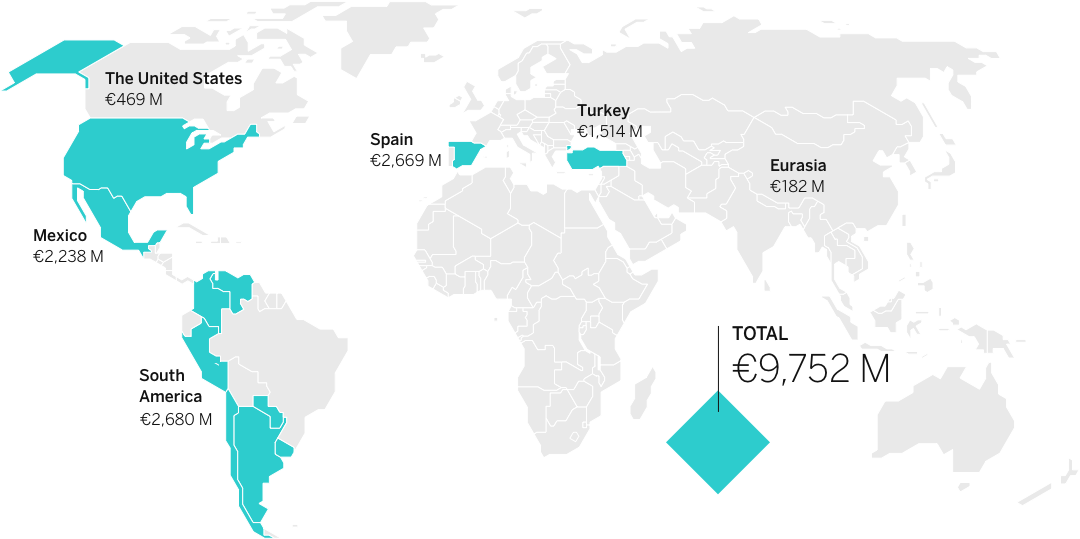

BBVA is committed to transparency in tax payments, which is why, one more year, it has voluntarily disclosed all major tax payments in the countries where it has a significant presence.

9,752

MILLIONS OF EUROS

4,502

MILLIONS OF EUROS

5,250

MILLIONS OF EUROS

Corporate Income Tax

€2,753 M

Taxes on employees and professionals

€713 M

Other taxes

€399 M

Taxes on goods and services (VAT)

€637 M

Withholdings on income tax

€1,122 M

Taxes on employees and professionals

€1,422 M

Other taxes

€1,604 M

Taxes on goods and services (VAT)

€1,102 M

BBVA has consolidated it's transformation in the Procurement function, based on three main pillars: Focus on service, limitation of reputational risk and contribution to the Group´s efficiency

61,434

SUPPLIERS

22 days

AVERAGE PAYMENT PERIOD TO SUPPLIERS

97.7%

LOCAL SUPPLIERS

The BBVA Group incorporates its values into operational management as an integral part of the development of its purpose. For this, it has different systems that ensure the integration of these values and constitute a different way of doing business

The Group's compliance system constitutes one of the bases on which BBVA consolidates the institutional commitment to conduct all its activities and businesses in accordance with strict codes of ethical conduct

Based on best operational risk management practices, BBVA Group has established and maintained an internal control model organized around three lines of defense

BBVA is committed with promoting and respecting human rights in all Group´s activities and operations. This commitment is comprehensively monitored in the 2018-2020 HHRR Action Plan