Mexico

Highlights

- Growth in lending activity in the first nine months of the year driven by the acceleration in the retail portfolio

- Good performance of customer funds continues, as a result of growing demand deposits, which allows for an improvement in the funding mix of BBVA Mexico

- Increase in recurring income and strength of operating income

- Decrease in impairment on financial assets, compared to the first nine months of 2020, which were strongly affected by the pandemic

Business activity (1)

(Year-to-date change, at a constant exchange

rate)

(1) Excluding repos.

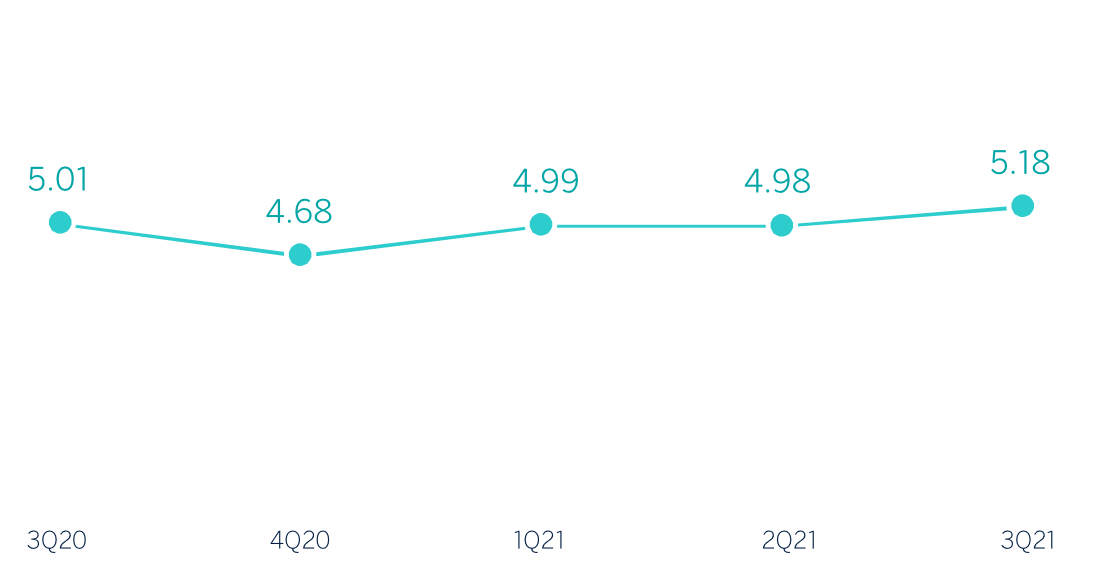

Net interest income/ATAs

(Percentage. Constant exchange rate)

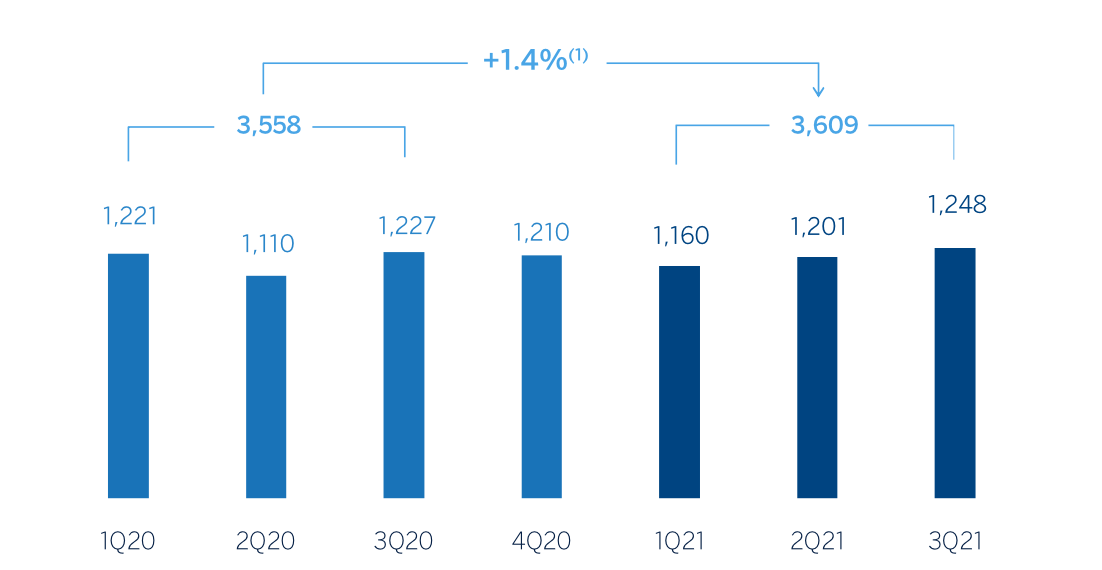

Operating income

(Millions of euros at constant exchange rate)

(1) At current exchange rate: +3.4%

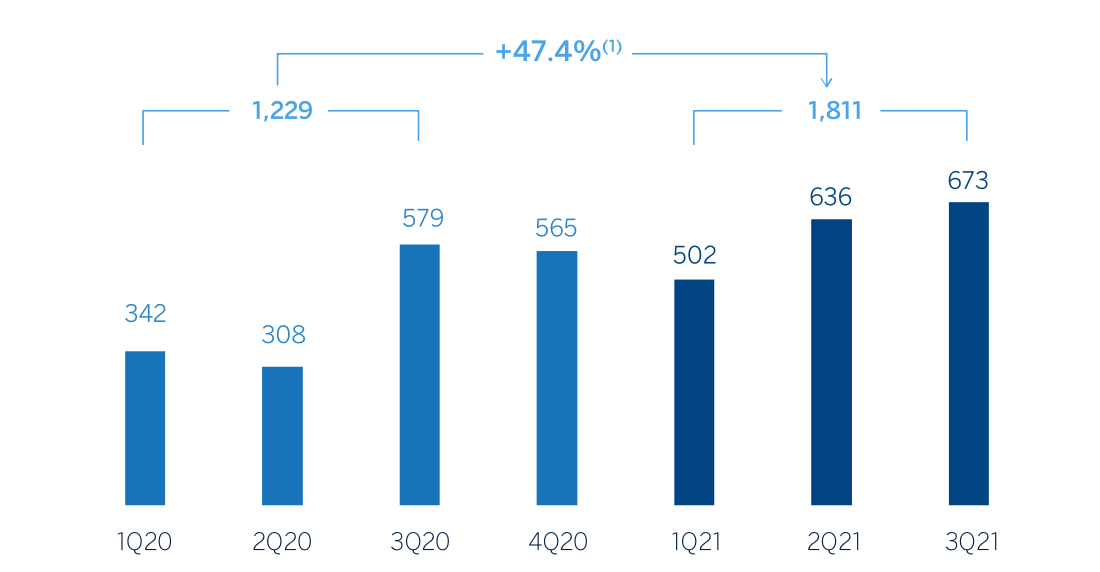

Net attributable profit

(Millions of euros at constant exchange rate)

(1) At current exchange rate: +50.2%

Financial statements and relevant business indicators (Millions of euros and percentage)

| Income statement | Jan.-Sep 2021 | ∆% | ∆% (1) | Jan.-Sep. 2020 |

|---|---|---|---|---|

| Net interest income | 4,280 | 6.0 | 4.1 | 4,036 |

| Net fees and commissions | 898 | 17.7 | 15.5 | 763 |

| Net trading income | 253 | (23.4) | (24.8) | 330 |

| Other operating income and expenses | 127 | 17.9 | 15.6 | 107 |

| Gross income | 5,558 | 6.1 | 4.1 | 5,237 |

| Operating expenses | (1,948) | 11.6 | 9.5 | (1,745) |

| Personnel expenses | (853) | 18.1 | 15.9 | (722) |

| Other administrative expenses | (853) | 8.0 | 6.0 | (790) |

| Depreciation | (242) | 3.8 | 1.8 | (233) |

| Operating income | 3,609 | 3.4 | 1.4 | 3,491 |

| Impairment on financial assets not measured at fair value through profit or loss | (1,075) | (38.5) | (39.7) | (1,749) |

| Provisions or reversal of provisions and other results | 18 | n.s. | n.s. | (48) |

| Profit/(loss) before tax | 2,551 | 50.6 | 47.7 | 1,694 |

| Income tax | (740) | 51.6 | 48.7 | (488) |

| Profit/(loss) for the period | 1,812 | 50.2 | 47.4 | 1,206 |

| Non-controlling interests | (0) | 40.6 | 38.0 | (0) |

| Net attributable profit/(loss) | 1,811 | 50.2 | 47.4 | 1,206 |

| Balance sheets | 30-09-21 | ∆% | ∆% (1) | 31-12-20 |

|---|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 13,777 | 50.4 | 46.2 | 9,161 |

| Financial assets designated at fair value | 33,472 | (7.9) | (10.5) | 36,360 |

| Of which loans and advances | 1,361 | (47.4) | (48.9) | 2,589 |

| Financial assets at amortized cost | 62,196 | 4.0 | 1.1 | 59,819 |

| Of which loans and advances to customers | 53,014 | 6.0 | 3.1 | 50,002 |

| Tangible assets | 1,644 | (0.2) | (3.0) | 1,647 |

| Other assets | 2,866 | (11.8) | (14.2) | 3,249 |

| Total assets/liabilities and equity | 113,955 | 3.4 | 0.5 | 110,236 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 21,232 | (10.8) | (13.2) | 23,801 |

| Deposits from central banks and credit institutions | 5,509 | 7.5 | 4.5 | 5,125 |

| Deposits from customers | 58,440 | 8.1 | 5.1 | 54,052 |

| Debt certificates | 7,811 | 2.2 | (0.6) | 7,640 |

| Other liabilities | 13,624 | 5.5 | 2.6 | 12,911 |

| Regulatory capital allocated | 7,339 | 9.4 | 6.4 | 6,707 |

| Relevant business indicators | 30-09-21 | ∆% | ∆% (1) | 31-12-20 |

|---|---|---|---|---|

| Performing loans and advances to customers under management (2) | 53,465 | 6.0 | 3.1 | 50,446 |

| Non-performing loans | 1,459 | (19.7) | (22.0) | 1,818 |

| Customer deposits under management (2) | 57,893 | 7.7 | 4.7 | 53,775 |

| Off-balance sheet funds (3) | 24,947 | 10.8 | 7.7 | 22,524 |

| Risk-weighted assets | 61,162 | 0.6 | (2,2) | 60,825 |

| Efficiency ratio (%) | 35.1 | 33.4 | ||

| NPL ratio (%) | 2.5 | 3.3 | ||

| NPL coverage ratio (%) | 131 | 122 | ||

| Cost of risk (%) | 2.70 | 4.02 |

(1) At constant exchange rate.

(2) Excluding repos.

(3) Includes mutual funds and other off-balance sheet funds.

Macro and industry trends

Economic growth shows signs of moderation following the strong expansion recorded in the first half of 2021. BBVA Research estimates that GDP will expand by 6.0% in 2021, two tenths below its previous forecast. In an environment of relatively weak domestic demand, the price of commodities and certain production inputs has increased inflationary pressures, which have led Banxico to raise monetary policy interest rates to 4.75% in September, from 4.0% in May.

With regard to the banking system, based on data at the end of August 2021, the system's lending volume increased slightly since December 2020 (+0,9%), showing strong growth in the mortgage portfolio (+5,8% since the end of 2020), while deposits increased slightly (+1.6 since December 2020). The NPL ratio in the system recorded slight improvement, reaching an NPL ratio of 2.32% at the end of August (+2.56% in December last year) and capital indicators, by their part, remained comfortable.

Unless expressly stated otherwise, all the comments below on rates of change, for both activity and results, will be given at constant exchange rate. These rates, together with changes at current exchange rates, can be found in the attached tables of financial statements and relevant business indicators.

Activity

The most relevant aspects related to the area's activity during the first nine months of 2021 were:

- Lending activity (performing loans under management) grew 3.1% compared to December 2020 thanks to the performance of the retail segment (+6.3%), which continued to show the dynamism that began in the second quarter of 2021. Within the retail segment, the mortgage portfolio was once again notable (+6.5% compared to December 2020). Consumer finance and credit cards accelerated its growth rate (+4.5% in the first nine months of 2021), and so did SME financing which was up 13.7% compared to the end of December 2020. The promotion of the business model for the SME segment has allowed the product offering to be expanded and the commercial effort to be increased with more qualified personnel to meet needs and thus increase the number of customers. Meanwhile, the wholesale portfolio posted slight growth compared to the end of December 2020 (+0.6%). As a result of the above, BBVA Mexico's mix shows an increase toward the most profitable portfolio, with the retail portfolio representing 51% and the wholesale portfolio 49%.

- With regard to asset quality indicators, the NPL ratio recorded a decrease of 51 basis points in the third quarter of 2021 to stand at 2.5%, as a result of practically flat activity (excluding the exchange rate effect), a slight decrease in non-performing loans due to higher write-offs and contained wholesale entries. Meanwhile, the NPL coverage ratio improved due to the positive dynamics of NPL flows in the quarter, standing at 131%.

- Customer deposits under management showed an increase of 4.7% during the first nine months of 2021. This performance is explained by growth of 6.8% in demand deposits, due to customers' preference for having liquid balances in an uncertain environment, compared to the decline observed in time deposits (-4.3%). The above has allowed BBVA Mexico to improve its deposits mix, with 82% of total deposits in lower-cost funds. Mutual funds grew 7.8% between January and September 2021, favored by an improved offering which recently includes funds linked to environmental, social and governance (ESG) factors.

The most relevant aspects related to the area's activity during the third quarter of 2021 were:

- Lending activity (performing loans under management) grew 1.2% in the quarter thanks to the good performance of practically all portfolios in the retail segment (+2.9%), while the wholesale portfolio remained stable (-0.3%), due to maturities and repayments of commercial and corporate loans that have materialized between July and September, offset in part by the good performance of loans to the government (+2.0%), by actively participating in bidding processes.

- Total funds under management increased in the quarter (1.5%) with growth in both demand deposits and time deposits, which recorded growth of 1.9%, the latter favored by Banxico's recent increases in interest rates by 75 basis points. Mutual funds closed September with growth of 1.7%.

Results

BBVA Mexico posted a net attributable profit of €1,811m accumulated at the end of September 2021, representing a 47.4% increase compared to the same period in 2020, which was significantly affected by the COVID-19 pandemic.

The most relevant aspects of the year-on-year changes in the income statement at the end of September 2021 are summarized below:

- Net interest income closed up higher than the figure posted between January and September 2020 (+4.1%), due to lower financing costs, the negative impact on this line of customer support measures against a backdrop of the pandemic in the second quarter of 2020 and, to a lesser extent, the improvement in the portfolio mix in 2021. Also notable is the upward trend toward recovery in the new retail loan origination, which is already reflected in this line.

- Net fees and commissions increased 15.5% thanks to increased number of transactions, especially on credit cards, and thanks to fees and commissions arising from investment banking operations and mutual fund management.

- NTI decreased by 24.8% year-on-year, mainly due to lower results from the Global Markets unit in 2021, as well as lower results from ALCO portfolios.

- The other operating income and expenses line increased by 15.6% year-on-year as a result of the extraordinary revenue generated by the effects of initiatives aimed at transforming the production model, which have allowed the level of fraud to be reduced and operational efficiencies to have increased. All this enabled growth in this line of the income statement, despite lower results from the insurance unit, which was mainly affected by increased claims.

- Operating expenses increased (+9.5%) in an environment of high inflation, mainly due to higher personnel expenses against a backdrop of increased activity. Also contributing to the year-on-year growth is the fact that certain expenses were not incurred in 2020 as a result of the pandemic, and thus increased general expenses in 2021, like technology expenses, among others.

- The impairment on financial assets line item decreased significantly compared to the same period last year (-39.7%), mainly due to additional provisions for COVID-19 recorded in 2020 and to better-than-expected portfolio performance. With regard to the cumulative cost of risk as of September 2021, this continued on its downward trend and stood at 2.70%.

- The provisions and other resultsline showed a favorable comparison, driven by higher sales of foreclosed assets in 2021 and lower provisions related to contingent risks compared to those recorded during the first nine months of 2020.

This quarter, BBVA Mexico generated a net attributable profit of €673m, with growth of +5.8% compared to the previous quarter, influenced by the good performance of recurring revenue items (+4.9%), the increase in operating expenses against a backdrop of recovering activity (+3.4%), increased provisions for impairment on financial assets (+15.7%, below the recurring historical level prior to the outbreak of the pandemic), and a downward adjustment in the effective tax rate.