Non-financial Information Report

- Environment

- Strategy and business model

- Customer comes first

- Technology and innovation

- The best and most engaged team

- Ethical behaviour

- Sustainability at BBVA

- Contribution to society

- Contents index of the Law 11/2018

- Contents index of the GRI Standards

- Contents index of the UNEP FI Principles for responsible banking

Pursuant to Law 11/2018 of December 28, modifying the Commercial Code, the revised text of the Capital Companies Law approved by Royal Legislative Decree 1/2010 of July 2, and Law 22/2015 of July 20 on Accounts Auditing, regarding non-financial information and diversity (hereinafter, Law 11/2018), BBVA presents a non-financial information report that includes, but is not limited to: the information needed to understand the performance, results, and position of the Group, and the impact of its activity on environmental, social, respect for human rights, and the fight against corruption and bribery matters, as well as employee matters.

In this context, BBVA prepares the Consolidated Non-financial information report in the Group's Management Report, which is attached to the Consolidated Financial Statements for the 2020 fiscal year as covered in the article 49.6 of the Commercial code introduced by Law 11/2018.

Reporting of the non-financial key performance indicators included (KPI) in this consolidated non-financial information report is performed using the GRI (Global Reporting Initiative) guide as an international reporting framework in its exhaustive option.

In addition, for the preparation of the non-financial information contained in this Management Report, the Group has considered the Communication from the Commission of July 5, 2017 on Guidelines on non-financial reporting (methodology for reporting non-financial information, 2017/C 215/01).

In relation to the COVID-19 pandemic, specific sections have been included throughout, which describe how the outbreak of the pandemic has affected the development of BBVA Group's activities. In addition, in compliance with the recommendations issued by the European Securities and Markets Authorities (ESMA) throughout 2020, specific disclosures have been included in relation to this issue throughout this report.

The information included in the consolidated non-financial information report is verified by KPMG Auditores, S.L., in its capacity as independent provider of verification services, in accordance with the new wording given by Law 11/2018 to article 49 of the Commercial Code.

Environment

Macro and industry trends

The Global economy is being severely affected by the COVID-19 pandemic. Supply, demand and financial factors caused an unprecedented fall in GDP in the first half of 2020. Supported by strong fiscal and monetary policy measures, as well as greater control over the spread of the virus, global growth rebounded more than expected in the third quarter, before slowing down in the fourth, when the number of infections rose again in many regions, mainly in the United States and Europe. As for 2021, the unfavorable evolution of the pandemic is expected to adversely affect activity in the short term, while new fiscal and monetary stimuli, as well as the administering of coronavirus vaccines, are expected to support recovery from mid-year onwards.

Following the massive fiscal and monetary stimuli to support economic activity and reduce financial tensions, government debt has increased across the board and interest rates have been cut, and are now at historical low levels. Additional countercyclical measures may be required. Similarly, a significant reduction in current stimuli is not expected, at least until the recovery takes hold.

Tensions in the financial markets have moderated rapidly since the end of March 2020, following the decisive actions taken by the main central banks and the fiscal packages announced in many countries. In recent months, the markets have shown relative stability and, at certain times, risk-taking movements. Likewise, progress related to the development of COVID-19 vaccines and prospects for economic recovery should pave the way for financial volatility to persist at relatively low levels in general going forward.

BBVA Research estimates that global GDP contracted by around 2.6% in 2020 and will expand by around 5.3% in 2021 and 4.1% in 2022. Activity will recover gradually and heterogeneously among countries. Various epidemiological, financial and geopolitical factors are also contributing to the persistent exceptionally high uncertainty.

GLOBAL GDP GROWTH AND INFLATION (REAL PERCENTAGE GROWTH)

| 2020 | 2021 | |||

|---|---|---|---|---|

| GDP | Inflation | GDP | Inflation | |

| World | (2.6) | 3.4 | 5.3 | 3.3 |

| Eurozone | (7.3) | 0.3 | 4.1 | 0.8 |

| Spain | (11.0) | (0.3) | 5.5 | 0.7 |

| The United States | (3.6) | 1.3 | 3.6 | 2.6 |

| Mexico | (9.1) | 3.4 | 3.2 | 3.3 |

| South America (1) | (6.8) | 8.8 | 4.7 | 10.4 |

| Turkey | 1.0 | 14.6 | 5.0 | 10.5 |

| China | 2.2 | 2.5 | 7.5 | 1.7 |

Source: BBVA Research estimates.

(1) It includes Argentina, Brazil, Chile, Colombia and Peru.

With regard to the banking system, in an environment in which much of the economic activity has been at a stand still for several months, the services provided have played an essential role, basically for two reasons: firstly, the banks have ensured the proper functioning of collections and payments for households and companies, thereby contributing to the maintenance of economic activity; secondly, the granting of new lending or the renewal of existing lending has reduced the impact of the economic slowdown on household and business income. The support provided by the banks over the months of lockdown and public guarantees have been essential in softening the impact of the crisis on companies' liquidity and solvency, meaning that banking has become its main source of funding for most companies.

In terms of profitability, European and Spanish banking have deteriorated, primarily because many entities recorded high provisions for impairment on financial assets in the first two quarters of 2020 as a result of the worsening macroeconomic environment following the pandemic outbreak. Pre-pandemic profitability levels remained far from the levels prior to the previous financial crisis. This is in addition to the accumulation of capital since the previous crisis and the very low interest rate environment that we have been experiencing for several years. Nevertheless, the banks are facing this situation from a healthy position and with solvency that has been constantly increasing since the 2008 crisis, with reinforced capital and liquidity buffers and, therefore, with a greater lending capacity.

Europe

In Europe, the European Commission (hereinafter EC) approved the European Recovery Fund (Next Generation EU, hereinafter NGEU) in the amount of €750,000m (5.4% of EU GDP), through subsidies and loans to support investment and reforms. The NGEU is an important step in supporting the recovery that could increase the EU GDP between about 1.5 and 2% above the trajectory predicted for 2024, according to EC estimates, but also poses a challenge in terms of absorbing resources and investing in effective projects. Furthermore, the extension of support measures by countries to the most affected sectors is expected to continue in the first quarter of 2021 at the least. For its part, the European Central Bank (hereinafter the ECB) approved a package of accommodative measures at its December meeting. In particular, it expanded the pandemic emergency purchase program (PEPP) and extended the purchasing timeline until at least March 2022, readjusted the conditions of the TLTRO III liquidity auctions, and expanded the measures to relax eligibility criteria for collateral. In terms of growth, following a rebound in the Eurozone GDP of up 12.5% quarterly in the third quarter of 2020, the resurgence of COVID-19 infections since the fall, and the consequent stricter social restrictions in general, are negatively affecting activity in the fourth quarter of 2020 and are likely to extend into the first half of 2021. The new lockdown measures are, however, more selective, and both manufacturing and exports appear to be more resilient, which is also thanks to recovery in global demand, especially from China. This could partially offset the sharp decline in activity in the consumer and service sectors. BBVA Research expects Eurozone's GDP to contract around 2.5% in the fourth quarter of 2020, resulting in an annual fall in GDP of 7.3% in 2020, while weaker stimulus in the first half of 2021 should result in slower-than-expected recovery for the year as a whole (4.1%), though vaccine distribution and the EU fiscal program should underpin growth from the second half of 2021 and in 2022 (4.4%). Moreover, national fiscal policies, the extension of support measures to the most affected sectors and support from the ECB should prevent more-persistent negative effects, which could arise in supply, but also in weaker demand or increased financial tensions.

Spain

In terms of growth, according to BBVA Research estimates, Spanish GDP could contract 11.0% in 2020 and grow by 5.5% in 2021. With regard to 2020, performance in the third quarter was somewhat better than expected in terms of activity, but Spain's GDP was close to stagnation in the fourth quarter. BBVA Research predicts that accelerated economic activity in the second half of this year will lead to 7% GDP growth in 2022, assuming that both private consumption and investment (public and private) benefit from the mass vaccination campaign, from expansionary fiscal policy and from favorable financing conditions. Mass vaccinations will result in reduced health uncertainty, eased restrictions on the mobility of workers and families, and will allow businesses in the service sector to open. These factors will be key to boosting consumption and reducing savings accumulated during the crisis period. The funds associated with NGEU will have an increasing impact over time, especially on investment, which will also contribute to economic acceleration. Estimates of the impact that these funds will have on the economy continue to point to a significant effect in 2021 and the next two years (1.5 percentage points on average per year).

As regards the banking system, according to the latest Bank of Spain data available, the total volume of lending to the private sector recovered slightly in October 2020 (up +2.4% year-on-year) as a result of the growth of new business lending transactions since April, within the framework of the public guarantee programs launched by the government to combat COVID-19. For their part, asset quality indicators have continued to improve (the NPL ratio was 4.57% in October 2020). Profitability entered negative ground in the first nine months of 2020 due to the increase in provisions resulting from the coronavirus crisis and, more importantly, the extraordinary negative results recorded in the first half of the year associated with the deterioration of goodwill in some entities. In addition, the low interest rate environment has kept profitability under pressure. Spanish institutions maintain comfortable levels of capital adequacy and liquidity.

United States

After contracting by 9.0% in the second quarter of the year compared to the previous quarter, GDP increased by 7.4% in the third quarter, above expectations. Activity indicators suggest that the recovery process slowed significantly in the fourth quarter of 2020, in an environment of a sharp increase in COVID-19 infections. In 2021 the progressive vaccination of the population and the highly expansionary fiscal and monetary policies are expected to provide increasing support for economic activity. The Federal Reserve will most likely remain committed to supporting financial stability and the recovery process, mainly through its zero interest rate policy and asset purchase program. Counter-cyclical fiscal measures, which already amount to around 23% of GDP, could soon be expanded. According to BBVA Research estimates, GDP could expand by 3.6% in 2021 and 2.4% in 2022, after falling by around 3.6% in 2020. Meanwhile, the unemployment rate is expected to reach 5.4% at this year-end and 4.8% at next year end, well below the 14.7% rate recorded in April 2020 after the first wave of COVID-19 infections impacted the economy, though still above the average unemployment rate of 3.7% observed in 2019. Likewise, GDP and unemployment could improve more than expected if the newly elected Administration and Congress adopt additional fiscal stimulus measures.

In the banking system as a whole, the most recent activity data provided by the Fed (November 2020) shows the effects of the programs launched to combat COVID-19, with year-on-year lending and deposit growth rates of 3.63% and 20.37% respectively for the system. NPLs remain under control, with the NPL ratio standing at 1.58% in the third quarter of 2020.

Mexico

Following a rebound in growth during the third quarter of the year, Mexico's economic recovery slowed in the last quarter, which was also influenced by the announcement of new mobility restrictions during November and December. BBVA Research estimates that the Mexican economy will contract by 9.1% in 2020 and will grow by 3.2% in 2021. In this sense, the lack of sufficient fiscal stimuli can result in slow recovery. On the other hand, Mexico has acquired vaccine doses from different suppliers, which implies an impetus for economic activities to resume. In terms of inflation, this will remain close to the center of the Bank of Mexico's target range, and BBVA Research estimates that the central bank will continue with the decreasing cycle of monetary policy rate gradually in February from the current 4.25% to 3.5% in May 2021.

Regarding the banking system, according to CNBV data as of November 2020, loans decreased by 0.79%, whereby an increase was only observed in the mortgage portfolio, while deposits increased by 11.4% year-on-year (demand and term deposits). The NPL ratio increased year-on-year (4.01% in November 2020) and capital indicators were comfortable.

Turkey

For Turkey, BBVA Research estimates that GDP grew by 1% in 2020, and is expected to increase by 5.0% in 2021 and by 4.5% in 2022. GDP in the third quarter of 2020 grew more than expected and the services sector contributed positively, while other key sub-sectors also showed a strong rebound. The central bank (CBRT) continued to tighten its monetary policy through various different channels in the third quarter of 2020. But in November, at its monetary policy meeting following the appointment of a new governor, CBRT raised the official interest rate (one-week repo) by 475 basis points to 15% and reinforced this stance at the December monetary policy meeting by raising the policy rate another 200 basis points to 17%. BBVA Research predicts that CBRT will start to lower rates gradually in the fourth quarter of 2021. Inflation estimates have been adjusted to 10.5% for 2021.

Based on data from November 2020, the total volume of lending in the banking system increased by 38.4% year-on-year. These growth rates include the effect of inflation. The NPL ratio stood at 3.97% at the close of November 2020.

Argentina

In Argentina, GDP in the third quarter of the year was a positive surprise, driven by eased mobility restrictions, with moderation observed in the last quarter of 2020. BBVA Research estimates that GDP has contracted by 11% in 2020 and will partially recover to around 6% in 2021. Inflation closed the year at 36.1%, and BBVA Research believes that 2021 will see authorities maintain the preference for avoiding abrupt exchange rate adjustments, the freezing of public service fees and the extension of closures to contain the pandemic, though they will be partial. Therefore BBVA Research estimates that inflation will close the year at 50%. With regard to fiscal policy, some savings measures were implemented at the end of 2020 so that the primary deficit would close the year at around 6.5% of GDP, significantly below our previous estimates. BBVA Research believes that an agreement will be reached with the IMF by the second quarter to refinance loans in excess of USD 50,000m.

In the banking system, the positive trend for both lending and deposit growth has continued in 2020, although notably influenced by high inflation. Based on data from October 2020, profitability indicators have deteriorated significantly (ROE: 15.0% and ROA: 2.2%) due to the effect of COVID-19, after reaching record highs at the end of 2019. For its part, the NPL ratio fell slightly to 4.3% in October 2020.

Colombia

BBVA Research estimates a contraction of 7.2% in 2020 and a partial recovery of 4.8% in 2021. The growth dynamic this year will be driven by housing construction, which is one of the pillars of the government's recovery policies. Recovery will, however, be limited due to the effect of new closures given the outbreaks of the pandemic and due to the effect of the probable tax reform, which could entail a higher VAT. In terms of inflation, prices recorded their lowest change since the 50s, closing 2020 at 1.6%, resulting from low demand and the low level of exchange rate transfer to prices. By 2021, BBVA Research estimates that inflation will remain low until April, with a significant rebound thereafter, to around 2.8% at year end. BBVA Research believes that with inflation under control and activity beginning to normalize, the Central Bank could keep the monetary policy interest rate stable at its current level of 1.75% until the second quarter of 2022.

Total lending in the banking system grew by 5.95% year-on-year at the end of September 2020, due to the growth in the commercial portfolio driven by government-approved letters of lending and guarantee programs during the pandemic. The system's NPL ratio as of October 2020 was 5.04%. Total deposits increased by 15.47% year-on-year in the same period.

Peru

Peru's GDP was a positive surprise in the last quarter of 2020 with a contraction of close to 3.3%, much lower than estimated. This improved dynamic was the result of the continued reopening of the economy following the lockdown measures adopted to limit the spread of the pandemic. BBVA Research estimates that the GDP contracted by 11.5% in 2020. For 2021, BBVA Research estimates that growth will stand at 10%, and that the mining and construction sectors will drive this recovery. Meanwhile, the political tensions experienced at the end of the year have diminished, but the elections scheduled for April will bring about political uncertainty, at least during the first part of the year. In terms of inflation, it closed the year at 2%, within the central bank's target. BBVA Research expects a declining profile in the coming months, influenced by weak demand and closing the year at 1.6%. The Central Bank has reduced the monetary policy rate to the lowest level in history, 0.25%. BBVA Research estimates that this interest rate level will remain throughout the year and predicts that the first increase to the interest rate will not occur until the first half of 2022.

The banking system showed high year-on-year growth rates for lending and deposits (up 14.0% and up 23.6% respectively, at the end of November 2020), due to the strong momentum of the Plan Reactiva Perú; the system presented lower profitability levels due to the current crisis (ROE: 5.39% as of November 2020) but with contained NPLs (NPL ratio: 3.22% as of November 2020) due to the payment deferrals applied.

INTEREST RATES (PERCENTAGE)

| 31-12-20 | 30-09-20 | 30-06-20 | 31-03-20 | 31-12-19 | 30-09-19 | 30-06-19 | |

|---|---|---|---|---|---|---|---|

| Official ECB rate | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Euribor 3 months (1) | (0.54) | (0.49) | (0.38) | (0.42) | (0.39) | (0.42) | (0.33) |

| Euribor 1 year (1) | (0.50) | (0.41) | (0.15) | (0.27) | (0.26) | (0.34) | (0.19) |

| USA Federal rates | 0.25 | 0.25 | 0.25 | 0.25 | 1.75 | 2.00 | 2.50 |

| TIIE (Mexico) | 4.25 | 4.25 | 5.00 | 6.50 | 7.25 | 7.75 | 8.25 |

| CBRT (Turkey) | 17.00 | 10.25 | 8.25 | 9.75 | 12.00 | 16.50 | 24.00 |

(1) Calculated as the month average.

Foreign exchanges have also been subject to volatility in other markets as a result of the COVID-19 outbreak. The strong monetary and fiscal response at the global level, in addition to idiosyncratic factors in some of the geographic areas in which the Group operates, have conditioned the performance of currencies. The euro has generally appreciated against major currencies. The Mexican peso suffered a sharp depreciation following the COVID-19 outbreak in the first quarter of the year, but has subsequently recovered ground, closing the year with a depreciation of 13.1% against the euro. The U.S. dollar has also weakened in the second part of the year and closed 2020 with an 8.5% decline against the euro. The Turkish lira has ended with a negative variation by 26.7%. Other currencies depreciated against the euro as follows: Colombian peso (down 12.6%), Peruvian sol (down 16.3%), Chilean peso (down 3.6%) and Argentine peso (down 34.8%).

For information on the BBVA Group's exchange rate risk management policies, see the "Risk Management" chapter of this report.

EXCHANGE RATES (EXPRESSED IN CURRENCY/EURO)

| Year-end exchange rates | Average exchange rates | ||||

|---|---|---|---|---|---|

| 31-12-20 | ∆ % on 31-12-19 | ∆ % on 30-09-20 | 2020 | ∆ % on 2019 | |

| U.S. dollar | 1.2271 | (8.5) | (4.6) | 1.1418 | (2.0) |

| Mexican peso | 24.4160 | (13.1) | 7.2 | 24.5301 | (12.1) |

| Turkish lira | 9.1131 | (26.7) | (0.2) | 8.0501 | (21.0) |

| Peruvian sol | 4.4470 | (16.3) | (5.3) | 3.9923 | (6.5) |

| Argentine peso (1) | 103.2543 | (34.8) | (13.7) | - | - |

| Chilean peso | 872.41 | (3.6) | 5.3 | 903.06 | (12.9) |

| Colombian peso | 4,212.02 | (12.6) | 7.8 | 4,216.81 | (12.9) |

(1) According to IAS 29 "Financial information in hyperinflationary economies", the year-end exchange rate is used for the conversion of the Argentina income statement.

Regulatory Environment

Banking after COVID-19

The regulatory environment of the financial industry during 2020 has been marked by the COVID-19 health crisis and the changes that have occurred in the lives of companies, consumers, workers and, ultimately, in society as a whole. Throughout this financial year, the rapid reaction of supervisors and regulators has been particularly notable, as they did not wait for the situation to deteriorate before adopting strong response measures, allowing them to relax some existing regulatory requirements and implement regulatory changes and measures to adapt to the challenges posed by this pandemic and the challenges it could pose in the coming months, since, unlike during the previous crisis, banks were in a solid position in terms of solvency and liquidity this time around.

This section analyzes the regulatory milestones set due to COVID-19 (regulatory flexibility, payment deferrals, restriction of dividend distribution and use of capital buffers), as well as other measures taken for trends prior to its emergence, such as those aimed at improving the situation in the markets (with projects such as the Capital Markets Union and reference indices reforms), the challenge of financial sustainability with the fulfillment of Environmental, Social and Governance (ESG) criteria and the transformation toward an increasingly digital business model where regulation must aid innovation and change processes and systems so that banks can compete in the new ecosystem of financial service providers that are highly efficient, technologically advanced and subject to less-demanding regulation.

Regulatory response to COVID-19 (payment-deferrals, dividends, NPL buffers)

The economic consequences of the health crisis caused by the COVID-19 outbreak have been met by an agile, forceful response from national and international regulatory authorities. These measures have highlighted the fundamental role that banks play as finance providers in extraordinary situations such as the one experienced, which entails strong liquidity stress.

The set of measures taken by the global, European and Spanish regulatory authorities during 2020 to reduce pressure on banks in the midst of the global pandemic has enabled institutions to channel their efforts and resources more efficiently and swiftly in order to contribute to a rapid economic recovery.

At the global level, the Financial Stability Board (hereinafter FSB) encouraged competent authorities to use the flexibility of international standards. The Basel Committee on Banking Supervision (BCBS) announced a delay in implementing the Basel III package (until 2023) and the International Accounting Standards Board (IASB) issued a guide on the application of IFRS 9 in the context of the COVID-19 crisis.

These measures have been aimed at maintaining the provision and extension of credit in exceptional circumstances. However, this extension necessarily requires proper recognition of potential impairments. In this regard, both prudential and accounting authorities have made it clear that the flexibility that has been included in the rules should be used so as to avoid automatisms in the reclassification of exposures. This has been particularly relevant in cases where payments have been made on certain loans.

Among the measures announced by European agencies, the most significant have been those related to the possibility of using prudential buffers, for both capital and liquidity. In this regard, the European Commission, the European Banking Authority (hereinafter, EBA) and the ECB have had to adjust their initial work plans to allow financial institutions to devote more resources to stimulating the real economy.

The ECB stated that entities could operate under capital and liquidity buffers, and called on banks to apply restrictions on dividend distribution and share buybacks until September 30, 2021, as well as to exercise caution when paying variable remuneration. For its part, the EBA updated its work program for 2020 to reflect all the changes that the COVID-19 pandemic has had on its activities. The EBA therefore only engaged in new consultations that were considered critical, postponed the publication of the final technical standards based on their degree of completion and the time frame envisaged for their implementation, and suspended the data collections normally used for ad-hoc analyses. The EBA also provided operational relief to financial institutions by postponing the 2020 stress test and recommending that authorities make use of the regulatory flexibility. It has also published guidelines on the handling of public and private payment deferrals and other national measures. Additionally, the EBA has published guidelines regarding the treatment of public and private payment deferrals, which have been extended until March 31, 2021, as well as its reporting and other national measures for the banks to continue to grant loans at the same time as recognizing any solvency issue, ensuring by the latter, that problematic loans are adequately reflected in the banks’ accounts.

The European Commission published in December 2020 its Action Plan about non-performing loans (NPLs) in which it highlights the need to act rapidly and not incurring the same situation lived during the last crisis to guarantee the protection of clients and especially vulnerable debtors. This action plan is based on four points: i) Development of secondary markets for the impaired assets; ii) network of bad banks (AMCs); iii) Frameworks for insolvency, restructuring and debt recovery; and iv) NPLs management via a crisis management framework and governmental support programs.

In terms of regulations affecting the banking sector, the main changes to the prudential framework of the Capital Requirements Regulation (known as "CRR Quick Fix") intended to mitigate the effects of the pandemic and ensure the flow of credit have been as follows: i) extension of the transitional agreement to mitigate the effect of IFRS 9 on capital; ii) modification of the prudential backstop of provisions for loans with public guarantees, bringing it in line with the beneficial treatment received by other guaranteed exposures; iii) anticipation of support factors for SMEs and infrastructure, which allow the risk weighting of these exposures to be reduced; (iv) early implementation of the EBA decision on software deduction; and (v) prudential filtering for sovereign bond exposures so as to reduce the effects of potential volatility in these instruments on entities capital.

As regards the regulation of the bank resolution framework, under the umbrella of the Single Resolution Board (hereinafter SRB), in response to the pandemic, the deadlines for banks to report the creation of the minimum required eligible liabilities (MREL) required by European standards have been extended. The body, however, has decided not to extend the deadline for banks to make their annual contribution to the future Single Resolution Fund and has encouraged the early adoption of the Resolution Directive and Regulation (known as BRRD2/SRMR2 respectively). The European Commission published a consultation paper on the roadmap for the crisis management framework and its intention to carry out an impact assessment on the potential modification of the crisis management framework and the deposit guarantee fund framework (BRRD/SRMR/DGSD) for a legislative initiative in 2021.

On a purely

Lastly, operational measures have also been adopted, mainly related to reporting and information disclosure requirements, which aim to relieve entities from part of the operational burden resulting from regulatory and supervisory processes, thus allowing them to focus on their main activity, the granting of loans.

Financial markets: Capital Markets Union, securitization and reference indices.

1. Capital Markets Union

The European Commission published an ambitious new Action Plan to boost the EU's Capital Markets Union (hereinafter, CMU), proposing 16 specific measures to make real progress toward completing the CMU in the coming years. The EU's main priority in 2020 has been to ensure that Europe can recover from the unprecedented economic crisis caused by COVID-19 and, in this sense, it is considered that the CMU can act as a lever to boost private finance as an essential factor in this recovery, to boost the transition toward a sustainable economy, to put the capital markets at the service of people and to project the global competitiveness of the EU economy by strengthening the international role of the euro. The Action Plan has three key objectives: i) to ensure that the EU's economic recovery is green, digital, inclusive and solid by making finance more accessible to European businesses, particularly to SMEs; ii) to make the EU an even safer place for individuals to save and invest in the long term; and iii) to integrate national capital markets into a genuine single EU-wide capital market.

As part of this plan, the European Commission has proposed the Capital Markets Recovery Package, which contains specific adjustments to the Prospectus Regulation, MiFID II and securitization rules. The Commission has proposed creating an "EU Recovery Prospectus," a kind of shortened prospectus, for companies that already have a track record in the public market. It is also introducing some specific modifications to MiFID II requirements in order to reduce some of the administrative burdens that investors have faced in their business-to-business relations. At the same time, it also proposes to readjust requirements to ensure that there is a high level of transparency with respect to the customer, while simultaneously guaranteeing the highest standards of protection and acceptable compliance costs for European companies. Lastly, specific modifications to the securitization rules have been proposed to amend the Securitization Regulation and the Capital Requirements Regulation in order to enhance the securitization market as a balance sheet management tool for risk reduction and NPL management as a result of COVID-19. Its final version will not be available until the beginning of 2021.

2. Reference indices reform

Throughout 2020, the public and private sectors continued to work in coordination on the reform of the financial market interest reference indices and on the transition toward new alternative indices. The FSB has called on financial and non-financial sector entities in all jurisdictions to continue their efforts to make wider use of risk-free rates in order to reduce dependence on IBORs (such as LIBOR, EURIBOR and TIBOR), and in particular to eliminate the remaining dependence on the London Interbank Offering Rate (LIBOR), which could disappear by the end of 2021, by publishing a roadmap setting out a timetable of actions for financial and non-financial entities to ensure an orderly transition.

In Europe, the Commission proposed amending EU rules on financial reference indices in July. The purpose of the amendments is to create a framework that allows for the application, at the request of the European Commission, of a legal substitute rate when a systemically important reference index such as LIBOR or others ceases to be published or becomes unrepresentative. This will reduce legal uncertainty surrounding existing contracts that do not contain adequate replacement indices and will avoid risks to financial stability.

The United Kingdom has also presented a legislative proposal that seeks to reduce the risk of litigation linked to potential disputes in contracts linked to LIBOR that cannot be renegotiated before the LIBOR's date of disappearance or unrepresentativeness in order to change the rate or include suitable substitutes. Among other issues, the regulatory proposal allows the Financial Conduct Authority (FCA) to urge a change in the methodology of an index ("synthetic benchmark") and prohibit its use by supervised entities in the United Kingdom except for certain types of contracts, which have yet to be specified ("tough legacy").

Lastly, various policy proposals have been made in the United States, some of which are limited to New York State and some of which are nationwide, but, thus far, none have been as successful as hoped.

Greater coordination between the various legislators would be very conducive to ensuring an orderly transition.

3. Anti-Money Laundering (AML)

There is a strong global consensus on the need to improve policies on anti-money laundering and anti-terrorist financing. To this end, the European Commission iniciated consultation on an action plan for a comprehensive EU policy on the Prevention of Money Laundering and Terrorist Financing (PMLTF). The plan aims to implement an improved, robust and efficient regulatory framework that is adapted to innovation and ensures harmonized supervision, in all member states. Legislative proposals are expected for 2021.

Sustainable finance: Toward integration in regulation and prudential supervision

Throughout 2020, progress has continued to be made so that the ESG criteria reach the entities' policies and their financial and risk departments specifically, so that these criteria fully integrate into their actions and corporate culture. The pandemic appears to have been an accelerator in this area as well.

At the global level, the FSB published its assessment of financial authorities' experience in including physical and transitional weather risks as part of their financial stability monitoring. The Task Force on Climate-related Financial Disclosures (hereinafter, TCFD), created by the FSB, has published a consultation paper with the objective of gathering feedback on climate-related forward-looking metrics that are useful for decision-making in the financial sector. The TCFD has also published important documents on sustainability: its third progress report in which it highlights the growth of disclosures in companies linked to the TCFD Recommendations; a guide on the analysis of climate-related scenarios and on the integration of climate-related risks in existing risk management processes; and a guide on the analysis of climate-related scenarios for non-financial companies.

The EU continues to integrate sustainability into the financial system and continues to make progress in developing regulations for this purpose. The European Commission therefore consulted on its renewed sustainable finance strategy, which is expected to be published in early 2021. It has also consulted on a possible initiative on sustainable corporate governance principles. For their part, the Commission, Council and Parliament agreed on the taxonomy of sustainable activities with a common classification system applicable from the end of 2021 for adaptation and mitigation objectives. The European supervisory authorities (ESAs) published a consultation paper with a set of disclosure standards on ESG information. The survey is part of EBA's work to develop a draft Technical Implementation Standard (TIS) on the disclosure of prudential information regarding ESG risks. It will also be used to monitor the short-term expectations specified in the EBA Action Plan on Sustainable Finance. The EBA has also published for consultation the document on management and monitoring of ESG risks, which covers a wide range of topics (definition of ESG risks and factors, quantitative and qualitative indicators). Lastly, the ECB published its final guidelines on its supervisory expectations regarding climate change and environmental risks at the end of the year.

Regulation in the field of digital transformation of the financial sector

The regulatory environment in the framework of digital transformation has also been significantly influenced by the COVID-19 health crisis, which has helped to establish the pre-existing trends in the economy's digitalization. The lessons learned during this crisis about the benefits of digitalization have fueled the authorities' work during this year, whereby they have updated their priorities and defined new action plans to maximize the benefits of digitalization for the economy. In the European Union, this has resulted in the publication of new strategies and initiatives, both throughout the economy as a whole and specifically for the financial sector.

In February, the European Commission published a strategy to shape the European Union's digital future. This digital strategy is based on two main pillars: strengthening the use of data, and developing and regulating artificial intelligence (hereinafter AI). As regards the first pillar, the data strategy, the European Commission announced a series of measures and new regulations, to be adopted between 2020 and 2021, aimed at facilitating the reuse of data, with a focus on public and business data. Among these measures, the Data Governance Regulations published in November will regulate the so-called "data spaces," aimed at facilitating the aggregation of data from certain sectors and the development of frameworks for data sharing. Furthermore, although the strategy is not especially focused on personal data, it contemplates that the right to data portability established in the General Data Protection Regulations could be improved in another new regulatory initiative (Data Act), to be published in 2021. These initiatives can certainly contribute to increasing the European Union's competitiveness, allowing European citizens and companies to extract more value from their data.

In the White Paper on Artificial Intelligence —the second pillar of the digital strategy— the European Commission proposed measures to encourage research and investment in AI, and raised the possibility of introducing new regulation for certain applications of this technology in sectors designated as high risk, such as health or transport. The European Commission is expected to publish its proposal to regulate AI in the first quarter of 2021. In Spain, on December 2, 2020, the Government published the National Strategy of Artificial Intelligence aligned with the European initiatives.

In their effort to ensure a digital, competitive European economy, the authorities have also worked on revising the competition rules during 2020, to ensure that they are appropriate to the challenges of the digital age. With this objective, on December 15, the European Commission published a new legal proposal which aims to establish new obligations for large digital platforms, as part of a new regulation of digital services. The modernization of competition policy has also been a priority in the United States in 2020, as shown by the report published by Congress in October discussing the state of competition in digital markets and proposing options for updating competition policy.

The work plans of the European authorities to promote the digitalization of the financial sector have also been renewed this year. In September, the European Commission published its new strategy for digital finance, which outlines the roadmap until 2024. In addition to pursuing a regulatory framework that encourages innovation, the strategy seeks to eliminate barriers to the digital single market by implementing, among other things, a new cross-border framework for digital identity. Furthermore, largely motivated by the emergence of new financial service providers (FinTechs and BigTechs), the strategy proposes a review of the financial sector's regulatory and supervisory framework to ensure compliance with the "same activity, same risk, same regulation" principle.

In line with the growing importance of data in the digital world, another key objective of this new strategy is to move toward a more data-driven financial sector. To this end, the European Commission, in collaboration with the European Supervisory Authorities, will study how to facilitate the use of AI in the financial sector and the possibility of extending the data-sharing principles of open banking regulations such as the Payment Services Directive (PSD2) to other financial services and products. We still have to wait until 2022 to find out the authorities' proposals on the latter point; i.e. once the new rules to promote data sharing in the digital economy have been developed (within the framework of the aforementioned data strategy).

Alongside this strategy for digital finance, the European Commission proposed a new Regulation on Digital Operational Resilience to harmonize requirements across the EU. This new Regulation establishes requirements for technological risk management and proposes the creation of a direct monitoring framework for critical third parties (e.g. cloud computing service providers).

The year 2020 has also been very significant for the payments sector. On July 2, 16 major banks in the Eurozone, including BBVA, announced the beginning of the implementation phase of the European Payments Initiative (EPI). The objective of this initiative—to create a comprehensive pan-European payment solution enabling instant payments—is shared by European authorities. This is demonstrated by the European Commission's new retail payments strategy, published in September, which, among other things, aims to promote pan-European payment solutions and immediate payments in the "new normal." The intention to revise the aforementioned PSD2 at the end of next year has also been announced as part of this strategy. At the global level, following the G20 mandate, the Committee on Payments and Market Infrastructures (CPMI) and the FSB published a roadmap in 2020 setting out actions to be implemented in the coming years to improve cross-border payments.

Another area that attracted a lot of attention from international bodies and European regulators during 2020 was that of cryptoassets. At the global level, the FSB published a report in October with high-level recommendations for the regulation and supervision of global stablecoin schemes. The Financial Action Task Force (FATF) also worked throughout 2020 to strengthen its standards to address the money laundering risks of this type of activity.

At the European level, the Commission published several legislative proposals on this matter in September, including the proposal for regulation to govern the cryptoasset markets (known as MiCA). This proposal includes rules to regulate the issuance of previously unregulated cryptoassets (including stablecoins) and related service providers, such as the custody or exchange of cryptoassets. For its part, the ECB published a report and a consultation paper in October on the possible issuance of a "digital euro," an official digital currency, at the retail level, which would complement cash. The Eurosystem has not made a decision on its issuance, but wants to be prepared to do so in the future, if necessary.

The year 2020 has also been a year of much regulatory action on the digital plane in all countries. In Spain, the most notable development has been the approval of legislation in November to create a regulatory sandbox for the financial sector. In Turkey, a new payment rule came into force in January, which introduced a new open banking framework, similar to the one introduced by the aforementioned PSD2 in Europe. Turkish authorities worked throughout 2020 to develop the exact rules for implementing this framework. Meanwhile, Mexico's financial authorities also continued to develop the body of regulations derived from the Fintech Act throughout the year.

Strategy and business model

Introduction

In 2019, BBVA conducted a strategic review process to continue its transformation and adapt itself to the major trends that were reshaping the world and the financial services industry. In 2020, BBVA made progress in the development of its strategy, based on its Purpose, the six Strategic Priorities, and its Values, all of which are fundamental pillars of the Organization's overall strategy.

The COVID-19 crisis validates our strategic vision

During 2020 an unprecedented sanitary crisis has been suffered, with major economic and social implications. This unique situation has accelerated some relevant trends some of which are expected to remain, as outlined below:

- More challenging macroeconomic environment with a strong GDP contraction in 2020 whose recovery is still uncertain. This tougher context will impact directly on the banking sector with lower expected loan growths, lower interest rates for longer and higher Cost of Risk.

- Acceleration of client digitization. Social distancing has led to a massive use of e-commerce and other remote services (tele-health, e-learning, etc.). This acceleration has also been perceived in the banking sector with higher usage of online and remote assistance channels.

- Higher concern for sustainability, both in the climate and social field. Social component has gained momentum due to the social urgency derived from the economic crisis while climate action remains a key topic for all stakeholders.

- Acceleration of innovation. The pandemic has made evident the vulnerability of economies to external shocks. In order to look for a greater resilience, governments, public institutions and the private sector, see the recuperation plans as an opportunity to advance faster in terms of innovations (such as the investment in 5G, AI, data, etc.).

This rapid advance of previous trends reinforces BBVA’s vision of the future and its strategy:

Good progress in a challenging year

The emergence of the COVID-19 virus in China and its global spread to a large number of countries resulted in the viral outbreak being classified as a global pandemic by the World Health Organization from March 11, 2020. The pandemic has and continues to adversely affect the global economy and the economic conditions and activity of the countries in which the Group operates, driving many of these countries into an economic recession.

After following the latest news about the virus at the beginning of 2020, the Bank's Corporate Continuity Committee decided on March 9 to create a global war room, a crisis management team with a global overview of what was happening at each moment, and with the operational capacity to make swift decisions, in order to meet two of the Bank's fundamental and priority objectives: first of all, to preserve the health of all employees and customers, and secondly to ensure business and service continuity. The continuous and efficient coordination with the countries’ war rooms, as well as continuous reporting to the Group's management and governance bodies, have facilitated the rapid and effective adoption of the measures required at any given time.

This swift decision-making, combined with digital and remote management capabilities, has allowed the BBVA Group to continue providing its services in all of the geographical areas in which it operates throughout the pandemic, and to provide its customers with the necessary support to meet their financing needs and alleviate their burden through various initiatives such as payment deferrals or making payments more flexible. All this has been accompanied by continuous monitoring and management of the main impacts of the crisis on the Bank's business and risks, such as the financial impacts on the income statement, capital or liquidity.

In this context, BBVA's strategy regarding the relationship model and digital capabilities has been reaffirmed and has proven to be an asset in this environment, allowing it to be closer to customers when they have needed it most.

2020 was an extraordinary year that required a rapid and efficient response. Despite this tough environment and thanks to the agility of the Organization, BBVA has been able to take an important step in the promotion and evolution of the six strategic priorities.

1. Improving our clients’ financial health

BBVA aspires to be the trusted financial partner for its clients helping them with personal advice in their decision-making and management of their finances in order to help them achieve their vital and business goals.

In this sense, during 2020, BBVA continued enhancing its differentiated value proposition by developing financial health global solutions, launching initiatives to be present in its clients’ day to day transactionality and evolving its digital offer to enterprise clients, taking advantage of its international presence.

For more information, see the chapters "The customer comes first" and "Contribution to society" included in this report.

2. Helping our clients transition towards a sustainable future

BBVA is aware of the remarkable role of banks in the transition toward a more sustainable and inclusive future, through its financing operations and advisory services. For this reason, BBVA is committed to align its activity to the Paris Agreement, and it wants to use its role to help its clients transition toward a more sustainable future, inspiring itself in the Sustainable Development Goals selected.

For BBVA those Sustainable Development Goals (SDGs) are priority in which the Group can have a greater positive impact by harnessing the multiplier effect of banking.

In this regard, BBVA is implementing this strategic priority through two ways:

- Climate Action: mobilizing the appropriate resources to manage the challenge of climate change tackling those SDGs involved, i.e. Affordable and clean energy (SDG 7), Responsible consumption and production (SDG 12) and Climate action (SGD 13).

- Inclusive Growth: mobilizing the investments needed to build inclusive infrastructures and support inclusive economic development. In this case, the SDGs that BBVA wants to foster are: Decent work and economic growth (SDG 8) and Industry, innovation and infrastructure (SDG 9).

For more information, see the chapter “Sustainability at BBVA” included in this report.

3. Reaching more clients

BBVA looks to grow by being where the client is. It aims to accelerate the profitable growth, supporting itself on its own and third party channels with a special focus on digital and most profitable segments.

In this sense, during 2020, and despite the tough environment, BBVA has been able to increase strongly its clients in all its footprint (+ 3.6% with respect to 2019). This growth has been boosted by the digital channels. The number of customers acquired through these channels has increased in 56% with respect to 2019.

BBVA not only has carried out successful strategies to gain clients but also has set the grounds for future growth in the coming years. On the one hand, it has strengthened its open market capabilities in its own channels (e.g. biometric own verification technology improvement, E2E digital onboarding channel optimization, etc.). On the other hand, it has reinforced the acquisition of customers with attractive partnerships with third parties.

For more information, see the chapter “The customer comes first” that follows.

4. Driving operational excellence

BBVA wants to provide the best customer experience, with simple and automated processes, and maintaining its focus in the solid management of risks and the optimum capital allocation.

In this regard, BBVA is focusing on a simpler, more scalable and productive model leveraging on BBVA´s digital capabilities where customers could access products and services remotely. BBVA wants to perform this service with an efficient and productive operational model with simple and automated processes on account of new technology and data analytics.

This operational excellence has to be performed with a robust risk management, taking into account both financial and non-financial risks. In this regard, BBVA is working on enhancing its global platforms to improve its Retail and SMEs risk management. Additionally, the optimum capital allocation is still a key factor for BBVA.

For more information see the chapters “The customer comes first”, “Technology and innovation”, “The best and most engaged team”, “Ethical behavior” and “Contribution to society” and “Risk management” included in this report.

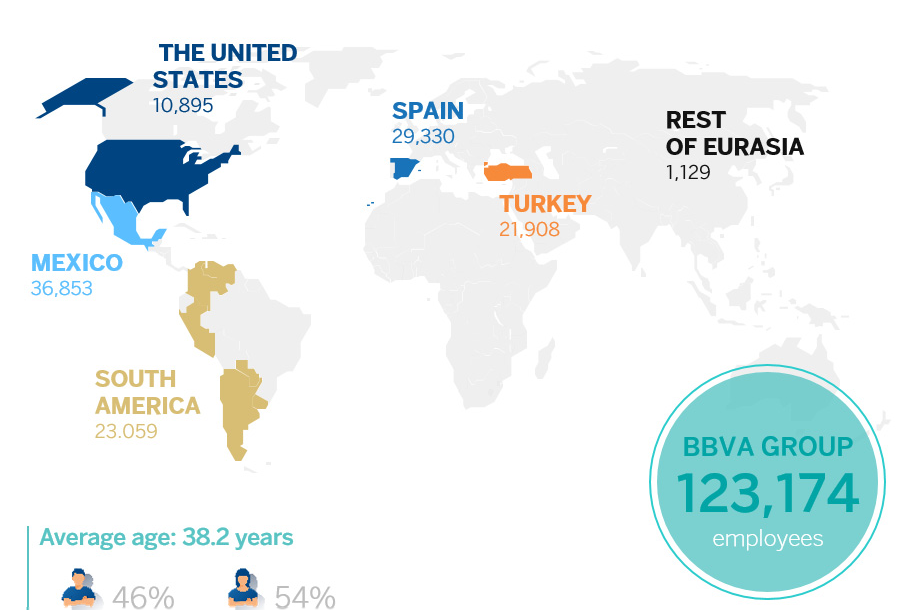

5. The best and most engaged team

The team continues to be a strategic priority for the Group. Our business is a people business (“we are people serving people”) and our values are at the core of our organization.

In 2020, the employee engagement (measured through Gallup’s survey grand mean) has improved in BBVA Group from 4.11% to 4.25% and the internal reputation has been strengthened reflecting the efforts made through several initiatives.

BBVA is inspiring a high-performing team with a common purpose and shared values, fostering diversity plans and its leadership model. BBVA is reinventing its professional development model by building an ecosystem where people can create and capture opportunities and leading the transformation by developing core capabilities and reskilling the teams. BBVA is also creating the conditions for a flexible and sustainable work environment.

For more information, see the chapter “The best and most engaged team”.

6. Data and Technology

Data and Technology are two accelerators to achieve our strategy.

Data is essential to deliver a better value proposition to our stakeholders. BBVA is building cutting-edge data capabilities, developing a global platform, training the teams in data analytics capabilities and building robust governance processes to improve data quality. Data also allows to create more business value as it helps to enhance other strategic priorities (e.g. in Financial Health, supporting to develop personal finance management tools).

With regards to technology, BBVA’s focus continues to be on the reliability and resilience of the platform, which allows to be more productive and efficient and to deliver more quality and functionalities to customers globally, and on its security and privacy model (i.e. cybersecurity, business processes, fraud and data security).

For more information see the section “Customer security” within the chapter “Customer comes first” and the chapter "Technology and innovation".

Values

BBVA’s values and behaviors are the action guidelines which guide the Entity in its day-to-day when making decisions, and help it accomplish its purpose and strategic priorities. They are the hallmark of everyone working in the Bank and they define the DNA of the company. The values inspire the form of leadership and boost the commitment at BBVA:

- Customer comes first

- We are empathetic: we take the customer's viewpoint into account from the outset, putting ourselves in their shoes to better understand their needs.

- We have integrity: everything we do is legal, publishable and morally acceptable to society. We always put customer interests' first.

- We meet their needs: we are swift, agile and responsive in resolving the problems and needs of our customers, overcoming any difficulties we encounter.

- We think big

- We are ambitious: we set ourselves ambitious challenges to have a real impact on people's lives.

- We break the mold: we question everything we do to discover new ways of doing things, innovating and testing new ideas which enables us to learn.

- We amaze our customers: we seek excellence in everything we do in order to amaze our customers, creating unique experiences and solutions which exceed their expectations.

- We are one team

- I am committed: I am committed to my role and my objectives and I feel empowered and fully responsible for delivering them, working with passion and enthusiasm.

- I trust others: I trust others from the outset and work generously, collaborating and breaking down silos between areas and hierarchical barriers.

- I am BBVA: I feel ownership of BBVA. The Bank's objectives are my own and I do everything in my power to achieve them and make our Purpose a reality.

The values are reflected in the main levers for the Bank’s transformation and in the Talent & Culture processes: from the selection of new talent to the roles allocation procedures, people development, training and inducement for goals attainment. One of the main actions to promote the living of the Values at BBVA is the Values Day, a global event in the cultural transformation of BBVA that aims to approach the values of the Entity to all the Group employees, creating conversation spaces about them. In 2020, the Bank has held the third Values Day edition, which, due to the COVID-19 context, has been 100% digital. Despite the distance, the employees have remained more united than ever thanks to the Values, and that has been the motto this year: “United by our values”. More than 90,000 employees, 80% of the workforce, has logged in at any time during the day in order to take part in the activities performed. Around 6,800 global workshops have been carried out with nearly 58,000 participants from the 19 countries where BBVA has headquarters. The 100% digital format has resulted in an increase in the participation in the activities in more than a 55% with respect to the previous year.

In addition, at the beginning of 2020, one of the Group priorities was launched: a new leadership program called “We lead together”, which is linked with the purpose and the values of BBVA, and which seeks to make all the employees leaders and that this leadership is exercised with integrity. This new model aims to boost three skills: entrepreneurship, empowerment and accountability, which are incorporated into the intrinsic skills catalogue, and become part of the professional development model. A leader at BBVA is, above all, somebody that lives the values of the Group with integrity and honesty, who has an entrepreneurial spirit and who seeks new ways of doing things, who empowers the teams and assumes the responsibility of his decisions and its results.

Another priority for the Bank is the commitment of all employees. BBVA’s goal is to improve the commitment because, the greater it is, the higher is the satisfaction of employees at their workplace and company, and better is the answer to the customer’s needings. Annually, BBVA carries out the Employee Engagement Survey, managed by Gallup. In 2020, 94.2% of the employees have participated in the survey, 4.4 percentage points more than in 2019 (89.8%). The most relevant aspect is the significant improvement of the Grand Mean, the strategic KPI which measures the progress made in the strategic priority “The best and most engaged team”, and which is obtained by the average of the twelve main questions of the survey. Thus, this last year a value of 4.25 out of 5 was reached, which represents an improvement compared to last year (4.11 points). In the same way, the BBVA employee engagement index, which is calculated by dividing the percentage of engaged employees by that of actively unengaged employees, improved in 2020 to 10.17 (6.63 in 2019).

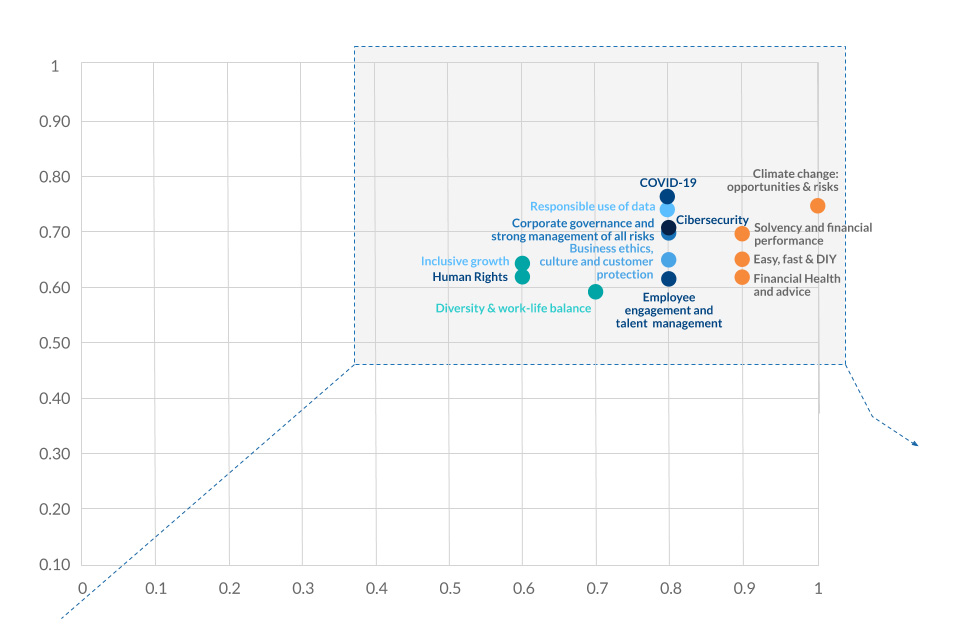

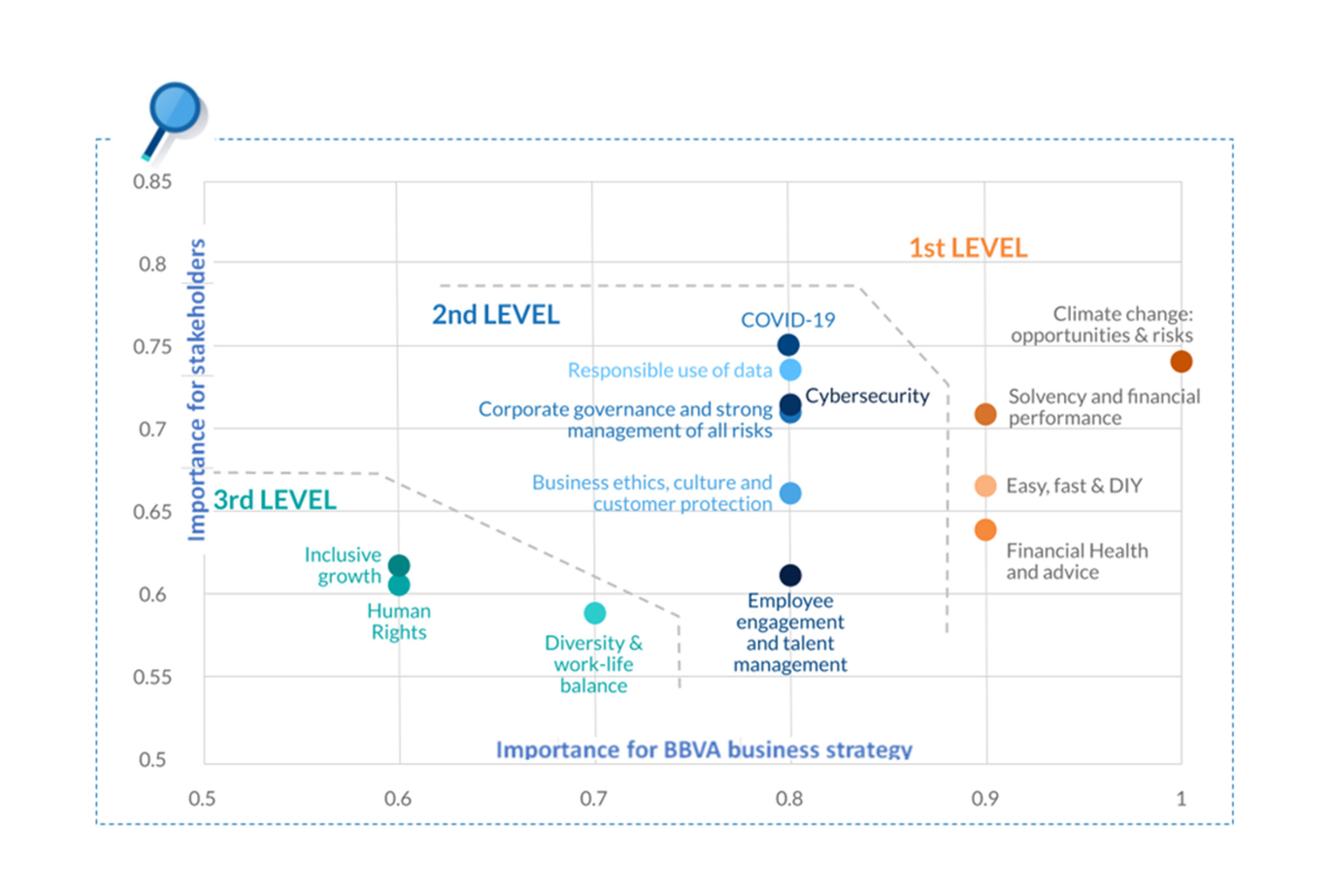

Materiality

In 2020, BBVA updated its materiality analysis with the intention of prioritizing the most relevant issues for both its key stakeholders (customers, employees, shareholders and society) and its business. The materiality matrix is one of the sources that feeds the Group's strategic planning and determines the priority issues to report on.

This analysis includes the perspective of the stakeholders of the main countries where the Group operates: Spain, Mexico, the United States, Turkey, Argentina, Colombia and Peru.

The materiality analysis phases have been as follows:

- 1. Identification of the material issues in 2020. Based on the material issues of 2019, the different tools for listening to the stakeholders managed by the Bank were reviewed, as well as the most recent trend studies and this list was updated. As the main novelty, the management of COVID-19 appears as a new issue.

- 2. Prioritization of issues according to their importance for stakeholders. BBVA carried out a series of interviews and ad-hoc surveys in the countries covered by the study in order to learn the priorities of various stakeholders. Datamaran was used as a data analysis tool for other stakeholders in all countries except in Turkey, where local Turkish sources were used. Together, the sources that made it possible to complete the analysis of the stakeholders, global trends and key issues in the sector are:

- 3. Prioritization of issues according to their impact on BBVA’s business strategy. An assessment was made on how each issue impacts the six strategic priorities. The most relevant issues for BBVA are those that help to achieve its strategy as well as possible.

The result of this analysis is contained in the Group's materiality matrix.

Therefore, the most relevant issues have been:

- Climate change: opportunities and risks: Stakeholders have climate change among their main concerns and they hope that BBVA will contribute to an ordered transition towards a low-emission economy, which will make it possible to stop it. This requires an adequate management of risks and opportunities.

- Solvency and financial results: The stakeholders expect BBVA to be a robust and solvent bank, thus contributing to the stability of the system. They also expect BBVA to be a bank with good results over time. That is, they demand a sustainable business model in the current context characterized by the continuous development of disruptive technologies and the consolidation of Big Tech as competitors. A more competitive environment, with more opportunities and also with more risks.

- Easy, fast and do it yourself (DIY): The stakeholders expect BBVA to continue putting technology and digitalization at the service of customers and the business. Thus, it will be more agile and more simple for customers to operate with the Bank any time and from anywhere (mobile banking, fully digital contracting processes, etc.). In addition, new technologies will allow BBVA for greater operational efficiency, generating value for shareholders.

- Financial health and personalized advice to customers: The stakeholders expect the Bank to get to know its customers and, where appropriate, propose personalized solutions and recommendations to better manage their financial health and achieve their vital objectives, all this proactively.

BBVA has set goals related to the material issues of the previous materiality matrix. The goals and their degree of progress are detailed below.

Goals and level of progress of the material issues for BBVA. 2020.

| Material issue | Indicator | Goal | 2020 Progress |

|---|---|---|---|

| Climate change | Sustainable finance mobilization | €100.000 million between 2018-2025 | €50,155m |

| Allignment by sectors indicators | Portfolio alignment with Paris Agreement | Defined methododologies and indicators and pilot assessment in sensible sectors | |

| Energy obtained from renewables sources | 70% in 2025 and 100% in 2030 | 65% | |

| CO2 emissions (scope 1 and 2)(1) | -68% reduction in 2015-2025 period | -60% | |

| TCFD recommendations in 2020 | Implementation of TCFD recommendations in 2020 | Publication of TCFD report in november 2020 | |

| Solvency and financial results | CET 1 fully-loaded ratio | 2020: 225- 275 basic points over a 8.59% requirement 2019: 11.5% -12% |

11.73% (314 basic points over the requirement of 8.59%) |

| Easy, fast and do it yourself | Reaching more clients | % customers acquired by digital channels (2021 >36%) | 33.3% |

(1) Scope 1: Emissions from direct energy consumption (fossil fuels), calculated based on the emission factors of the 2006 IPCC Guidelines for National Greenhouse Gas Inventories. The IPCC Fifth Assesment Report and the IEA were used as sources to convert these to CO2e.

Scope 2: Emissions from electricity consumption, calculated based on the latest emission factors available from the IEA for each contry.

Likewise, BBVA is working to establish objectives and metrics in relation to the strategic priority “Improving financial health and personalized advice to clients”.

The information regarding the performance of the relevant matters by the Group in 2020 is reflected in the different chapters of this report.

Customer comes first

Response to COVID-19

In order to provide service to its customers in response to the crisis generated by COVID-19, and given that financial services are legally considered an essential service in most of the countries in which the Group operates, the branch network remained operational with a dynamic management of the network considering the evolution of the pandemic and activity. In addition, the use of digital channels and remote managers was encouraged. BBVA also launched support initiatives throughout 2020 focused on the most affected customers, whether they be companies, SMEs, the self-employed workers or individuals, and which include, among others:

- In Spain, support for SMEs, the self-employed workers and companies through credit lines guaranteed by the Spanish Instituto de Crédito Oficial (ICO ), grace periods on loans to individuals (up to 12 months in residential mortgages for primary residence and up to 6 months in consumer finance) and moratorium of 3 months for citizens on social rental housing under the Social Housing Fund;

- Im the United States, flexibility in the repayment of the loans for small business and for consumer finance has been extended and certain fees and commissions for individual customers has been eliminated;

- In Mexico, BBVA granted various supports with personalized characteristics based on the needs of each of the customer segments, offering personalized solutions in a wide variety of products ranging from a grace period of 6 months in capital and/or interest in various lending products to the suspension of Point of Sale (POS) fees to support retailers with lower turnover, as well as different support plans aimed at each situation for larger businesses customers;

- In Turkey, delay of loan repayments, interests and amortizations until June, 2021, without any penalty for individual customers and extension of up to 6 months in the payment of principal on credits to companies;

- In South America, Argentina has provided micro-SMEs and SMEs with access to credit facilities to purchase remote working equipment, funding facilities for payroll payments and the refinancing unpaid credit card balances in 9 installments; Colombia has frozen the repayment of loans for individuals and companies for up to 6 months, and is offering a special working capital facility for companies; and in Peru, several measures were approved to order to support SMEs and customers with consumer loans or credit cards, including debts rescheduling, extending the payment periods.

Solutions for customers

In recent years, BBVA has focused on offering the best customer experience, distinguished by its simplicity, transparency and speed, and increasing the empowerment of customers and offering them a personalized advice.

In order to continue improving customer solutions, the Group's value proposition evolved throughout the year 2020 around seven axes on which global programs developed, related to both retail and corporate projects:

- Growth in customers through own and third-party channels.

- Growth in revenue with a focus on profitable segments.

- Value proposition, differentiation through customer advice.

- Operational efficiency.

- Data-focused capabilities and enablers.

- New business models.

- A Global Entity.

These solutions can be divided into two large groups: Those that allow the customer to access the services in a more convenient and simple way (Do It Yourself, DIY) and those that provide customers with personalized advice, offering them products or information specific to their current situation. These last two items are particularly important in the new strategy related to the commitment to improve customers' financial health.

Solutions for 2020 customers include the following:

- In individual banking, the “GLOMO” DIY mobile banking platform stands out, whose development continues, reaching Peru and Argentina. This solution is being continuously enhanced by features such as “Valora auto” for advice on the purchase and sale of second-hand cars in Spain. BBVA continues to deploy these capabilities in all of its geographical areas, where it has developed various journeys and digital advisory tools to help improve the financial health of its customers, such as warnings and advice for certain events such as a duplicate receipt or the possibility of investing in Spain or Turkey, help to control their finances on a day-to-day basis through analysis of expenses and income (Personal Financial Management, PFM) in Peru and Colombia, tools for effortless savings, such as “Metas” in Peru or investment advisory tools such as “Invest” in Mexico.

With the aim of enhancing security, financing, loyalty and offering value added features, BBVA has transformed its value proposal into cards, as it is the case with the launch of a new family of pioneering cards in Spain, “Aqua”, where the personal account number (PAN) and expiration date are not printed on the card, and the card verification value (CVV) is dynamic, preventing possible fraudulent use of these data.

Furthermore, high digital capacities have been brought to all the geographical areas in which the Group operates and the sustainability panel has been introduced, which focuses on offering customer guidance on the concept of sustainability and on how to reduce their impact on the emission of greenhouse gases in their business activity. - As part of its commitment to promoting the use of technology in order to improve its customer relationship, BBVA has developed “Blue”, the virtual assistant that uses various artificial intelligence tools to help users both to perform tasks within the BBVA app and to obtain detailed and personalized information about their accounts.

- In the SME and retailer segment, BBVA continues to make strong progress in delivering solutions that enables customers to interact with the Bank in the most convenient way for their needs. A significant example of these developments are the new digital signature capabilities, which prevents the customers from having to go to the branches.

With regard to SMEs and self-employed workers, relationship and management models are being reinforced in order to be able to manage them according to their needs across the different channels. This meant that the Bank was awarded second place as "SME Global Bank of the Year" by the SME Finance Forum (International Finance Corporation - World Bank, IFC-WB). Among other achievements, the tool "Banco de Barrio" has been implemented in Mexico, a model that seeks even closer relationships with SMEs. Progress has also been made in the remote customer management model with, for example, the creation of the transactional SMEs managerial figure in Spain.

In terms of digital channels, the launch of the BBVA Empresas app (GEMA) in Mexico and its extension to Peru are particularly notable, allowing SMEs and the self-employed workers to manage and run their businesses from their cell phones more quickly and easily. Among other features, customers can request a POS advance, a pioneer product in the Mexican market, based on the customer's transactions. Furthermore, within the COVID-19 environment, the Bank has helped SMEs to sell online and 100% digital registration processes have been developed in Spain.

Furthermore, as part of the Bank's commitment to globalization, the range of services for companies operating in various geographical areas continues to grow, such as the incorporation of BBVA USA into the global payment and collection platform (“OneBank Hub”), thus completing its deployment in all the countries in which BBVA operates, in addition to offering new services such as global balances and transactions (Global MT940) and payments from third parties (Global MT101), among others, together with the new “Global NetCash” app. A new supply chain finance solution has also been launched to compete with and drive business in South America, the United States and Europe. - As part of its commitment to sustainability guidance, BBVA has also added a new feature to the OneView financial aggregator that allows companies to know the volume of emissions they emit into the atmosphere through their activity.

The development of new business models allows BBVA to reach new customers in third-party channels, where it is worth highlighting:

- The launch, together with an insurance company and a representative organization of the official vehicle dealers association, of the NIW platform in Spain, a website for buying and selling used cars that integrates with BBVA Automik's digital solution for car financing.

- Agreements with third parties which have enabled BBVA to reach more users, such as the agreement with a company which offers vehicles for hire in Mexico to offer a co-branded account to its drivers, or with a Chinese international online shop in Spain which enables Chinese tourists to pay at Spanish retailers using , the world's leading payment platform .

BBVA's customer solutions are leveraged on the improvement of design capabilities or the use of data for analysis. They also contribute positively to increasing digital sales and improving the main customer satisfaction indicators, such as the Net Promoter Score (NPS), shown in the following section, and the drop-out ratio.

BBVA therefore occupies the first positions in the NPS, which is reflected in the retention data, which shows a positive evolution in the levels of customer drop-outs (retail customers and SMEs), and a greater commitment from digital customers, whose drop-out rate is 7.4% lower than that of non-digital customers.

Likewise, the data of the Group total active customers is also showing a positive trend with an increase of 2.8 million customers in 2020 (+9.2 million since 2015), with positive developments in all of the countries in which BBVA is present. At the end of the year, BBVA's digital customers accounted for 63% of the total and customers operating with the bank through their mobile phones accounted for 59% across the entire Group.

Net Promoter Score

The internationally recognized Net Promoter Score (NPS) methodology, measures customers’ willingness to recommend a company and therefore, the level of satisfaction of BBVA’s customers with its different products, channels and services. This index is based on a survey that measures on a scale of zero to ten whether a bank’s customers are promoters (a score of nine or ten), passives (a score of seven or eight) or detractors (a score of zero to six) when asked if they would recommend their bank, a specific channel or a specific customer journey to a friend or family member. This information is vital for checking for alignment between customer needs and expectations and implemented initiatives, establishing plans that eliminate detected gaps and providing the best experiences.

The Group’s consolidation and application of this methodology over the last ten years provides a common language both internally and with customers that facilitates everyone’s involvement and the integration of the voice of customers in everything the Bank does, from the beginning. This has led to a steady increase in customers’ level of trust, as they recognize BBVA to be one of the most secure and recommendable banking institutions in every country where it operates.

As of December 31, 2020, BBVA has remained the leader in the retail NPS indicator in Spain, Mexico, Colombia and Peru. In Uruguay, it has climbed one position with respect to 2019, reaching the top position. In Turkey, BBVA ranked second, maintaining its position with respect to 2019, whereas in Argentina the customer’s perception has been affected by the incidences in digital channels and the blocking of the call center due to an increase in the use of these channels as a result of the pandemic. To reverse it, different action plans have been boosted by Top Management.

Meanwhile, in the commercial NPS indicator BBVA maintained the leading position in four countries: Mexico, Colombia, Peru and Uruguay. In Spain and Argentina, BBVA ranked second.

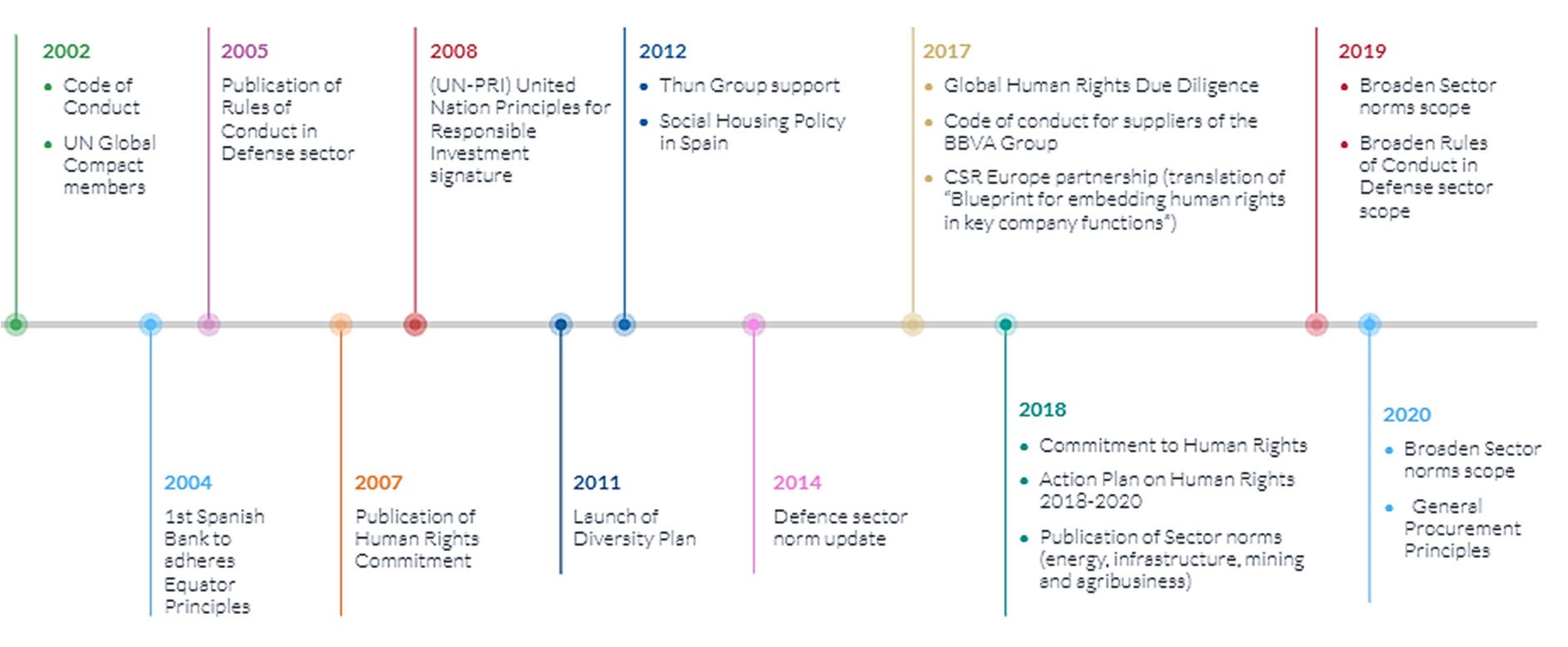

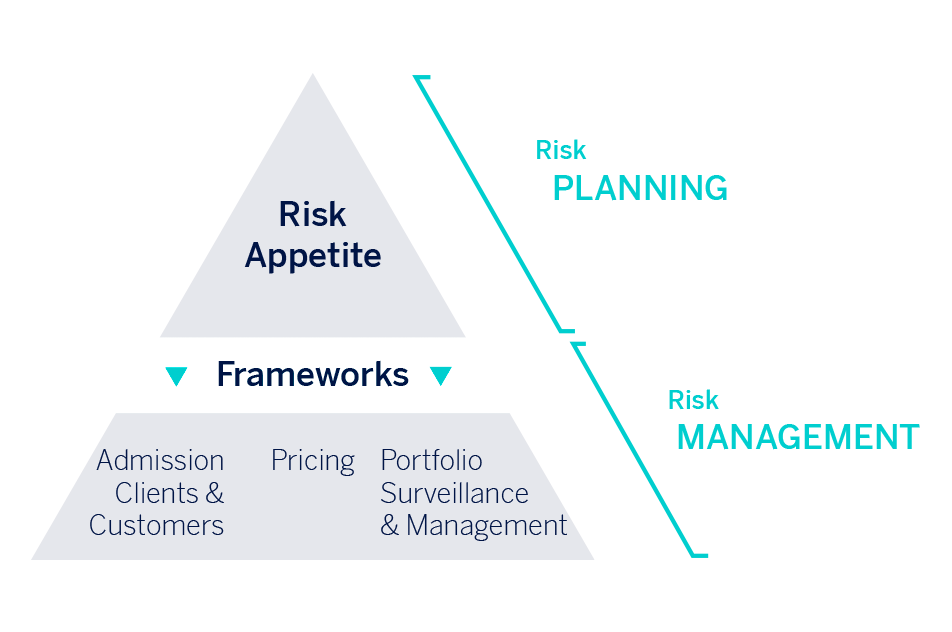

Transparent, Clear and Responsible Communication: a lever to improve financial health