The difference between what the Bank pays for deposits and the interest it charges for loans, i.e. the net interest income, is its main source of revenue.

Recurring revenues, which are the sum of net interest income and income from fees and commissions, allow the Bank to cover its overheads, including salaries and payment of taxes and dividends. The role of banks thus has a positive impact on society. It also requires the maintenance of levels of capital that are sufficient to keep the Entity solvent.

Results

Generalized growth in the more recurring revenue items

GROSS INCOME (€M)

23,747

+4.3%

OPERATING INCOME (€M)

12,045

+6.2%

NET ATTRIBUTABLE PROFIT (€M)

5,324

+78.2%

Year-on-year changes at constant exchange rates.

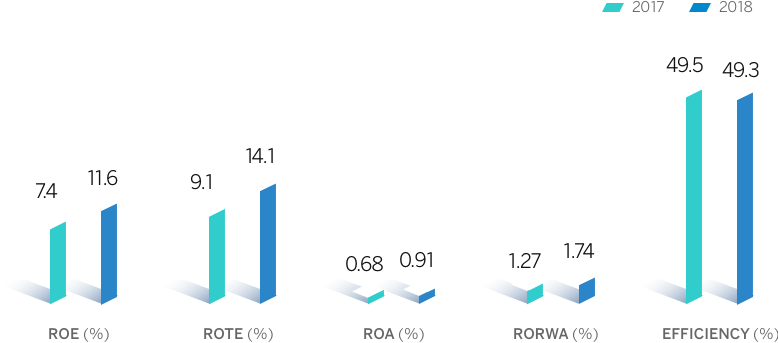

Profitability / Efficiency

Profitability and efficiency indicators improvement

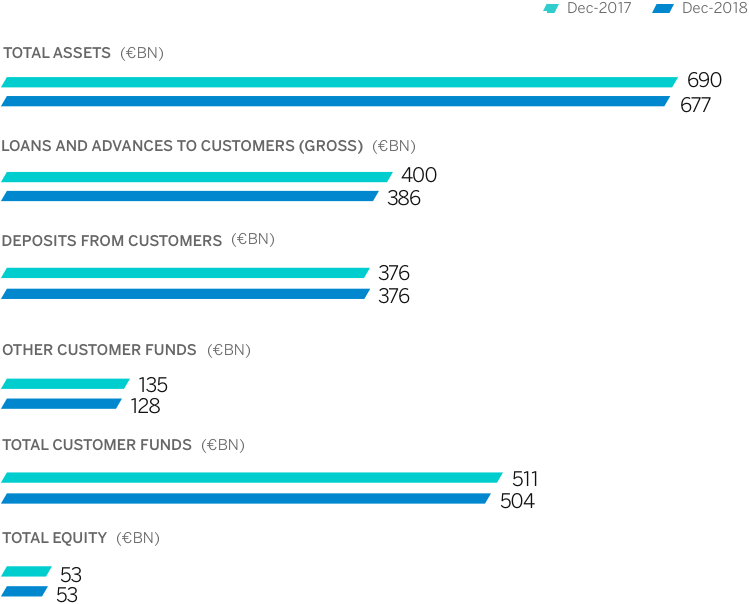

Balance sheet and business activity

Activity figures affected by the operations carried out in 2018 (1)

(1) Sales of BBVA Chile and the real-estate business in Spain.

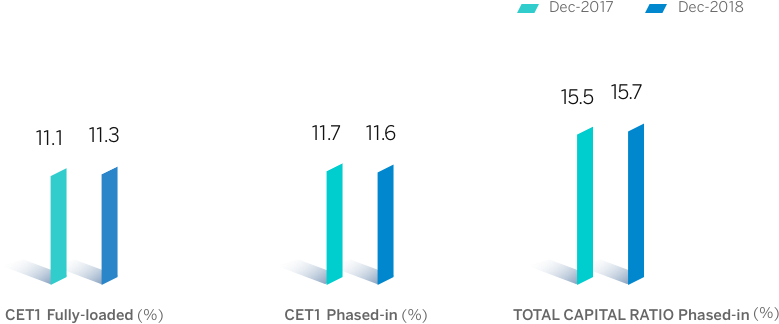

Solvency

The capital position is above regulatory requirements

Risk management

Solid indicators of the main credit-risk metrics