Non-financial Information Report

Pursuant to Law 11/2018 of December 28, modifying the Commercial Code, the revised text of the Capital Companies Law approved by Royal Legislative Decree 1/2010 of July 2, and Law 22/2015 of July 20 on Accounts Auditing, regarding non-financial information and diversity (hereinafter, Law 11/2018), BBVA presents a non-financial information report that includes, but is not limited to: the information needed to understand the performance, results, and position of the Group, and the impact of its activity on environmental, social, respect for human rights, and the fight against corruption and bribery matters, as well as employee matters.

In this context, BBVA prepares the Consolidated Non-financial information report in the Group's Management Report, which is attached to the Consolidated Financial Statements for the 2019 fiscal year as covered in the article 49.6 of the Commercial code introduced by Law 11/2018.

Reporting of the non-financial key performance indicators included (KPI) in this consolidated non-financial information report is performed using the GRI (Global Reporting Initiative) guide as an international reporting framework in its exhaustive option.

In addition, for the preparation of the non-financial information contained in this Management Report, the Group has considered the Communication from the Commission of July 5, 2017 on Guidelines on non-financial reporting (methodology for reporting non-financial information, 2017/C 215/01).

The information included in the consolidated non-financial information report is verified by KPMG Auditores, S.L., in its capacity as independent provider of verification services, in accordance with the new wording given by Law 11/2018 to article 49 of the Commercial Code.

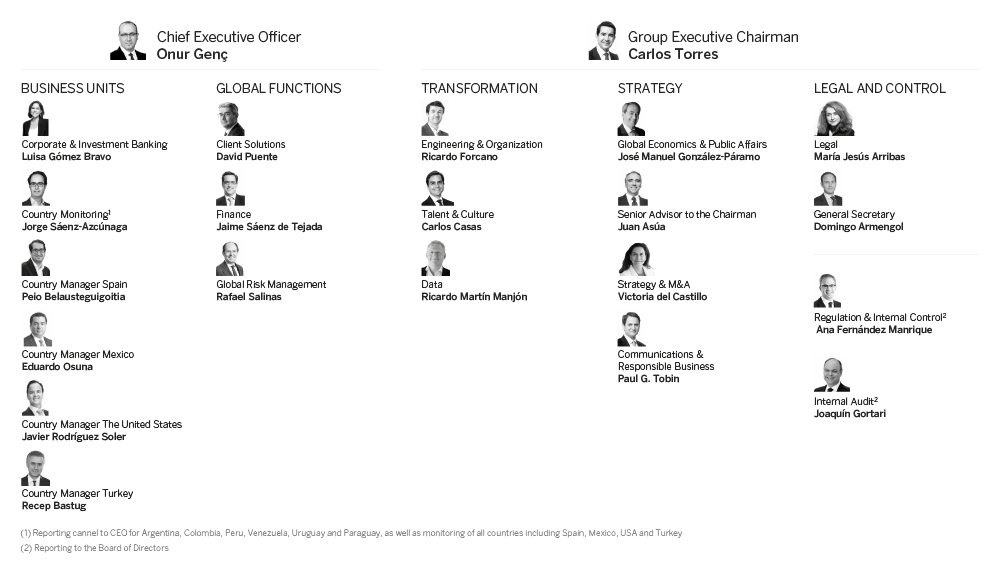

The Group’s organizational chart

In 2019, the organizational structure of the Group remains in line with that approved by the Board of Directors of BBVA at the end of 2018. This structure aimed at fostering the Group’s transformation and businesses, while further specifying responsibilities for executive functions.

The main aspects of the organizational structure are as follows:

- The Group Executive Chairman is responsible for the management and well-functioning of the Board of Directors, the supervision of the management of the Group, the institutional representation, and leading and boosting the Group’s strategy and its transformation process.

The areas reporting directly to the executive chairman are those related to the transformation’s key levers: Engineering & Organization, Talent & Culture and Data; those related to the Group’s strategy: Global Economics & Public Affairs, Strategy & M&A, Communications & Responsible Business and the figure Senior Advisor to the Chairman; and the Legal-related and Board-related areas: Legal and General Secretary.

- The Chief Executive Officer (CEO) is in charge of the daily management of the Group’s businesses, reporting directly to BBVA’s Board of Directors.

The areas reporting to the CEO are the Business Units in the different countries and Corporate & Investment Banking, as well as the following global functions: Client Solutions, Finance and Global Risk Management.

Additionally, there are two control areas with direct reporting of their heads to the Board of Directors through the corresponding committees. These control areas are Internal Audit and the new Regulation & Internal Control, area that is in charge of the relationship with regulators and supervisors, the monitoring and analysis of regulatory trends and the development of the Group’s regulatory agenda, and the management of compliance-related risks.

Environment

Macro and industry trends

Global growth decelerated in 2019 to growth rates slightly below 3% in annual terms in the second half of the year, below the 3.6% of 2018. Increased trade protectionism and geopolitical risks had a negative impact on economic activity, mainly on exports and investment, additionally to the structural slowdown in the Chinese economy and the cyclical moderation of the US and Eurozone economies. However, the counter-cyclical policies announced in 2019, led by central banks, along with the recent reduction in trade tensions between the United States and China and the disappearance of the risk of a disorderly Brexit in the short term, are leading to some stabilization of global growth, based on the relatively strong performance of private consumption supported by the relative strength of labor markets and low inflation. Thus, global growth forecasts stand around 3.1% for both 2019 and 2020.

Global GDP growth and inflation in 2019 (Real percentage growth)

| GDP | Inflation | |

|---|---|---|

| World | 3.1 | 3.7 |

| Eurozone | 1.2 | 1.2 |

| Spain | 1.9 | 0.7 |

| The United States | 2.3 | 1.8 |

| Mexico | 0.0 | 3.6 |

| South America (1) | 0.9 | 10.8 |

| Turkey | 0.8 | 15.5 |

| China | 6.1 | 2.9 |

Source: BBVA Research estimates.

(1) It includes Argentina, Brazil, Chile, Colombia and Peru.

In terms of monetary policy, the major central banks took more loosening measures last year. In the United States, the Federal Reserve reduced interest rates between July and October by 75 basis points to 1.75%. In the eurozone, the European Central Bank (ECB) announced in September a package of monetary measures to support the economy and the financial system, including: (i) a deposit facility interest rate reduction of ten basis points, leaving them at -0.50%, (ii) the adoption of a phased interest rate system for the previously mentioned deposit facility, (iii) a new debt purchase program of €20 billion per month, and (iv) an improvement in financing conditions for banks in the ECB's liquidity auctions. The latest signs of growth stabilization contributed to the decision of both monetary authorities to keep interest rates unchanged in recent months, although additional stimulus measures are not ruled out in the event of a further deterioration of the economic environment. In China, in addition to fiscal stimulus decisions and exchange rate depreciation, a cut in reserve requirements for banks was recently announced and base rates have been reduced. Accordingly, interest rates will remain low in major economies, enabling emerging countries to gain room for maneuver.

Spain

In terms of growth, the latest data confirms that GDP continues to grow at a higher rate than in the rest of the eurozone, though it has slowed to 0.4% quarterly in the second quarter of 2019 from an average growth of around 0.7% since 2014, and stabilized in the third quarter. This result reflects a moderation in domestic demand, in both private consumption and investment, as well as some fading stimuli and the negative effect of uncertainty.

As for the banking system, the total volume of credit to the private sector continues to decline while asset quality indicators improve (the non-performing loan ratio was 5.1% in October 2019). Profitability remained under pressure (ROE of 5.2% in the first nine months of 2019) due to low interest rates and lower business volumes. Spanish institutions maintain comfortable levels of capital adequacy and liquidity.

United States

In the third quarter of 2019, growth remained stable at 2.1% on an annualized quarterly basis, following the slowdown observed in the previous quarter from rates of 3.1% at the beginning of last year, confirming a period of economic moderation and dispelling, for the time being, fears of a recessionary scenario. The strength of private consumption, based on the soundness of the labor market, continues to contrast with weak investment, negatively affected by political uncertainty and lower global growth, coupled with poorer performance of net exports. In this context, the Federal Reserve points to a pause in interest-rate cuts to 1.75% as long as there are no significant changes in the scenario, although additional stimulus measures are not ruled out in the event of a further deterioration in the economic environment, nor an upward adjustment if inflation rises more than expected.

In the banking system, as a whole, the most recent activity data (November 2019) show that credit and deposits in the system are growing at year-on-year rates of 4.0% and 10.6%, respectively. Non-performing loans remain under control: thus the non-performing loan ratio stood at 1.46% at the end of the third quarter of 2019.

Mexico

In terms of growth, the economy stagnated in the third quarter of 2019 after three quarters of slight contraction (about -0.1% per quarter) and no signs of recovery were visible in the last quarter of the year, especially in terms of investment. Several factors were behind this behavior: the delay in ratifying the new trade agreement between the United States and Canada, the continuing uncertainty due to external and internal factors, the slowdown in the manufacturing sector in the United States, as well as the slowdown in employment and private consumption. In this context, inflation declined rapidly and significantly from annual rates of just over 4% in mid-year to 2.8% in December 2019, promoting the central bank to initiate an interest rate-cut cycle, with four cuts of 25 basis points between August and December, to 7.25%.

The banking system continued to grow year-on-year. According to data from November 2019, lending and deposits grew by 4.7% and 4.0% year-on-year respectively, with increases in all portfolios. The non-performing loan ratio remained under control (2.24% in November 2019, compared to 2.18% twelve months previously) and capital indicators were comfortable.

Turkey

In terms of growth, the Turkish economy technically emerged from the recession in the first quarter of 2019, growing by 1.7% on a quarterly basis, and the recovery continued although at a more moderate rate in the second and third quarters (1.0% and 0.4%, respectively). The correction in domestic demand seems to have ended in the third quarter with the recovery of private consumption and investment, although support for net exports dissipated and slightly hampered growth. The economy is expected to have grown by 0.8% in 2019. Inflation slowed significantly during the second half of the year, from rates of just over 20% to around 12% in December. In this context, the central bank cut the interest rate by 425 basis points in July, 325 basis points in September, 250 basis points in October, 200 basis points in December down to a 12.00% interest rate at the end of the year. In January 2020, the central bank reduced the interest rate 75 basis points to 11.25%.

With data from November 2019, the total volume of credit in Turkish liras is the banking system increased by 11.4% year-on-year while credit in foreign currency grew by 4.9% in the same period. The NPA ratio stood at 5.3% at the end of November 2019.

Argentina

With regards to economic growth, following the outcome of the primary elections in mid-August 2019, capital outflows led to a sharp exchange rate depreciation, a situation that the government attempted to alleviate with a highly restrictive monetary policy and capital control measures. All this resulted in a rapid deterioration in confidence, a sharp increase in inflation, a fall in real wages and consequently a sharp contraction in consumption and investment. The external sector is the sole support for the activity, prompted by the boost of depreciation on exports along with a considerable adjustment of imports. There is uncertainty about the measures and policies that will be implemented to tackle the crisis.

In the banking system, lending and deposits are growing at high rates, albeit with the notable influence of high inflation. Profitability indicators are very high (ROE: 42.9% and ROA: 4.8% in October 2019) and non-performing loans increased, with a non-performing loan ratio of 4.9% in October 2019.

Colombia

The economy continued to recover in 2019, with growth slightly above the 3.0% year-on-year average level until the third quarter, after advancing 2.6% in 2018. The recovery continues to be driven by consumption as well as investment in machinery and equipment. Private consumption is expected to moderate somewhat in light of the deterioration of the labor market and weak confidence, although this will be partly offset by higher expenditure linked to the increase in immigration, while investment in construction should start to show signs of recovery, supported by some public policies. Nevertheless, growth is expected to remain relatively stable in the coming quarters. Inflation increased in the second half of the year to levels around 3.8% due mainly to the effect of the exchange rate depreciation, but still within the target range of the Bank of the Republic, which kept the reference interest rate at 4.25%.

Total credit in the banking system grew by 9.1% year-on-year in September 2019, with a non-performing loan ratio of 4.4%. Total deposits increased by 8.5% year-on-year in the same period.

Peru

Activity slowed in 2019, with annual growth of about 2% from rates of around 4% in 2018. This weak growth responded to the worse performance of primary activities, and to a lower public investment that was noted in construction and some manufacturing. In this context, with inflation below the 2% target, the central bank lowered the interest rate by 50 basis points between August and November to 2.25%. In 2020, the growth of the Peruvian economy could gain traction once some of the temporary factors that affected primary activities disappear, once public investment returns to normal and reconstruction efforts resume in some areas of the north of the country.

The banking system showed moderate year-on-year growth rates in lending and deposits (+7.3% and +12.0% respectively, in September 2019), with reasonably high levels of profitability (ROE: 18.9%) and contained non-performing loans (NPL ratio: 2.7%).

Interest rates (Percentage)

| 31-12-19 | 30-09-19 | 30-06-19 | 31-03-19 | 31-12-18 | 30-09-18 | 30-06-18 | 31-03-18 | |

|---|---|---|---|---|---|---|---|---|

| Official ECB rate | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Euribor 3 months (1) | (0.39) | (0.42) | (0.33) | (0.31) | (0.31) | (0.32) | (0.32) | (0.33) |

| Euribor 1 year (1) | (0.26) | (0.34) | (0.19) | (0.11) | (0.13) | (0.17) | (0.18) | (0.19) |

| USA Federal rates | 1.75 | 2.00 | 2.50 | 2.50 | 2.50 | 2.25 | 2.00 | 1.75 |

| TIIE (Mexico) | 7.25 | 7.75 | 8.25 | 8.25 | 8.25 | 7.75 | 7.75 | 7.50 |

| CBRT (Turkey) | 12.00 | 16.50 | 24.00 | 24.00 | 24.00 | 24.00 | 17.75 | 8.00 |

(1) Calculated as the month average.

Exchange rates (Expressed in currency/euro)

| Year-end exchange rates | Average exchange rates | ||||

|---|---|---|---|---|---|

| 31-12-19 | ∆ % on 31-12-18 | ∆ % on 30-09-19 | 2019 | ∆ % on 2018 | |

| U.S. dollar | 1.1234 | 1.9 | (3.1) | 1.1195 | 5.5 |

| Mexican peso | 21.2202 | 6.0 | 1.1 | 21.5531 | 5.3 |

| Turkish lira | 6.6843 | (9.4) | (8.0) | 6.3595 | (10.3) |

| Peruvian sol | 3.7205 | 3.8 | (1.1) | 3.7335 | 3.9 |

| Argentine peso (1) | 67.29 | (35.7) | (7.2) | - | - |

| Chilean peso | 841.13 | (5.4) | (6.1) | 786.75 | (3.8) |

| Colombian peso | 3,681.54 | 1.7 | 2.4 | 3,673.67 | (5.2) |

(1) According to IAS 29 "Financial information in hyperinflationary economies", the year-end exchange rate is used for the conversion of the Argentina income statement.

Economic outlook

BBVA Research’s scenario update takes into account the easing of trade tensions between the United States and China and the removal of the risk of a disorderly Brexit in the short term (even if a risk remains for the end of 2020), which has contributed to a fall in economic uncertainty over the global environment. This paves the way for a slowdown in growth and for the global economy to stabilize, even though increased protectionism will continue to affect world trade. This prospect of stabilizing global growth has been reinforced by robust activity in the United States and by the most recent slight upward surprises in growth data in China and the eurozone. Economic policy has also continued to support growth, and will continue to do so in the coming quarters, at least in the world’s major economies: following the monetary stimulus actions in 2019, both the Federal Reserve and the European Central Bank are expected to keep interest rates low for an extended period of time, while in China further fiscal and monetary stimulus measures will bolster the economy. Increased optimism about the global environment has also led to a marked improvement in the tone of financial markets. That said, BBVA Research forecasts stable growth in 2020 and 2021 of just over 3%, which is below the growth of previous years following the slowdown observed in 2019.

By country, the slowdown is becoming more evident and widespread in developed economies in the 2019-2020 period, but a very gradual recovery is expected in 2021. In the United States, growth is likely to continue to slowdown in the short term as a result of poor investment performance as well as a brake on exports due to the global slowdown and the strength of the dollar, despite a more accommodative monetary policy. However, over the course of 2020, growth could return to rates close to potential (2%) as uncertainty subsides. As a result, the US economy is expected to decelerate from 2.9% in 2018 to 2.3% in 2019 and 1.8% in 2020, with a slight improvement in 2021 to 2%. Growth in the eurozone suffered throughout 2019 due to weaker global demand and deteriorating industrial production, as well as the burden of reversing the uncertainty associated with the UK’s exit from the European Union. Slightly more accommodative economic policies helped to contain the slowdown in the second half of 2019 and maintain domestic demand, while decreased uncertainty surrounding trade and Brexit tensions could contribute to somewhat stronger growth this year. As a result, growth in the eurozone appears to have slowed significantly from 1.9% in 2018 to 1.2% in 2019 and could slow somewhat more gradually in 2020 to 0.9%, before picking up slightly to 1.2% in 2021. This trend will also have an impact on growth in Spain, although it will still be higher than that recorded in the eurozone, with a slowdown from 2.4% in 2018 to 1.9% in 2019 and 1.6% in 2020, before rising slightly to 1.9% in 2021.

Growth in emerging economies was hampered by the downturn in the global environment. For the 2020-2021 period, the slowdown expected in Asian countries, which are burdened by China’s downward trend (from 6.6% in 2018 to 6.1% in 2019, 5.8% in 2020 and 5.5% in 2021), will continue to contrast with the gradual recovery projected for Latin American economies. In 2019, the slowdown was most pronounced in Mexico (0.0% compared to 2.1% in 2018) and Peru (2.1% after 4.0% in 2018), although a somewhat stronger recovery is expected in 2020 to 1.5% and 3.1%, respectively. In contrast, the strength of domestic demand in Colombia allowed the country to better withstand global uncertainties and maintain relatively stable growth in 2019-2021, which is expected to be slightly above 3%. In Argentina, the sharp depreciation of the exchange rate and the outflow of capital following the election result led to strong monetary policy restrictions and capital controls, which will lead to a sharp correction in both consumption and investment. In Turkey, the recovery that began in early 2019 will be further strengthened by a less restrictive monetary policy following the adjustment of inflation and current account imbalances, which will be reflected in growth of 0.8% in 2019, 4.0% in 2020 and 4.5% in 2021.

Overall, the global scenario predicts a degree of stabilization of growth, supported by the countercyclical policies implemented in most regions, as well as a reduction in uncertainty over 2019, although trade tensions and fears of a disorderly Brexit could resurface during 2020. Moreover, geopolitical and structural risk remain high.

Digitalization, new consumers and sustainability

Digitalization is transforming financial services at a global level. Consumers are changing their purchasing habits through the use of digital technologies, which increase their ability to access financial products and services at any time and from anywhere. Greater availability of information is creating more demanding customers, who expect swift, easy and immediate responses to their needs. And digitalization is what enables the financial industry to meet these new demands.

In this way, the role of technology in the day-to-day life of people and companies is growing steadily, causing notable changes in the technological landscape in areas such as retail banking, artificial intelligence and big data, behavioral economics, the creation of startups, quantum computing or blockchain.

On the other hand, technology is the lever for change which allows value proposition to be redefined to focus on the real needs of customers and to provide them with a simple and user-friendly experience without jeopardizing security. In this sense, the mobile is presented as the preferred, and often the only tool, enabling customers to interact with their financial entity.

In retail banking, the main change is in the way in which clients will access financial services in the future. Regarding access channels, the mobile is essential and will continue to grow, but voice-activated banking services may also become more frequent, which will pose a set of challenges. The automation of financial decisions will be possible through a series of staggered changes in the way in which banks provide services to people, such as automatic savings by rounding up transactions or separating a percentage of the payroll or, autonomous operation, in which the bank does everything for the client to ensure that their savings are managed in the most effective and efficient way possible. Currently, the emergence of large technology companies and digital companies are obliging the financial sector to rethink user experience, with customer trust being fundamental.

Artificial intelligence (AI) and big data are two of the technologies that are driving the transformation of the financial industry. Their adoption by entities translates into new services for customers that are more accessible and agile, and into the transformation of internal processes. AI allows, among other things, personalized products and recommendations to be offered to customers, and decisions to be made more intelligently. Data is the cornerstone of the digital economy. The use of algorithms based on big data can lead to the development of new advisory tools for managing personal finances and access to products, which until recently were only available to high-value segments.

Additionally, with behavioral economics, tailor-made experiences could be built for each client, with the objective of helping them with their finances, and that they can make better informed decisions according to their needs. It is about integrating what is known about how people make decisions—the real mechanics of what it means to make a decision—into the way of working.

As for the creation of startups, financial services could evolve by becoming more closely integrated with other digital experiences. The evolution towards models of platforms and/or ecosystems is consolidated, so that smaller companies can access customers.

Quantum computing will mean a drastic change for financial services, and for broader aspects of the global economy and society in general. The biggest impact is in the field of communications, cybersecurity, as well as in detection equipment, Internet operation, supply chain logistics and other aspects related to scientific research and finance.

Finally, developments in open finance, decentralized finance (DeFi) and blockchain have a significant and positive impact on how banking can be increasingly inclusive and at the same time contribute more to sustainability. For example, blockchain and new digital assets could favor sustainability by guaranteeing the traceability of carbon emissions and the equitable distribution of value through digital platforms among all participants (not only among rights holders).

On the other hand, the digital native generation, or the millennials, are one of the main drivers of this transformation. Millenials are changing their consumption patterns and even the business culture itself because a significant majority of them put the values of the company where they aspire to work above a salary. They also demand a different way of dealing with banks and the rest of financial institutions. Mobile banking apps are their favorite channel of interaction, as they allow them to manage their accounts remotely, whenever and from wherever they want. According to an Accenture study, The Future of Payments, 2017, 69% of millennials use them daily or weekly, compared to only 17% of members of the previous generations. 70% are interested in digital payment advisory services and expense management that can provide them a better understanding and control of their personal expenses.

Likewise, according to the CB Insights report, 2019, Millenials, more than any other generation, are interested in the idea that their investments have a positive impact in sustainability and climate change. With a real awareness of these problems, millennials seek to collaborate with those companies that have these premises as part of their ideology.

In this regard, it is important to connect digitalization and sustainability to unleash the full potential of the banking sector and the financial system in contributing to the UN’s Sustainable Development Goals (SDGs) and the Paris Agreement. One of the main areas in which digitalization is essential for banks to promote sustainable development is financial inclusion. Furthermore, the use of sustainability-related data is important if there is to be a progressive integration of environmental and social risks into banks’ risk management processes. The use of big data is crucial as data may be used to provide social initiatives that address new challenges for society.

In addition, technological transformation provides an opportunity for the financial sector, to the extent that sustainability can no longer be seen as a cost. Traditionally, sustainable solutions offered to customers were more expensive than standard solutions. These solutions can now be more efficient and affordable, moving from a market with limited potential to a larger and effective one. Specifically, the fundamental technological changes in the fields of energy efficiency, renewable energy, efficient mobility and the circular economy, with digitalization as a common denominator and the use of digital information and tools as a key element for improving efficiency in all sectors.

However, these opportunities also bring challenges that are important to face, such as the ability to narrow the digital divide, which will allow for the inclusion of disadvantaged social groups or the reduction of biases that favor fairer situations. In this new scenario it is necessary to work on improving financial and digital education, improving technological infrastructures and an adequate regulatory framework.

Regulatory Environment

The regulatory environment of the financial industry during the financial year 2019 was characterized by continuity and focused on completing and implementing previous regulatory initiatives, most of them related to the Basel and crisis management frameworks; the debate on the major ongoing European projects such as the banking union, the capital market union and the single digital market continued. Progress was made in regulating reference indices and reforming the EURIBOR, in sustainable finance, and in developing adequate regulation for the use of new technologies in the banking sector. In the European Union (EU), the institutions were renewed as a result of the European Parliament elections held in May and the establishment of a new European Commission.

1. Progress in measures to reduce risks in the banking sector

Prudential Framework

The banking package for risk reduction, which includes a set of new measures and the revision of other measures already in force, was approved in 2019 with the aim of continuing to reduce risks in the EU banking sector. The new legislative package reviews both the prudential framework (CRR2 and CRD IV) and the framework that governs the restructuring and resolution of banks (BRRD2 and SRMR2), and includes: (i) the incorporation of the latest Basel standards (excluding the completion of Basel); ii) the requirement for Total Loss-Absorbing Capacity (TLAC), which requires that institutions of global systemic importance have a greater capacity for loss absorption and recapitalization; and iii) the incorporation of technical adjustments identified in previous years. There will be a transposition period of 1.5 to 2 years, depending on the regulation, although some regulations will come into force immediately (TLAC for the G-SIIs). The review is reflected in two regulations and two directives, which have been in force since June.

Non-Performing Loans

The European Commission introduced a new prudential requirement that affects loans granted as of April 26, 2019 and in the event that at some point they become considered doubtful. A capital requirement is established for the difference between the prudential requirement and the amount of the provisions constituted, which depends on the age in which the exposures are classified as doubtful and the value of the guarantees provided in the operations.

Measures to reduce risks in banks

In 2019, work was carried out at a technical level so that (i) political negotiations resumed on the European Deposit Insurance Scheme (EDIS); (ii) the legislative text of the European Stability Mechanism (ESM) was drafted, which is likely to become the common backstop to the Single Resolution Fund (SRF) with a maximum allocation of €60,000m; (iii) the first approaches on the harmonization of the national insolvency laws were completed; and iv) initial discussions were held on creating a common risk-free asset, the so-called Sovereign Bond-Backed Security (SBBS). These measures will contribute to reducing risks in EU banks and completing the banking union.

Foreign banking organizations in the United States

The two most important standards published in 2019 for foreign banking organizations (FBOs) operating in the United States are the adjustment of reinforced prudential regulations and the reform of the Volcker rule. With regards to the adjustment, considering the bank’s exposure in the United States primarily as a measure to decide applicable requirements, smaller entities will benefit from a lower regulatory and supervisory burden, being exempt from standard liquidity requirements, or stress tests, for example. The change in the Volcker rule will mean a lower burden for banks to show they comply with reporting regulations.

2. Progress in the union of capital markets

The European Commission made progress in 2019 in some of its outstanding Capital Markets Union (CMU) action plans. The STS Regulation on securitization was adopted, and the Revision of the Directive and the Covered Bonds Framework (known as cédulas in Spain) was passed to boost both markets. In addition, the European Banking Authority (EBA) issued advice on a proposal to create an STS framework for synthetic securitization. Finally, a set of measures that will affect the prudential supervision of investment services companies and strengthen the coordination and powers of the European Supervisory Authorities were adopted.

On the other hand, sustainable finance is part of the capital markets union’s efforts to connect finance to the specific needs of the EU’s agenda on a carbon neutral economy. In 2018, the European Commission published its Action Plan on Sustainable Finance, and continued its development in 2019 with the presentation of the Reflection Paper: Towards a Sustainable Europe by 2030, the preparation of the first reports and the agreement of a common taxonomy. This initiative establishes a common language and is likely to become a classification tool to help investors and companies make environmentally friendly decisions. This taxonomy, which classifies economic activities, can be used for green products and also to identify investment products and strategies that actually finance sustainable activities. Furthermore, the European Parliament approved the proposed regulation to establish a framework that enables sustainable investment (on a provisional basis), and the Network of Central Banks and Supervisors for Greening the Financial System (NGFS) of which the European Central Bank (ECB), the Bank of Spain and the European Banking Authority (EBA), among others, are members, published its first report and its Sustainable and Responsible Investment Guide.

3. Regulation of digital transformation in the financial sector

The digital transformation of the financial sector continued to be a priority for the authorities in 2019, who continued to develop and implement the action plans and strategies outlined in 2018. In Europe, the EBA revised its guidelines on outsourcing, which together with other initiatives led by the European Commission, aim to create a harmonized framework at a European level to adopt cloud computing technology in the financial sector. In addition, the EBA and the other European supervisory authorities launched the European Forum for Innovation Facilitators, a network that aims to improve cooperation between national authorities on technological innovation issues in the financial sector. The new cybersecurity regulation, which strengthens the powers of the European Union Agency on this topic, also came into force. Furthermore, in Mexico, the financial authorities developed the bulk of a set of laws derived from the Fintech Law this year.

In addition, in 2019 most of the implementation of the technical standards of the new internal market Payment Services Directive in the internal market (PSD2) was carried out. This directive regulates access to customer payment accounts by third parties that may offer information-aggregation services and initiate payments. The main regulatory milestone in 2019 was the entry into force of third-party authentication and access obligations in September, resulting in increased security for electronic payments. However, some financial institutions will have a transitional period until December 31, 2020.

Another relevant development related to payments in Europe was the adoption of a new regulation to increase transparency in cross-border payments. This initiative is joined by the ECB and the European Commission’s main concern on how to develop pan-European payment solutions based on the instant payment infrastructure. In Spain, the regulatory framework that establishes the obligation of banks to offer basic payment accounts was completed in the first quarter of the year, and in December the transposal of PSD2 to the national legal framework was completed with the publication of a Royal Decree Law that establishes the legal framework for payment companies and a Ministerial Order that establishes the transparency requirements.

Digitization makes the storage, processing and exchange of large volumes of data possible. Once the regulatory framework for ensuring data privacy and integrity was implemented, which in Europe came into fruition with the General Data Protection Regulation (GDPR) - in force since May 2018, in 2019 the discussion focused on how to take advantage of data opportunities. Furthermore, the European Commission identified Artificial Intelligence (AI) as a priority, with the aim of increasing the competitiveness of the EU, for which a guide, with principles to ensure that European AI developments are reliable, was published.

Finally, in the field of crypto assets, the International Financial Action Group issued recommendations in June 2019 to address the risks of money laundering in this type of activity, especially as new players, including some financial institutions and large technology companies, announced their intention to join the market. In October, a working group led by the G7 published a report that analyzed the impact and regulatory fit of emerging initiatives in the field of so-called stable currencies or stablecoins, which share many traits with traditional crypto assets but seek to stabilize the price of the currency in different ways. Finally, in December, the European Commission and the Basel Committee issued consultation papers on a possible regulatory framework for crypto assets and on the prudential treatment of exposures of financial entities to them, respectively.

4. Reference indices

In 2019, the European institutions continued to work on reforming interest rate indices and transitioning to new alternative indices that are in line with the Reference Index Regulation (EU) 2016/1011. In October, the ECB began publishing the €STR (Euro short-term rate)1 , a short-term interest rate of the euro, reflecting the funding cost of euro-zone credit institutions for overnight deposits on the wholesale market. With regard to the EURIBOR, a new hybrid calculation methodology, which includes real transactions, was developed in 2019 to adapt to the new regulatory requirements. This new methodology was approved by the relevant authorities and there will be no need to modify existing contracts.

In the United Kingdom, the Bank of England has already reformed the SONIA (Sterling Overnight Index Average), and the term-SONIA (still pending) is expected to replace LIBOR GBP. Other countries such as the United States, Switzerland and Japan, also began to choose alternative indices to facilitate the transition toward an environment with a lower dependence on IBORs (interbank offered rates). For more information, see the section Regulatory and reputational risks - IBOR Reform within the Risk Management chapter of this Management Report.

1 The €STR will gradually replace the EONIA and will be calculated as a volume-weighted average of individual transactions in the European monetary market that 50 entities must report to the ECB on a daily basis under the Money Market Statistical Reporting Regulation (MMSR) 1333/2014.

5. Brexit

With regards to the outlook of the effect of Brexit on the European financial system, in 2019 work was carried out to develop contingency plans for both financial institutions and regulators (recognition of clearing houses, eligibility of debt instruments, among others).

After the approval of the withdrawal agreement between the United Kingdom and the European Union, the risk of a short-term No-deal Brexit has been eliminated, since the transition period will allow the institutions to operate under the current conditions. After having finished this period (December 31, 2020 or later if an extension, something that the British side has ruled out, will be agreed), the risk of a No-deal Brexit will occur again.

Therefore, 2020 will be a key year for determining how the future relationship between the United Kingdom and the European Union will be. As the time to negotiate a comprehensive trade deal, it is expected that the future relationship regarding financial services is based on an equivalence framework. The political statement that goes along with the withdrawal agreement includes references to the commitment from both sides to evaluate by the middle of the year the possibility to use equivalencies where it should be possible. This could be important to mitigate some of the consequences for the financial system, especially for such sensitive topics like the recognition of clearing houses.

Strategy and business model

BBVA’s Transformation Journey

BBVA boosted its transformation in 2015 with the definition of its purpose, six strategic priorities and the values that have led its strategy in the last years. BBVA’s aspiration was focused on strengthening the relationship with the customer, in order to obtain its trust, managing its finances through a simple and digital value proposition, offering the best customer experience.

In developing its transformation strategy, BBVA has achieved a relevant progress in the last years, which has been translated into excellent results in its main metrics.

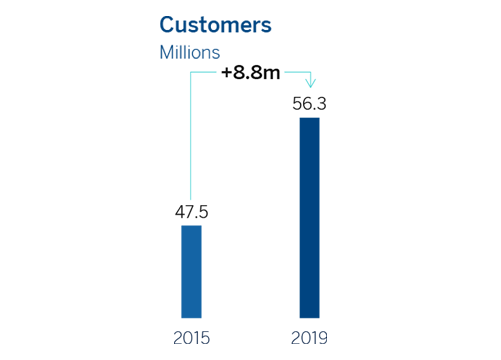

The client base has increased and today BBVA has more clients who are even more satisfied and loyal. Its commitment to the client is reflected in a growth of almost nine million (2015-2019) and in the leadership position in the satisfaction index (NPS) in most of the geographies.

Clientes activos Grupo BBVA (en millones)

(1) NPS Particulares y Empresas datos acumulados. Grupo Peer: España: Santander, CaixaBank, Bankia, Sabadell// México: Banamex, Santander, Banorte, HSBC // Argentina: Banco Galicia, HSBC, Santander Rio y Banco Macro // Colombia: Davivienda, Bancolombia, Banco de Bogotá // Perú: Interbank, BCP, Scotiabank // Uruguay: ITAU, Santander, Scotiabank //Turkey: Akbank, Isbank, YKB, Deniz, Finans.

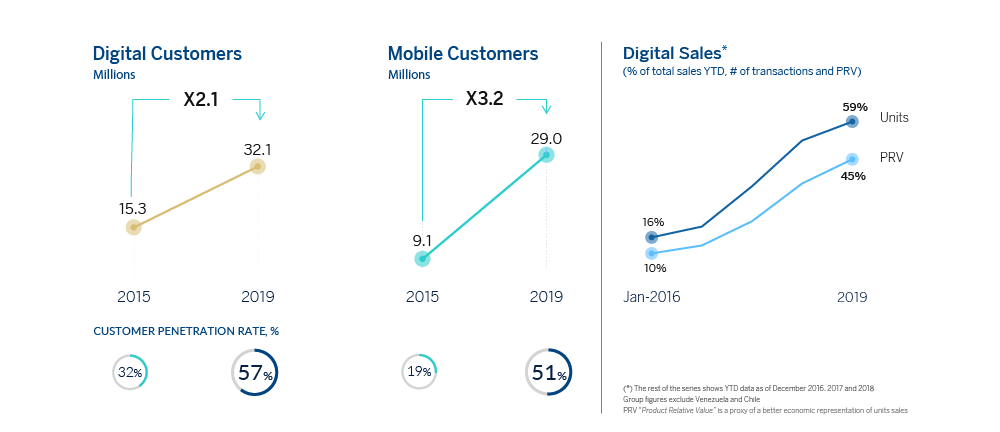

BBVA has also made significant advances in the digitization of its clients, relationship model and value proposition. Today, more than 50% of the clients regularly use the mobile channel to interact with BBVA, which indicates 2015’s figure has tripled.

Digital channels are accelerating sales growth and client acquisition. Digital sales represented in 2019, in terms of value, 45% of total sales, and almost 60% in units, versus levels of 10% and 16% respectively at the beginning of 2016.

Additionally, BBVA’s app has been considered the best mobile app globally in 2019, the third year in a row, according to Forrester Research, followed by Garanti BBVA’s app in second place.

BBVA is transforming its way of doing business and its corporate culture. The values are at the core of the strategy guiding the Group towards achieving its purpose. Also, BBVA has implemented tools for higher productivity, such as the Single Development Agenda, for the prioritization of resources in the execution of projects, and a new "Agile” organization model. Additionally, in 2019 BBVA adopted a common global brand in order to unify its name and corporate identity in its franchises and offer all its clients a unique value proposition and a homogeneous customer experience, which are distinctive aspects of a global company.

Evolution in the Strategic Priorities

In 2019, BBVA carried out a strategic review process to continue going in depth into its transformation and adapting itself to the major trends that are reshaping the world and the financial services industry:

- A challenging macroeconomic outlook, characterized by a rising uncertainty at a global level, lower economic growth, low interest rates, increasing regulatory requirements, geopolitical tensions and the emergence of new risks (cybersecurity, etc.).

- An evolution in clients’ behaviors and expectations. Clients demand more digital, simple and personalized value propositions, based on greater advice to make the best decisions.

- A strong competitive environment, where digitization is already a common priority for banks and the role of BigTech companies and ecosystems is rising as they are offering financial services within their global solutions with an excellent customer experience.

- The general concern in society is to achieve a sustainable and inclusive world. Climate change is a reality and all the stakeholders (consumers, companies, investors, regulators and public institutions) have set achieving a more sustainable world as a priority. The transition towards that sustainable world has major economic implications and the financial sector must play a very active role to ensure success of this evolution.

- Data has become a key differentiation factor and data management generates solid competitive advantages as it enables offering a customized value proposition, improves processes’ automation to enhance efficiency and reduces operational risks. Data also entails the management of new risks with relevant implications (privacy, security, ethics, etc.).

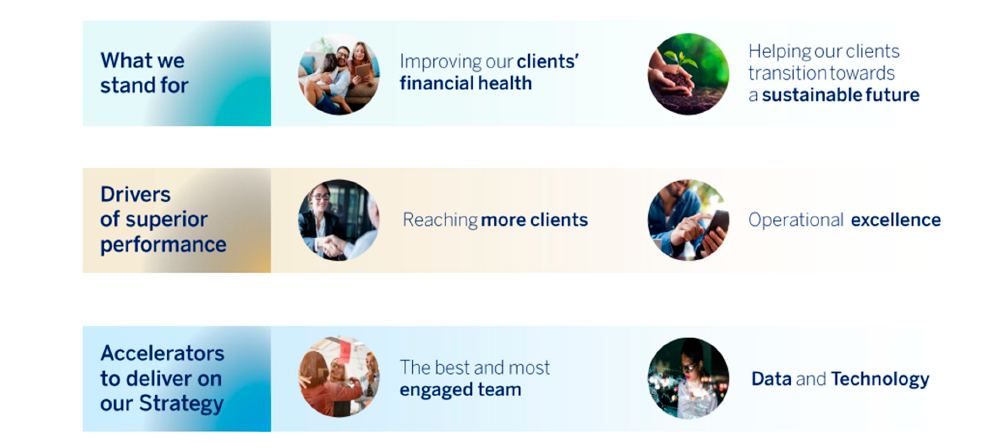

In this context, BBVA’s strategy has evolved with six strategic priorities which aim to accelerate and deepen the Group’s transformation and the achievement of its purpose.

BBVA’s new strategy is composed of three blocks and six strategic priorities.

1. Improving our clients’ financial health

Digitization allows a greater capacity to help clients manage their finances and, overall, to make better financial decisions, through personalized advice based on the use of data and artificial intelligence. BBVA aspires to be the trusted financial partner for its clients in the day-to-day management and control of their finances in order to help them improve their financial health and achieve their goals.

2. Helping our clients transition towards a sustainable future

The transition towards a sustainable economy is today a priority for all stakeholders. BBVA aims to play a relevant role in developing a more sustainable and inclusive world, as society demands, and helping its clients in the transition towards a more sustainable future.

Specifically, BBVA aims to make a significant contribution in the fight against climate change, helping its clients in the transition towards a low carbon emissions economy. Besides, BBVA is committed to support an inclusive economic development, both through its business and the various social programs fostered by the Group.

From a business standpoint, BBVA aspires to have an impact on its clients’ behavior, mainly focusing on the United Nations’ Sustainable Development Goals (SDGs) in which it can have more impact.

BBVA, as an organization, also aims to lead by example and is committed to meet its sustainable goals (“2025 Pledge”).

3. Reaching more clients

BBVA aims to accelerate its growth, positioning itself by being where clients are. In the current environment, growth requires a higher presence in digital channels, both its own channels and from third parties. Profitability will be a key factor, looking for profitable and sustainable growth in the most attractive segments.

4. Operational excellence

BBVA aims to provide an excellent customer experience at an efficient cost.

BBVA is focused on a relationship model leveraged on digitization, with the goal to have all its products and services digitally available so the commercial network can focus on advice and high value operations. Besides, BBVA is focused on an efficient and productive operating model with automated and simple processes from the use of new technologies and data analytics.

Operational excellence also implies strong management of all risks, both financial and non-financial, a relevant factor in the current dynamic environment.

The optimal capital allocation continues being a key factor in an environment in which capital is still an expensive and scarce resource with increasing regulatory requirements.

5. The best and most engaged team

The team continues to be a strategic priority for the Group. BBVA wants to continue boosting employee engagement and performance to achieve its purpose. By this, BBVA positions itself as an attractive place to work and for talent attraction.

BBVA is an organization which aspires to have its purpose and values at the core of its strategy and the employees’ day-to-day, with focus on topics such as diversity, equality and work-life balance.

6. Data and technology

Data management and new technologies are two clear accelerators to achieve the strategy and two generators of opportunities and competitive advantages.

On the one hand, data is key in generating a tangible impact in the business and the development of the value proposition. BBVA is carrying out several initiatives to achieve its objective of being a data driven organization. On the other hand, technology is an accelerator of value added solutions at an efficient cost.

Values

BBVA is engaged in an open process to identify the Group's values, which took on board the opinion of employees from across the global footprint and units of the Group. These Values define BBVA identity and are the pillars for making its purpose a reality:

Customer comes first

BBVA has always been customer-focused, but the customer now comes first before everything else. The Bank aspires to take a holistic customer vision, not just financial. This means working in a way which is empathetic, agile and with integrity, among other things.

- We are empathetic: we take the customer's viewpoint into account from the outset, putting ourselves in their shoes to better understand their needs.

- We have integrity: everything we do is legal, publishable and morally acceptable to society. We always put customer interests' first.

- We meet their needs: We are swift, agile and responsive in resolving the problems and needs of our customers, overcoming any difficulties we encounter.

We think big

It is not about innovating for its own sake but instead to have a significant impact on the lives of people, enhancing their opportunities. BBVA Group is ambitious, constantly seeking to improve, not settling for doing things reasonably well, but instead seeking excellence as standard.

- We are ambitious: we set ourselves ambitious challenges to have a real impact on people's lives.

- We break the mold: we question everything we do to discover new ways of doing things, innovating and testing new ideas which enables us to learn.

- We amaze our customers: we seek excellence in everything we do in order to amaze our customers, creating unique experiences and solutions which exceed their expectations.

We are one team

People are what matters most to the Group. All employees are owners and share responsibility in this endeavor. We tear down silos and trust in others as we do ourselves. We are BBVA.

- I am committed: I am committed to my role and my objectives and I feel empowered and fully responsible for delivering them, working with passion and enthusiasm.

- I trust others: I trust others from the outset and work generously, collaborating and breaking down silos between areas and hierarchical barriers.

- I am BBVA: I feel ownership of BBVA. The Bank's objectives are my own and I do everything in my power to achieve them and make our Purpose a reality.

The values are reflected in the daily life of all BBVA Group employees, influencing every decision.

The implementation and adoption of these values is supported by the entire Organization, including senior management, launching local and global initiatives which ensure these values are adopted uniformly throughout the Group.In 2019, the values and behaviors were included in all professional development model processes and the Talent & Culture policies, as well as actively present in the quarterly demos (SDA 2.0), both at the global scale and locally, reaching more than 500 shared initiatives to foster corporate culture.

One of the main hallmarks of BBVA is its purpose and values, as well as its status as a data-driven organization, which is to say that decisions are made based on data, ultimately in order to improve the customer experience. In 2019, the Bank made progress in strengthening its distinguishing features by holding the second edition of global Values Day, a milestone in BBVA’s culture that aims to celebrate, internalize and live its values. More than 82,000 employees participated in this online conference, via its web app, and 37,000 endeavored to showcase the Bank’s values with specific behaviors linked to the purpose, thereby compiling more than 10,000 case studies on how to apply the corporate culture. This edition of the conference was also used to reach out to customers, with over 16,000 opinions received, helping to understand the extent to which BBVA meets their current needs and how it can continue helping them in the future.

A new initiative was also created in 2019 to encourage an entrepreneurial attitude in the Group, which emerged from employee feedback on Values Day 2018. The name of this initiative is Values Challenge and it is a program aimed at making employees take an active part in the transformation of the Group, cooperating in the development of projects over a period of two months so that their ideas can be implemented at the Group. The first edition of the program held was attended by 500 employees from around the world.

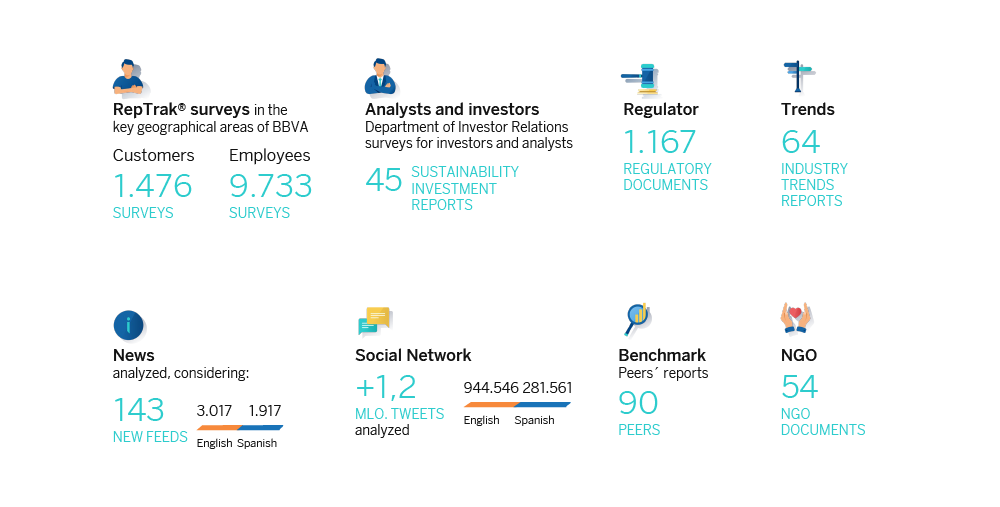

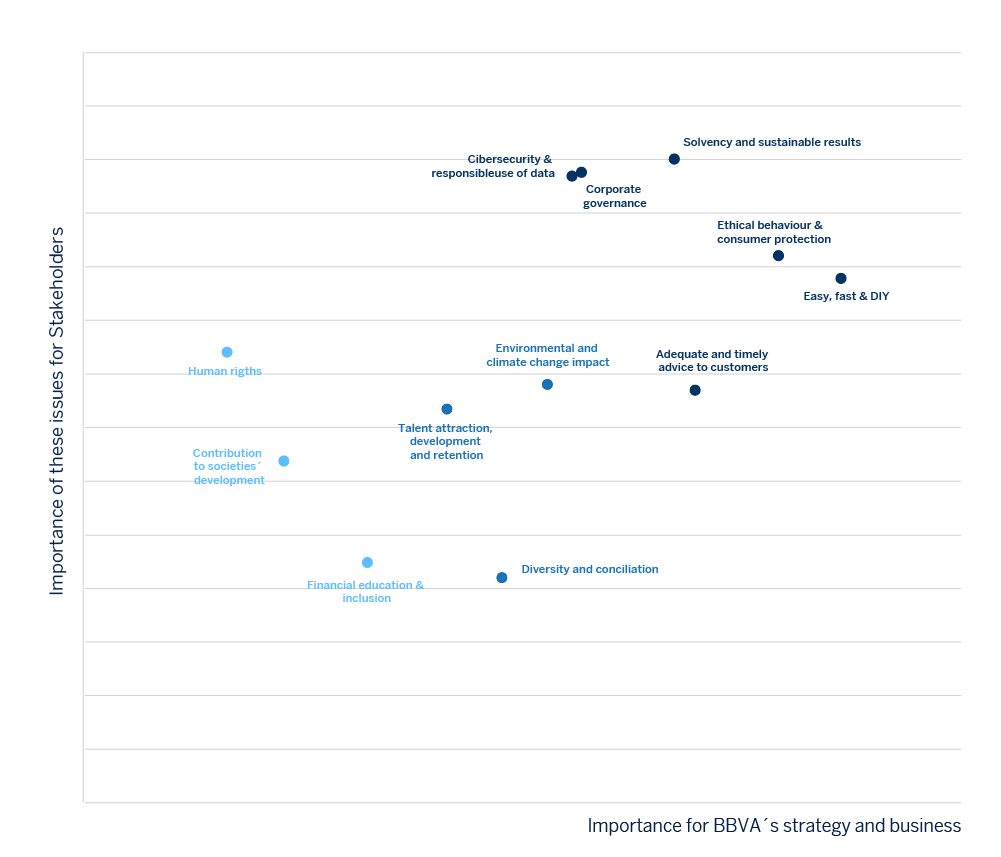

Materiality

In 2019, BBVA updated its materiality analysis with the intention of prioritizing the most relevant issues for both its key stakeholders and its business. The materiality matrix is one of the sources that feeds the Group's strategic planning and determines the priority issues to report on.

This analysis included this year, specifically issues relevant to BBVA in Turkey. Therefore, the 2019 analysis includes the material issues of Spain, Mexico, the United States, Turkey, Argentina, Colombia, Peru and Venezuela.

The materiality analysis phases have been as follows:

- 1. Verification of the validity of the list of relevant issues that were identified last year, based on information from the usual listening and dialog tools.

- 2. Prioritization of issues according to their importance for stakeholders following last year’s methodology. BBVA carried out a series of interviews and ad-hoc surveys in the countries covered by the study in order to learn the priorities of various stakeholders (customers, employees, investors). Datamaran was used as a data analysis tool for other stakeholders in all countries except Turkey, where local Turkish sources were used. Together, the sources that made it possible to complete the analysis of stakeholders, global trends and key issues in the sector are:

- 3. Prioritization of issues according to their impact on BBVA’s business strategy. The strategy team has assessed how each issue impacts the six Strategic Priorities. The most relevant issues for BBVA are those that help to achieve its strategy as well as possible.

The result of this analysis is contained in the Group's materiality matrix.

Therefore, the six most relevant issues are:

- Solvency and sustainable results: Stakeholders expect BBVA to be a robust and solvent bank with sustainable results, thus contributing to the stability of the system. They demand a business model that responds to changes in the context: disruptive technologies, new competitors, geopolitical issues, etc.

- Ethical behavior and consumer protection: Stakeholders expect BBVA to behave in a comprehensive manner and to protect clients or depositors by acting transparently, offering products that are appropriate to their risk profile and managing the ethical challenges presented by certain new technologies with integrity.

- Easy, fast and do it yourself (DIY): Stakeholders expect to work with BBVA in an agile and simple way, at any time and from anywhere, leveraging the use of new technologies that will allow for greater operational efficiency, generating value for shareholders.

- Adequate and timely advice to customers: Stakeholders expect BBVA to provide appropriate solutions to customers’ personal needs and circumstances and to proactively help them in the management of their finances and their financial health while providing proactive and excellent customer service.

- Cybersecurity and responsible use of data: Stakeholders expect their data to be secure at BBVA and for it to be used only for agreed purposes, always complying with current law. This is essential to maintain trust.

- Corporate governance: Stakeholders expect BBVA to have strong corporate governance with an adequate composition of governance bodies, solid decision-making processes, accountability and control processes, which are all well documented.

Information on the Group's performance in these relevant matters in 2019 is reflected in the various chapters of this Management Report.

Responsible banking

At BBVA we have a differential banking model, based on seeking out a return adjusted to principles, strict legal compliance, best practices and the creation of long-term value for all stakeholders. It is reflected in the Bank's Corporate Social Responsibility Policy. The policy's mission is to manage the responsibility for the Bank's impact on people and society, which is key to the delivery of BBVA's purpose.

All the Group’s business and support areas integrate this policy into their operational models. The Responsible Business Unit coordinates the implementation and basically operates as a second line for defining standards and offering support.

The four pillars of BBVA's responsible banking are as follows:

- Balanced relations with its customers, based on transparency, clarity and responsibility.

- Sustainable finance to combat climate change, respect human rights and achieve the UN Sustainable Development Goals (SDGs).

- Responsible practices with employees, suppliers and other stakeholders.

- Community investment to promote social change and create opportunities for all.

In 2018, BBVA approved its 2025 Pledge to climate change and sustainable development to contribute to the achievement of the Sustainable Development Goals (SDGs) and aligned with the Paris Agreement. This commitment is described in the Sustainable finance chapter.

Customer relationship

Solutions for customers

In recent years, BBVA has focused on offering the best customer experience, distinguished by its simplicity, transparency and speed, and increasing the empowerment of customers and offering them a personalized advice.

In order to continue improving customer solutions, the Group’s value proposition evolved throughout the year 2019 around seven axis on which global programs were developed, related to both retail projects and companies projects:

- Growth in customers through own and third-party channels.

- Growth in revenue with a focus on profitable segments.

- Value proposition - Differentiation through customer advice.

- Operational efficiency.

- Data-focused capabilities and enablers.

- New Business Models.

- A Global Entity.

These solutions can be divided into two large groups: Those that allow the customer to access the services in a more convenient and simple way (Do it yourself - DIY) and those that provide customers with personalized advice, offering them products or information specific to their current situation. These last two items are particularly important in the new strategic related to the commitment to improve customers’ financial health.

Solutions for customers in 2019 include the following:

- The DIY mobile banking platform GLOMO stands out in the retail banking (individuals and SMEs) area. This solution is constantly being improved by features such as 100% digital registration: Using biometrics, the user can be identified from one of their unique physical characteristics, such as the face, voice or fingerprint, and this makes the digital registration process simpler and easier. At the same time, this platform allows us to offer advice solutions, maximizing the number of customers reached. Examples of these solutions include Program your account, which allows customers to set rules in managing their finances, or My Travel, a digital solution available in Spain and Uruguay, which allows customers to control their travel expenses via a custom dashboard.

- BBVA has solutions for companies, which allow clients to interact with the Bank as legal entities in the manner that most suits their needs. One of these solutions is the Digital Client Acquisition (DCA), a fully digital enterprise registration process for SMEs, that allows opening a fully operational account and digital channel in just 10 minutes, thanks to the use of the Spanish legal digital certificate or “Netcash”, an application that has been launched in several countries.

BBVA’s customer solutions are leveraged on the improvement of design capabilities and the use of data for analysis. They also contribute positively to increasing digital sales and improving the main customer satisfaction indicators, such as the Net Promoter Score (NPS), shown in the following section, and the drop-out ratio.

BBVA therefore occupies the first positions in the NPS, which is reflected in the retention data, which show a positive evolution in the levels of customer drop-outs (retail customers and SMEs) and a greater commitment from digital customers, whose drop-out rate is 49.7% lower than non-digital customers.

Likewise, the data of Group total active customers is also showing a positive trend with an increase of 3.1 million in 2019 (+8.8 million since 2015), with positive developments in all the countries in which BBVA is present.

Net Promoter Score

The internationally recognized Net Promoter Score (NPS) methodology, measures customers’ willingness to recommend a company and therefore, the level of satisfaction of BBVA’s customers with its different products, channels and services. This index is based on a survey that measures on a scale of zero to ten whether a bank’s customers are promoters (a score of nine or ten), passives (a score of seven or eight) or detractors (a score of zero to six) when asked if they would recommend their bank, a specific channel or a specific customer journey to a friend or family member. This information is vital for checking for alignment between customer needs and expectations and implemented initiatives, establishing plans that eliminate detected gaps and providing the best experiences.

The Group’s consolidation and application of this methodology over the last nine years has led to a steady increase in customers’ level of trust, as they recognize BBVA to be one of the most secure and recommendable banking institutions in every country where it operates.

As of December 2019, BBVA ranked first in the retail NPS indicator in six countries: Spain, Mexico, Argentina, Colombia, Peru and Paraguay, and second in Turkey and Uruguay, while in the commercial NPS indicator BBVA ranked the leading position in six countries: Mexico, Argentina, Colombia, Peru, Paraguay and Uruguay.

Transparent, Clear and Responsible Communication

Transparency, Clearness and Responsibility (TCR) are three principles that are systematically integrated into the design and implementation of the main solutions, deliverables and experiences for customers.

The objectives pursued are designed to help customers make good life decisions, maintain and increase their confidence in the Bank and increase their recommendation rates.

Three work lines have been developed to turn these principles into reality:

- Implementing the TCR principles in new digital solutions through the participation of TCR experts in the conceptualization and design of these solutions, especially in massive impact solutions for retail customers (mobile apps, digital contracting processes, consumer finance solutions, etc.).

- Incorporating the TCR principles into the creation and maintenance of key content for customers (product sheets, contracts, sales scripts and responses to claim letters).

- Awareness raising and training on TCR throughout the Group, through workshops, online training and a virtual community.

After the advances in transparency and clarity in recent years, the emphasis in 2019 was on promoting financial health, particularly in new digital solutions. Financial health is defined as the dynamic relationship between health and personal finance and is reached when the individual makes decisions and adopts behaviors, routines and habits that allow them to be in a better financial situation to overcome crises and achieve their objectives. Financial and economic resources affect physical and social wellness.

The project is coordinated by a global team working together with a network of local owners located in the main countries in which the Group is present, and various departments and individuals from the Entity participate in its implementation.

Indicators

BBVA uses an indicator, the Net TCR Score (NTCRS), which is calculated following the same methodology of the NPS and allows measuring the degree to which customers perceive BBVA as a transparent and clear bank, compared to its peers, in the main countries where the Group is present. As of December 2019, BBVA ranked first in the NTCRS indicator in five countries: Spain, Argentina, Peru, Uruguay and Paraguay, and the second in Mexico, Turkey and Colombia.

In 2019, a financial health indicator, Net Financial Health Score (NFHS) was incorporated, which, like the previous one, is calculated following the same methodology of the NPS and allows measuring the degree to which customers perceive if BBVA supports them in looking after their personal finances compared to its peers. As of December 2019, BBVA ranked first in the NFHS indicator in four countries: Spain, Mexico, Colombia and Peru, and second in Turkey and Argentina. This indicator is on implementation phase in Uruguay and Paraguay.

Customer care

Complaints and claims

BBVA has a claims management model based on two key aspects: the agile resolution of claims and, most importantly, the analysis and eradication of the causes’ origin. This model is part of the BBVA Group’s overall customer experience strategy, having a very significant impact on improving the different customer journeys and positively transforming the customer experience.

In 2019, the Group’s various claims units worked to reduce response times, improve clarity of such responses and proactively identify potential problems to prevent them from becoming a cause of large claims. BBVA seeks to find a quick solution to problems with the aim of improving customer confidence through a simple and agile experience and with a clear and personalized response.

In short, the management of complaints and claims at BBVA is an opportunity to strengthen customers’ confidence in the Group.

Main indicators of claims (BBVA Group)

| 2019 | 2018 | |

|---|---|---|

| Number of claims before the banking authority for each 10.000 active customers | 8.69 | 9.40 |

| Average time for setting claims (natural days) | 6 | 7 |

| Claims settled by First Contact Resolution (FCR) (% over total claims) | 23 | 26 |

The volume of claims for every 10,000 active customers registered in 2019 decreased by 2.7% compared to the 2018 figure, basically as a result of the improvements implemented in the claims management process in the Group, especially in Spain and in Mexico. The latter country, as a consequence of its largest customer base, is the one that records the largest number of claims.

Claims before the banking authority by country (Number for each 10.000 active customers) (1)

| 2019 | 2018 | |

|---|---|---|

| Spain | 1.48 | 3.54 |

| The United States | 4.08 | 4.56 |

| Mexico | 14.63 | 17.94 |

| Turkey | 4.46 | 4.03 |

| Argentina | 0.09 | 1.11 |

| Colombia | 33.51 | 21.56 |

| Peru | 4.05 | 1.19 |

| Venezuela | 0.16 | 0.47 |

| Paraguay | 0.07 | 1.19 |

| Uruguay | 0.40 | 0.68 |

| Portugal | 14.52 | 21.92 |

Scope: BBVA Group.

(1) The banking authority refers to the external body in which the customers can complain against BBVA.

The Group’s average claim resolution time improved at 6 days in 2019, with an improvement of 1 day, specifically in Spain, the United States and Peru.

Average time for setting claims by country (Natural days)

| 2019 | 2018 | |

|---|---|---|

| Spain | 8 | 10 |

| The United States | 3 | 5 |

| Mexico | 6 | 5 |

| Turkey | 4 | 2 |

| Argentina | 8 | 7 |

| Colombia | 6 | 5 |

| Peru | 7 | 9 |

| Venezuela | 16 | 14 |

| Paraguay | 11 | 6 |

| Uruguay | 8 | 7 |

| Portugal | 3 | 3 |

Claims settled by the First Contact Resolution (FCR) model, which consists in the resolution of the claim in the first notice, and account for 23% of total claims, thanks to the fact that the management and handling of these claims aims to reduce resolution times and increase the service quality, thus improving the customer experience.

Claims settle by first contact resolution (FCR. percentage over total claims)

| 2019 | 2018 | |

|---|---|---|

| Spain (1) | n.a. | n.a. |

| The United States | 46 | 54 |

| Mexico | 21 | 30 |

| Turkey (2) | 35 | 38 |

| Argentina | 48 | 21 |

| Colombia | 37 | 69 |

| Peru | 5 | 8 |

| Venezuela | n.a. | n.a. |

| Paraguay | n.a. | 39 |

| Uruguay | 14 | 14 |

| Portugal (3) | n.a. | n.a. |

n.a. = not applicable.

(1) In Spain, a FCR type called IRR (Inmediate Resolution Response) applies to credit card incidents, but not to claims.

(2) In Turkey, the weighting is calculated by the total number of customers.

(3) This kind of management does not apply in Portugal.

Customer Care Service and Customer Ombudsman in Spain

In 2019, the activities of the Customer Care Service and Customer Ombudsman were carried out in accordance with the stipulations of Article 17 of the Ministerial Order (OM) ECO/734/2004, dated March 11, of the Ministry of Economy, regarding customer care and consumer ombudsman departments of financial institutions, and in compliance with the competencies and procedures outlined in BBVA Group’s Regulation for Customer Protection in Spain, approved on July 23, 2004 by the Bank’s Board of Directors, and subsequent modifications, the last one being at the end of 2019 with regard to regulation of the activities and competencies, complaints and claims related to the Customer Care Service and Customer Ombudsman.

Based on the above regulations, the Customer Care Service is in charge of handling and resolving customers’ complaints and claims regarding products and services marketed and contracted in Spanish territory by BBVA Group entities.

On the other hand, and in accordance with the aforementioned regulation, the Customer Ombudsman is made aware of and resolves, in the first instance, all complaints and claims submitted by the participants and beneficiaries of the pension plans. It also resolves those related to insurance and other financial products that BBVA Group Customer Care Service considers appropriate to escalate, based on the amount or particular complexity, as established under article 4 of the Customer Protection Regulation. And in the second instance, the Customer Ombudsman is made aware of and resolves the complaints and claims that the customers decide to submit for their consideration after their claim or complaint has been dismissed by the Customer Care Service.

Activity report on the Customer Care Service in Spain

The Customer Care Service works to detect recurring, systemic or potential problems in the Entity, in compliance with European claims guidelines established by the relevant authorities, the ESMA (European Securities Market Authority) and the EBA (European Banking Authority). Its activity, therefore, goes beyond merely managing claims, but rather, it works to prevent them and in cooperation with other BBVA departments.

The main types of claims received in 2019 have been, as in previous years, related to mortgage loans. Furthermore, the Customer Care Service team conducted a training course this year on Law 5/2019 of March 15, which regulates real estate credit contracts. The aim was to gain an understanding of the new features of the law and thus ensure the managers have an adequate understanding of it.

Claims of customers admitted to BBVA’s Customer Care Service in Spain amounted to 85.879 cases in 2019, 82.531 of which were resolved by the Customer Care Service itself and concluded in the same year, which represents 96% of the total. As of December 31, 2019, 3.348 were pending analysis. On the other hand, 17.128 claims were not admitted for processing as they did not meet the requirements set out in OM ECO/734. 35% of the claims received corresponded to mortgage loans, mainly mortgage arrangement expenses.

Complaints handled by the customer care service by complaint type (Percentage)

| Type | 2019 | 2018 |

|---|---|---|

| Resources | 35 | 29 |

| Assets products | 24 | 39 |

| Insurances | 3 | 3 |

| Collection and other services | 5 | 5 |

| Financial counselling and quality service | 5 | 4 |

| Credit cards | 16 | 13 |

| Securities and equity portfolios | 1 | 1 |

| Other | 11 | 6 |

| Total | 100 | 100 |

Complaints handled by the customer care service according to resolution (Number)

| 2019 | 2018 | |

|---|---|---|

| In favor of the person submiting the complaint | 38,045 | 25,970 |

| Partially in favor of the person submitting the complaint | 11,449 | 18,563 |

| In favor of the BBVA Group | 33,037 | 37,093 |

| Total | 82,531 | 81,626 |

Activity report of the Customer Ombudsman in Spain

One more year, the Customer Ombudsman, along with the BBVA Group, once more achieved the objective of unifying criteria and favoring customer protection and security, making progress in compliance with transparency and customer protection regulations. In order to efficiently translate their observations and criteria on the matters submitted for their consideration, the Ombudsman promoted several meetings with the Group’s areas and units: Insurance, Pension Plan Management, Business, Legal Services, etc.

In this sense, the Customer Ombudsman has been holding a Claims follow-up committee on a monthly basis, with the main objective of keeping a permanent dialog with the BBVA Services that contribute to positioning the Group in relation to its customers. The Directors of Quality, Legal Services and the Customer Care Service attend this committee. Likewise, the Customer Ombudsman participates in the Transparency and good practices committee, in which the Bank’s actions are analyzed, in order to adapt them to the regulations on transparency and good banking practices and standards.

In 2019, 3,330 customer claims were filed at the Customer Ombudsman Office (compared to 3,020 in 2018). Of these, 70 were not admitted to processing due to a failure to comply with the requirements of OM ECO/734/2004 and 207 were pending as of December 31, 2019.

Complaints handled by the customer ombudsman office by complaint type (Number)

| Type | 2019 | 2018 |

|---|---|---|

| Insurance and welfare products | 808 | 753 |

| Assets operations | 794 | 709 |

| Investment services | 173 | 146 |

| Liabilities operations | 515 | 753 |

| Other banking products (credit card, ATMs, etc.) | 707 | 437 |

| Collection and payment services | 140 | 106 |

| Other | 193 | 116 |

| Total | 3,330 | 3,020 |

The categorization of the claims managed in the previous table follows the criteria established by the Complaints Department of the Bank of Spain, in its requests for information.

Complaints handled by the customer ombudsman office according to resolution (Number)

| 2019 | 2018 | |

|---|---|---|

| In favor of the person submiting the complaint - Formal resolution | - | - |

| Partially in favor of the person submitting the complaint - Estimate (in whole or in part) | 1,794 | 1,482 |

| In favor of the BBVA Group - Dismissed | 1,259 | 1,290 |

| Processing suspended | - | 1 |

| Total | 3,053 | 2,773 |

57.4% of customers who brought claims before the Customer Ombudsman during the course of the year obtained some type of satisfaction, total or partial, by resolution of the Customer Ombudsman Office in 2019. Customers who are not satisfied with the Customer Ombudsman’s response can go to the official supervisory bodies (the Bank of Spain, the CNMV and General Directorate of Insurance and Pension Funds). 274 claims were filed by customers to supervisory bodies in 2019.

The BBVA Group continues making progress in the implementation of the different recommendations and suggestions of the Customer Ombudsman with regard to adapting products to the customer profiles and the need for transparent, clear and responsible information throughout the year. In 2019, these recommendations and suggestions focused on raising the level of transparency and clarity of the information that the Group provides for its customers, both in terms of commercial offers available to them for each product, and in compliance with the orders and instructions thereof, so that the following is guaranteed:

- an understanding by customers of the nature and risks of the financial products offered to them,

- the suitability of the product for the customer profile, and

- the impartiality and clarity of the information that the Entity targets at customers, including advertising information.

In addition, and with the advance in the digitalization of the products offered to customers together with the increasing complexity thereof, special sensitivity is required with certain groups that, due to their profile, age or personal situation, present a certain degree of vulnerability.

Technology and innovation

BBVA aspires to be the most trusted Bank to give financial advice to all of its customers. To achieve this goal, technology plays a key role, making available to the business areas the necessary capacities to meet this challenge and offering customers reliable and secure solutions. Thus, technology allows to offer reliable and secure solutions to all customers, from the most digitized to the most traditional. This strategy is focused on incorporating the new capabilities that technology offers in BBVA to make them available to customers while operating in the most efficient and reliable way possible. All this through four lines of action:

- Reliability and productivity, that is, to obtain the best technological performance and to do it reliably, guaranteeing the highest quality standards,

- Based on our new technological stack that allows us to offer customers the most advanced technology and the most adjusted service to their needs in a timely manner,

- Dispose of a strong cybersecurity strategy to face the increase in cybercrime threats,

- Help BBVA achieve operational excellence through initiatives to streamline and automate processes.

Reliability and productivity