Customer comes first

We are empathetic

We have integrity

We meet their needs

We made significant progress in our transformation process during 2018, based on our Purpose, the six Strategic Priorities, and our Values, all of which are fundamental pillars of the Organization's overall strategy

Our Purpose

To bring the age of opportunity to everyone

New value proposition based on our customers' real needs

to make the best financial decisions offering relevant advice

that generate trust for our customers, being clear, transparent and based on integrity

Do It Yourself (DIY) through digital channels or human interaction

Our aspiration is to strengthen the relationship with the customer

We are empathetic

We have integrity

We meet their needs

We are ambitious

We break the moid

we amaze our customers

I am committed

I trust others

I am BBVA

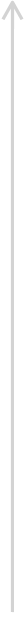

BBVA carries out an analysis to know and prioritize the most relevant issues for its stakeholders and thus contribute to the development of the Group's strategy.

We have a differential banking model that we refer to as responsible banking, based on seeking out a return adjusted to principles, strict legal compliance, best practices and the creation of long-term value for all stakeholders. Four pillars of the model: