Contribution to society

Investment in social programs

In 2017, BBVA allocated €103m to social projects. This figure accounts for 2.9% of the Group’s net attributable profit.

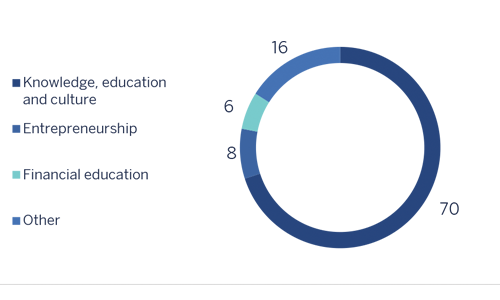

Investment in social programs by focus of actions (Percentage)

Investment in social programs by geographical area and Foundation (Thousand euros)

| 2017 | % | 2016 | % | |

|---|---|---|---|---|

| Spain and corporate areas | 24,728 | 24 | 16,923 | 16 |

| The United States | 9,042 | 9 | 8,732 | 8 |

| Mexico | 26,847 | 26 | 24,612 | 24 |

| Turkey | 5,184 | 5 | 6,193 | 6 |

| South America | 5,971 | 6 | 6,380 | 6 |

| BBVA Foundation | 25,930 | 25 | 25,598 | 25 |

| BBVA Microfinance Foundation | 5,372 | 5 | 4,827 | 5 |

| Total | 103,075 | 100 | 93,265 | 100 |

In 2017, BBVA continued to push forward the main areas of action of the Community Investment Plan for the period 2016-2018, which include:

- Financial education, aimed at promoting the acquisition of financial skills and competencies to enable people to make informed financial decisions.

- Social entrepreneurship, designed to support the most vulnerable entrepreneurs and those whose companies have a positive social impact.

- Knowledge, through support for initiatives that drive development and create opportunities for people.

Education for society was one of the core areas of the previous Plan until 2016. It is now framed within the strategic line of knowledge. Nonetheless, it retains a significant weight in BBVA’s social investment, which continues to support access to education, educational quality and education in values as sources of opportunity. However, it also shares this space with other Group initiatives such as the BBVA Foundation activities and research work by the BBVA Research Department.

The BBVA’s community support activity has been focusing on these three strategic lines since 2016, although at the local level the Group’s banks will maintain their commitment to investment in the community to address local social problems. In this regard, the Support to Social Organizations program backs educational and community development projects carried out by non-governmental organizations, and other non-profit associations and institutions.

Financial education

Financial education is one of the three lines of action established in the 2016-2018 Community Investment Plan.

Through its financial education programs, BBVA fosters the acquisition of financial knowledge, skills and abilities that allow people to make better financial decisions and thus access new opportunities.

Since 2008, BBVA has run its own financial education programs and worked together with other actors on more projects. These programs are designed for a diverse target audience, including children, young people and adults, and also entrepreneurs and managers of small businesses. They cover a broad range of subjects, from financial planning to savings and investment. BBVA also adapts its programs at a local level to provide financial education adapted to the environment and economic reality across its global footprint.

In these ten years, BBVA has invested over €73m, benefiting over 11 million people.

Entrepreneurship

In the 2016-2018 Community Investment Plan the entrepreneurship support programs are organized into a single line of action that thus becomes particularly important. Through this line of action, BBVA supports two types of entrepreneurs:

- Vulnerable entrepreneurs, who are supported through the BBVA Microfinance Foundation.

- Entrepreneurs who create high social impact through their enterprises, who are supported by the BBVA Momentum program.

Knowledge, education and culture

Knowledge, education and culture are three areas of activity that are grouped together in a new line of action included in the new Community Investment Plan for 2016-2018 and that encompasses the activities carried out by the BBVA Foundation and local educational and cultural initiatives.

Fiscal transparency

Fiscal strategy

In 2015, the BBVA Board of Directors approved the "Corporate Principles in BBVA’s Tax and Fiscal Strategy".

The strategy forms part of BBVA’s corporate governance system and establishes the policies, principles and values that guide the way the Group behaves with respect to taxes. This strategy has a global scope and affects everyone who is part of the Bank. Compliance with the strategy is very important, given the scale and impact that the tax contributions of large multinationals such as BBVA have on the jurisdictions where they operate.

Effective compliance with the tax strategy is duly monitored and supervised by BBVA’s governing bodies.

Accordingly, BBVA’s fiscal strategy consists of the following basic points:

- BBVA’s decisions concerning fiscal-related matters are determined by the payment of taxes, given that they contribute heavily to the economies of all the jurisdictions in which it operates. Tax payments are aligned with effective business practices and the generation of value in the different geographic areas in which BBVA operates.

- Active adaptation to the new digital environment, also in terms of taxation, through the incorporation of virtual presence into the generation of value, and its consequent valuation.

- The establishment of reciprocal cooperative relations with tax authorities that are based on the principles of transparency, mutual trust, good faith and fairness.

- Promotion of a clear, transparent and responsible reporting strategy to stakeholders on its main fiscal-related matters.

Total tax contribution

BBVA is committed to providing full transparency in tax payments, which is why once more this year the Group has voluntarily disclosed all major tax payments in the countries where it has a significant presence, as it has done every year since 2011.

BBVA Group’s total tax contribution (TTC), which uses a method created by PwC, includes its own and third-party payments of corporate taxes, VAT, local taxes and fees, income tax withholdings, Social Security payments, and payments made during the year arising from tax litigation in relation to the aforementioned taxes. In other words, it includes both the taxes related to the BBVA Group companies (taxes which represent a cost to them and affect their results) and taxes collected on behalf of third parties. The Total Tax Contribution Report gives all the stakeholders an opportunity to understand BBVA’s tax payments and represents a forward-looking approach and commitment to corporate social responsibility, by which it assumes a leading position in fiscal transparency.

Global Tax Contribution (BBVA Group. Million euros)

| 2017 | 2016 | |

|---|---|---|

| Own taxes | 4,106 | 3,762 |

| Third-party taxes | 5,775 | 5,678 |

| Total tax contribution | 9,881 | 9,440 |

Offshore financial centers

BBVA maintains a policy on activities in entities permanently registered in offshore financial centers, which includes a plan for reducing the number of offshore financial centers.

In this respect, both from the OCDE and the Spanish regulation perspective, as of December 31, 2017, the BBVA Group’s permanent establishments registered in offshore financial centers considered tax havens are as follows:

- Branches of the BBVA Group’s banks in the Cayman Islands

- Issuers of securities in the Cayman Islands: BBVA Global Finance, Ltd., Continental DPR Finance Company, Garanti Diversified Payment Rights Finance Company and RPV Company.

1. Banking branch

As of December 31, 2017, the BBVA Group had a banking branch registered in the Cayman Islands engaging in corporate banking activities. The activities and business of this branch, which do not include the provision of private banking services, are pursued under the strictest compliance with the applicable law, both in the jurisdictions in which it is domiciled and in those where its operations are effectively managed, in this case the United States of America.

Branch at offshore entities (BBVA Group. Million euros)

| Main figures of the balance sheets | 31-12-17 | 31-12-16 |

|---|---|---|

| Loans and advances to customers | 1,499 | 805 |

| Deposits from customers | 1,144 | 430 |

2. Issuers of securities

The BBVA Group has four issuers registered in Grand Cayman, two of them from the Garanti Group.

Issues outstanding at offshore entities (BBVA Group. Million euros)

| Issuing entity | 31-12-17 | 31-12-16 | ||

|---|---|---|---|---|

| Subordinated debts(1) | ||||

| BBVA Global Finance LTD | 162 | 188 | ||

| Other debt securities | ||||

| Continental DPR Finance Company(2) | 59 | 102 | ||

| Garanti Diversified Payment Rights Finance Company | 1,879 | 1,760 | ||

| RPV Company | 1,262 | 1,457 | ||

| Total | 3,362 | 3,508 | ||

- (1) Securities issued before the enactment of Act 19/2003 dated 4 July 2003.

- (2) Securitization bond issues on flows generated from export bills.

3. Supervision and control of the permanent establishments of the BBVA Group in offshore financial centers

The BBVA Group applies risk management criteria and policies to all its permanent establishments in offshore financial centers that are identical to those for the rest of the companies making up the Group.

During the reviews carried out annually on each and every one of the BBVA Group’s permanent establishments in offshore financial centers, BBVA’s Internal Audit Department checks the following: i) that their activities match the definition of their corporate purpose, ii) that they comply with corporate policies and procedures in matters relating to knowledge of the customers and prevention of money laundering, iii) that the information submitted to the parent company is true, iv) and that they comply with tax obligations. In addition, every year a specific review of Spanish legislation applicable to the transfer of funds between the Group’s banks in Spain and its companies established in offshore centers is performed.

In 2017, BBVA’s Compliance and Internal Audit Departments have supervised the action plans deriving from the audit reports on each one of these centers.

As far as external audits, are concerned, one of the functions of the Audit and Compliance Committee is to select an external auditor for the Consolidated Group and for all the companies in it. For 2017, all of the BBVA Group’s permanent establishments registered in offshore financial centers have the same external auditor (KPMG), except Continental DPR Finance Company.