Turkey

Highlights

- Activity growth driven by Turkish lira loans and deposits

- Outstanding performance of NTI and net fees

- Downward trend in the cost of risk continues

- Net attributable profit growth driven by lower impairment losses on financial assets, compared to 2020 which was strongly affected by the effects of the pandemic

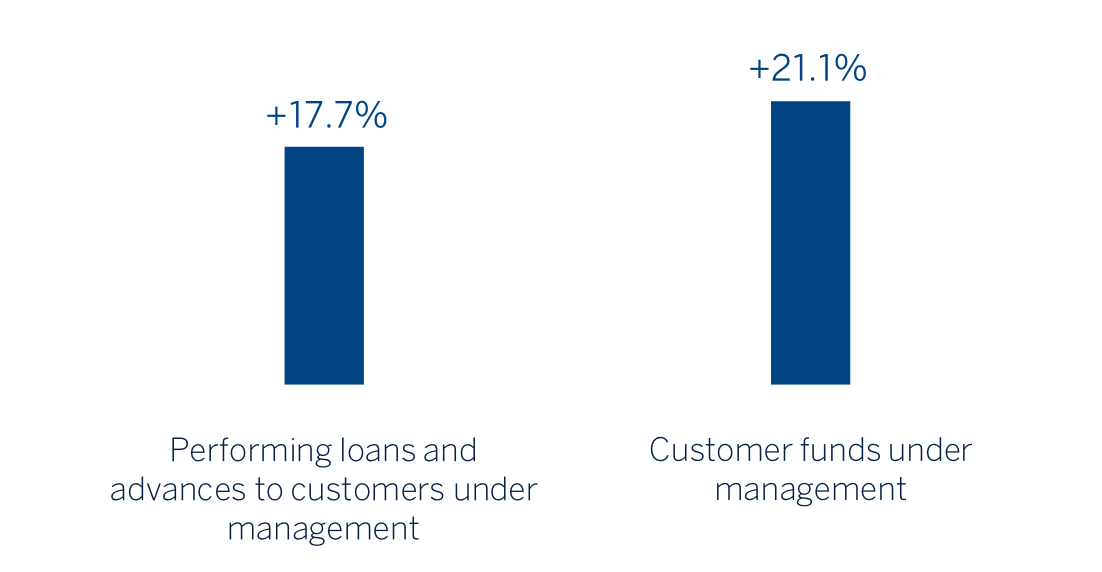

Business activity (1)

(Year-to-date change, at a constant exchange

rate)

(1) Excluding repos.

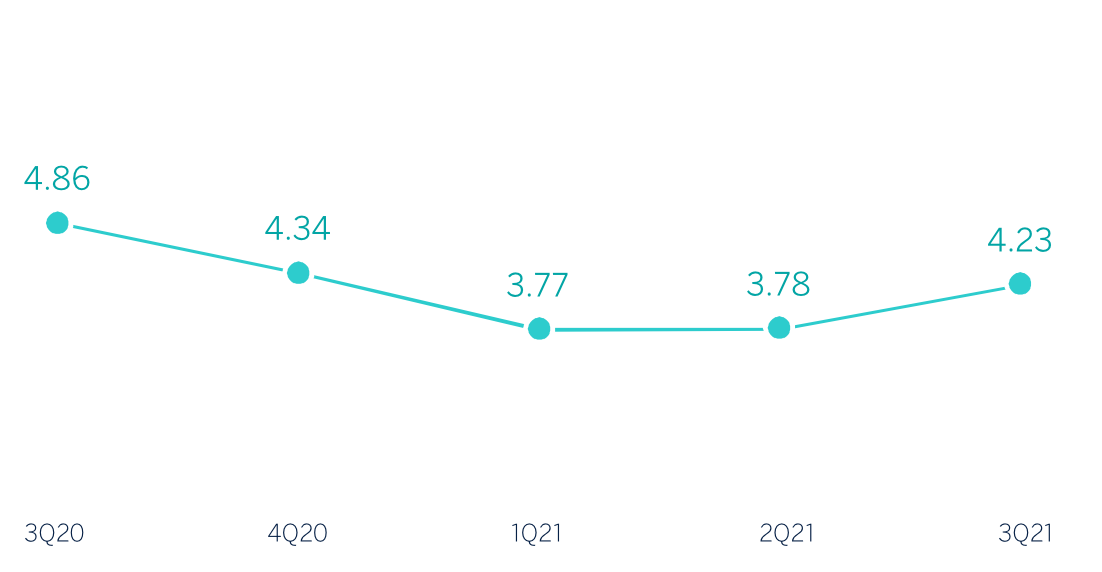

Net interest income/ATAs

(Percentage. Constant exchange rate)

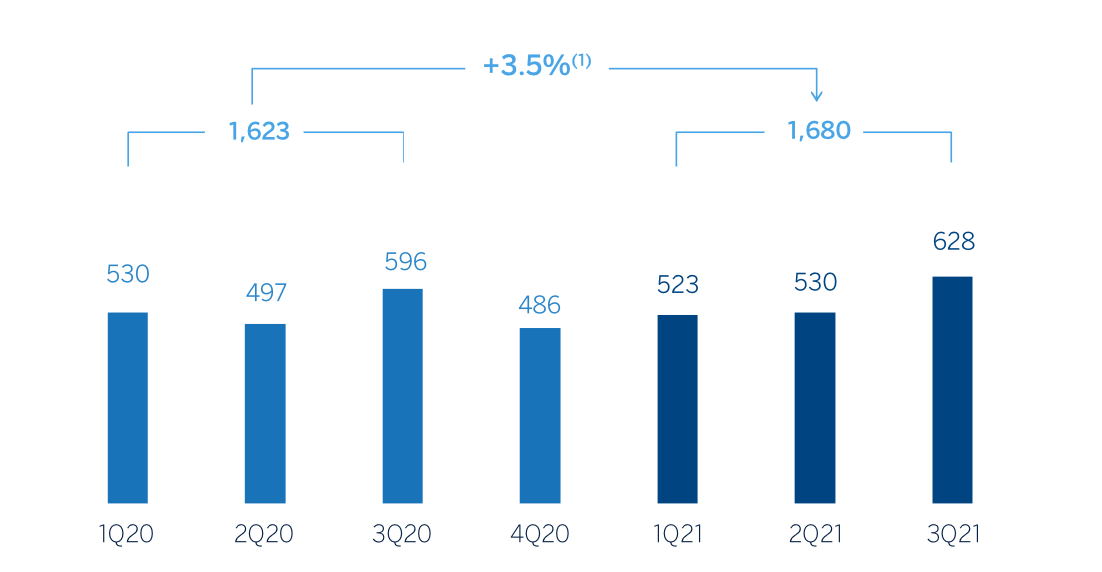

Operating income

(Millions of euros at constant exchange rate)

(1) At current exchange rate: -19.0%

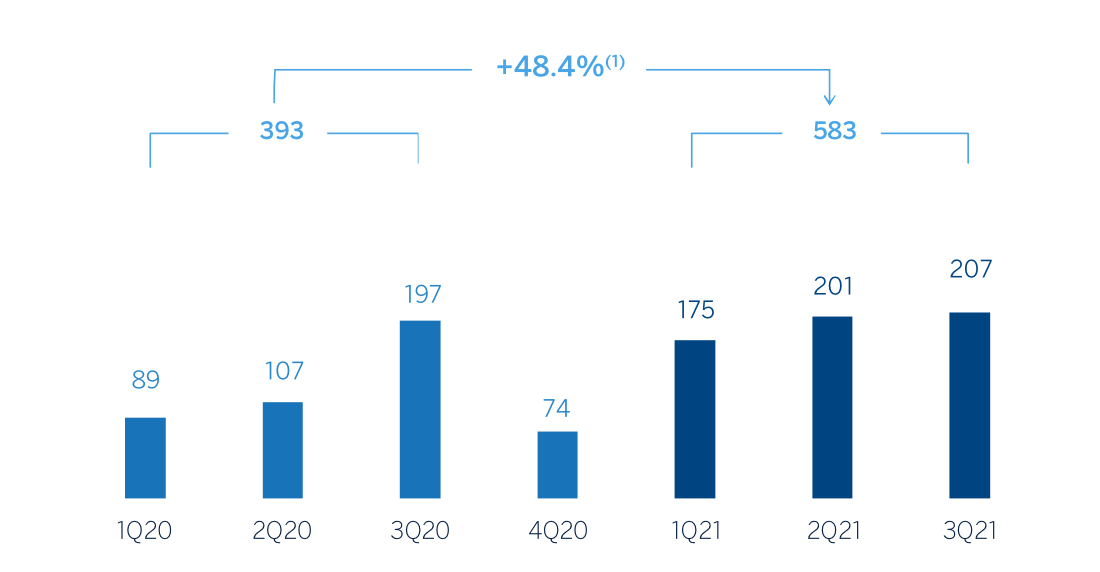

Net attributable profit

(Millions of euros at constant exchange rate)

(1) At current exchange rate: +16.1%

Financial statements and relevant business indicators (Millions of euros and percentage)

| Income statement | Jan.-Sep. 21 | ∆% | ∆% (1) | Jan.-Sep. 20 |

|---|---|---|---|---|

| Net interest income | 1,651 | (25.6) | (4.9) | 2,218 |

| Net fees and commissions | 443 | 13.2 | 44.6 | 391 |

| Net trading income | 239 | 15.9 | 48.1 | 206 |

| Other operating income and expenses | 81 | 59.9 | 104.3 | 51 |

| Gross income | 2,414 | (15.8) | 7.6 | 2,866 |

| Operating expenses | (734) | (7.3) | 18.5 | (792) |

| Personnel expenses | (421) | (3.7) | 23.1 | (437) |

| Other administrative expenses | (218) | (7.4) | 18.3 | (236) |

| Depreciation | (95) | (20.3) | 1.9 | (119) |

| Operating income | 1,680 | (19.0) | 3.5 | 2,075 |

| Impairment on financial assets not measured at fair value through profit or loss | (235) | (65.4) | (55.8) | (680) |

| Provisions or reversal of provisions and other results | 59 | n.s. | n.s. | (70) |

| Profit/(loss) before tax | 1.504 | 13.5 | 45.1 | 1,325 |

| Income tax | (323) | 5.0 | 34.2 | (308) |

| Profit/(loss) for the period | 1,181 | 16.1 | 48.4 | 1,017 |

| Non-controlling interests | (598) | 16.1 | 48.4 | (515) |

| Net attributable profit/(loss) | 583 | 16.1 | 48.4 | 503 |

| Balance sheets | 30-09-21 | ∆% | ∆% (1) | 31-12-20 |

|---|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 6,258 | 14.2 | 29.1 | 5,477 |

| Financial assets designated at fair value | 5,417 | 1.6 | 14.8 | 5,332 |

| Of which loans and advances | 413 | (0.5) | 12.5 | 415 |

| Financial assets at amortized cost | 47,893 | 2.5 | 15.9 | 46,705 |

| Of which loans and advances to customers | 38,933 | 4.4 | 18.0 | 37,295 |

| Tangible assets | 851 | (5.5) | 6.8 | 901 |

| Other assets | 1,130 | (3.5) | 9.1 | 1,170 |

| Total assets/liabilities and equity | 61,549 | 3.3 | 16.7 | 59,585 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 1,999 | (14.4) | (3.3) | 2,336 |

| Deposits from central banks and credit institutions | 3,880 | 14.8 | 29.7 | 3,381 |

| Deposits from customers | 41,282 | 4.9 | 18.5 | 39,353 |

| Debt certificates | 3,971 | (1.6) | 11.2 | 4,037 |

| Other liabilities | 3,735 | (13.3) | (2.0) | 4,308 |

| Regulatory capital allocated | 6,682 | 8.3 | 22.4 | 6,170 |

| Relevant business indicators | 30-09-21 | ∆% | ∆% (1) | 31-12-20 |

|---|---|---|---|---|

| Performing loans and advances to customers under management (2) | 38,173 | 4.2 | 17.7 | 36,638 |

| Non-performing loans | 3,330 | 4.6 | 18.2 | 3,183 |

| Customer deposits under management (2) | 41,280 | 4.9 | 18.6 | 39,346 |

| Off-balance sheet funds (3) | 4,565 | 33.3 | 50.6 | 3,425 |

| Risk-weighted assets | 55,233 | 4.2 | 17.7 | 53,021 |

| Efficiency ratio (%) | 30.4 | 28.8 | ||

| NPL ratio (%) | 6.5 | 6.6 | ||

| NPL coverage ratio (%) | 78 | 80 | ||

| Cost of risk (%) | 0.88 | 2.13 |

(1) At constant exchange rate.

(2) Excluding repos.

(3) Includes mutual funds and other off-balance sheet funds.

Macro and industry trends

Economic activity indicators continue to show strength, suggesting that GDP could grow by 9.5% in 2021, according to BBVA Research’s estimate. Economic dynamism, as well as the recent depreciation of the Turkish lira and the prices of certain commodities, have contributed to annual inflation rising to 19.6% at the end of September 2021. Despite inflationary pressures, the Central Bank of the Republic of Turkey has cut benchmark interest rates by 100 basis points to 18.0% in September 2021.

With regard to the banking system, based on data as of August 2021, the total volume of lending in the system increased by 9.3% since December 2020 (+8.1% in Turkish lira and +11.8% in foreign currency), while deposits grew by 13.2%, these growth rates include the effect of inflation. The NPL ratio stood at 3.67% at the end of August 2021 (4.08% at the end of 2020).

Unless expressly stated otherwise, all comments below on rates of changes for both activity and income, will be presented at constant exchange rates. These rates, together with changes at current exchange rates, can be observed in the attached tables of the financial statements and relevant business indicators.

Activity

The most relevant aspects related to the area’s activity during the first nine months of 2021 were:

- Lending activity (performing loans under management) increased by 17.7% between January and September 2021, driven by the growth in Turkish lira loans (+22.3%) which was supported mainly by consumer loans, thanks to the strong origination in General Purpose Loans, and also by credit cards, mortgage and commercial loans. Foreign-currency loans (in U.S. dollar) contracted during the first nine months of 2021 (-8.2%).

- In terms of asset quality,the NPL ratio decreased 81 basis points to 6.5% compared to June 2021, due to contained nonperforming loans together with strong recoveries in the wholesale portfolio and an increase in activity focused on the retail portfolio. The NPL coverage ratio stood at 78% as of September 30, 2021, with an increase of 863 basis points in the quarter, mainly due to the good performance of non-performing loans.

- Customer deposits under management (67% of total liabilities in the area as of September 30, 2021) remained as the main source of funding for the balance sheet and increased by 18.6%. It is worth highlighting the positive performance of Turkish lira demand deposits (+29.9%), which represent 27% of total customer deposits in local currency, as well as time deposits (+16.2%). By its part, the evolution of off-balance sheet funds (+50.6%) also stood out. In line with the sector trend, foreign currency deposits decreased by 2.0%.

The most relevant developments in the area’s activity in the third quarter of 2021 were:

- Lending activity (performing loans under management) was above the previous quarter (+6.3%) as a result of the evolution in Turkish lira loans, with a particular focus on consumer loans (+9.8%) and credit cards (+13.0%), with flat performance in the commercial portfolio between July and September.

- Total funds under management showed a positive quarterly evolution (+4.5%), highlighting the growth of demand deposits, both in local and foreign currencies, as well as the increase in off-balance sheet funds.

Results

Turkey generated a net attributable profit of €583m in the first nine months of 2021, 48.4% higher than in the same period of the previous year, which was impacted by a strong increase in the impairment losses on financial assets due to the COVID-19 pandemic. Taking into account the effect of the depreciation of the Turkish lira over the period, the results generated by Turkey increased by 16.1%.

The most significant aspects of the year-on-year evolution in the area's income statement at the end of September 2021 are the following:

- Net interest income declined by 4.9% mainly due to contraction in the customer spread and increasing funding costs, despite higher loan volume and higher contribution from inflation-linked bonds.

- Net fees and commissions grew significantly (+44.6% year-on-year) mainly driven by the positive performance in brokerage fees and payment systems.

- NTI performed significantly well (+48.1%), mainly due to the positive impact of trading transactions in foreign currencies, the profit from the Global Markets unit and securities transactions.

- Other operating income and expenses increased by 104.3% between January and September, compared to the same period in 2020, mainly due to the positive contribution of the subsidiaries of Garanti BBVA, with the renting activity standing out.

- Operating expenses increased by 18.5%, impacted by the higher average annual inflation rate, the depreciation of the Turkish Lira and increased activity. On the other hand, there was a reduction in some discretionary expenses in 2020 due to COVID-19, affecting the year-on-year evolution. Nevertheless, the efficiency ratio remained low (30.4%).

- Impairment losses on financial assets decreased by 55.8% compared to those registered between January and September 2020, mainly due to the negative impact of the deterioration in the macroeconomic scenario as a result of the outbreak of the COVID-19 pandemic in March 2020, as well as the improvement of said scenario in 2021. At the end of September 2021, recoveries and repayments from one-off clients were registered. As a result of the aforementioned, the cumulative cost of risk decreased to 0.88% at the end of September 2021.

- The provisions and other results line closed September with a profit of €59m, compared to the loss of €-70m recorded in the same period of the previous year, mainly thanks to capital gains from the sale of real estate assets and lower provisions for special funds and contingent liabilities and commitments.

Turkey generated a net attributable profit of €207m in the quarter, which represents an increase of 2.6% compared to the previous quarter, mainly due to the positive evolution of the net interest income, which increased by +19.7%, promoted by loans in Turkish lira, improvement in customer spreads and the higher contribution of inflation-linked bonds. The latter was in part offset by an increase in the impairment of financial assets in the quarter (+35.9%) and the upward adjustment of the effective tax rate, resulting from the tax reform implemented in April 2021.