Spain

Highlights

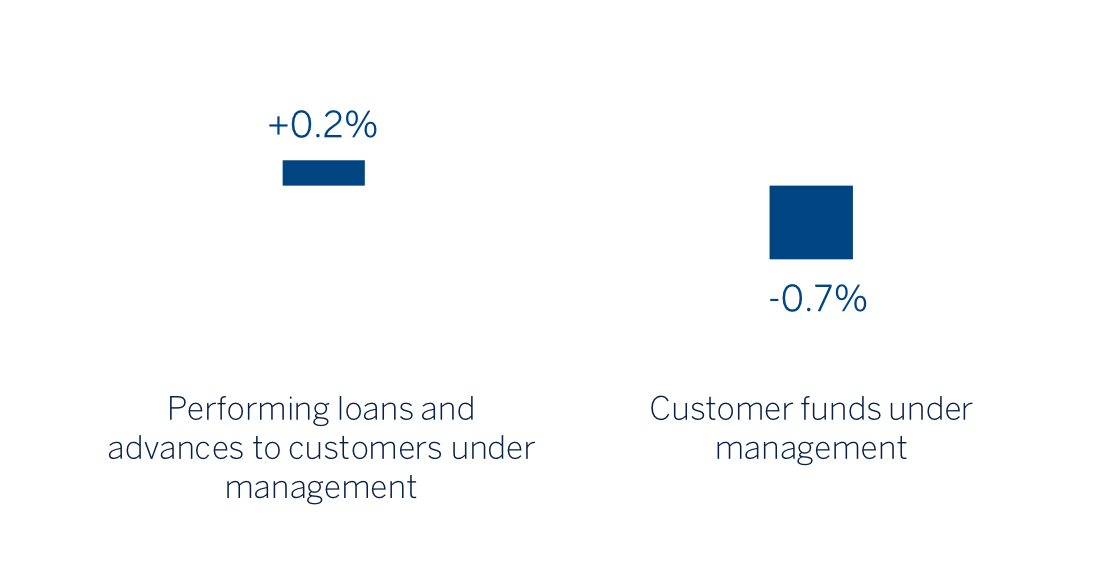

- Slight growth in lending activity throughout the year

- Improvement in the efficiency ratio

- Favorable year-on-year growth of recurring revenue due to the evolution of fees

- Decrease in impairment on financial assets, compared to a 2020 that was strongly affected by the pandemic, resulting in an improvement in the cost of risk

Business activity (1)

(YEAR-TO-DATE CHANGE)

(1) Excluding repos.

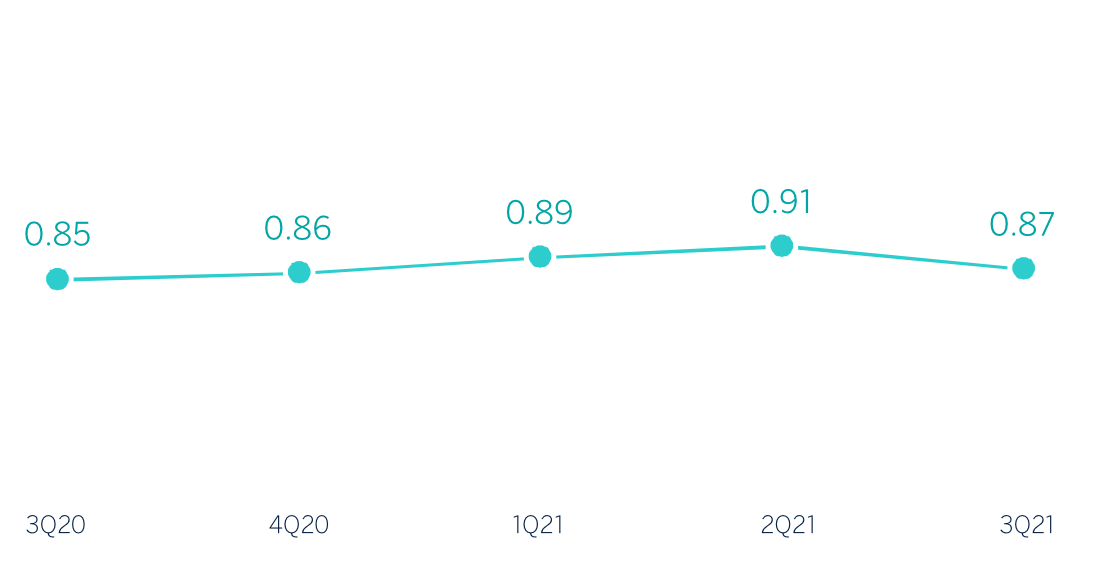

Net interest income/ATAs

(Percentage)

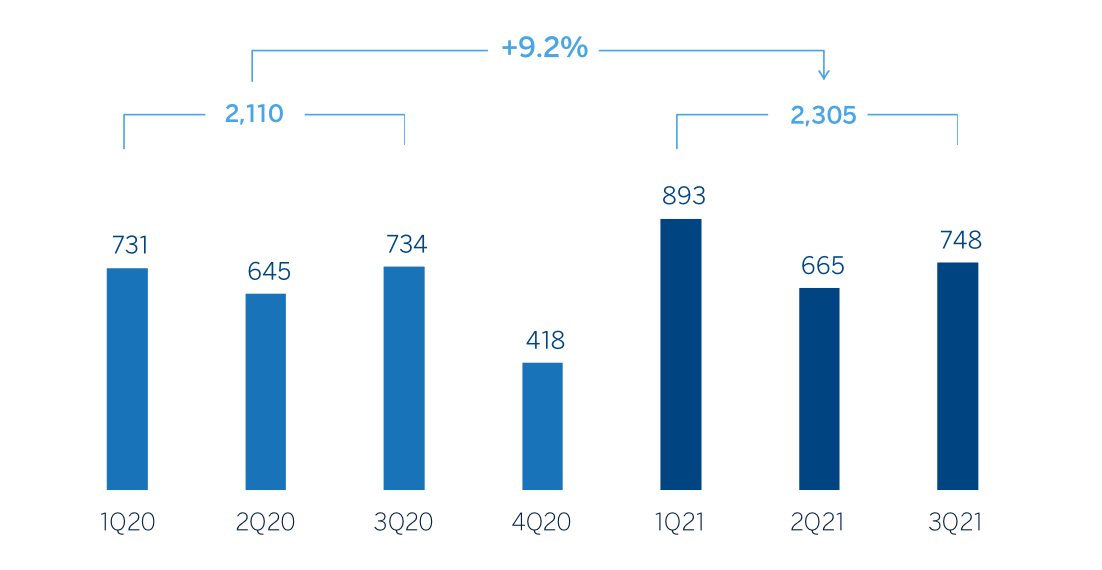

Operating income (Millions of euros)

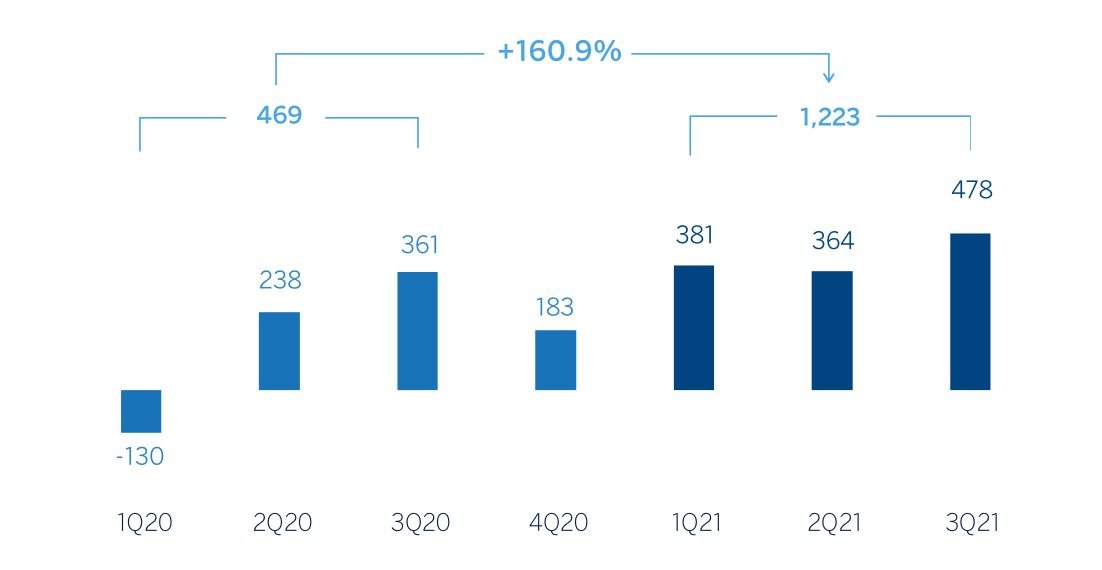

Net attributable profit (Millions of euros)

Financial statements and relevant business indicators (Millions of euros and percentage)

| Income statement | Jan.-Sep. 21 | ∆% | Jan.-Sep. 20 |

|---|---|---|---|

| Net interest income | 2,635 | (1.9) | 2,686 |

| Net fees and commissions | 1,592 | 18.0 | 1,349 |

| Net trading income | 305 | 40.7 | 217 |

| Other operating income and expenses | 19 | (86.9) | 141 |

| Of which insurance activities (1) | 268 | (26.1) | 362 |

| Gross income | 4,550 | 3.6 | 4,393 |

| Operating expenses | (2,245) | (1.7) | (2,283) |

| Personnel expenses | (1,280) | (0.8) | (1,291) |

| Other administrative expenses | (638) | (1.2) | (646) |

| Depreciation | (326) | (5.7) | (346) |

| Operating income | 2,305 | 9.2 | 2,110 |

| Impairment on financial assets not measured at fair value through profit or loss | (402) | (62.6) | (1,075) |

| Provisions or reversal of provisions and other results | (242) | (43.7) | (430) |

| Profit/(loss) before tax | 1,662 | 174.5 | 605 |

| Income tax | (437) | 226.1 | (134) |

| Profit/(loss) for the period | 1,225 | 159.9 | 471 |

| Non-controlling interests | (2) | (23.0) | (2) |

| Net attributable profit | 1,223 | 160.9 | 469 |

- (1) Includes premiums received net of estimated technical insurance reserves.

| Balance sheets | 30-09-21 | ∆% | 31-12-20 |

|---|---|---|---|

| Cash, cash balances at central banks and other demand deposits | 23,138 | (39.7) | 38,356 |

| Financial assets designated at fair value | 141,522 | 2.6 | 137,969 |

| Of which: Loans and advances | 37,440 | 22.0 | 30,680 |

| Financial assets at amortized cost | 197,527 | (0.3) | 198,173 |

| Of which: Loans and advances to customers | 168,408 | 0.2 | 167,998 |

| Inter-area positions | 30,098 | 13.7 | 26,475 |

| Tangible assets | 2,458 | (15.3) | 2,902 |

| Other assets | 6,105 | (6.6) | 6,535 |

| Total assets/liabilities and equity | 400,849 | (2.3) | 410,409 |

| Financial liabilities held for trading and designated at fair value through profit or loss | 72,655 | (1.7) | 73,921 |

| Deposits from central banks and credit institutions | 58,351 | (0.7) | 58,783 |

| Deposits from customers | 200,222 | (3.0) | 206,428 |

| Debt certificates | 37,605 | (8.3) | 41,016 |

| Inter-area positions | - | - | - |

| Other liabilities | 18,496 | 9.1 | 16,955 |

| Regulatory capital allocated | 13,520 | 1.6 | 13,306 |

| Relevant business indicators | 30-09-21 | ∆% | 31-12-20 |

|---|---|---|---|

| Performing loans and advances to customers under management (1) | 165,889 | 0.2 | 165,511 |

| Non-performing loans | 8,022 | (3.8) | 8,340 |

| Customer deposits under management (1) | 199,600 | (3.0) | 205,809 |

| Off-balance sheet funds (2) | 67,119 | 7.0 | 62,707 |

| Risk-weighted assets | 108,921 | 4.3 | 104,388 |

| Efficiency ratio (%) | 49.3 | 54.6 | |

| NPL ratio (%) | 4.1 | 4.3 | |

| NPL coverage ratio (%) | 65 | 67 | |

| Cost of risk (%) | 0.32 | 0.67 |

- (1) Excluding repos.

- (2) Includes mutual funds and pension funds.

Macro and industry trends

The economy continues to recover against a backdrop in which the vaccine rollout has resulted in fewer infections and an easing of restrictions on mobility. Growth in the second quarter (1.1% quarterly) was lower than initially forecasted by BBVA Research, thus contributing to a downward revision of its growth forecast for 2021 from 6.5% to 5.2%. Europe is also experiencing a recovery, meaning that the ECB will reduce asset purchases under the PEPP program. Inflation continues to accelerate, as in other neighboring countries (in August, it stood at 3.3%, higher than forecasted by BBVA Research), driven mainly by energy.

With regard to the banking system, with data as of the end of July 2021, the volume of lending to the private sector recorded a slight decline of 0.3% since December 2020, following growth of 2.6% in 2020. The NPL ratio continued to decline to 4.39%, also at the end of July 2021 (4.51% at 2020 year-end). Therefore, the system maintained comfortable levels of capital adequacy and liquidity.

Activity

The most relevant aspects related to the area's activity during the first nine months of 2021 were:

- Lending activity (p(performing loans under management) was slightly higher than at the end of 2020 (+0.2%) mainly due to growth in loans to SMEs (+6.2%) and consumer loans (+6.3% including credit cards),

- With regard to asset quality, the non-performing loan ratio decreased by 8 basis points in the quarter to stand at 4.1%, mainly due to the positive evolution of the underlying flows, and specially to the recovery of certain wholesale customers, contributing to an increase in the average coverage up to 65% as of September 30, 2021.

- Total customer funds rremained stable (-0.7%) compared to 2020 year-end, thanks to the good performance of offbalance sheet funds (+7.0%), which partially offset the decrease in customer deposits under management (-3.0%) due to the lower balance of time deposits held by retail clients in a low interest rate environment.

The most relevant aspects related to the area's activity in the third quarter of 2021 were

- Lending activity (performing loans under management) was slightly down from the previous quarter (-0.8%), mainly due to the decrease in lending to the public sector (-11.9%), which was partially offset by growth in the SME segments (+1.8%) and in consumer finance and credit cards (+1.6 %).

- Total customer funds remained stable throughout the quarter (+0.3%), thanks to growth of demand deposits (+1.6%) and off-balance sheet funds (+1.1%), which offset the decrease in time deposits (-11.7%).

Results

Spain generated a net attributable profit of €1,223m during the first nine months of 2021, up +160.9% from the result posted in the same period of the previous year, mainly due to the increased provisions for impairment on financial assets as a result of the COVID-19 outbreak and provisions made in both cases in 2020, as well as the increased contribution from commission fees and NTI in 2021.

The most notable aspects of the year-on-year changes in the area's income statement at the end of September 2021 were:

- Net interest income continues to decrease compared to the same period last year, although at a slower rate (-1.9% compared to -2.2% year-on-year at the end of June 2021), affected by the context of falling interest rates and partially offset by lower financing costs.

- Net fees and commissions continued to show positive performance (+18.0% year-on-year), mainly favored by a greater contribution from revenues associated with asset management activities and the contribution of banking and insurance services, in the latter case, by the bancassurance operation with Allianz.

- NTI Iat the end of September 2021 continued to show significant year-on-year growth of 40.7%, mainly due to the results of the Global Markets unit.

- The other operating income and expenses l line performed poorly compared to the first nine months of the previous year (€19m accumulated at the end of September 2021 compared to €141m accumulated at the end of September 2020), mainly due to the greater contribution to the Single Resolution Fund (SRF) and the lower contribution from the insurance business in this line due to the bancassurance operation with Allianz.

- Operating expenses were down (-1.7% in year-on-year terms) as a result of the reduction in both the depreciation line, personnel expenses and general expenses.

- As a result of the growth in gross income and the aforementioned reduction in expenditure, the efficiency ratio stood at 49.3%, compared to 52.0% recorded at the end of September 2020.

- Impairment on financial assets totaled €-402m, a significant reduction from the amount recorded in the first nine months of 2020, mainly due to the negative impact of the worsening macroeconomic scenario caused by the pandemic following the outbreak of COVID-19 in March 2020, as well as the improvement of said scenario in 2021. For its part, the accumulated cost of risk remained on a downward trend and stood at 0.32% as of September 30, 2021.

- The provisions and other results line closed at €-242m, which was well below the €-430m recorded in the same period last year, which included provisions for potential claims

In the third quarter of 2021, Spain generated a net attributable profit of €478m (+31.2% compared to the previous quarter). Performance has mainly been favored by the contribution to the SRF made in the second quarter of 2021 and the lower loan allowance for impairment on financial assets, which have largely offset the decrease in recurring income, affected by summer season, and the lower NTI, due to the lower results of the Global Markets unit between July and September.