Sustainable finance

Banks play a crucial role in the fight against climate change, thanks to their unique position in mobilizing capital through investment, loans and advisory functions. Although most banks have worked in recent years to mitigate the direct impacts of their activity, there are other very important ways they can contribute to this challenge: first, by providing innovative solutions to their customers to help them move to a low-carbon economy and by promoting sustainable finance; and second, by systematically integrating social and environmental risks into decision-making.

BBVA’s commitment to sustainable development is reflected in its Environmental policy, which is global in scope.

During 2017, BBVA has worked on its strategy on climate change and sustainable development. The strategy covers comprehensive management of the risks and opportunities deriving from the fight against climate change and the resolve to achieve the Sustainable Development Goals (SDGs).

This strategy is based on a threefold commitment to 2025:

- First, a commitment to finance, which contributes to the mobilization of the capital needed to halt climate change and achieve the SDGs.

- Second, a commitment to mitigate the social and environmental risks derived from the Bank’s activity, to minimize their potential direct and indirect negative impacts.

- And finally, a commitment to engagement with all the stakeholders involved in the collective promotion of the role of the financial industry in sustainable development.

As of December 31, 2017, the accompanying Annual Financial Statements of the BBVA Group do not include any material item that would warrant inclusion in the environmental information document set forth in the Ministry of Justice Order JUS / 471/2017, of May 19, which approves the new models for the presentation in the Companies Registry of the financial statements of the subjects bound to its publication.

Sustainable financing

Sustainable bonds and loans

Sustainable bonds and loans are instruments used for channeling funds to finance our customers’ projects in sectors such as renewable energies, energy efficiency, waste management, water treatment and access to essential goods and services such as homes or inclusive finance.

BBVA has the knowledge and experience to provide its customers with comprehensive advice on sustainable financing solutions through both bonds and loans, and it is also playing a relevant role in the development of this market. Since 2014 BBVA is signatory of the Green Bond Principles, a series of voluntary guidelines that establish the issuance transparency requirements and promote integrity in the development of the green bond market. In addition, since 2017, it has also formed part of the working group that is developing the Green Lending Principles, an initiative of the Loan Market Association adapted to the needs in the case of loans.

In bonds, the Bank has been very active in the green bond market in the Iberian Peninsula in 2017. It is a globally recognized institution, having advised, placed and structured green bonds for customers in a variety of sectors in Mexico, the United States and Europe in both local currency and euros and U.S. dollars.

On another note, green loan are beginning to take off in the market. In 2017, the Bank has been very active as structuring bank, with a total of ten operations.

Financing sustainable projects

BBVA has been supporting the renewable energy sector for years. Thus, in 2017, the Group financed projects of this type with a total installed capacity of more than 700 MW, for a total volume of €218m.

Among the highlighted operations of 2017 are the financing of seven wind farms in Portugal, two in Italy and Spain and one photovoltaic plant in Mexico. Moreover, in 2017 the Bank also financed social infrastructure projects for an amount of €333m

Socially Responsible Investment

BBVA assumed its commitment to Socially Responsible Investment (SRI) in 2008 when it joined the United Nations Principles for Responsible Investment (PRI) through the employee pension plan and one of the Group’s major asset management companies, Gestión de Previsión y Pensiones.

The goal at the time was to start building BBVA’s own SRI model from the ground, with the initial implementation focused on employment pension funds. Nine years later, the Group continues to work on improving its model, making it more complete and solid every day.

During 2017, BBVA Asset Management (BBVA AM) continued to adapt to the market and changes in it, working to extend and improve the SRI solutions offered. Among them are the training solutions in place, such as events streamed and available via its website and the regular newsletters addressing SRI matters, which are also posted on the BBVA AM website; and in particular through personal meetings with its customers to address their specific concerns in this field.

BBVA AM’s SRI model has implemented the following strategies:

- Integration of ESG criteria in the investment process.

- Exclusion: Rules of Conduct in Defense.

- ESG analysis of third-party funds.

- Engagement and exercise of voting rights.

Financial inclusion

BBVA is aware that greater financial inclusion has a favorable impact on the welfare and sustained economic growth of countries. The fight against financial exclusion is therefore consistent with its ethical and social commitment, as well as its medium-term and long-term business objectives. For this purpose, the Group has developed a financial inclusion (FI) business model to cover the low-income population in emerging countries within its global footprint. This model is based on the development of a responsible business model that is sustainable in the long term, shifting from a model that is intensive in human capital and of limited scalability to a scalable strategy that is intensive in alternative and digital channels with a multi-product focus. In short, this model is based on:

- the use of new digital technologies,

- an increase in products and services offered through nonbranch platforms,

- innovative low-cost financial solutions designed for this segment.

At the end of 2017, BBVA had more than 8 million active customers in this segment.

Management of environmental and social impacts

Social, environmental and reputational risks

As a financial institution, BBVA has an impact on the environment and society: directly through the consumption of natural resources and its relationship with stakeholders; and indirectly through its credit activity and the projects it finances.

These non-financial risks may affect the credit profile of borrowers or the projects financed by the Bank. To manage such risks, BBVA takes into account environmental, social and reputational aspects in its risk management, alongside traditional financial variables.

In 2017, BBVA worked with a number of areas involved in the development of new standards for the mining, energy, infrastructure and agricultural business sectors, and a new improved process of due diligence that can assess new operations, customers or products with criteria that are aligned with BBVA’s strategy of climate change and sustainable development.

1. Equator Principles

The energy, transport and social services infrastructures that boost economic development and create jobs can have an impact on the environment and society. BBVA is committed to managing the financing of these projects in order to avoid and reduce their negative impacts and boost their economic, social and environmental value.

All the decisions on project finance are based on the criterion of return adjusted to principles. Placing people at the core of the business implies dealing with stakeholder expectations and the social demand to fight against climate change and respect human rights.

In line with this commitment, BBVA adhered to the Equator Principles in 2004. Based on the International Finance Corporation’s (IFC) Policy and Performance Standards on Social and Environmental Sustainability and the World Bank’s Environmental, Health and Safety guidelines, the Equator Principles are a set of standards for managing environmental and social risks in project finance. These principles have set the benchmark for responsible finance.

During 2017, the Group contributed to their development and dissemination as a member of the working groups in which it participates and has been one of the eleven signatories to the letter sent to the Equator Principles Association, in which it urged measures to be taken to tighten the environmental and social due diligence requirements for project finance.

The Corporate & Investment Banking (CIB) Sustainable Finance and Reputational Risk team is responsible for analysis of the projects, representation of the Bank before its stakeholders, accountability to senior management, and the design and implementation of the management system, proposing the adoption of best practices and contributing toward training and communication on matters related to the Equator Principles.

The application of the Equator Principles in BBVA is integrated into the internal processes for structuring, admission and monitoring of transactions, and is subject to regular controls by the Internal Audit Department.

In 2017, BBVA took the decision to enhance its due diligence procedures associated with the financing of projects whose development affects indigenous communities. When this occurs, the free, prior and informed consent (FPIC) by these communities must be taken into consideration, regardless of the geographic location of the project. This means extending the current demands of the Equator Principles, which limits this requirement to countries classified as “non-designated”, leaving out the “designated” countries (those that are considered to have a robust legal system and an institutional capacity that provides sufficient guarantees of environmental protection and their people’s social rights). BBVA is one of the ten banks that in 2017 called on the rest of the banks adhering to the Equator Principles to support the adoption of amendments in this respect.

Details of the Equator Principles operations analyzed (BBVA Group)

| 2017 | 2016 | |

|---|---|---|

| Number of operations(1) | 22 | 32 |

| Total Amount (millon euros) | 7,069 | 6,863 |

| Amount financed by BBVA (millon euros) | 1,054 | 1,451 |

- (1) Within the 22 analized operations, 9 are into Ecuator Principles Scope and the other 13 are analized voluntarily by BBVA under the same criteria.

2. Eco-rating

The Eco-rating tool is used to rate the risk portfolio of SMEs from an environmental point of view. This is done by assigning a level of credit risk to each customer in accordance with a combination of several factors such as location, polluting emissions, consumption of resources, potential to affect the environment and applicable legislation.

3. Reputational risk management

Since 2006, BBVA has had a methodology in place for identifying, evaluating and managing reputational risk. Through this methodology, the Bank regularly defines and reviews a map in which it prioritizes the reputational risks it faces, together with a set of action plans to mitigate them.

This prioritization is carried out according to two variables: the impact on stakeholder perceptions and the strength of BBVA’s resilience to risk.

This reputational exercise is carried out in each country, and the integration of all of them provides a consolidated view of the Group. In addition, since 2017 a specific exercise has been carried out for the CIB EMEA area.

This exercise has been performed since 2015 using a computer tool that allows risks to be assessed by the competent areas.

The main milestones related to reputational risk management in 2017 were:

- Strengthening of the reputational risk model with the establishment of the position of Corporate Reputation Specialist, integrated into BBVA’s model of three lines of defense.

- Participation of the Reputational Risk Department in the 2017 corporate Risk Assessment processes and in estimating the impacts of the scenarios in the recovery plan.

- Global Risk Management calculated reputational risk capital for the first time.

- Integration of key risk indicators into the reputational risk management tool with the aim of improving risk monitoring.

- Integration of CIB into the reputational risk management model.

Eco-efficiency

BBVA also assumes its commitment to mitigate the direct impacts of its activity. These impacts are fundamentally those derived from the use of its buildings and offices around the world.

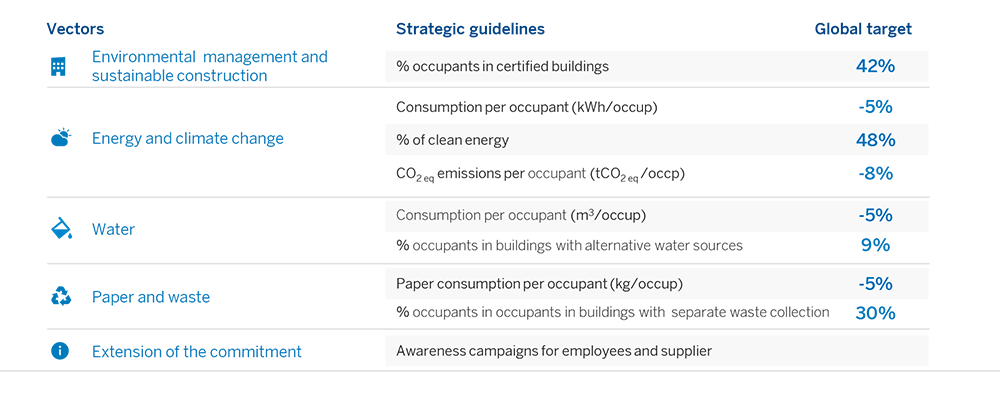

During 2017, BBVA has continued to work on its third Global Eco-efficiency Plan (GEP), focused on positioning the Group among the leading entities at global level in terms of ecoefficiency. The GEP establishes the following strategic areas and global targets for the period 2016-2020, continuing on from the two previous plans that were begun in 2008 and 2012, respectively, and setting the following targets:

Global Eco-efficiency Plan

Goals per person

During 2017 a number of the goals set have been achieved, such as the percentage of people in certified buildings, in buildings with alternative water sources and with selective collection of waste, which have already reached 42%, 11% and 41%, respectively. The evolution of the GEP indicators in the last year is reflected in the table below:

Main GEP indicators

| 2017 | 2016 | |

|---|---|---|

| People working in certified buildings (%)(1) | 42 | 40 |

| Electricity usage per person (MWh) | 5.9 | 5.8 |

| Energy coming from renewable sources (%) | 27 | 25 |

| CO2 emissions per person (T) | 2.2 | 2.1(2) |

| Water consumption per person (m3) | 23 | 21.1 |

| People working in buildings with alternative sources of water supply (%) | 10 | 11 |

| Paper consumption per person (T) | 0.1 | 0.1 |

| People working in buildings with separate waste collection certificate (%) | 41 | 32 |

- (1) Including IS0 14001 and LEED certifications.

- (2) This figure has been adjusted according to update of the emissions factor applied.

Note: indicators calculated based on employees and external staff.

To achieve these targets, BBVA continued its efforts to minimize its environmental footprint through initiatives in all the countries where the Group is present, most notably:

- Improvement in efficiency in the air conditioning and lighting systems of buildings and branches.

- Remodeling of some headquarters.

- Adaptation to ISO 14001:2015 of the Environmental Management System certifications under ISO 14001. In total, 1,034 branches and 79 of the Group’s buildings around the world possess this certification.

- Achievement of LEED Platinum certification in two new buildings. In addition to the 19 BBVA buildings that have already received it.

- Participation in the Earth Hour campaign in 177 cities around the world.

Engagement

BBVA is participating in major international sustainable development initiatives (UN Global Compact, Equator Principles, Principles for Responsible Investment, United Nations Environment Programme Finance Initiative, Thun Group of Banks and Human Rights, Green Bond Principles and Social Bond Principles), and has been committed, since 2017, to achieve the United Nations Sustainable Development Goals (SDGs). BBVA is also part of the pilot group of banks that have committed to implement financing and climate change recommendations that were published in July by the Financial Stability Board in the framework of the G20.

Sustainable Development Goals

On September 25, 2015, the world leaders adopted 17 SDGs to protect the planet, fight poverty and try to eradicate it and to achieve a prosperous world for future generations. These goals are part of the 2030 Sustainable Development Agenda. The aim is to involve everyone: governments, companies, civil society and individuals. Each goal, set out with a specific purpose, has in turn a number of targets to be achieved; and each target has its own indicators that serve to determine the level of achievement of each goal.

Given its broad spectrum of business, BBVA contributes to a number of SDGs, together with the BBVA Microfinance Foundation and the different geographic areas in which it operates. To respond to the obligations it has imposed on itself as a bank, BBVA has defined its strategy for climate change and sustainable development that orders its different commitments and relates them directly to the SDGs. In this way, BBVA aims to respond to the commitments of the 2030 Agenda, but at the same time to take advantage of the business opportunities derived from compliance.

Task Force on Climate-related Financial Disclosures (TCFD)

BBVA is committed to mitigating the impacts derived from climate change and to integrating these risks into its risk management model. To further this end, it has joined the pilot group of banks working under the tutelage of the UN Environment Program - Finance Initiative (UNEP FI) to implement the recommendations of the Task Force on Climate Related Climate Disclosures, created by the Financial Stability Board (FSB).

This pilot group of 16 banks aims to analyze how climate change affects the banking industry in its governance model, strategy and risk model.

Over the next two years (2018-2019), a number of possible climate change scenarios will be used to determine how global warming will affect the banking business. The basic aim of the working group will be focused on analyzing risks, whether physical (associated mainly with the direct effects of climate change) or transitional (regulatory, technological or social changes), and how these form part of each entity’s risk model.

Currently, the group is working to determine the sectors on which the analysis will focus, together with the geographic areas of analysis on which the pilot program will be run.