Regulatory environment in 2013

- Legal changes in the Community area

- Legal changes in IFRS

- Legal changes at international level

Circular 3/2008 dated May 22 of the Bank of Spain (1) and its amendments 9/2010 dated December 22 and 4/2011 dated November 30 (hereinafter, the Solvency Circular) constitute the final implementation of legislation on the capital base and supervision on a consolidated basis, within the scope of Spanish credit institutions.

This legislation established by Act 13/1985, dated May 25, on Investment ratios, bank capital and reporting requirements of financial intermediaries and other financial system regulations, and in Spanish Royal Decree 216/2008, dated February 15, on Financial institutions’ own funds, constitutes as a whole the transposition to Spanish credit institutions of Community Directives 2006/48/EC, of June 14, relating to the taking up and pursuit of the business of credit institutions and 2006/49/EC, of June 14, on the capital adequacy of investment firms and credit institutions, of the European Parliament and of the Council.

In accordance with Rule 109 of the Solvency Circular, financial institutions are required to publish a document called “Information of Prudential Relevance” including the contents stipulated in chapter 11 of this circular. This report has been drawn up in keeping with these requirements.

In accordance with the policy defined by the Group for drawing up the Information of Prudential Relevance, the content of this report refers to December 31, 2013 and was approved by the Group’s Audit and Compliance Committee at its meeting held on March 25, 2014, having previously been reviewed by the External Auditor. This review has not revealed any material discrepancies concerning compliance with the reporting requirements laid down in the Bank of Spain Solvency Circular.

(1) http://www.bde.es/bde/es/Regulatory environment in 2013

Legal changes in the Community area

European Commission/European Parliament/European Council

Circular 3/2008 implements Spanish regulations on capital base and consolidated supervision of financial institutions, as well as adapting Spanish law to the relevant European Union Capital Requirements Directives, in compliance with the accords by the Committee on Banking Supervision of the Bank for International Settlements in Basel.

As part of those recommendations, in December 2010 the Committee on Banking Supervision published the document “Basel III: A global regulatory framework for more resilient banks and banking systems”, in order to improve the sector’s ability to withstand the impacts arising from both financial and economic crises. Since then, the European Union has worked to incorporate these Basel recommendations and, after two years of negotiations, the so-called CRDIV was published on June 27, 2013 in the Official Journal of the European Union. CRDIV consists of a Directive that replaces capital Directives 2006/48 and 2006/49 and a common Regulation (575/2013). These Directives require transposition, while the Regulation is directly applicable.

This regulation took effect on January 1, 2014. After that date, the articles of the current Rules that contradict the European regulation have been repealed. Spanish Royal Decree 14/2013 was published on November 29. It adapted Spanish legislation to European Union rules on financial institution supervision and solvency.

The BBVA Group is ready for these amendments within the capital framework for banking institutions (BIS III according to CRDIV). The amendments on current requirements involve higher quality of capital, together with an increase in deductions and capital requirements for certain groups of assets and new capital buffer, leverage and liquidity requirements.

The capital base under CRD IV would mainly consist of the following elements:

Table 1. Calculation of the Capital Base according to CRD IV

| CET 1 | Common Equity Tier I |

|---|---|

| + | Capital |

| + | Reserves |

| + | Non-controlling interests up to limit when calculating |

| – | Goodwill and other intangible assets |

| – | Treasury stock |

| – | Loans financing treasury stock |

| – | DTAs for loss carry forwards |

| – | DVA |

| – | Limits applicable to Financial Institutions + Insurance Companies + DTAS for temporary differences |

| T1 | Tier I |

| + | COCOs and preferred securities that meet calculation criteria |

| + | Remaining non-controlling interests not assessed in CET1 |

| Total T1 | CET1 +T1 |

| T2 | TIER II |

| + | Subordinated debt under new criteria |

| + | Preferred securities not assessed in T1 |

| + | Generic Provision |

| – | Remaining non-controlling interests not assessed in CET1 and T1 |

| Capital base | Tier I + Tier II |

The most relevant aspects affecting common equity and risk-weighted assets are summarized below.

The main impacts affecting common equity TIER I (CET1) arise on the limit when calculating non-controlling interests and the deductions for significant and non-significant financial holdings, insurance companies and deferred taxes. Moreover, deferred taxes from loss carry forwards, the provision deficit on expected loss for IRB models and the debit valuation adjustment (DVA) of derivatives will now be deducted directly from CET1.

In the calculation of the additional Tier 1 and Tier 2 elements, only issues convertible into shares or redeemable at the option of the authority and subject to capital ratio triggers are calculated.

There are stricter requirements for risk-weighted assets, mainly for counterparty risk in derivatives and exposures within the financial sector.

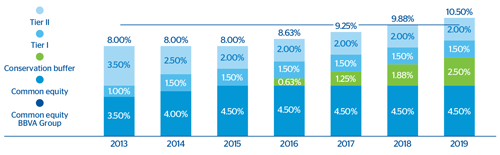

The gradual adaptation schedule detailed below has been established for compliance with the new capital ratios:

Chart 1. Schedule for gradual adaptation to CRD IV

As of December 31, 2013, according to the new CRD IV requirements that took effect in 2014, the BBVA Group’s estimated fully-loaded CET1 ratio stood at around 9.8%, well over the minimum CET1 that will be required in 2019 (7%), demonstrating the Group’s comfortable capital position. In terms of phased CET1 ratio according to the new CRD IV rules, the estimate as of January 1, 2014 stands at around 10.8%.

These requirements may be increased by the counter-cyclical buffer, the systemic bank buffer (a financial cushion required for those banks whose disorder may cause disturbances in the global financial system) and the systemic risk buffer, should they apply.

The BBVA Group is ready for these amendments and meets the new and more demanding requirements.

In order to provide the financial system with a metric that serves as a backstop at capital levels, irrespective of the credit risk, a measure complementing all the other capital indicators has been incorporated into Basel III and transposed to the CRR.

This measure, the leverage ratio, can be used to estimate the percentage of the assets financed with level 1 capital.

Although the book value of the assets used in this ratio is adjusted to reflect the bank’s current or potential leverage with a given balance sheet position, the leverage ratio is intended to be an objective measure that may be reconciled with the financial statements.

In recent months, the industry has made a significant effort to standardize both the definition and calculation of the leverage ratio and the minimum level that should be required from financial institutions to guarantee that adequate levels of leverage are maintained. Although this definition and calibration will take effect in 2018, BBVA estimates and monitors this measure in its most restrictive version (fully loaded) to guarantee that leverage is kept far from the minimum levels (which could be considered risky), without undermining the return on investment.

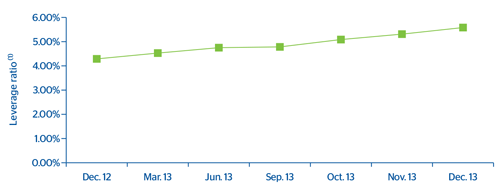

After the positive performance of the business in the last quarter of the year, BBVA closed 2013 at 5.6%, a very comfortable level that confirms its position as a bank with a sound funding structure. The chart below shows the annual change in the Bank’s leverage ratio:

In addition, the BBVA Group is actively managing liquidity by incorporating into its metrics the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR) defined under the capital framework. The Group thus continues to adapt early to regulatory changes, advocating proactive policies in managing the risk-return trade-off.

Chart 2. Annual change in the bank’s leverage ratio

Other relevant changes

- Single Supervision Mechanism (SSM): The European Central Bank (1), as the body responsible for ensuring the security and soundness of the European banking system and for promoting financial integration and stability in the euro zone, has begun a process aimed at setting up a new single financial supervision system made up of the ECB and the competent national authorities of the participating European Union countries.

The ECB is conducting a complete assessment before taking full responsibility for supervision, which is planned for November 2014, aimed at guaranteeing greater transparency of the balance sheets of the affected banks.

This assessment, which will be completed in October 2014, is based on three main actions:

- A Supervisory Risk Assessment to examine the key risks from a quantitative and qualitative point of view, including liquidity, leverage and funding.

In turn, this action will be carried out in three stages:

- Portfolio selection: The ECB will review the portfolios to be included in the assessment by setting minimum coverage criteria at bank and country level.

- Execution: This stage includes the validation of data integrity, an assessment of the proper valuation of the assets by the affected banks, the assessment of the guarantees and the calculation of the provisions for risk-weighted assets, among others.

- Checking of the final consistency of the data to enable a comparison of the results of all the banks.

- Stress Test to examine the resilience of the banks’ balance sheets.

The comprehensive assessment will end with the disclosure of the results in aggregate form, including the conclusions for the three components, and will be published before the ECB assumes its supervision role in November 2014.

- Coming into force of Regulation (EU) No. 575/2013 of the European Parliament and of the Council on prudential requirements for credit institutions and investment firms, dated June 26, 2013, amending Regulation (EU) No. 648/2012, whose implementation date has been set for January 1, 2014.

Legal changes in IFRS

The following amendments to IFRS took effect in 2013:

IFRS 10 “Consolidated financial statements”, IFRS 11 “Joint arrangements” and IFRS 12 “Breakdowns on investments in other banks”

IFRS 10 establishes a single consolidation model based on the principle of control, and applicable to all types of entities.

The main change it introduces is a definition of control, according to which a reporting entity controls another entity when it is exposed or has rights to variable returns from its involvements with the entity and has the ability to affect the amount of returns through its power over the entity.

IFRS 11 introduces new consolidation principles applicable to all joint arrangements. These arrangements are classified as either “joint operations” or “joint ventures” depending on the rights and obligations arising from the arrangement.

A joint operation is when the parties who have control have rights to the assets of the arrangement and obligations to the liabilities of the arrangement. A joint venture is when the parties who have joint control have rights to the net assets of the arrangement.

Joint operations shall be accounted for by including them in the financial statements of the entities controlling the assets, liabilities, income and expenses corresponding to them according to the contractual agreement. Joint ventures shall be accounted for in the consolidated financial statements using the equity method. They can no longer be accounted for by the proportionate consolidation method.

The main impact of the new applicable rules, IFRS 10 and 11, is the change in the consolidation method for the Group’s holding in the Garanti joint venture. Starting on January 1, 2013, this holding is valued using the equity method, while in 2012 and 2011 it was accounted for using the proportionate consolidation method. However, for solvency purposes, jointly-controlled financial entities continue to be accounted for using the proportionate consolidation method (including Garanti).

IFRS 12 introduces changes on the disclosure requirements for all types of holdings in other entities, including subsidiaries, joint arrangements, associates and unconsolidated structured entities.

IFRS 13 “Fair value measurement”

IFRS 13 provides guidelines for fair value measurement and reporting requirements. Under the new definition, fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. It is therefore a market-based measurement, and not specific to each entity.

The rule’s requirements to not change the previous criteria about when an entity should recognize an asset or liability at fair value, but they do provide guidelines on how the fair value should be measured when its use is required or permitted by other rules.

Legal changes at international level

In today’s difficult economic situation, the need for structural reforms in the system has become the subject of intense debate in 2013. This debate has adopted different approaches in the different geographical regions.

In the United States, the Volcker Rule has come into effect, aimed at restricting proprietary trading activities by U.S. banking institutions, i.e. trading with derivatives or other financial instruments not financed with deposits in order to obtain a profit.

On January 29, the European Commission (EC) announced its proposal for structural reform, which would impose new restrictions on the structure of European banks. The proposal aims to guarantee the harmonization of divergent national initiatives in Europe.

However, the EC goes beyond many European national legislations and opts for a mixed solution that establishes both:

- The prohibition of proprietary trading, similarly to the aforementioned Volcker Rule.

- A mechanism to require the separation of commercial activities, following the model of the banking reform in the United Kingdom.

The proposal is twofold, as it imposes both the prohibition of proprietary trading operations and investments in hedge funds and the separation of commercial activities.

The EC’s reform is stricter than most of the national initiatives in countries like France, Germany or the U.S., as it goes beyond the recommendations of the High-Level Panel of Experts set up by the EC itself, which recommends a separation of proprietary trading operations, but not the prohibition of commercial activities.

The scope of the banks subject to the reform is very wide. All European global systemically important banks (G-SIB) and institutions that carry out significant commercial activities, i.e. around 29 European banks, will be subject to this new regulation.

Exercise in transparency carried out by the bank

The BBVA Group has carried out an exercise in order to increase the transparency of the information provided in this Report based on the recommendations issued by the EBA (1) in its report “Follow-up review of banks’ transparency in their 2012 Pillar 3 Reports”. Based on its recommendations, new information breakdowns have been included throughout the document.

(1) http://www.eba.europa.eu/languages/home_es