Spain

Highlights

- Activity growth, partly driven by the government support programs.

- Significant improvement in operating income due to an increase in NTI and commissions, as well as a decrease in operating expenses.

- Risk indicators contained.

- Net attributable profit affected by the level of the impairment on financial assets.

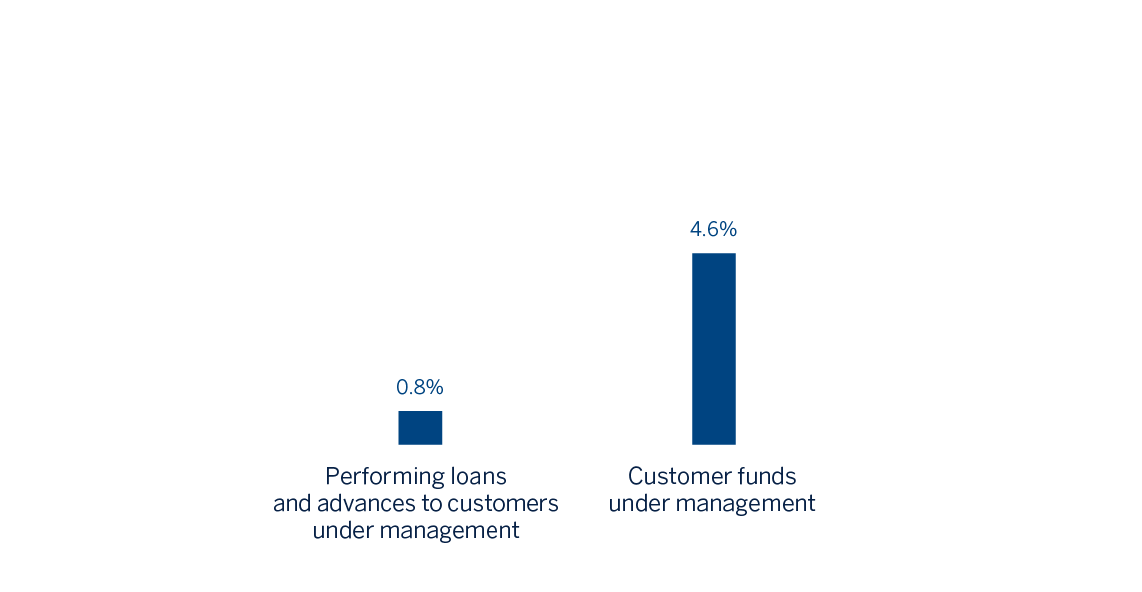

Business activity (1)

(Year-on-year change. Data as of 30-09-20)

(1) Excluding repos.

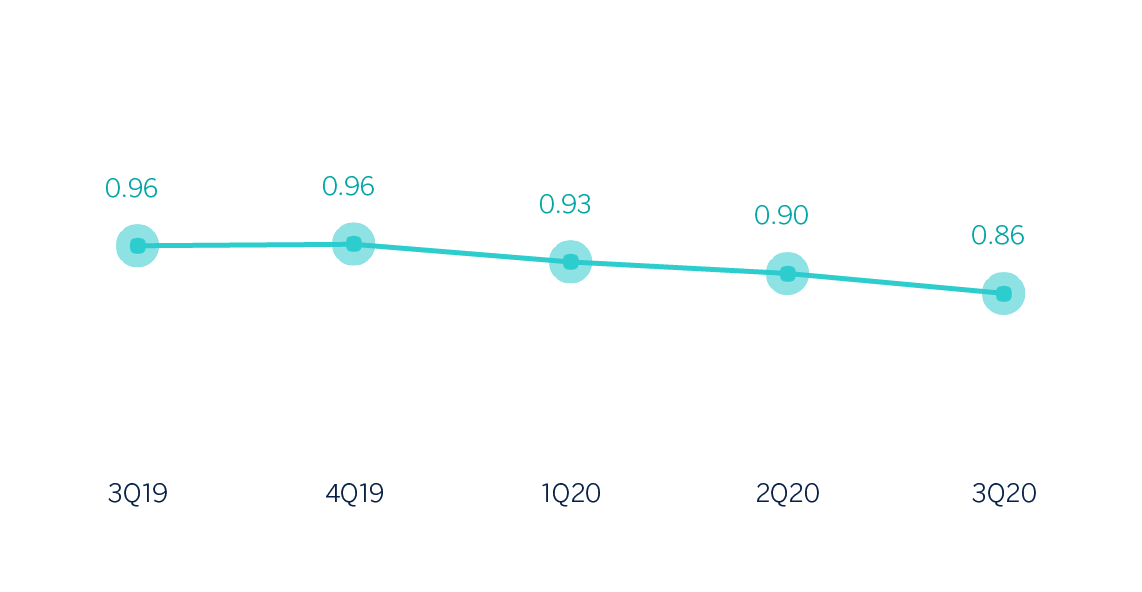

Net interest income/ATAs

(Percentage)

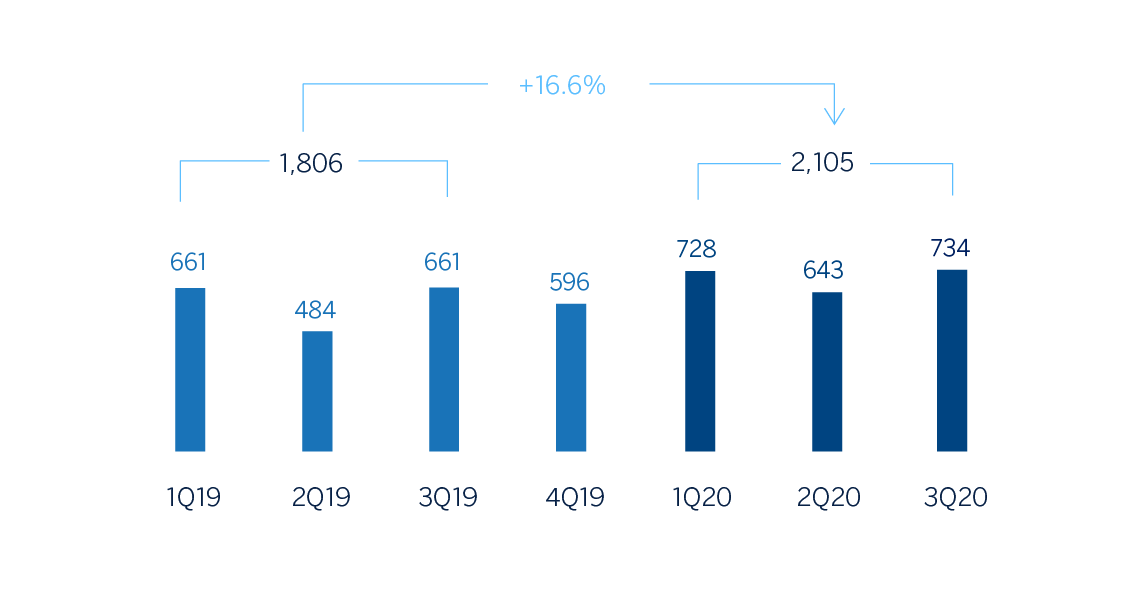

Operating income (Millions of euros)

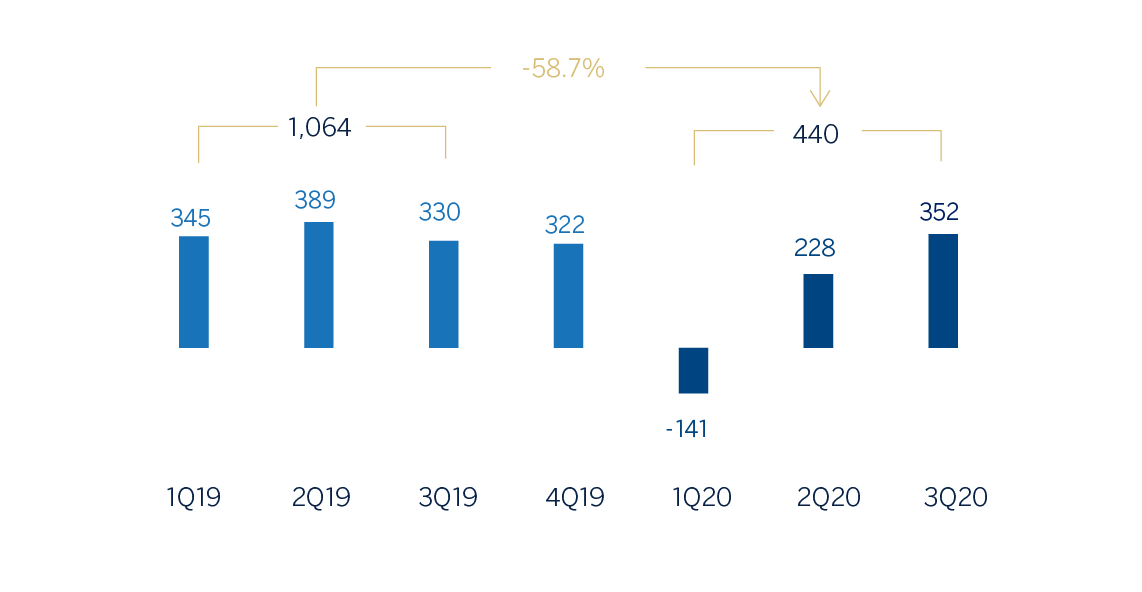

Net attributable profit (Millions of euros)

Financial statements and relevant business indicators (Millions of euros and percentage)

| Income statement | Jan.-Sep. 20 | ∆% | Jan.-Sep. 19 |

|---|---|---|---|

| Net interest income | 2,675 | 0.5 | 2,661 |

| Net fees and commissions | 1,349 | 4.8 | 1,287 |

| Net trading income | 217 | 78.3 | 121 |

| Other operating income and expenses | 141 | (20.3) | 177 |

| Of which insurance activities (1) | 362 | (5.8) | 385 |

| Gross income | 4,382 | 3.2 | 4,247 |

| Operating expenses | (2,277) | (6.7) | (2,441) |

| Personnel expenses | (1,291) | (8.7) | (1,414) |

| Other administrative expenses | (640) | (4.3) | (668) |

| Depreciation | (346) | (3.6) | (359) |

| Operating income | 2,105 | 16.6 | 1,806 |

| Impairment on financial assets not measured at fair value through profit or loss | (1,075) | n.s. | (46) |

| Provisions or reversal of provisions and other results | (430) | 58.8 | (271) |

| Profit/(loss) before tax | 600 | (59.7) | 1,489 |

| Income tax | (158) | (62.6) | (423) |

| Profit/(loss) for the year | 442 | (58.5) | 1,066 |

| Non-controlling interests | (2) | 32.9 | (2) |

| Net attributable profit | 440 | (58.7) | 1,064 |

- (1) Includes premiums received net of estimated technical insurance reserves.

| Balance sheets | 30-09-20 | ∆% | 31-12-19 |

|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 35,206 | 121.4 | 15,903 |

| Financial assets designated at fair value | 138,504 | 12.7 | 122,844 |

| Of which: Loans and advances | 33,891 | (0.8) | 34,175 |

| Financial assets at amortized cost | 195,981 | 0.4 | 195,260 |

| Of which: Loans and advances to customers | 166,568 | (0.5) | 167,332 |

| Inter-area positions | 23,705 | 9.6 | 21,637 |

| Tangible assets | 3,055 | (7.5) | 3.302 |

| Other assets | 7,076 | 9.9 | 6,436 |

| Total assets/liabilities and equity | 403,527 | 10.4 | 365,380 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 85,296 | 8.4 | 78,684 |

| Deposits from central banks and credit institutions | 54,427 | 32.5 | 41,092 |

| Deposits from customers | 195,682 | 7.3 | 182,370 |

| Debt certificates | 41,433 | 16.6 | 35,520 |

| Inter-area positions | - | - | - |

| Other liabilities | 16,425 | (11.1) | 18,484 |

| Economic capital allocated | 10,263 | 11.2 | 9,229 |

| Relevant business indicators | 30-09-20 | ∆% | 31-12-19 |

|---|---|---|---|

| Performing loans and advances to customers under management (1) | 164,150 | 0.0 | 164,140 |

| Non-performing loans | 8,380 | (3.0) | 8,635 |

| Customer deposits under management (2) | 195,682 | 7.3 | 182,370 |

| Off-balance sheet funds (3) | 60,891 | (7.8) | 66,068 |

| Risk-weighted assets | 107,046 | 2.0 | 104,911 |

| Efficiency ratio (%) | 52.0 | 57.5 | |

| NPL ratio (%) | 4.3 | 4.4 | |

| NPL coverage ratio (%) | 68 | 60 | |

| Cost of risk (%) | 0,80 | 0.08 |

- (1) Excluding repos.

- (2) Includes mutual funds, pension funds and other off-balance sheet funds.

Activity

The most relevant aspects related to the area's activity during the first nine months of 2020 were:

- The lending activity (performing loans under management) stood at similar levels to the close of 2019. The reduction in mortgage lending and lending to public institutions was largely offset by higher balances in corporate banking (up 5.4%), retail businesses (up 9.0%) and SMEs (up 4.2%), which benefited from the facilities guaranteed by the Spanish Instituto de Crédito Oficial (ICO).

- With respect to asset quality, the NPL ratio remained stable compared to the previous two quarters, at 4.3%, and the coverage ratio increased to 68%.

- Total customer funds grew by 3.3% compared to the close of 2019, partly due to the trend toward increasing savings, both by companies and by individual customers. This has meant an increase in customer deposits under management (up 7.3%), which offsets the negative evolution of off-balance sheet funds (down 7.8%) resulting from the performance of the markets between January and September 2020.

Results

Spain generated a cumulative net attributable profit of €440m between January and September 2020, compared to a profit of €1,064m in the same period of the previous year, mainly due to the increase in the impairment on financial assets, as operating income grew 16.6% compared to the same period in 2019.

The main highlights of the area's income statement are:

- Net interest income increased slightly compared to the first nine months of the previous year (up 0.5%), mainly due to the lower funding costs and the greater contribution of earnings from the Global Markets.

- Net fees and commissions performed well (up 4.8% year-on-year), strongly supported by asset management fees and commissions and those generated by corporate banking transactions.

- Outstanding performance of NTI (up 78.3% year-on-year), mainly due to higher ALCO portfolio sales in 2020.

- The other operating income and expenses line was down 20.3% compared to the same period of 2019 due to higher contributions to the SRF and lower returns from the insurance business, although in the quarter the latter grew by 7.0%.

- There was a reduction in operating expenses (down 6.7% year-on-year), mainly as a result of the costcontainment plans supported by the reduction in discretionary expenses as a result of the pandemic. Therefore, the efficiency ratio stood at 52.0% compared to 57.5% in the same period in 2019.

- The impairment on financial assets increased by €1,029m compared to the same period of the previous year, due fundamentally to the negative impact, registered mainly in the first quarter, of the deterioration in the macroeconomic scenario as a result of COVID-19, including credit provisions for those sectors most affected, in a comparison that is further impacted by portfolio sales made in the last financial year. In quarterly terms, this line continued to decline after the increase experienced in March, which has favored the cumulative cost of risk to stand at 0.80% at the end of September.

- Finally, provisions and other gains closed at €-430m, partly due to provisions to deal with potential claims.