Customer relationship

Customer experience

BBVA’s main focus of attention is to satisfy its customers’ needs and connect with them in a more attractive way that combines innovation, technology and experience. That is because a new standard in customer experience is one of the Group’s Strategic Priorities, as explained in the Strategy section.

A customer-centric approach

There has been a radical change in the way clients interact with banks. “Do it yourself”, new technologies and the desire of customers to be connected at any time and from anywhere is booming. In this changing scenario, BBVA has a clear strategy: to put the customer at the center of everything we do.

The objective of BBVA is to move from being infrastructure providers around the money to helping our clients in making financial decisions, providing them with relevant advice and solutions with greater added value. In short: at BBVA we want to have a positive impact on the lives of people and companies.

In addition, BBVA promotes a customer-centered mentality throughout the Organization, because it considers all its employees can have a positive effect on customers, regardless of the department they work in. That is why it is implementing new ways of doing things, such as design thinking method, intra-entrepreneurship, external collaboration, and other.

BBVA is also becoming an increasingly global bank through its focus on creating global products and experiences. This allows it to leverage best practices, wherever they come from. This model of creation is present in each global project, and is supported by two key elements: the triangle and 3-6-9. It aims to offer incredible experiences to customers, while reducing execution time.

The triangle is formed by three vertices: business, customer experience and technology. It represents the connection between three disciplines in a single project: those responsible for the business, for user experience (designers and data experts) and for the responsibles for technology (or software engineers).

Relationship model

The aim of the 3-6-9 methodology is to speed up the pace of creation and launch solutions onto the market in record time, starting from when teams are defined until the solution is made available to customers.

Net Promoter Score

Agility, simplicity and transparency are key factors that mark the improvement initiatives at BBVA Group to ensure that all customer interactions with the Bank are a positive experience.

The internationally recognized Net Promoter Score (NPS or Net Recommendation Index - IReNe) methodology calculates the level of recommendation, and hence, the level of satisfaction of BBVA customers with its different products, channels and services. This index is based on a survey that measures on a scale of 0 to 10 whether a bank’s customers are positive (score of 9 or 10), neutral (score of 7 or 8) or negative (score of 0 to 6) when asked if they would recommend their bank, a specific product or a channel to a friend or family member. This is vital information for identifying their needs and drawing up improvement plans, on multidisciplinary teams work to create unique and personal experiences.

The Group’s internalization and application of this methodology over the last six years has led to a steady increase in the customers’ level of trust, as they recognize BBVA to be one of the most secure and recommendable banking institutions in every country where it operates.

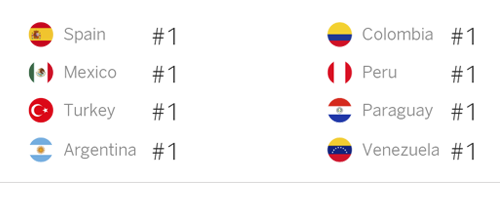

In 2017, BBVA ranked first in the NPS indicator in eight countries (seven in 2016): Spain, Mexico, Turkey, Argentina, Colombia, Peru, Venezuela and Paraguay. By channels, there was also an improvement in this indicator in both digital banking and branches, with the improvement experienced among digital customers being greater.

Net Promoter Score (NPS) (31-12-2017)

Grupo Peer: España: Santander, CaixaBank, Bankia, Sabadell, Popular // México: Banamex, Santander, Banorte, HSBC // Turquía: AKbank, Isbank , YKB, Deniz, Finanz // Argentina: Galicia, HSBC, Santander Río // Colombia: Davivienda, Bogotá, Bancolombia // Perú: Interbank, BCP, Scotiabank // Paraguay: Continental, Itaú, Regional // Venezuela: Banesco, Mercantil, Banco de Venezuela.

TCR Communication

The Transparent, Clear and Responsible (TCR) Communication project promotes transparent, clear and responsible relations between BBVA and its customers.

- T is for transparency: providing customers with all relevant information at the right time, maintaining a balance between benefits and costs.

- C is for clarity, meaning easy to understand. It is achieved by the Group through language, structure and design.

- R is for responsibility, and means looking after the customers’ interests in the short, medium and long term.

The objectives are to help customers make informed decisions, improve customer relations with the Bank, look out for their interests and make BBVA the most transparent and clearest bank in all the markets where it operates. It also means BBVA can attract new customers and encourage existing customers to recommend it.

The project is coordinated by a global team together with a network of local TCR owners located in the main countries where the Bank operates, while its execution involves the participation of many of the Bank’s areas and employees.

The project has two main lines of work:

- Implement TCR to transform the traditional bank, through the creation of product cards, the adaptation of the agreements to a TCR format, the amendment of the claims response letters and the follow up of the telephone sales and advertising of the Entity.

- Implement TCR in the new bank and progress in the training and change towards a TCR culture.

TCR indicators

BBVA has an indicator called the Net TCR Score (NTCRS), which measures the degree to which customers perceive BBVA as a transparent and clear bank in comparison with its peers in the main geographic areas where the Group operates.

In 2017 BBVA was in first place in six countries: Mexico, Turkey, Colombia, Peru, Venezuela and Uruguay

Customer care

Complaints and claims

The BBVA Group has an appropriate claims management and service modelo that positively transforms customer experience. Customer opinions are gathered by digital feedback quickly and efficiently, allowing BBVA to anticipate any problems that they may have in real situations and meet their expectations. In this way, BBVA wants to respond precisely to its customers’ demands, avoiding bad experiences that can harm its image and lose trust.

In line with the commitment to digital transformation, any type of opinion provided by the customer is examined, whatever its source (NPS, digital feedback, complaints, claims, etc.). In addition, BBVA is active in the social media, which gives it the opportunity to respond and manage negative comments from dissatisfied customers, and offer solutions to problems with simple, friendly, quick and above all personalized responses.

Main indicators of claims (BBVA Grupo)

| 2017 | 2016 | |

|---|---|---|

| Number of claims before the banking authority (for each 10.000 active customers) | 10.02 | 9.93 |

| Average time for settling claims (normal days) | 7 | 12 |

| Claims settled by First Contact Resolution (FCR) (%) | 31 | 37 |

The various claims units in BBVA Group are constantly evolving, optimizing processes and improving and developing new functionalities to which defined protocols are applied. All this will lead to greater efficiency in the service offered to customers.

In addition, work continues on a specific site for recording and monitoring the claims metrics. All the information related to complaints and claims is loaded into it, and it generates reports that analyze changes and behavior that is reported to senior management. The site also includes work on a system of alerts on the main claims indicators by country, designed to ensure compliance with the benchmark indicators based on the acceptable number of claims for each country.

The Group’s claims units implemented action plans on a regular basis, in which the most important initiatives to be carried out were prioritized to solve the problems detected, based on understanding of the root causes identified in the claims analysis.

In short, BBVA’s claims management is an opportunity to offer greater value to customers and increase their loyalty to the Group.

Customer claims in 2017 showed a growth trend compared to the previous year in Spain, a very focused increase in clauses related to mortgage loans. Mexico, with the biggest active customer base, is also the country with the biggest number of claims.

Number of claims before the banking authority (For each 10.000 active customers) (1)

| 2017 | 2016 | |

|---|---|---|

| Spain | 4.87 | 0.82 |

| The United States | 4.96 | n/av |

| Mexico | 16.12 | 19.87 |

| Turkey | 3.21 | 3.76 |

| Argentina | 2.68 | 1.90 |

| Chile | 5.55 | 5.90 |

| Colombia | 21.65 | 19.69 |

| Peru | 2.21 | 2.02 |

| Venezuela | 1.04 | 1.93 |

| Paraguay | 0.79 | 0.19 |

| Uruguay | 0.41 | 0.39 |

| Portugal | 34.84 | 43.66 |

- n/av = not available

- (1) The banking authority refers to the external body in which the customers can complain against BBVA.

The average time for settling claims in the Group has been reduced by nearly half, mainly due to the significant reduction in the average time for resolution in Mexico (from 13 days in 2016 to 4 in 2017).

Average time for settling claims by countries (normal days)

| 2017 | 2016 | |

|---|---|---|

| Spain | 25 | 15 |

| The United States | 3 | n/av |

| Mexico | 4 | 13 |

| Turkey | 2 | 1 |

| Argentina | 7 | 8 |

| Chile | 5 | 6 |

| Colombia | 4 | 4 |

| Peru | 12 | 15 |

| Venezuela | 13 | 4 |

| Paraguay | 6 | 5 |

| Uruguay | 8 | 6 |

| Portugal | 5 | 3 |

- n/av = not available

The claims settled by the First Contact Resolution (FCR) model account for 31% of total claims, thanks to the management and attention of these claims are aimed to reduce the time of resolution and increase the quality service, improving so the customer experience.

Claims settled by First Contact Resolution (FCR Percentage)

| 2017 | 2016 | |

|---|---|---|

| Spain(1) | n/a | n/a |

| The United States | 63 | n/av |

| Mexico | 38 | 40 |

| Turkey(2) | 40 | 44 |

| Argentina | 27 | 34 |

| Chile | 6 | 18 |

| Colombia | 73 | 78 |

| Peru | 4 | 4 |

| Venezuela | 1 | 8 |

| Paraguay | 28 | 35 |

| Uruguay | 12 | 16 |

| Portugal(3) | n/a | n/a |

- n/a = not applicable

- n/av = not available

- (1) In Spain, is applicable a FCR type called IRR (Immediate resolution response) to credit card incidents, but not claims.

- (2) In Turkey, the weighting is calculated by the total number of customers.

- (3) This kind of management does not apply in Portugal.

Customer Care Service and Customer Ombudsman

The activities of the Customer Care Service and Customer Ombudsman in 2017 were carried out in accordance with the stipulations of Article 17 of the Ministerial Order (OM) ECO/734/2004, dated March 11, of the Ministry of the Economy, regarding customer care and consumer ombudsman departments at financial institutions, and in line with the new “Regulations for Customer Protection in Spain” of the BBVA Group approved by the Board of Directors of the Bank in 2015, regulating the activities and powers of the Customer Care Service and Customer Ombudsman.

The Customer Care Service processes complaints and claims addressed to both the Customer Ombudsman and the Customer Care Service itself in the first instance, except for matters falling within the powers of the Customer Ombudsman as established in the aforementioned regulation

Activity report on the Customer Care Service in Spain

2017 was marked by a difficult environment, above all relating to the various clauses in mortgage loan agreements (arrangement fees), which have conditioned the figures for claims in the Spanish financial system. In addition, the Customer Care Service Department assumed the claims of all customers from Catalunya Bank, which were integrated into BBVA in September 2016, which resulted in a greater number of claims compared to the previous year.

Customer claims admitted by BBVA’s Customer Care Service in Spain amounted to 174,249 cases in 2017, of which 171,146 were resolved by the Customer Care Service itself and concluded in the same year, which accounted for 98% of the total. A total of 3,103 cases remained as pending analysis.

On the other hand, 153,061 cases were not admitted to processing as they did not comply with the requirements of OM ECO/734. Practically 90% of the claims received corresponded to mortgage loans, mainly to expenses from the formalization of mortgages.

In 2016, the admitted claims amounted to 23,060 and the cases resolved and concluded amounted to 20,279, an 88% of the issues.

Claims handled by Customer Care Service by complaint type (Percentage)

| Type | 2017 | 2016 |

|---|---|---|

| Resources | 9 | 24 |

| Assets products | 79 | 27 |

| Insurances | 1 | 7 |

| Collection and payment services | 2 | 8 |

| Financial counselling and quality service | 2 | 7 |

| Credit cards | 4 | 10 |

| Securities and equity portfolios | 1 | 5 |

| Other | 2 | 12 |

| Total | 100 | 100 |

Claims handled by Customer Care Service according to resolution (Number)

| 2017 | 2016 | |

|---|---|---|

| In favor of the person submitting the claim | 29,041 | 7,071 |

| Partially in favor of the person submitting the claim | 90,047 | 2,830 |

| In favor of the BBVA Group | 52,058 | 10,378 |

| Total | 171,146 | 20,279 |

The claims management model and the principles governing the activity of the Customer Care Service are aimed at achieving recognition and trust on the part of the Group’s customers, with the aim of increasing their satisfaction levels. The model operates from the origination stage, as the Customer Care Service sits on the committees presenting new products and services. In this way, possible customer dissatisfaction can be anticipated and avoided.

Additionally, in accordance with the recommendation of the regulatory body, progress continued in 2017 on the ambitious training plan that has been created for the whole team making up this Service. The aim is to guarantee the BBVA managers have the knowledge to improve identification of customer needs and contribute high added value solutions.

Report on the activity of the BBVA Group Customer Ombudsman in Spain

In 2017, the Customer Ombudsman maintained the goal common to the BBVA Group as a whole of unifying criteria and fostering the protection and security of customers, making progress in compliance with regulations on transparency and customer protection. With the aim of passing on effectively its reflections and criteria on matters subjected to its consideration, the Ombudsman meets with areas and units in BBVA Group: Insurance, Pension Plan Manager, Business, Legal Services, etc.

The number of customer claims managed by the Customer Ombudsman for resolution in 2017 was 1,661. Of these, 121 were finally not processed as they did not meet the requirements set out in OM ECO/734/2004.

Claims handled by the Customer Ombudsman by complaint type (Number)

| Type | 2017 | 2016 |

|---|---|---|

| Insurance and welfare product | 600 | 590 |

| Assets operations | 367 | 305 |

| Investment services | 133 | 141 |

| Liabilities operations | 257 | 175 |

| Other banking products (credit card, ATM, etc.) | 140 | 100 |

| Collection and payment services | 69 | 63 |

| Other | 95 | 127 |

| Total | 1,661 | 1,501 |

The type of complaints managed in the table above follow the criteria established by the Complaints Department of the Bank of Spain in their requests for information.

Claims handled by Customer Ombudsman according to resolution (Number)

| 2017 | 2016 | |

|---|---|---|

| In favor of the person submitting the claim | - | - |

| Partially in favor of the person submitting the claim | 797 | 861 |

| In favor of the BBVA Group | 622 | 516 |

| Suspended processing | 8 | - |

| Total | 1,427 | 1,377 |

51.48% of the customers who submitted a claim to the Ombudsman in 2017 reported some level of satisfaction, either because of the decision of the Customer Ombudsman or its role as mediator between BBVA Group entities and customers.

Customers who are not satisfied with the Customer Ombudsman’s response may refer the matter to the official supervisory bodies (the Bank of Spain, CNMV and the Directorate General of Insurance and Pension Funds). The number of claims submitted by customers to the supervisory bodies in 2017 was 127.

In 2017, BBVA Group continued to make progress in implementing the suggestions of the Customer Ombudsman related to adapting products to the profile of customers and the need for transparent, clear and responsible information. The recommendations and suggestions made by the Customer Ombudsman are focused on increasing the level of transparency and clarity of information that BBVA Group provides for its customers, both in its commercial products that it makes available to them, and in compliance with the orders and instructions issued by customers. The aim is to guarantee that customers understand the nature and risks of the financial products that they are offered, that the product is adapted to the customer profile and that the information provided by the Entity is impartial and clear, including the advertising targeted at customers. To do so, the Group is employing the Transparent, Clear and Responsible (TCR) communication initiative for Responsible Business, providing as much data and documentation as necessary.

In addition, with the increasing digitalization of the products offered to customers and their growing complexity, a special sensitivity is required with some groups of customers that due to their profile, age or personal situation present a high level of vulnerability.

Operational risk management and customer protection

Security measures have been strengthened in 2017 as a result of the increase in cyber threats and cyber crime in general. Protection and prevention strategies have been applied to mitigate the risk of attacks and their possible impacts on internal and external resources.

A working methodology has been developed to allow the deployment of baselines (resources, capacities, plans and responsibilities) according to the different vectors of attack, based on four key elements: prevention, preparation, response and recovery. This working methodology forms part of a general framework that BBVA defined at the end of 2016 for the Group’s organizational resilience, geared to:

- improving the procedures for detection, prioritization and escalation;

- improving the global capacity for reaction and response; and

- strengthening the technical teams in all the countries dedicated to cybersecurity and engineering risk management.

In addition, the capacities created by the Engineering Risk & Corporate Assurance (ERCA) committee have been consolidated in the area of security mechanisms, and specifically in the area of identification and authentication, allowing the Group to generate new customer experiences and improve existing ones. As a result of this work with a single team, together with the business areas, and with the precept that the customer is first, a significant increase in new experiences for customers has been noted, which allows BBVA to follow the path of the latest technological innovations offered by the major players.

A number of initiatives have been taken within the area of business continuity, in other words, incidents with a low probability of occurrence and very high impact, such as reviewing and updating the corporate regulations; continuing with the implementation of the business impact analysis, with the resulting update of the continuity plans; and reviewing technological dependency on critical processes, informing the corresponding continuity committees of their results so they can be aware and improve response where necessary, in a scenario of unavailability due to failures in the information systems.

During 2017 numerous business continuity strategies have been activated in BBVA Group, among them related to the earthquakes in Chile, and particularly Mexico; those affecting the United States as a result of hurricanes and storms: Harvey in Texas, Irma in Florida and Stella in New York; the problems of social conflict in Venezuela; serious flooding in the north of Peru; and the torrential rains in the area of Mocoa, Colombia.

As regards personal data protection, there has been much work done in 2017 to implement the General Data Protection Regulation in BBVA Group, which will enter into force in 2018. Moreover, in compliance with one of the new requirements under the aforementioned Regulation, a Data Protection Officer for the BBVA Group was appointed.

With respect to the personal data security measures, and in line with the above, a supplementary organizational project was implemented to review and update all functions, processes, methodologies, classification models, controls, incident management, etc. and ensure they are adapted to the new Regulation.