months of the year, with the share price increasing by 3.1% and closing September 2019 at €4.78.

BBVA share evolution compared with European indices (Base indice 100=31-12-18)

BBVA

Stoxx Europe 600

Stoxx Banks

The BBVA share and share performance ratios

| 30-09-19 | 31-12-18 | |

|---|---|---|

| Number of shareholders | 884,412 | 902,708 |

| Number of shares issued | 6,667,886,580 | 6,667,886,580 |

| Daily average number of shares traded | 28,631,263 | 35,909,997 |

| Daily average trading (millions of euros) | 144 | 213 |

| Maximum price (euros) | 5.68 | 7.73 |

| Minimum price (euros) | 4.19 | 4.48 |

| Closing price (euros) | 4.78 | 4.64 |

| Book value per share (euros) | 7.63 | 7.12 |

| Tangible book value per share (euros) | 6.35 | 5.86 |

| Market capitalization (millions of euros) | 31,876 | 30,909 |

| Yield (dividend/price; %) (1) | 5.4 | 5.4 |

- (1) Calculated by dividing shareholder remuneration over the last twelve months by the closing price of the period.

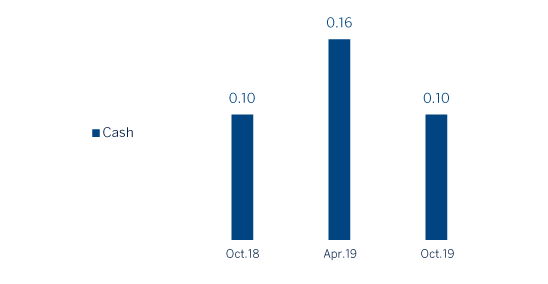

Regarding shareholder remuneration in 2019, on October 15, BBVA paid a cash interim dividend of €0.10 (gross) per share on account of the 2019 dividend. This payment is in line with the policy announced in the Relevant Event released on February 1, 2017, in which BBVA plans to distribute between 35% and 40% of annual earnings in dividends. This shareholder remuneration policy, will consist of two cash payments, the aforementioned in October and the foreseen in April 2020, all subject to the appropriate approvals by the relevant governing bodies.

Shareholder remuneration

(Euros per share)

As of September 30, 2019, the number of BBVA shares remained at 6.668 billion, held by 884,412 shareholders, of which 43.59% are Spanish residents and the remaining 56.41% are non-residents.

Shareholder structure (30-09-19)

| Numbers of shares | Shareholders | Shares | ||

|---|---|---|---|---|

| Number | % | Number | % | |

| Up to 150 | 174,725 | 19.8 | 12,353,130 | 0.2 |

| 151 to 450 | 174,662 | 19.7 | 47,919,315 | 0.7 |

| 451 to 1,800 | 277,401 | 31.4 | 271,773,883 | 4.1 |

| 1,801 to 4,500 | 135,514 | 15.3 | 386,115,280 | 5.8 |

| 4,501 to 9,000 | 63,147 | 7.1 | 397,898,075 | 6.0 |

| 9,001 to 45,000 | 52,561 | 5.9 | 911,679,986 | 13.7 |

| More than 45,001 | 6,402 | 0.7 | 4,640,146,911 | 69.6 |

| Total | 884,412 | 100.0 | 6,667,886,580 | 100.0 |

BBVA shares are included on the main stock market indexes, including the Ibex 35, and the Stoxx Europe 600 index, with a weighting of 6.5% and 0.4%, respectively at the closing of September of 2019. They are also included on several sector indexes, including Stoxx Europe 600 Banks, which includes the United Kingdom, with a weighting of 4.0% and the Euro Stoxx Banks index for the Eurozone with a weighting of 8.4%.

Finally, BBVA maintains a significant presence on a number of international sustainability indexes or Environmental, Social and Governance (ESG) indexes, which evaluates companies' performance in these areas. In September, BBVA continued to be included in the Dow Jones Sustainability Index (DJSI), the markets leading benchmark index, which measures the economic, environmental and social performance of the most valuables companies by market capitalization of the world (in the DJSI World and DJSI Europe), achieving the highest score in financial inclusion and occupational health and safety and the highest score in climate strategy, environmental reporting and corporate citizenship and philanthropy.

Main sustainability indices on which BBVA is listed as of 30-09-19

AAA Rating

Listed on the FTSE4Good Global Index Series

Listed on the Euronext Vigeo Eurozone 120 and Europe 120 indices

Listed on the Ethibel Sustainability Excellence Europe and Eithebel Sustainability Excellence Global indices

Listed on the Bloomberg Gender-Equality Index

In 2018, BBVA obtained a “B” rating

(1) The inclusion of BBVA in any MSCI index, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement or promotion of BBVA by MSCI or any of its affiliates. The MSCI indices are the exclusive property of MSCI. MSCI and the MSCI index names and logos are trademarks or service marks of MSCI or its affiliates.