The advanced internal model follows the LDA (Loss Distribution Approach) methodology. This methodology estimates the distribution of losses by operational event by convoluting the frequency distribution and the loss given default distribution of these events.

The calculations have been made using internal data on the Group’s historic losses as its main source of information. External databases (ORX consortium) have been employed to enrich the data from this internal database and to take account of the impact of possible events not yet considered therein; scenario simulations have also been included using information from the Group’s operational risk self-assessment tool.

The distribution of losses is constructed for each of the different types of operational risk, which are defined as per Basel Accord cells; i.e. a cross between business line and risk class. In those cases in which there is not sufficient data for a sound analysis, it becomes necessary to undertake cell aggregations, and to do so the business line is chosen as the axis. In certain cases, a greater disaggregation of the Basel cell has been selected. The objective consists of identifying statistically homogenous groups and a sufficient amount of data for proper modeling. The definition of these groupings is regularly reviewed and updated.

The Solvency Circular establishes that regulatory capital for operational risk is determined as the sum of individual estimates by type of risk, but allowing the option of incorporating the effect of the correlation among them. This impact has been taken into consideration in BBVA estimates with a conservative approach.

The model of calculating capital in both Spain and Mexico incorporates factors that reflect the business environment and situation of internal control systems. Thus the calculation obtained is higher or lower according to how these factors change in anticipating the result.

As regards other factors considered in the Solvency Circular, current estimates do not include the mitigating effect of insurance.

Finally, the capital resulting from the application of the advanced models is adjusted by factors related to the environment of the country and by internal control factors that depend on the level of mitigation of the weaknesses identified by the controls.

The tables below show the operational risk capital requirements broken down according to the calculation models used and by geographical area, to provide a global vision of capital consumption for this type of risk:

Table 41. Regulatory capital for operational risk

(Millions of euros)

|

|

2013 | 2012 |

|---|---|---|

| Advanced | 1,310 | 1,333 |

| Spain | 796 | 782 |

| Mexico | 514 | 551 |

| Standard | 975 | 867 |

| Basic | 136 | 205 |

| BBVA Group total | 2,421 | 2,405 |

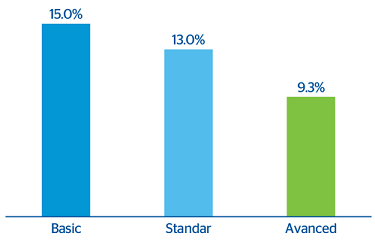

Chart 21. Capital required by method

The increased capital requirement is mainly due to changes to the standard model, originated by the increase in relevant income, primarily in countries like Venezuela, Argentina and Peru, and also as a result of the migrations in Paraguay and Uruguay, which previously were calculated using the Basic Model.

Lastly, the Basic Model decreases due to the aforementioned migrations and to Unnim’s switch to the Advanced Model.