South America

Highlights

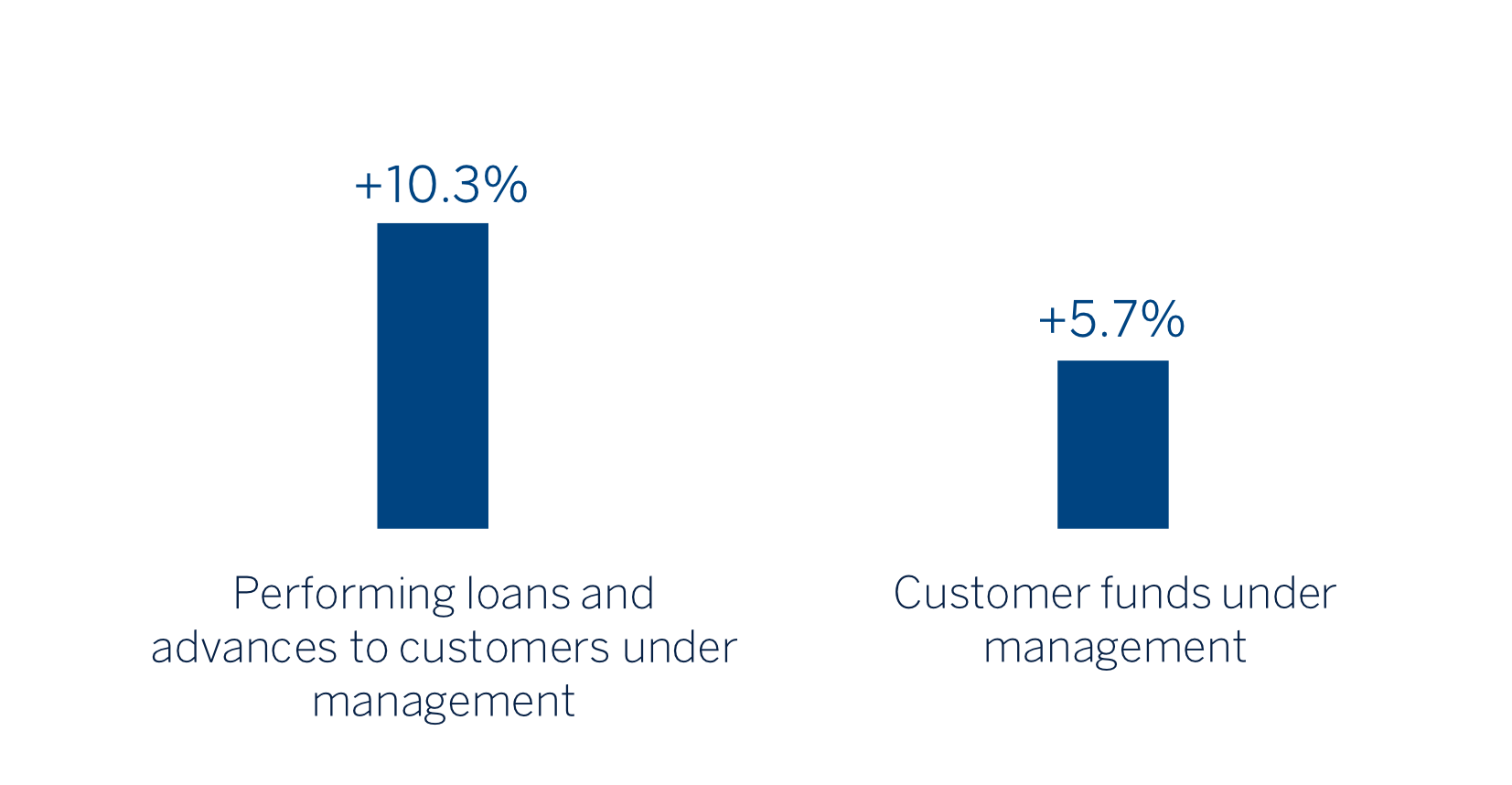

- Increase in lending activity in 2021, with growth in both retail and commercial segments

- Reduction in higher-cost customer funds

- Favorable year-on-year evolution of recurring income and higher adjustment for inflation in Argentina

- Reduction in the impairment on financial assets line as 2020 was affected by the outbreak of the pandemic

Business activity (1)

(VARIATION AT CONSTANT EXCHANGE RATES COMPARED TO 31-12-20)

(1) Excluding repos.

It excludes the balances of BBVA Paraguay

as of 31-12-2020.

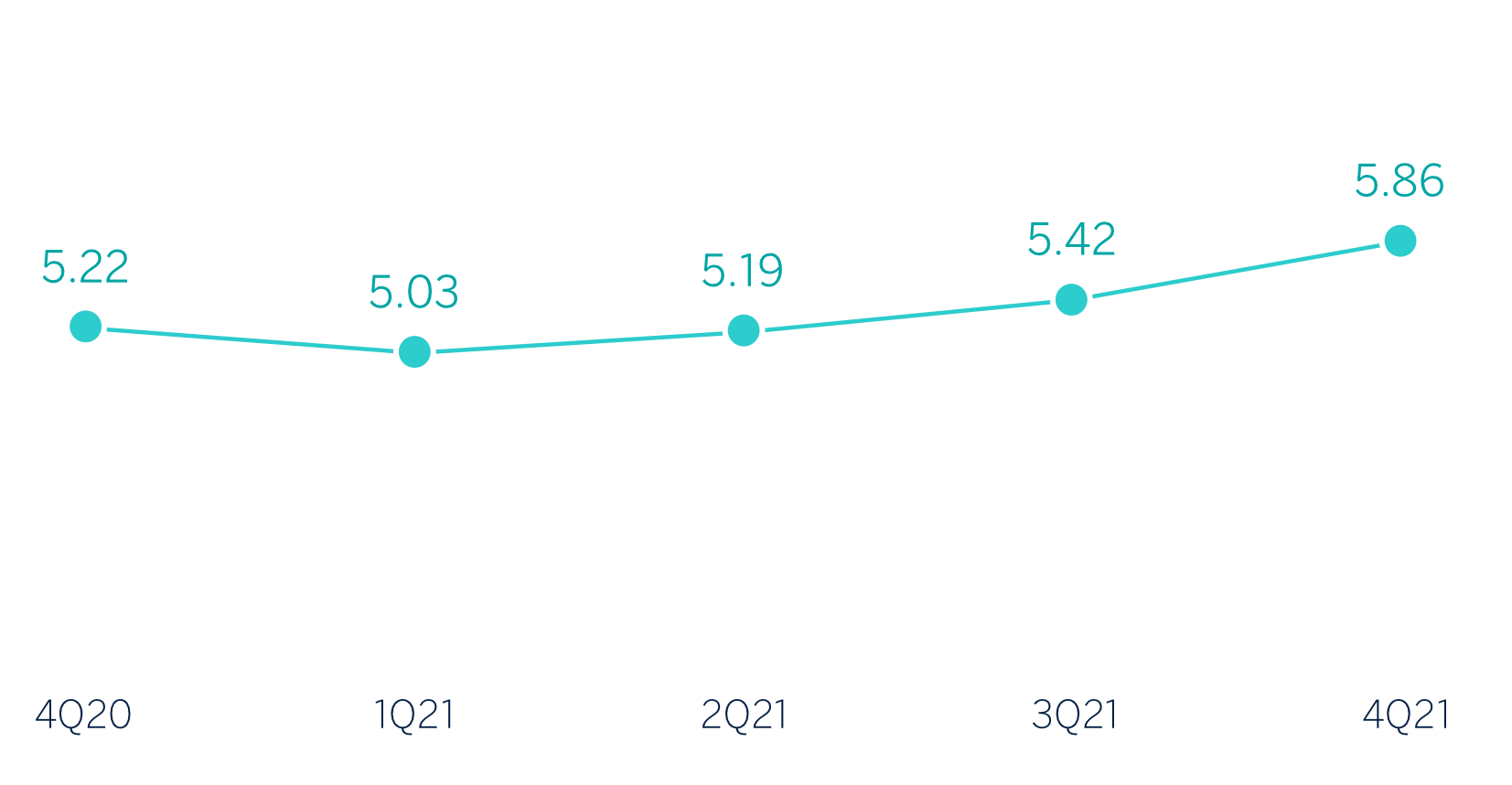

Net interest income/ATAs

(Percentage. Constant exchange rates)

General note: Excluding BBVA Paraguay.

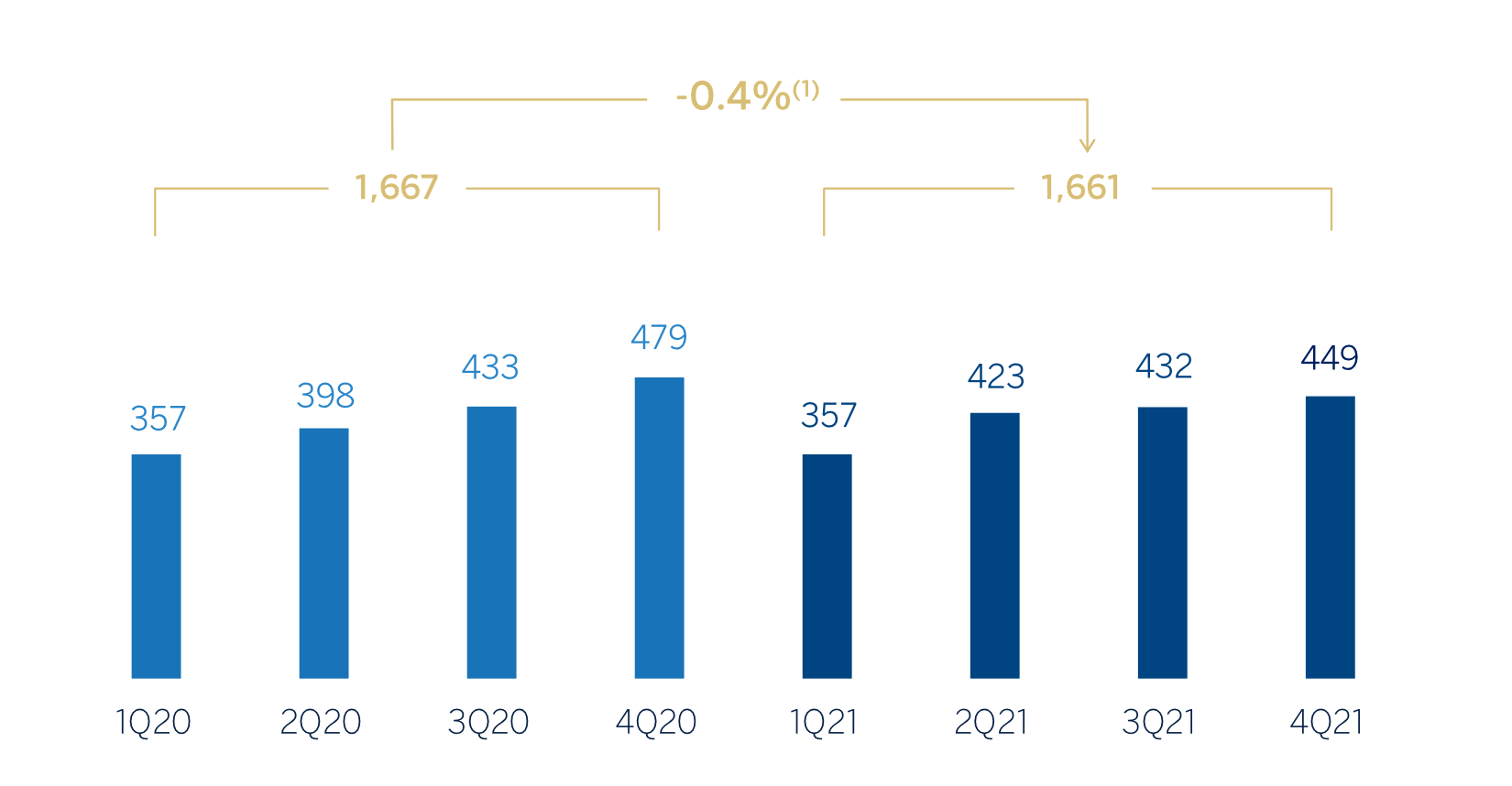

Operating income

(Millions of euros at constant exchange rates)

(1) At current exchange rates:-10.4%

At constant exchange rates, excluding BBVA Paraguay: +2.0%

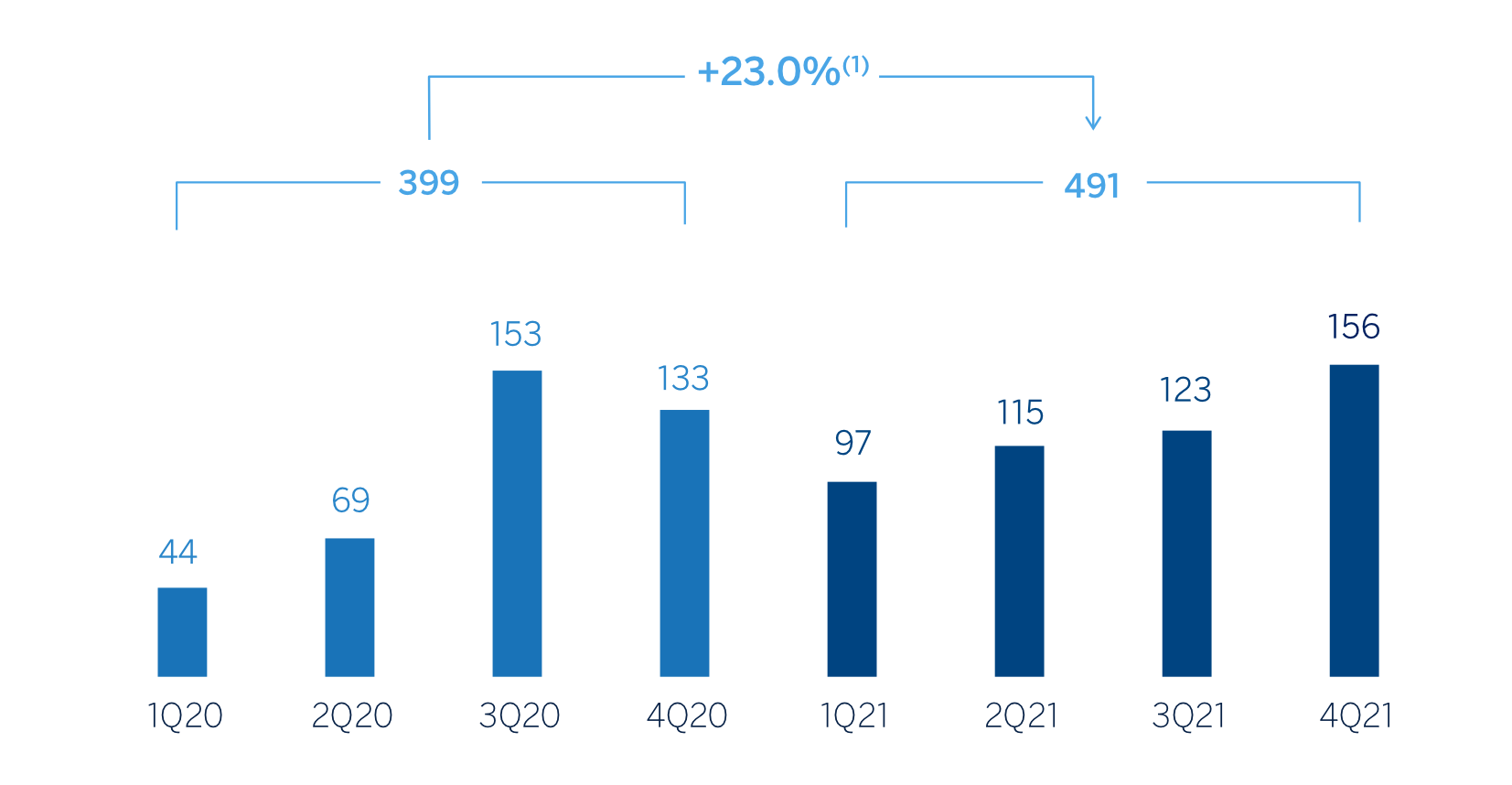

Net attributable profit (LOSS)

(Millions of euros at constant exchange rates)

(1) At current exchange rates: +10.1%

At constant exchange rates, excluding BBVA Paraguay: +30.3%

Financial statements and relevant business indicators (Millions of euros and percentage)

| Income statement | 2021 | ∆% | ∆% (1) | ∆% (2) | 2020 |

|---|---|---|---|---|---|

| Net interest income | 2,859 | 5.8 | 15.5 | 18.1 | 2,701 |

| Net fees and commissions | 589 | 21.8 | 34.9 | 37.8 | 483 |

| Net trading income | 324 | (20.3) | (11.6) | (9.8) | 407 |

| Other operating income and expenses | (611) | 66.4 | 71.9 | 74.4 | (367) |

| Gross income | 3,162 | (2.0) | 8.1 | 10.6 | 3,225 |

| Operating expenses | (1,501) | 9.4 | 19.4 | 22.0 | (1,372) |

| Personnel expenses | (724) | 8.2 | 18.4 | 21.4 | (670) |

| Other administrative expenses | (632) | 15.0 | 25.3 | 27.6 | (549) |

| Depreciation | (145) | (5.7) | 2.4 | 4.8 | (154) |

| Operating income | 1,661 | (10.4) | (0.4) | 2.0 | 1,853 |

| Impaiment on financial assets not measured at fair value through profit or loss | (622) | (28.0) | (21.3) | (20.0) | (864) |

| Provisions or reversal of provisions and other results | (77) | (17.0) | (7.7) | (6.8) | (93) |

| Profit (loss) before tax | 961 | 7.3 | 21.3 | 25.3 | 896 |

| Income tax | (287) | 3.5 | 16.0 | 17.3 | (277) |

| Profit (loss) for the year | 674 | 9.0 | 23.8 | 29.1 | 618 |

| Non-controlling interests | (184) | 6.3 | 25.9 | 25.9 | (173) |

| Net attributable profit (loss) | 491 | 10.1 | 23.0 | 30.3 | 446 |

| Balance sheets | 31-12-21 | ∆% | ∆% (1) | ∆% (2) | 31-12-20 |

|---|---|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 8,549 | 20.0 | 24.1 | 33.1 | 7,127 |

| Financial assets designated at fair value | 7,175 | (2.1) | 2.5 | 2.5 | 7,329 |

| Of which loans and advances | 157 | 45.4 | 55.6 | 55.6 | 108 |

| Financial assets at amortized cost | 37,747 | (2.1) | 1.8 | 5.0 | 38,549 |

| Of which loans and advances to customers | 34,608 | 3.0 | 7.0 | 10.7 | 33,615 |

| Tangible assets | 895 | 10.7 | 13.7 | 14.9 | 808 |

| Other assets | 1,758 | 8.3 | 14.4 | 16.6 | 1,624 |

| Total assets/liabilities and equity | 56,124 | 1.2 | 5.3 | 8.7 | 55,436 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 1,884 | 42.0 | 50.6 | 50.7 | 1,326 |

| Deposits from central banks and credit institutions | 5,501 | 2.3 | 5.1 | 5.4 | 5,378 |

| Deposits from customers | 36,340 | (1.4) | 2.3 | 6.5 | 36,874 |

| Debt certificates | 3,215 | (1.7) | 3.8 | 4.7 | 3,269 |

| Other liabilities | 4,207 | 10.3 | 16.1 | 17.9 | 3,813 |

| Regulatory capital allocated | 4,977 | 4.2 | 8.8 | 12.7 | 4,776 |

| Relevant business indicators | 31-12-21 | ∆% | ∆% (1) | ∆% (2) | 31-12-20 |

|---|---|---|---|---|---|

| Performing loans and advances to customers under management (3) | 34,583 | 2.6 | 6.6 | 10.3 | 33,719 |

| Non-performing loans | 1,813 | 1.8 | 5.6 | 8.1 | 1,780 |

| Customer deposits under management (4) | 36,364 | (1.4) | 2.3 | 6.5 | 36,886 |

| Off-balance sheet funds (5) | 14,756 | 7,5 | 3.7 | 3.7 | 13,722 |

| Risk-weighted assets | 43,334 | 8.9 | 13.6 | 17.6 | 39,804 |

| Efficiency ratio (%) | 47.5 | 42.6 | |||

| NPL ratio (%) | 4.5 | 4.4 | |||

| NPL coverage ratio (%) | 99 | 110 | |||

| Cost of risk (%) | 1.65 | 2.36 |

- (1) At constant exchange rates.

- (2) At constant exchange rates excluding BBVA Paraguay.

- (3) Excluding repos.

- (4) Excluding repos and including specific marketable debt securities.

- (5) Includes mutual funds, pension funds and other off-balance sheet funds.

South America. Data per country (Millions of euros)

| Operating income | Net attributable profit/(loss) | |||||||

|---|---|---|---|---|---|---|---|---|

| Country | 2021 | ∆% | ∆% (1) | 2020 | 2021 | ∆% | ∆% (1) | 2020 |

| Argentina | 260 | (24.2) | n.s. | 343 | 63 | (29.4) | n.s. | 89 |

| Colombia | 569 | (3.8) | 1.0 | 591 | 228 | 38.5 | 45.4 | 165 |

| Peru | 685 | (4.6) | 9.6 | 718 | 122 | 11.4 | 28.0 | 110 |

| Other countries (2) | 147 | (26.8) | (24.9) | 200 | 77 | (5.8) | (2.4) | 82 |

| Total | 1,661 | (10.4) | (0.4) | 1,853 | 491 | 10.1 | 23.0 | 446 |

- (1) Figures at constant exchange rates.

- (2) Bolivia, Chile (Forum), Paraguay in 2020, Uruguay and Venezuela. Additionally, it includes eliminations and other charges.

South America. Relevant business indicators per country (Millions of euros)

| Argentina | Colombia | Peru | ||||

|---|---|---|---|---|---|---|

| 31-12-21 | 31-12-20 | 31-12-21 | 31-12-20 | 31-12-21 | 31-12-20 | |

| Performing loans and advances to customers under management (1) (2) | 3,333 | 2,495 | 12,334 | 10,913 | 15,552 | 14,914 |

| Non-performing loans and guarantees given (1) | 81 | 46 | 697 | 632 | 966 | 892 |

| Customer deposits under management (1) (3) | 6,083 | 4,101 | 12,814 | 11,330 | 13,946 | 15,648 |

| Off-balance sheet funds (1) (4) | 1,716 | 860 | 998 | 1,463 | 1,543 | 2,119 |

| Risk-weighted assets | 6,775 | 5,685 | 14,262 | 13,096 | 18,016 | 15,845 |

| Efficiency ratio (%) | 68.2 | 53.6 | 36.2 | 35.2 | 37.6 | 37.7 |

| NPL ratio (%) | 2.3 | 1.8 | 5.0 | 5.2 | 4.9 | 4.5 |

| NPL coverage ratio (%) | 146 | 241 | 103 | 113 | 89 | 101 |

| Cost of risk (%) | 2.20 | 3.24 | 1.85 | 2.64 | 1.59 | 2.13 |

- (1) Figures at constant exchange rates.

- (2) Excluding repos.

- (3) Excluding repos and including specific marketable debt securities.

- (4) Includes mutual funds.

Unless expressly stated otherwise, all the comments below on rates of change, for both activity and results, will be given at constant exchange rates. These rates, together with the changes at current exchange rates, can be found in the attached tables of the financial statements and relevant business indicators. The information for this business area includes BBVA Paraguay with regard to data on the results, activity, balance sheet and relevant business indicators for 2020, but does not include Paraguay for 2021, as the sale agreement materialized in January of that year. To facilitate an homogeneous comparison, the attached tables include a column at constant exchange rates that does not take BBVA Paraguay into account. All comments for this area also exclude BBVA Paraguay.

Activity and results

The most relevant aspects related to the area's activity during 2021 were:

- Lending activity (performing loans under management) recorded a variation of +10.3% over the period, with growth in all products and in all countries of the region, highlighting consumer and credit cards portfolios (+15.2%) and corporate portfolio (+9.3%).

- With regard to asset quality, the NPL ratio stood at 4.5%, which represents a decrease of 6 basis points compared to the end of September 2021, even taking into account the increase in non-performing loans due to the implementation of the new definition of default. For its part, the NPL coverage rate stood at 99, with a decrease of -943 basis points in the quarter due to this increase in non-performing loans.

- Customer funds under management increased (+5.7%) compared to the previous year's closing balances, with growth in demand deposits (+13.3%) and off-balance sheet funds (+3.7%) and a reduction in time deposits, in line with the strategy of some countries to reduce higher-cost liabilities in an environment whereby the Group's liquidity situation throughout the region is adequate.

The most relevant aspects of the area's activity in the fourth quarter of 2021 were:

- Lending activity (performing loans under management) was higher than in the previous quarter (+4.3%), mainly thanks to the good performance of consumer loans and credit cards (+5.2% and +11.8%, respectively) and the performance of the corporate portfolio (+3.6%).

- Total customer funds recorded a slight increase in the quarter (+0.9%), favored by the growth in both demand deposits (+4.7%) and off-balance sheet funds (+0.4%), which offset the decrease in time deposits (-8.5%).

With regard to the year-on year evolution of the results of South America, the area generated €491m in 2021, representing a year-on- year variation of +30.3%, mainly due to the improved performance of recurring income in 2021 (+21.0%), despite COVID-19 outbreaks and restrictions on mobility which have been in force during part of 2021 in some countries of the region. This comparison is also affected by the significant provision for impairment on financial assets made in 2020, also caused by COVID-19. In addition to all the aforementioned, it is worth mentioning two impacts originating in Argentina in the cumulative net attributable profit of the area: on the one hand, the impact derived from inflation in the country, which stood at €-164m at the close of December 2021, compared to €-104m accumulated at the close of December 2020; and on the other hand, a lower contribution due to the annual valuation on the remaining stake in Prisma Medios de Pago S.A. (hereinafter Prisma), with an impact on the NTI of the area.

In the quarter, excluding the exchange rate effect, South America generated a net attributable profit of €156m (+26.9%), mainly supported by the good performance of the net interest income (+9.4%), which, together with a lower level of provisions for impairment on financial assets (-31.3%), offset the increase in operating expenses in a context of higher activity.

More detailed information on the most representative countries of the business area is provided below:

Argentina

Macro and industry trends

Greater control of the pandemic during the second half of 2021 has allowed for a rapid recovery of economic activity. BBVA Research estimates that, after a contraction of 9.9% in 2020, GDP could stand at around 10.0% growth in 2021 and forecasts moderation to around 3.5% in 2022. Inflation remains very high, at around 50% at the end of December 2021, and some acceleration is expected during 2022, pending the negotiation of a new loan agreement with the International Monetary Fund.

The banking system continues to be influenced by the high inflation scenario. At the end of October 2021, lending grew by 28% compared to December 2020, while deposits grew by 39%. Meanwhile, during 2021, the NPL ratio increased to 4.9% in October (+1 percentage point compared to December 2021).

Activity and results

- Lending activity increased by 33.6% compared to the close of December 2020, a figure that is below inflation, with growth in the retail segment (+38.2%), highlighting credit cards (+38.4%), consumer loans (+41.1%) and corporate loans (+27.0%). The NPL ratio decreased in the last quarter of the year to 2.3%, due to increased activity and higher level of write- offs. For its part, the NPL coverage ratio was reduced to 146%, as a result of the reversal of provisions due to the annual parameters' recalibration.

- Balance sheet funds grew by 48.3% in 2021 and off-balance sheet funds (mutual funds) grew by 99.5% compared to December 2020.

- In the fourth quarter of 2021, Argentina continued to show a good performance in net interest income, mainly offset by Argentina’s hyperinflation adjustment, which was more negative than the previous quarter and higher operating expenses. The cumulative net attributable profit at the end of December 2021 stood at €63m, below the figure achieved twelve months earlier, as a result of the good performance of the recurring income, offset by: lower NTI, impacted by a lower contribution from Prisma's annual valuation; a more negative adjustment for inflation; higher expenses and higher provisions compared to 2020.

Colombia

Macro and industry trends

Economic activity has shown greater dynamism than expected in the last months of 2021, so that growth in the year could reach 10% (one point higher than expected three months ago), a significant recovery from the 6.8% contraction of GDP in 2020. In addition, the high inflation has helped the Bank of the Republic raise interest rates to 3.0% in December, from 1.75% in August. BBVA Research also estimates that further interest rate hikes will help control inflation expectations and that growth will converge to about 4.0% by 2022

Total lending in the banking system recovered (+7.5% at the end of October 2021, compared to December 2020), driven by credit to households, particularly the consumer portfolio (+8.8%). Corporate lending grew by 5.8%. Total deposits, meanwhile, grew by 3.9% at the end of October 2021 compared to December 2020. The system's NPL ratio at the end of October 2021 fell to 4.29% (70 basis points lower than in December 2020).

Activity and results

- Lending activity grew by 13.0% compared to 2020 year-end, with a good performance in both wholesale (+20.3%) and retail portfolios (+9.0%). In terms of asset quality, between September and December 2021 there was a -25 basis points drop in the NPL ratio to 5.0%, as a result of higher recoveries and good write-off management, coupled with the increase in activity mentioned above. For its part, the NPL coverage ratio stood at 103%, lower than the figure recorded in September 2021 (107%) due to a reduction in provisions.

- Customer deposits under management increased by 13.1%, compared to 2020 year-end, with growth in demand deposits, which compensated for the strategic reduction of time deposits, with higher costs for BBVA Colombia. For its part, off- balance sheet funds closed with a negative variation of 31.8% in 2021 due to the volatility of investments made by institutional customers.

- In the fourth quarter of 2021, BBVA Colombia recorded a growth in gross margin, due to the good evolution of the net interest income and the NTI. There was also an increase in operating expenses against a backdrop of increased activity, as well as lower provisions for impairment on financial assets. The net attributable profit for 2021 stood at €228m, significantly higher (+45.4% year-on-year) than the €165m reached in 2020, thanks to the favorable evolution of recurring income, as well as lower provisions for impairment on financial assets in 2021 compared to the previous year, when they increased notably due to the outbreak of the pandemic, which offset the negative impact on the other operating income and expenses line and the increased costs.

Peru

Macro and industry trends

The economic recovery process continued in the last months of 2021. Activity indicators have surprised positively compared to what was expected. Thus, BBVA Research estimates that after a fall of 11% in 2020, GDP would have increased by around 13.1% in 2021 (about one point above the previous forecast), despite inflationary pressures and monetary policy interest rate hikes to 2.5% in December. BBVA Research also projects growth to slightly exceed 2% in 2022, against a background of relatively high, albeit declining, inflation and further increases in interest rates.

Total lending in the banking system recovered (+5.6% at the end of September 2021, compared to December 2020) due to the stabilization of the consumer portfolio after decresing in 2020 and the first months of 2021. The housing portfolio accelerated its growth (+8.9%) and the corporate portfolio continued its deceleration (-6.2%) in September 2021, compared to December 2020, after the strong growth of the previous year due to the Reactiva program. For its part, the system's NPL ratio was still contained at 3.11% on the same date.

Activity and results

- Lending activity was favored by improving economic conditions and closed December 2021 with a growth of 4.3% compared to the previous year, mainly due to the performance of mortgages (+4.1%), consumer loans (+21.9%) and corporate lending (+2.7%). The NPL ratio increased in the fourth quarter of 2021 to stand at 4.9% (+18 basis points compared to September 2021), due to the implementation of the new definition of default. For its part, the NPL coverage ratio decreased to 89%, due to the increase in non-performing loans.

- Customers funds under management decreased by 12.8% in 2021, mainly due to lower balances in time deposits, with the aim of reducing their cost, as well as the reduction in mutual funds, which also recorded a decrease compared to the close of December 2020 (-27.2%), due to the departure of some customers.

- In the fourth quarter, BBVA Peru has shown a good evolution in net interest income and the NTI, as well as a reduction in provisions for impairment on financial assets. In the year-on-year evolution of the income statement, recurring income grew by 11.1%, thanks to the favorable evolution of the net interest income and commissions, which grew by 8.2% and 21.8%, respectively, offsetting the increase in operating expenses. Regarding items below operating income on the income statement, the year-on-year reduction in provisions for impairment on financial assets has boosted the results (-16.1%), as a result of high provision charges in 2020 following the pandemic outbreak. As a result, the net attributable profit stood at €122m at the end of December 2021, 28.0% higher than the figure posted in 2020.