4.6.1. General characteristics of securitizations

Purpose of securitization

The Group’s current policy on securitization involves a program of recurrent issue, with a deliberate diversification of securitized assets that adjusts their volume to the Bank’s capital requirements and to market conditions.

This program is complemented by all the other finance and equity instruments, thereby diversifying the need to resort to wholesale markets.

The definition of the strategy and the execution of the operations, as with all other wholesale finance and capital management, is supervised by the Assets & Liabilities Committee, with the pertinent internal authorizations obtained directly from the Board of Directors or from the Executive Committee.

The main purpose of securitization is to act as an instrument for efficient balance-sheet management, as a source of:

- Liquidity at an efficient cost, complementing all the other finance instruments.

- Freeing up regulatory capital, through the transfer of risk.

- Freeing up potential excesses of generic allowances for losses, provided that the volume of the first-loss tranche and the effective risk transfer so permit.

Functions pursued in the securitization process and degree of involvement

The Group’s degree of involvement in its securitization funds is not usually restricted to the mere role of assignor and administrator of the securitized portfolio.

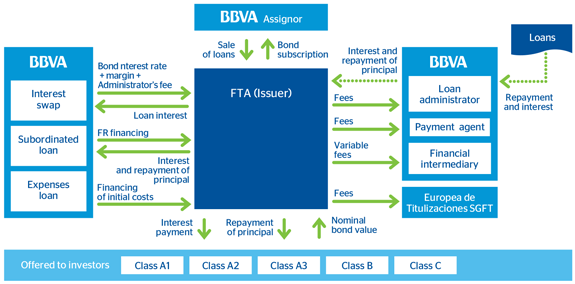

As can be seen in the above chart, the Group has usually taken additional roles such as:

- Payment Agent.

- Provider of the treasury account.

- Provider of the subordinated loan and of the loan for start-up costs, with the former being the one that finances the first-loss tranche, and the latter financing the fund’s fixed expenditure.

- Administrative agent of the securitized portfolio

The Group has not assumed the role of sponsor of securitizations originated by third-party institutions.

The Group’s balance sheet maintains the first-loss tranches of all securitizations performed.

It is worth noting that the Group has not modified its model for the generation of securitization operations since the credit crunch, which began in July 2007. Accordingly:

- There have been no transfers of risk through synthetic securitizations. All operations have involved traditional securitizations with simple structures in which the underlying assets were loans or financial leasing.

- It has not been involved in recurrent structures such as conduits or SIVs. All its issues have been one-offs, with no mandatory commitments for asset repackaging or the replacement of loans.

Methods used for the calculation of risk-weighted exposures in its securitization activity

The methods used to calculate risk-weighted exposures in securitizations are:

- The standardized approach: when this method is used for fully securitized exposures, in full or in a predominant manner if it involves a mixed portfolio.

- The IRB approach: when internal models are used for securitized exposures, in full or in a predominant manner. Within the alternatives of the IRB approach, use is made of the model based on external ratings.

Chart 15. Group’s degree of involvement in its securitization funds

4.6.2. Risk transfer in securitization activities

A securitization fulfills the criterion of significant and effective transfer of risk, and therefore falls within the solvency framework of the securitizations, when it meets the conditions laid down in Rules Fifty-five and Fifty-six in the Solvency Circular.

4.6.3. Investment or retained securitizations

The table below shows the amounts in terms of EAD of investment and retained securitization positions by type of exposure, tranches and weighting ranges corresponding to securitizations. In the case of originated securitizations, only those in which the Group fulfills the criteria for transfer of risk as of December 31, 2013 and 2012 are included.

Table 32. Amounts in terms of EAD of investment and retained securitization positions

2013

(Millions of euros)

|

|

|

|

EAD broken down by ECAI tranches | |||||

|---|---|---|---|---|---|---|---|---|

|

|

|

Standard | Advanced | |||||

| Security type |

Exposure type |

Tranche | 20% | 40%; 50%; 100%; 225%; 350%; 650% |

1,250% | RW<15% | 15%<RW<1,250% | 1,250% |

| Investment | Balancesheet exposure |

Preferential | 4,291 | 0 | 0 | 11 | 0 | 0 |

| Intermediate | 0 | 116 | 0 | 0 | 761 | 0 | ||

| First-loss | 0 | 0 | 6 | 0 | 0 | 10 | ||

| Offbalancesheet exposure |

Preferential | 0 | 0 | 0 | 0 | 0 | 0 | |

| Intermediate | 0 | 0 | 0 | 0 | 0 | 0 | ||

| First-loss | 0 | 0 | 0 | 0 | 0 | 0 | ||

| TOTAL |

|

|

4,291 | 116 | 6 | 11 | 761 | 10 |

| Retained | Balancesheet exposure |

Preferential | 11 | 0 | 0 | 28 | 0 | 0 |

| Intermediate | 0 | 89 | 0 | 0 | 25 | 0 | ||

| First-loss | 0 | 0 | 197 | 0 | 0 | 75 | ||

| Offbalancesheet exposure |

Preferential | 0 | 0 | 0 | 0 | 0 | 0 | |

| Intermediate | 0 | 0 | 0 | 0 | 0 | 0 | ||

| First-loss | 0 | 0 | 0 | 0 | 0 | 0 | ||

| TOTAL |

|

|

11 | 89 | 197 | 28 | 25 | 75 |

2012

(Millions of euros)

|

|

|

|

EAD broken down by ECAI tranches | |||||

|---|---|---|---|---|---|---|---|---|

|

|

|

Standard | Advanced | |||||

| Security type |

Exposure type |

Tranche | 20% | 40%; 50%; 100%; 225%; 350%; 650% |

1,250% | RW<15% | 15%<RW<1,250% | 1,250% |

| Investment | Balancesheet exposure |

Preferential | 5,783 | 0 | 0 | 20 | 0 | 0 |

| Intermediate | 0 | 263 | 0 | 0 | 578 | 0 | ||

| First-loss | 0 | 0 | 23 | 0 | 0 | 30 | ||

| Offbalancesheet exposure |

Preferential | 0 | 0 | 0 | 0 | 0 | 0 | |

| Intermediate | 0 | 0 | 0 | 0 | 0 | 0 | ||

| First-loss | 0 | 0 | 0 | 0 | 0 | 0 | ||

| TOTAL |

|

|

5,783 | 263 | 23 | 20 | 578 | 30 |

| Retained | Balancesheet exposure |

Preferential | 24 | 0 | 0 | 91 | 0 | 0 |

| Intermediate | 0 | 154 | 0 | 0 | 1,692 | 0 | ||

| First-loss | 0 | 0 | 198 | 0 | 0 | 313 | ||

| Offbalancesheet exposure |

Preferential | 0 | 0 | 0 | 0 | 0 | 0 | |

| Intermediate | 0 | 0 | 0 | 0 | 0 | 0 | ||

| First-loss | 0 | 0 | 0 | 0 | 0 | 0 | ||

| TOTAL |

|

|

24 | 154 | 198 | 91 | 1,692 | 313 |

The reduction seen in the exposure calculated using the standardized approach is due to sale of a large part of the Unnim securitizations, as well as the transfer of the rest of its outstanding securitizations to advanced models.

In addition, the depreciation of the dollar-Mexican peso exchange rate has contributed to a reduction in the exposure to the securitizations of the Group’s companies (primarily Bancomer and Compass).

4.6.4. Originated securitizations

Rating agencies used

The rating agencies that have been involved in the Group’s issues that fulfill the criteria of risk transfer and fall within the securitizations solvency framework are, generally, Fitch, Moody’s, S&P and DBRS.

In all the SSPEs, the agencies have assessed the risk of the entire issuance structure:

- Awarding ratings to all bond tranches.

- Establishing the volume of the credit enhancement.

- Establishing the necessary triggers (early termination of the restitution period, pro-rata amortization of AAA classes, pro-rata amortization of series subordinated to AAA and amortization of the reserve fund, among others).

In each and every one of the issues, in addition to the initial rating, the agencies carry out regular quarterly monitoring.

Breakdown of securitized balances by type of asset

The next tables give the current outstanding balance, non-performing exposures and impairment losses recognized in the period corresponding to the underlying assets of originated securitizations, in which risk transfer criteria are fulfilled, broken down by type of asset, as of December 31, 2013 and 2012.

The originating securitizations calculated using the advanced measurement approach have decreased due to the repurchases made during the year; they no longer have risk transfer and are now weighted by credit risk.

The Group has not securitized positions in revolving structures.

In 2013 and 2012, there were no securitizations that fulfill the transfer criteria according to the requirements of the Solvency Circular, and, therefore, no results were recognized.

BBVA has been the structurer of all transactions effected since 2006 (excluding the Unnim transactions).

The table below shows the outstanding balance of underlying assets of securitizations originated by the Group, in which risk transfer criteria are not fulfilled. These, therefore, are not included in the solvency framework for securitizations; the capital exposed is calculated as if they had not been securitized:

Table 33. Breakdown of securitized balances by asset balance

2013

(Millions of euros)

| Type of asset | Current balance |

Of which: Non-performing Exposures (1) |

Total impairment losses for the period |

|---|---|---|---|

| Commercial and residential mortgages | 182 | 15 | 61 |

| Credit cards | 0 | 0 | 0 |

| Financial leasing | 286 | 30 | 5 |

| Lending to corporates or SMEs | 435 | 54 | 7 |

| Consumer finance | 309 | 25 | 20 |

| Receivables | 0 | 0 | 0 |

| Securitization balances | 0 | 0 | 0 |

| Other | 0 | 0 | 0 |

| TOTAL | 1,212 | 124 | 93 |

2012

(Millions of euros)

| Type of asset | Current balance |

Of which: Non-performing Exposures (1) |

Total impairment losses for the period |

|---|---|---|---|

| Commercial and residential mortgages | 4,884 | 381 | 5 |

| Credit cards | 0 | 0 | 0 |

| Financial leasing | 402 | 32 | 22 |

| Lending to corporates or SMEs | 694 | 74 | 13 |

| Consumer finance | 577 | 45 | 24 |

| Receivables | 0 | 0 | 0 |

| Securitization balances | 0 | 0 | 0 |

| Other | 0 | 0 | 0 |

| TOTAL | 6,557 | 532 | 64 |

Table 34. Outstanding balance corresponding to the underlying assets of the Group’s originated securitizations, in which risk transfer criteria are not fulfilled

(Millions of euros)

|

|

Current balance | |

|---|---|---|

| Type of asset | 2013 | 2012 |

| Commercial and residential mortgages | 19,404 | 11,414 |

| Credit cards | 0 | 0 |

| Financial leasing | 25 | 31 |

| Lending to corporates or SMEs | 3,760 | 5,509 |

| Consumer finance | 1,209 | 1,300 |

| Receivables | 0 | 0 |

| Securitization balances | 0 | 0 |

| Mortgage-covered bonds | 0 | 4,402 |

| Other | 75 | 96 |

| TOTAL | 24,474 | 22,752 |

The movement in securitizations with no transfer arises from the combined effect of the repurchase of securitizations (which increases the balance) and their sale and amortization, not to mention the impact of the currency effect.