Mexico

Highlights

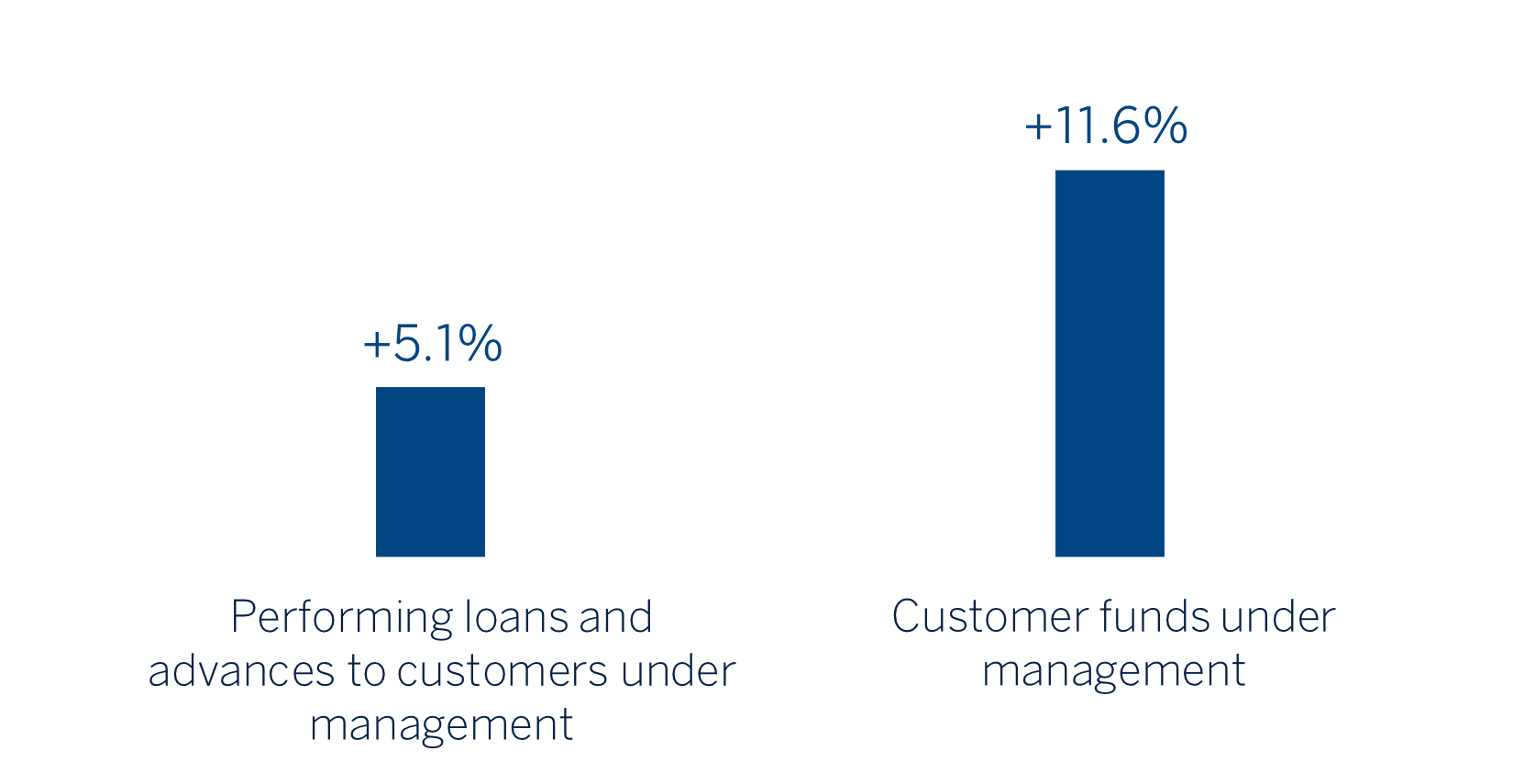

- Growth in lending activity in the year driven by the continued acceleration in the retail portfolio segment since the second quarter of 2021

- Increase in demand deposits and therefore improvement in the funding mix

- Growth in recurring income and strength of operating income throughout the year

- Better performance of impairment on financial assets in 2021

Business activity (1)

(VARIATION AT CONSTANT EXCHANGE RATE COMPARED TO 31-12-20)

(1) Excluding repos.

Net interest income/ATAs

(Percentage. Constant exchange rate)

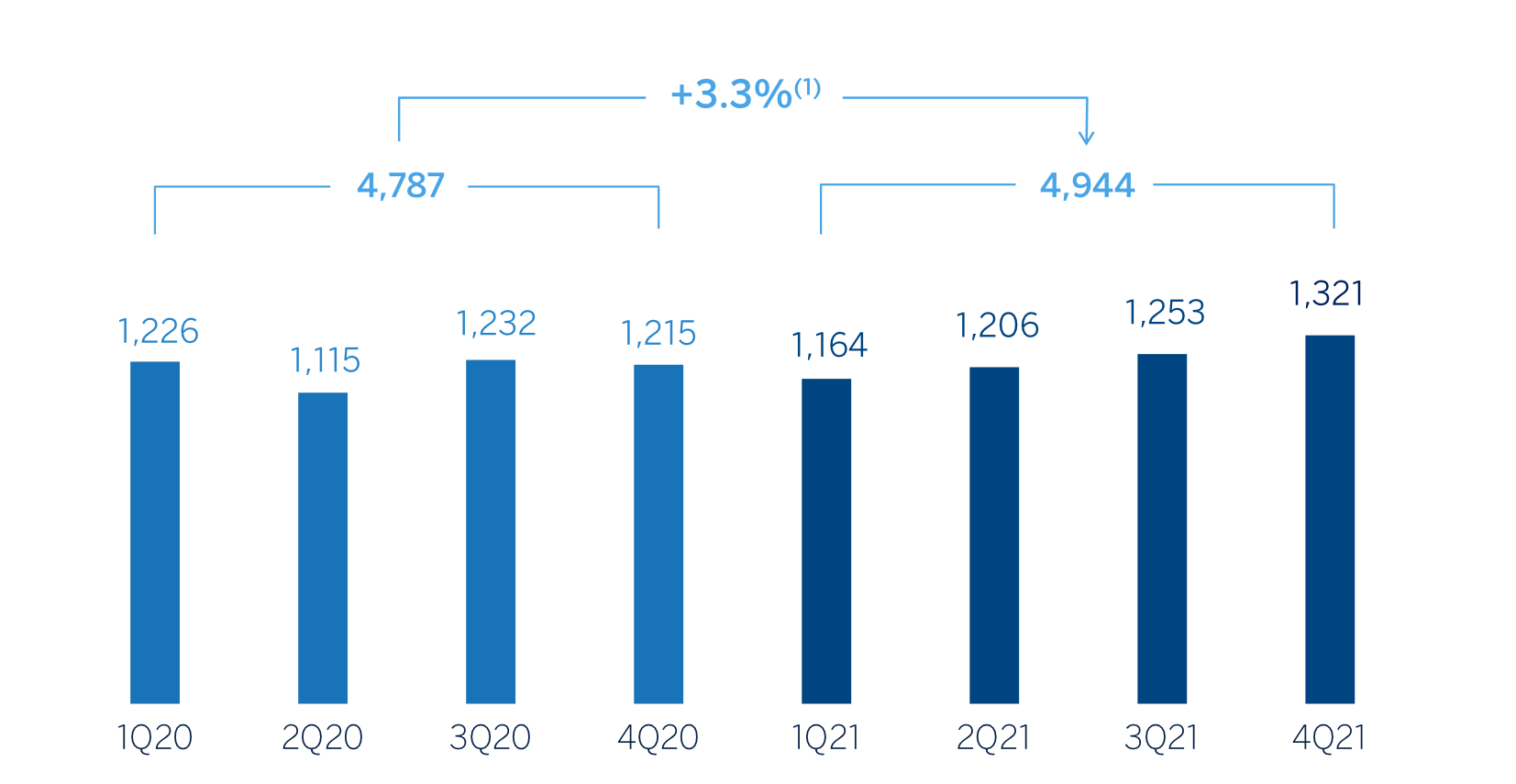

Operating income

(Millions of euros at constant exchange rate)

(1) At current exchange rate: +5.6%

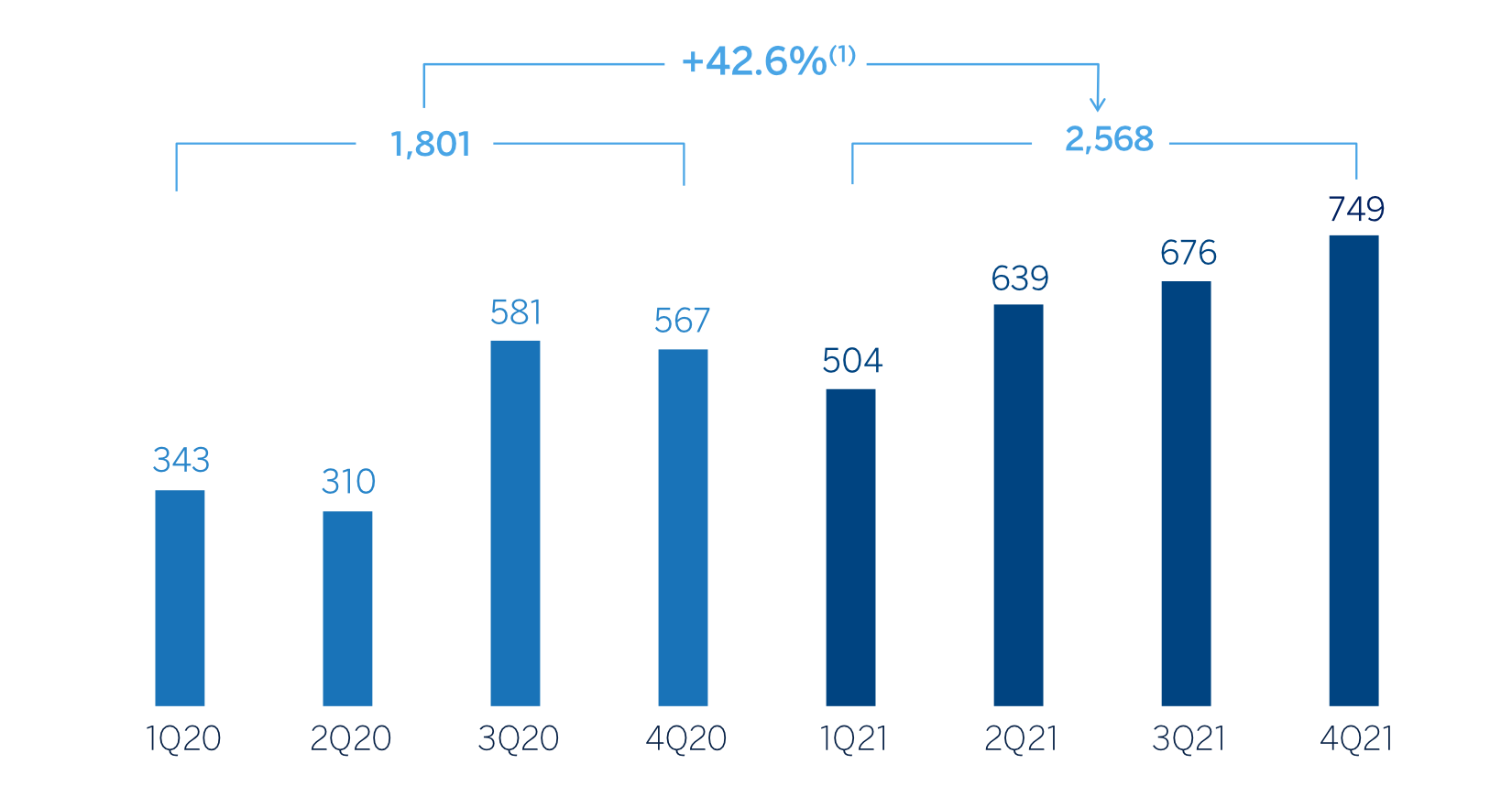

Net attributable profit (LOSS)

(Millions of euros at constant exchange rate)

(1) At current exchange rate: +45.8%

Financial statements and relevant business indicators (Millions of euros and percentage)

| Income statement | 2021 | ∆% | ∆% (1) | 2020 |

|---|---|---|---|---|

| Net interest income | 5,836 | 7.8 | 5.4 | 5,415 |

| Net fees and commissions | 1,211 | 14.1 | 11.6 | 1,061 |

| Net trading income | 366 | (13.3) | (15.3) | 423 |

| Other operating income and expenses | 190 | 50.3 | 46.9 | 126 |

| Gross income | 7,603 | 8.2 | 5.8 | 7,025 |

| Operating expenses | (2,659) | 13.4 | 10.9 | (2,344) |

| Personnel expenses | (1,199) | 22.9 | 20.2 | (976) |

| Other administrative expenses | (1,134) | 7.3 | 4.9 | (1,057) |

| Depreciation | (326) | 4.6 | 2.3 | (312) |

| Operating income | 4,944 | 5.6 | 3.3 | 4,680 |

| Impairment on financial assets not measured at fair value through profit or loss | (1,440) | (33.7) | (35.2) | (2,172) |

| Provisions or reversal of provisions and other results | 24 | n.s. | n.s. | (33) |

| Profit (loss) before tax | 3,528 | 42.5 | 39.4 | 2,475 |

| Income tax | (960) | 34.5 | 31.5 | (714) |

| Profit (loss) for the year | 2,568 | 45.8 | 42.6 | 1,761 |

| Non-controlling interests | (0) | 41.4 | 38.3 | (0) |

| Net attributable profit (loss) | 2,568 | 45.8 | 42.6 | 1,761 |

| Balance sheets | 31-12-21 | ∆% | ∆% (1) | 31-12-20 |

|---|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 12,985 | 41.7 | 34.4 | 9,161 |

| Financial assets designated at fair value | 35,126 | (3.4) | (8.4) | 36,360 |

| Of which loans and advances | 835 | (67.7) | (69.4) | 2,589 |

| Financial assets at amortized cost | 65,311 | 9.2 | 3.5 | 59,819 |

| Of which loans and advances to customers | 55,809 | 11.6 | 5.8 | 50,002 |

| Tangible assets | 1,731 | 5.1 | (0.4) | 1,647 |

| Other assets | 2,953 | (9.1) | (13.9) | 3,249 |

| Total assets/liabilities and equity | 118,106 | 7.1 | 1.6 | 110,236 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 19,843 | (16.6) | (21.0) | 23,801 |

| Deposits from central banks and credit institutions | 3,268 | (36.2) | (39.6) | 5,125 |

| Deposits from customers | 64,003 | 18.4 | 12.2 | 54,052 |

| Debt certificates | 7,984 | 4.5 | (0.9) | 7,640 |

| Other liabilities | 15,779 | 22.2 | 15.8 | 12,911 |

| Regulatory capital allocated | 7,229 | 7.8 | 2.2 | 6,707 |

| Relevant business indicators | 31-12-21 | ∆% | ∆% (1) | 31-12-20 |

|---|---|---|---|---|

| Performing loans and advances to customers under management (2) | 55,926 | 10.9 | 5.1 | 50,446 |

| Non-performing loans | 1,921 | 5.7 | 0.1 | 1,818 |

| Customer deposits under management (2) | 63,349 | 17.8 | 11.7 | 53,775 |

| Off-balance sheet funds (3) | 26,445 | 17.4 | 113 | 22,524 |

| Risk-weighted assets | 64,573 | 6.2 | 0.6 | 60,825 |

| Efficiency ratio (%) | 35.0 | 33.4 | ||

| NPL ratio (%) | 3.2 | 3.3 | ||

| NPL coverage ratio (%) | 106 | 122 | ||

| Cost of risk (%) | 2.67 | 4.02 |

(1) At constant exchange rate.

(2) Excluding repos.

(3) Includes mutual funds and other off-balance sheet funds.

Macro and industry trends

Economic growth decelerated in the second half of 2021 after a strong expansion in the first half of the year. Given the recent slowdown, BBVA Research estimates that GDP growth was 5.3% in 2021, seven tenths lower than in the previous forecast, reflecting a partial recovery from the 8.4% drop in 2020. At the same time, in an environment of relatively weak domestic demand, strong inflationary pressures have led Banxico to raise monetary policy interest rates to 5.5% in December, from 4.0% in May. According to estimates by BBVA Research, interest rates will continue to increase, in an environment of relatively high inflation, and GDP growth will moderate significantly to around 2.2% in 2022.

With regard to the banking system, based on data at the end of November 2021, the system's lending volume increased since December 2020 (+4.1%), showing strong growth in the mortgage portfolio (+8,8% since the end of 2020), followed by consumer loans (+3.4%) and corporate loans (+2.1%), while demand and time deposits increased (+4.6 since December 2020). The NPL ratio in the system recorded slight improvement in 2021, reaching a NPL ratio of 2.15% at the end of November (+2.56% at the end of 2020) and capital indicators, by their part, remained comfortable.

Unless expressly stated otherwise, all the comments below on rates of change, for both activity and results, will be given at constant exchange rate. These rates, together with changes at current exchange rates, can be found in the attached tables of financial statements and relevant business indicators.

Activity

The most relevant aspects related to the area's activity during 2021 were:

- Lending activity (performing loans under management) grew by 5.1% compared to December 2020 thanks to the performance of the retail segment (+9.5%), which continued to show the dynamism that began in the second quarter of 2021. Within the retail segment, credit cards continued to stand out (+13.4%) followed by consumer and mortgage loans (+4.7% and +9.7%, respectively). Within this segment, SME financing was 15.4% higher compared to the end of December 2020, supported by the expansion of the product offering and the increase in the commercial effort with qualified personnel, which have resulted in a greater number of customers. For its part, the wholesale portfolio, which includes larger companies and the public sector, recorded a growth of (+3.6%). As a result of the above, BBVA Mexico's mix shows a shift towards the most profitable portfolio, with the retail portfolio representing 50.8% and the wholesale portfolio 49.2%.

- With regard to asset quality indicators, the NPL ratio recorded an increase of 63 basis points in the fourth quarter of 2021 and a decrease of 16 basis points compared to December 2020, explained by lower recurring NPL entries and a higher recognition of write-offs during the year, along with an increase in activity that has been partially offset in the last quarter due to the reclassification resulting from the implementation of the new definition of default. For its part, the NPL coverage ratio decreased to 106% during the year, due to the reclassification non-performing loans as a result of the new definition of default.

- Customer deposits under management showed an increase of 11.7% during 2021. This performance is explained by a growth of 15.9% in demand deposits, due to customers' preference for having liquid balances in an uncertain environment, compared to the decline observed in time deposits (-6.1%). The above has allowed BBVA Mexico to improve its deposits mix, with 84% of total deposits in lower-cost funds. Finally, mutual funds grew by 11.3% between January and December 2021, favored by an improved offering that includes funds linked to environmental, social and governance (ESG) factors.

The most relevant aspects related to the area's activity during the fourth quarter of 2021 were:

- Lending activity (performing loans under management) grew by 2.0% between October and December 2021, with growth leveraged on both the good performance of the retail segment (+3.0%), with credit cards standing out due to the "Buen fin" campaign, along with consumer and mortgage loans, and by the wholesale segment, which recorded a growth of 3.0%.

- Total funds under management increased in the quarter (+5.7%) with growth in demand deposits (+8.5%), partially offset by a decrease in time deposits (-2.0%). For their part, mutual funds closed December with a growth of 3.2%.

Results

In Mexico, BBVA achieved a net attributable profit of €2,568m in 2021, representing a 42.6% increase compared to the same period in 2020, which was significantly affected by the COVID-19 pandemic.

The most relevant aspects of the year-on-year changes in the income statement at the end of December 2021 are summarized below:

- Net interest income closed 2021 with an increase of 5.4%, due to lower financing costs, the negative impact on this line due to the customer support measures against a backdrop of the pandemic in the second quarter of 2020 and, to a lesser extent, the aforementioned improvement in the portfolio mix in 2021. Also notable is the favorable trend towards recovery in the new retail loan origination, which has already been reflected in this line since the third quarter.

- Net fees and commissions increased by 11.6% thanks to higher levels of transactions, especially on credit cards, as well as those arising from investment banking operations and mutual fund management.

- NTI decreased by 15.3% year-on-year, mainly due to lower results from the Global Markets unit in 2021, as well as lower results from ALCO portfolios.

- The other operating income and expenses line recorded a year-on-year increase of 46.9%, mainly thanks to the results of the insurance unit in 2021 and also supported by the extraordinary revenue generated by the effects of initiatives aimed at transforming the production model, which have allowed operational efficiencies to be increased.

- Operating expenses increased (+10.9%) in an environment of relatively high inflation, mainly due to higher personnel expenses against a backdrop of increased activity. Also contributing to the year-on-year growth is the fact that certain expenses were not incurred in 2020 as a result of the pandemic, and thus increased general expenses in 2021, like technology expenses, among others.

- The impairment on financial assets decreased significantly compared to the same period last year (-35.2%), mainly due to additional provisions for COVID-19 recorded in 2020. As a result of all the above, the cumulative cost of risk as of December 2021 stood at 2.67%.

- The provisions and other results line showed a favorable comparison, driven by higher sales of foreclosed assets in 2021 and lower provisions related to contingent risks compared to those recorded during 2020.

In the quarter, excluding the effect of the exchange rate variation, BBVA Mexico generated a net attributable profit of €749m, with a growth of 10.9% compared to the accumulated profit between July and September, in a quarter marked by the good performance of the net interest income (+3.6%), together with a better evolution of the NTI, the increase in operating expenses against a backdrop of recovering activity (+4.8%), increased provisions for impairment on financial assets (+10.1%, still below pre-pandemic levels), and a better performance of the other operating income and expenses line, thanks to the strong performance of insurance results in the quarter (+30.3%).