Liquidity and funding management of the BBVA Group’s balance sheet helps to fund the recurrent growth of the banking business at suitable maturities and costs, using a wide range of instruments that provide access to a large number of alternative sources of funding. A core principle of the BBVA Group’s liquidity and funding management is the financial independence of its banking subsidiaries. This aims to ensure that the cost of liquidity is correctly reflected in price formation and that there is sustainable growth in the lending business.

In 2013, short and long-term wholesale funding markets performed very well in Europe and in Spain as a result of the ECB’s measures, the significant progress made in European integration and banking union, and the improved risk perception of European countries. This improvement resulted in a reopening of the market in early 2013 for the main Spanish financial institutions. BBVA has been able to access the markets normally, as can be seen by its successful issuances in the covered bonds, senior debt and regulatory capital (issuance of CoCos eligible as Additional Tier 1) markets. In the first quarter, BBVA completed three public issues on the wholesale senior debt and covered bonds markets for a total amount of €4 billion (3 billion in senior debt and one billion in covered bonds), with very high levels of demand and acceptance among foreign fixed-interest investors.

The capital markets are currently open for all BBVA products and maturities, with strong demand for credit by all kinds of investors.

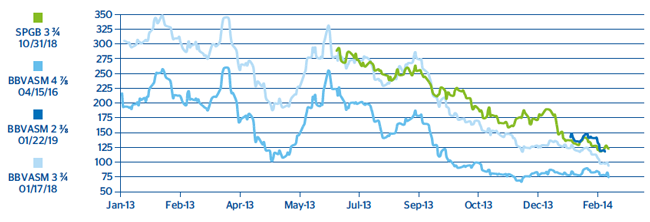

The improved risk perception of Spanish debt and of BBVA has driven a continued narrowing of the levels of both on the secondary market. This decrease of more than 150 bp in one year reduces the financial cost of the new issuances: 5-year senior in January 2014 at MS + 118 vs 5-year senior in January 2013 at MS + 295 or EUR AT1 in February 2014 with 7% coupon vs 9% for USD AT1 in May 2013.

The strong liquidity generated by the balance sheet in the BBVA Group (more than €33 bn) is due to the significant reduction in the Credit GAP (a combination of i) decline in lending in the euro zone and ii) increases in customer funds), which has been considerable in the euro zone and South America and moderate in Mexico and the U.S.

Each of the entities also maintains a diversified liquidity fund including liquid assets and securitized assets. The table below shows the rates and amounts of instruments included in the liquidity fund at the most significant units:

The euro zone has been one of the geographical areas with the greatest internal contribution of liquidity. This strong internal generation of liquidity has been used to:

- Cancel the Medium and Long-Term Issuance Program in April 2013.

- Reduce the need to resort to the ECB (€20 bn less).

In 2013, reliance on wholesale funding was reduced significantly and, therefore, the customer funds/total liabilities and Loan to Stable Customer Deposits ratios improved.

There was also a significant improvement in the euro zone’s wholesale funding structure, reducing reliance on both short-term funding and secured funding. This change in composition has improved the bank’s risk profile significantly by increasing the available assets to deal with possible tension in the unsecured financial markets (ratio above 2.5).

As mentioned earlier, the situation outside Europe has also been very positive, as the liquidity position has once again been reinforced in all the geographical areas where the Group operates. Thanks to the capacity of BBVA’s franchises to attract funds, there has been no need to access the international financial markets, and the Group’s funding structure has also improved once again.

These improvements in the liquidity profile in all the geographical areas is reflected in a Liquidity Coverage Ratio (regulatory short-term liquidity ratio defined by the Basel Committee) at Group level of over 100% throughout 2013.

The economic prospects for 2014 are positive, with growth forecasts in Europe. There is uncertainty surrounding the risk of deflation and the withdrawal of the Fed’s repurchase program (end of QE) and the end of its expansive policy.

The Euro balance sheet will continue to provide liquidity in 2014, although the amounts will be much more moderate than in 2013, through a reduction in the loan book and an increase in customer funds. Reliance on wholesale funding will also be reduced and the retail profile of the balance sheet will increase. Taking into account the ample liquidity existing in cash (over €10 bn at the end of the year) and the additional contribution of liquidity from the balance sheet in 2014, there is no need to renew all the medium and long-term wholesale funding maturities for 2014. In the first two months of the year, BBVA has once again had access to the markets on very favorable terms, specifically through the issuance of €1 bn of senior debt and €1.5 bn of regulatory capital (Additional Tier 1).

The evolution of liquidity in the rest of the geographical areas is expected to be as positive as in 2013, with slow growth in the loan book and funds.

The following is a breakdown of maturities of wholesale issues by the nature of the issues:

In conclusion, the BBVA Group’s proactive policy in liquidity management, its retail business model with an ample contribution of liquidity in 2014 and the reduced size of its assets, all give it a comparative advantage with respect to its European competitors. Moreover, the continued positive proportion of retail deposits on the balance sheet in all its geographical areas means the Group can continue to improve its liquidity position, while at the same time improving its funding structure.

The collateralized funding obtained by the Group amounted to nearly €111,000 million at the end of 2013, 19% of the total balance sheet, compared with €137,300 million and 22.1% the previous year. Collateralized funding, diversified by instruments and counterparties, corresponds mainly to issues of mortgage-covered and public-covered bonds, securitizations, assets sold under repurchase agreements and resorting to central banks.

In addition, within the framework of the policy implemented in recent years to strengthen its net worth position, the BBVA Group will at all times adopt the decisions it deems advisable to maintain its high level of capital solvency. In particular, the Annual General Meetings held on March 11, 2011, March 16, 2012 and March 15, 2013 authorized the issuance of fixed-income securities and convertible securities, which are specified in Note 27 to the Annual Consolidated Financial Statements as of December 31, 2013.

Chart 24. Changes in spread for wholesale issues

Table 45. Types and amounts of instruments included in the liquidity fund of the most significant units

2013

(Millions of euros)

|

|

BBVA Eurozone (1) |

BBVA Bancomer |

BBVA Compass |

Other |

|---|---|---|---|---|

| Cash and balances at central banks | 10,826 | 6,159 | 1,952 | 6,843 |

| Assets from credit transactions with central banks | 32,261 | 3,058 | 9,810 | 7,688 |

| Central government issues | 16,500 | 229 | 904 | 7,199 |

| Of which: Spanish government bonds | 14,341 | 0 | 0 | 0 |

| Other issues | 15,761 | 2,829 | 2,224 | 489 |

| Loans | 0 | 0 | 6,682 | 0 |

| Other non-eligible liquid assets | 4,735 | 425 | 278 | 396 |

| ACCUMULATED AVAILABLE BALANCE | 47,823 | 9,642 | 12,040 | 14,927 |

Table 46. Maturity of wholesale issues by nature

2013

(Millions of euros)

| Maturities of wholesale issues | 2014 | 2015 | 2016 | After 2016 | Total |

|---|---|---|---|---|---|

| Senior debt | 4,630 | 5,544 | 2,163 | 3,219 | 15,556 |

| Mortgage-covered bonds | 6,905 | 4,444 | 5,123 | 16,568 | 33,040 |

| Public-covered bonds | 1,305 | – | 150 | 984 | 2,439 |

| Regulatory capital instruments (1) | – | 63 | 207 | 4,789 | 5,059 |

| Other long-term financial instruments | 1 | 0 | 152 | 710 | 863 |

| TOTAL | 12,841 | 10,051 | 7,795 | 26,270 | 56,957 |