Rest of Business

Highlights

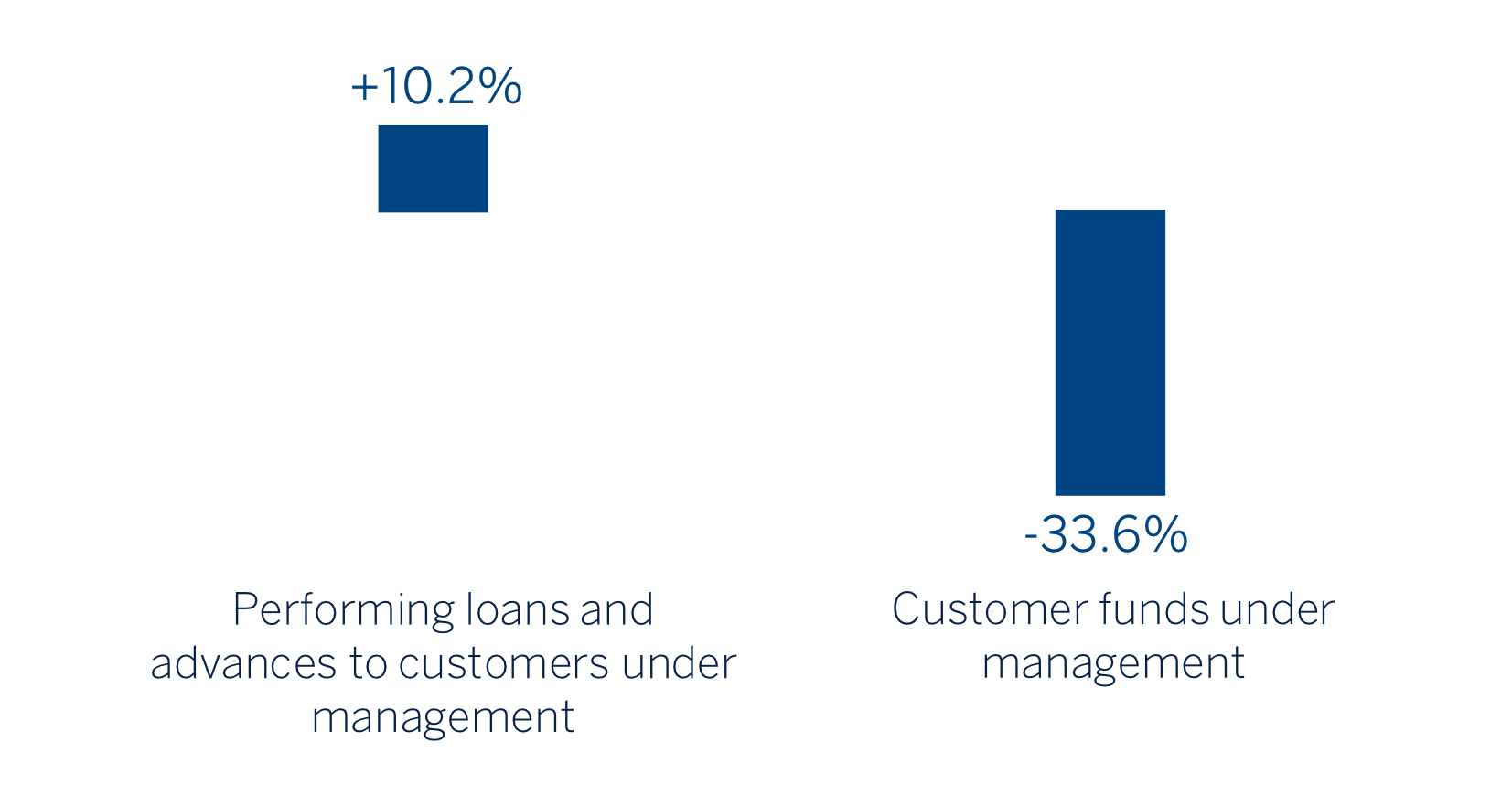

- Increase in lending due to evolution in the second half of the year and decrease in customer funds in 2021

- Good performance of recurring income in the fourth quarter

- Favorable evolution of risk indicators in the quarter

- Reversal in the impairment on financial assets line, which contrasts with provisions made in 2020

Business activity (1)

(VARIATION AT CONSTANT EXCHANGE RATES COMPARED TO 31-12-20)

(1) Excluding repos.

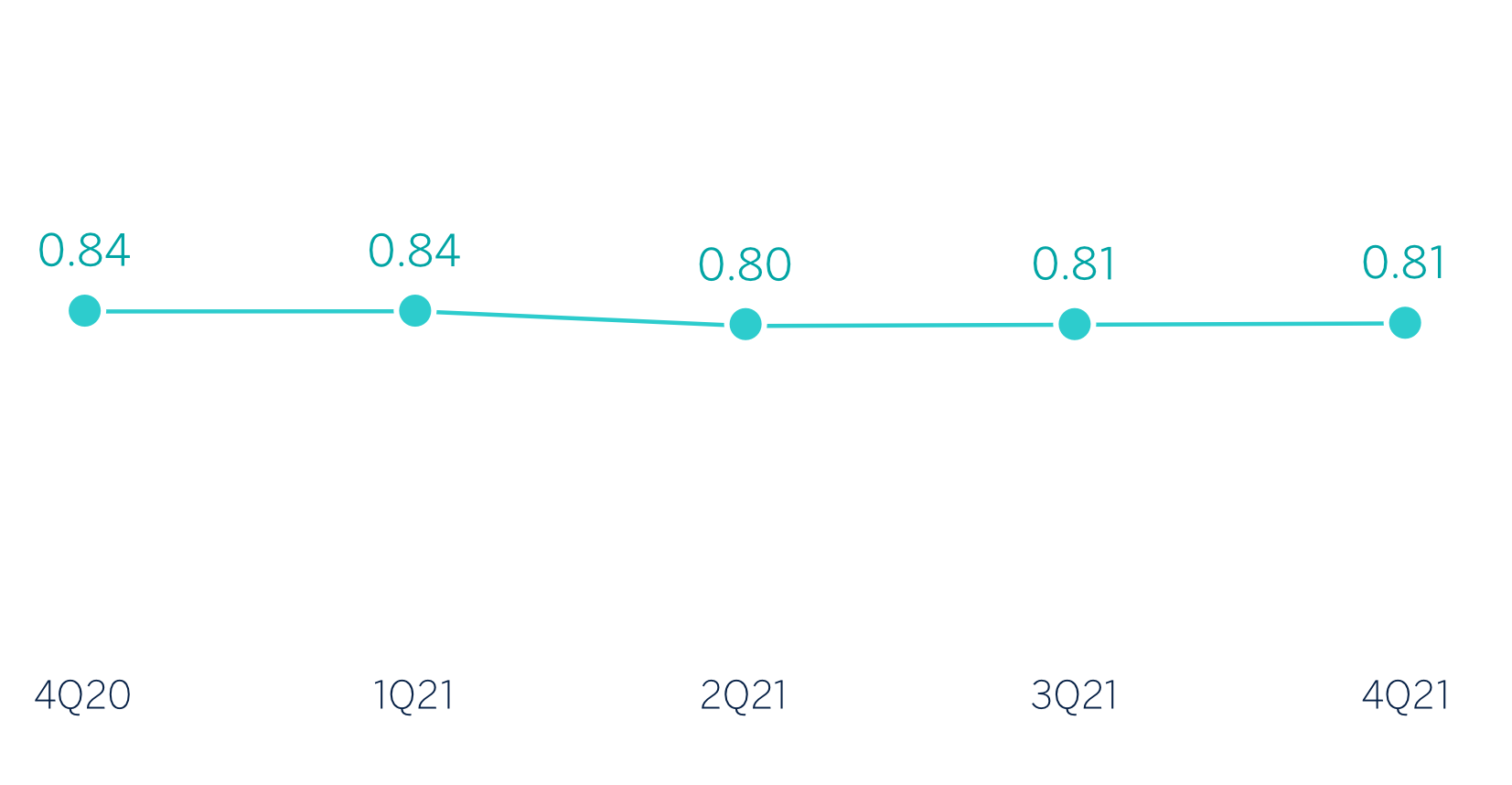

Net interest income/ATAs

(Percentage. Constant exchange rates)

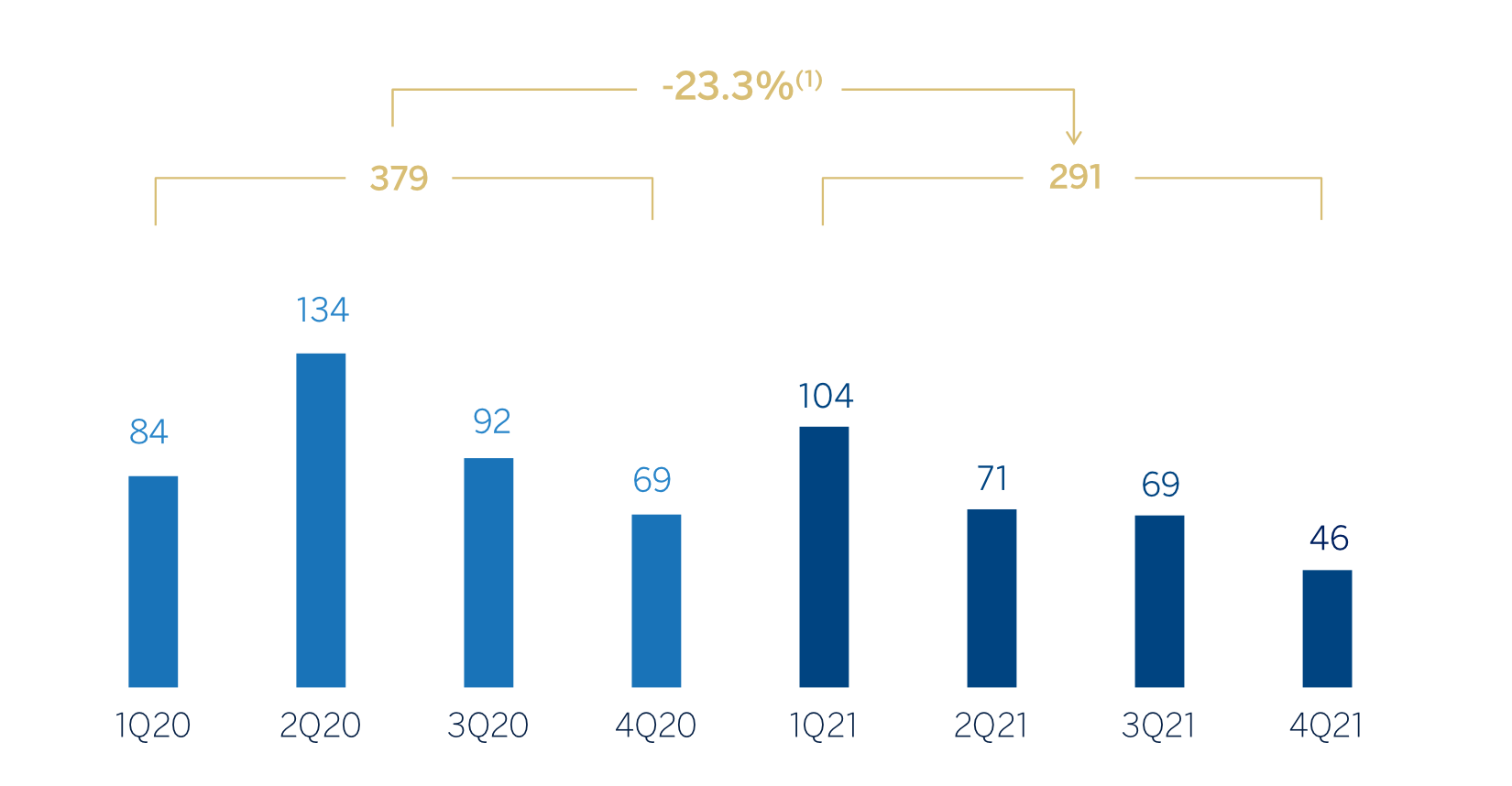

Operating income

(Millions of euros at constant exchange rate)

(1) At current exchange rates: -21.9%

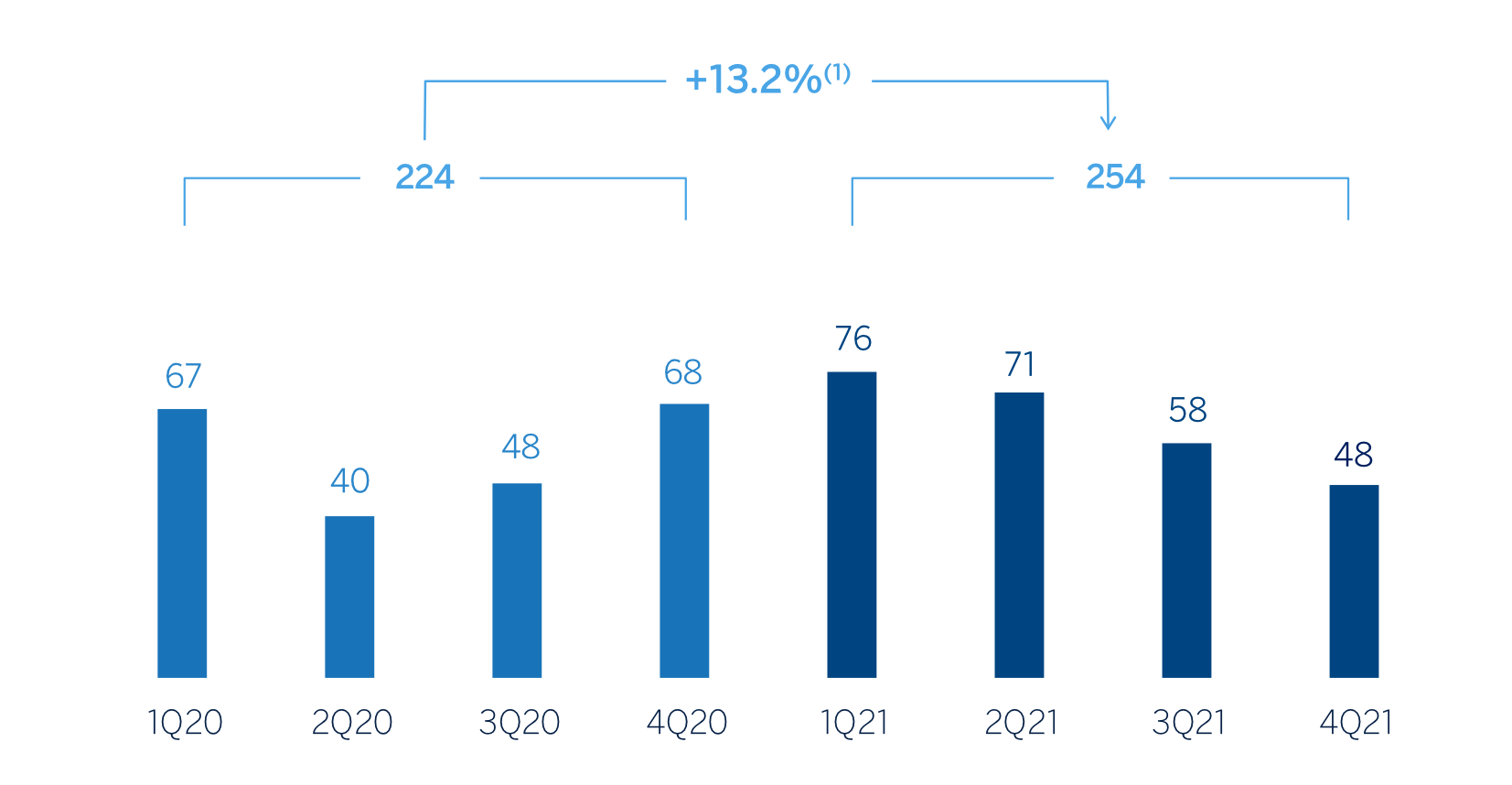

Net attributable profit (LOSS)

(Millions of euros at constant exchange rate)

(1) At current exchange rates: +14.2%

Financial statements and relevant business indicators (Millions of euros and percentage)

| Income statement | 2021 | ∆% | ∆% (1) | 2020 |

|---|---|---|---|---|

| Net interest income | 281 | (3.3) | (5.4) | 291 |

| Net fees and commissions | 248 | (25.4) | (24.8) | 332 |

| Net trading income | 197 | 15.0 | 13.3 | 171 |

| Other operating income and expenses | 16 | (65.4) | (65.3) | 45 |

| Gross income | 741 | (11.6) | (12.3) | 839 |

| Operating expenses | (451) | (3.4) | (3.4) | (467) |

| Personnel expenses | (233) | (9.3) | (8.9) | (257) |

| Other administrative expenses | (197) | 4.3 | 3.7 | (189) |

| Depreciation | (20) | (0.3) | (0.7) | (20) |

| Operating income | 291 | (21.9) | (23.3) | 372 |

| Impaiment on financial assets not measured at fair value through profit or loss | 27 | n.s. | n.s. | (85) |

| Provisions or reversal of provisions and other results | (4) | (51.9) | (54.6) | (8) |

| Profit (loss) before tax | 314 | 12.2 | 11.4 | 280 |

| Income tax | (60) | 4.8 | 4.3 | (57) |

| Profit (loss) for the year | 254 | 14.2 | 13.2 | 222 |

| Non-controlling interests | - | - | - | - |

| Net attributable profit (loss) | 254 | 14.2 | 13.2 | 222 |

| Balance sheets | 31-12-21 | ∆% | ∆% (1) | 31-12-20 |

|---|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 3,970 | (35.1) | (40.0) | 6,121 |

| Financial assets designated at fair value | 5,684 | 286.8 | 266.2 | 1,470 |

| Of which: Loans and advances | 4,693 | n.s. | n.s. | 153 |

| Financial assets at amortized cost | 30,299 | 11.3 | 9.4 | 27,213 |

| Of which: Loans and advances to customers | 26,949 | 12.2 | 10.2 | 24,015 |

| Inter-area positions | - | - | - | - |

| Tangible assets | 70 | (6.9) | (8.2) | 75 |

| Other assets | 291 | (0.6) | (3.3) | 293 |

| Total assets/liabilities and equity | 40,314 | 14.6 | 11.2 | 35,172 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 5,060 | n.s. | n.s. | 849 |

| Deposits from central banks and credit institutions | 1,709 | 0.5 | (3.5) | 1,700 |

| Deposits from customers | 6,266 | (32.9) | (35.9) | 9,333 |

| Debt certificates | 1,166 | (22.8) | (24.0) | 1,511 |

| Inter-area positions | 22.103 | 21.9 | 19.4 | 18,132 |

| Other liabilities | 723 | 18.8 | 15.5 | 608 |

| Economic capital allocated | 3,287 | 8.2 | 5.6 | 3,039 |

| Relevant business indicators | 31-12-21 | ∆% | ∆% (1) | 31-12-20 |

|---|---|---|---|---|

| Performing loans and advances to customers under management (2) | 26,983 | 12.3 | 10.2 | 24,038 |

| Non-performing loans | 261 | (19.6) | (20.2) | 324 |

| Customer deposits under management (2) | 6,266 | (32.9) | (35.9) | 9,333 |

| Off-balance sheet funds (3) | 597 | 4.9 | 4.9 | 569 |

| Risk-weighted assets | 29,252 | 20.2 | 17.7 | 24,331 |

| Efficiency ratio (%) | 60.8 | 55.6 | ||

| NPL ratio (%) | 0.7 | 1.0 | ||

| NPL coverage ratio (%) | 116 | 109 | ||

| Cost of risk (%) | (0.11) | 0.30 |

(1) At constant exchange rates.

(2) Excluding repos.

(3) Includes pension funds.

Unless expressly stated otherwise, all the comments below on rates of change, for both activity and results, will be given at constant exchange rates. These rates, together with the changes at current exchange rates, can be found in the attached tables of the financial statements and relevant business indicators. Comments that refer to Europe exclude Spain.

Activity

The most relevant aspects of the activity of Rest of Business of BBVA Group during 2021 were:

- Lending activity (performing loans under management) increased during the year (+10.2%), thanks to the business growth of BBVA's branches located in Asia.

- Regarding credit risk indicators, the NPL ratio stood at 0.7%, 23 basis points below the end of September 2021 due to increased activity and higher recoveries of wholesale customers in Europe, improving the coverage rate 18 percentage points to 116%.

- Customer funds under management decreased by 33.6% mainly due to a decrease in deposits from wholesale customers in the New York branch.

The most relevant developments in the area’s activity in the fourth quarter of 2021 were:

- Lending activity (performing loans under management) increased by 7.5% compared to the previous quarter due to the favorable performance of lending to wholesale customers of the New York branch.

- Total customer funds under management decreased in the quarter (-14.3%) with a reduction both in demand deposits (-8.0%) and time deposits (-25.5%), and a growth in off-balance sheet funds (+5.4%).

Results

The most significant aspects of the year-on-year evolution in the area's income statement at the end of December 2021 are the following:

- The net interest income decreased -5.4% compared to the same period of the previous year, mainly due to the evolution of the New York branch.

- Net commissions fell by 24.8% compared to the end of December 2020, due to lower issuance and advisory fees in Europe and, in particular, due to lower contribution from BBVA Securities, the Group's broker-dealer in the United States.

- The NTI line increased (+13.3%) driven by a better performance of BBVA Securities, the business in Europe and branches in Asia.

- Year-on-year decrease in operating expenses (-3.4%) due to lower expenses recorded by BBVA Securities.

- The impairment on financial assets line closed December with a reversal of €27m, which positively compares against the €-85m recorded twelve months earlier, mainly explained by the positive evolution of impaired clients of the New York branch and the retail portfolio in Europe.

- As a result, the area's cumulative net attributable profit between January and December 2021 was €254m (+13.2% year-on- year).

In the fourth quarter of 2021, excluding the exchange rate effect, the Group’s Rest of Business as a whole generated a net attributable profit of €48 million (-18.3% compared to the previous quarter), with a good performance in recurring income in the quarter, offset by lower NTI and higher operating expenses.