BBVA strategy on climate change and sustainable development

€100,000 M mobilized between 2018 and 2025

Transition to a low carbon economy

Sustainable infraestructures and agribusiness

Financial inclusion and entrepreneurship

Social and environmental impacts management

70% renewable energy and 68% CO2 emissions reduction

Transparency in carbon related exposure

New sector norms

Involvement in global initiatives

Active collaboration with stakeholders in mainstream initiatives

TCFD recommendations implementation on 2020

Transition to a low carbon economy

Sustainable infraestructures and agribusiness

Financial inclusion and entrepreneurship

70% renewable energy and 68% CO2 emissions reduction

Transparency in carbon related exposure

New sector norms

Active collaboration with stakeholders in mainstream initiatives

TCFD recommendations implementation on 2020

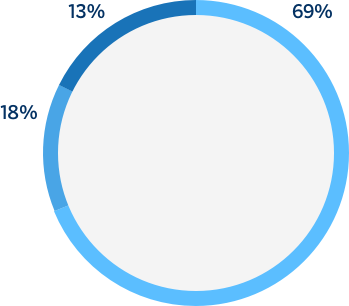

In 2018 BBVA reinforces its leadership in sustainable finance:

Green finance

€8,126 M

Sustainable infrastructure and agribusiness

€1,601 M

Financial inclusion and entrepreneurship

€2,087 M

€1,452 M in sustainable bonds intermediated

€1,850 M in sustainable loans

DIRECT

43%

people in certified buildings

35%

energy from renewable sources

-18%

paper consumption per person

INDIRECT

Elaboration of the United Nations Principles for Responsible Banking

Strong commitment to the Sustainable Development Goals

Member of the pilot group working to implement the Task Force on Climate-related Financial Disclosures recommendations

Members of the Katowice Commitment within COP24