7. Risk management

The BBVA Group understands the risk management function as one of the essential and differentiating elements of its competitive strategy. In this context, the aim of the Global Risk Management (GRM) Corporate Area is to preserve the BBVA Group’s solvency, help define its strategy with respect to risk and assume and facilitate the development of its businesses. Its activity is governed by the following principles:

- The risk management function is single, independent and global.

- The risks assumed by the BBVA Group must be compatible with the capital adequacy target and must be identified, measured and assessed. Risk monitoring and management procedures and sound mechanisms of control and mitigation systems must likewise be in place.

- All risks must be managed integrally during their life cycle, and be treated differently depending on their nature and with active portfolio management based on a common measure (economic capital).

- It is each operating segment’s responsibility to propose and maintain its own risk profile, within its autonomy in the corporate action framework (defined as the set of risk control policies and procedures defined by the BBVA Group), using an appropriate risk infrastructure to control their risks.

- The infrastructures created for risk control must be equipped with means (in terms of people, tools, databases, information systems and procedures) that are sufficient for their purpose, so that there is a clear definition of roles and responsibilities, thus ensuring efficient allocation of resources among the corporate area and the risk units in operating segments.

In light of these principles, integrated risk management is structured around five main components:

- A governance and organizational system for the risk function, which considers:

- Definition of roles and responsibilities for different functions and areas

- Organizational structure of the GRM Corporate Area and Risk Units of the operating segments, including relationship and codependency mechanisms

- Committee Schemes at a Corporate and operating segment levels

- Structure delegation of functions and risks

- Internal control system in line with the nature and volume of risk exposure

- A general risk framework, where the Group’s risk profile objective is defined and where the tolerance levels that the Group is willing to assume is clearly defined in order to carry out its strategic plan without relevant deviations, even in stress situations.

- A risk management corporate governance scheme which includes:

- a regulatory body of policies and procedures, tolerances and corrective actions

- Annual risk planning scheme whereby Risk Appetite is incorporated into the Group’s business decision making process

- ongoing management of financial and non-financial risks

- A Framework for Identification, Assessment, Monitoring and Reporting of risks assumed in base and stress scenarios, allowing prospective and dynamic risk assessment

- An infrastructure that encompasses the set of tools, methodologies and risk culture that is the basis on which the differentiated risk management scheme is founded.

Corporate governance system

The BBVA Group has developed a corporate governance system in line with the best international practices, which adapts to the regulatory requirements of the countries where its operating segments carry out their business.

The Board of Directors is, in accordance with the Regulations of the Board, the body responsible for approving the policy control and risk management, as well as performing the periodic monitoring of internal information and control systems. Based on the general policies established by the Board of Directors, the Executive Committee (EC) sets corporate policies that previously been approved by the Board of Directors and the Group's risk limits by geographies, sectors and portfolios composing all the corporate action framework on risk . In this context, and for the adequate performance of its functions, the EC has a key role in developing the Risk Committee of the Board which, among other functions, analyzes and evaluates proposals on these issues that are risen to the EC for approval, performing a continuous monitoring of risk evolution and approving transactions that are considered relevant for qualitative or quantitative reasons.

Risk management in the BBVA Group from a corporate action framework set by the governing bodies of the Bank is carried out by corporate risk management units and the operating segments themselves. Thus, the risk function in the Group (Global Risk Management , hereinafter GRM) , is distributed among the risk units of the operating segments and the GRM corporate area, the latter being responsible for ensuring compliance with policies and global strategies. The risk units of the operating segments advise and manage risk profiles within their autonomy, though they always respect the corporate framework for action.

The Corporate GRM Area combines a vision by risk type with a global vision. It is divided into six units, as follows:

- Corporate Risk Management and Risk Portfolio Management: Responsible for management and control of the BBVA Group’s financial risks. In addition, this area focuses on fiduciary risk management, insurance, Asset Management and monitors the retail banking business from a cross functional point of view.

- Operational and Control Risk: Manages operational risk, internal risk area control and the internal validation of the measurement models and the acceptance of new risks.

- Technology & Methodologies: Responsible for the management of the technological and methodological developments required for risk management in the Group.

- Technical Secretariat: Undertakes the contrast of the proposals made to the Risk Management Committee and the Risk Committee.

- Planning, Monitoring & Reporting: Responsible for the development of the ERM framework and the definition and monitoring of risk appetite. It also prepares reporting requirements, both internal and regulatory, for those risks the Group is exposed to.

- GRM South America: Responsible for credit risk management and monitoring in South America.

The head of the GRM Department is the Chief Risk Officer, and, among his responsibilities, ensures that the Group's risks are managed according to the defined policy, relying on the GRM corporate area units and the risk units of the operating segments. In turn, the risk managers of the operating segments maintain a hierarchical reporting line with the head of their operating segment and a functional reporting to the Group Chief Risk Officer. This structure ensures the independence of the role of local risk and alignment with the policies and objectives of the Group. This structure gives the Corporate GRM Area reasonable comfort with respect to:

- integration, control and management of all the Group’s risks;

- the application throughout the Group of standard principles, policies and metrics; and

- the necessary knowledge of each geographical area and each business.

This organizational scheme is complemented by various committees, which include the following:

- The Global Risk Management Committee: This committee is made up of the risk managers from the risk units located in the operating segments and the managers of the GRM Corporate Area units. This committee meets on a monthly basis and among its responsibilities are the following:

- establishing the Group’s risk strategy and presenting its proposal to the appropriate governing bodies, and in particular to the Board of Directors, for their approval,

- monitoring the management and control of risks in the Group, and

- adopting any necessary actions.

- The Risk Management Committee: Its permanent members are the Global Risk Management director, the Corporate Risk Management director and the Technical Secretariat. The other committee members propose the operations that are analyzed in its working sessions. The committee analyzes and, if appropriate, authorizes financial programs and operations within its scope and submits the proposals whose amounts exceed the set limits to the Risks Committee, when its opinion on them is favorable.

- The Assets and Liabilities Committee (ALCO): The committee is responsible for actively managing structural interest rate and foreign exchange risk positions, global liquidity and the Group’s capital base.

- The Technology and Methodologies Committee: The committee decides on the effectiveness of the models and infrastructures developed to manage and control risks that are integrated in the operating segments, within the framework of the operational model of Global Risk Management.

- The New Businesses and Products Committees: Their functions are to analyze and, where appropriate, give technical approval to and implement new businesses, products and services prior to their marketing: to undertake subsequent control and monitoring of new authorized products; and to foster orderly business operations to ensure they develop in a controlled environment.

- The Global Corporate Assurance Committee: Its task is to undertake a review at both Group and operating segment level of the control environment and the effectiveness of the operational risk internal control and management systems, as well as to monitor and analyze the main operational risks the Group is subject to, including those that are cross-cutting in nature.

Internal control system

The BBVA Group’s internal control system is based on the best practices developed in “Enterprise Risk Management – Integrated Framework” by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) as well as in “Framework for Internal Control Systems in Banking Organizations” by the Bank for International Settlements (BIS). The Group’s system for internal control is therefore part of the Integral Risk Management Framework.

The system of internal control of the Group reaches all areas of the organization and is designed to identify and manage the risks that the Group companies are facing and ensuring that the corporate objectives are met.

The control model has a three-line defense system:

- The first line is formed by the Group's operating segments, which are responsible for the control within their scope and implementation of the measures set by higher authorities.

- The second line are the specialists control units (Compliance, Global Accounting & Informational Management / Financial Internal Control , Risk Internal Control, IT Risk , Fraud & Security, Operational Control and production director support units , such as Human Resources , Legal , etc. ...). This line supervises the control of the different units from a horizontal hierarchy stand point. Also, reporting to this line is the operational risk corporate management unit, which provides a common methodology and management tools.

- The third line is the Internal Audit unit, which conducts an independent review of the model, verifying compliance and effectiveness of corporate policies and providing independent information on the control model.

Find following list shows the main principles that support the internal control system:

- Its core element is the “process.”

- The form in which the risks are identified, assessed and mitigated must be unique for each process; and the systems, tools and information flows that support the internal control and operational risk activities must be unique, or at least be administered fully by a single unit.

- The responsibility for internal control lies with the BBVA Group’s operating segments. These units, along with the specialized units mentioned above, are responsible for the implementation of the system of control within its scope of responsibility and managing the existing risk by proposing any improvements to processes it considers appropriate.

- Given that some operating segments have a global scope of responsibility, there are cross-cutting control functions which supplement the control mechanisms mentioned earlier.

- The Operational Risk Management Committee in each operating segment is responsible for approving suitable mitigation plans for each existing risk or weakness. This committee structure culminates at the Group’s Global Corporate Assurance Committee.

Within the GRM area, the Group has set up a unit of Internal Risk Control and Risk Validation that is independent from the units that develop models, manage processes and execute controls, and provide expert resources for the management of the different types of risks. Its objectives are:

- Ensure that there is a policy, process and measures identified for each risk relevant to the group.

- Ensure that these are implemented and applied in the manner in which they were defined.

- Control and communication any identified deficiencies and setting goals for improvement.

- Internal validation of models, independent from the model development process.

Both units report their activities and report their working plans to the Risk Committee of the Board.

The Internal Risk Control is built into the second line of defense. It has a global scope, both geographically and in terms of type of risk, reaching to all those risk types managed by the Corporate Risk Area. For the development of its function, the unit has a team structure at the corporate level and at the geography level in the case of the most important geographies in which the Group operates. As in the Corporate Area, the local units are maintained independent from the operating segment processes and from those units that execute controls. It maintains however a functional dependency to the Internal Risk control unit. The lines of action of this unit are set at a Group level, adapting and executing at a local level as well as reporting the most relevant aspects.

Risk Appetite Framework

The Group Risk policy is aimed towards a moderate risk profile through conservative management and a global banking business model diversified by geographical area, type of assets, portfolios and customers. The Group has a large international presence, both in emerging and developed countries, maintaining a medium/low risk profile in each geography while seeking sustainable growth over time.

In order to achieve the above, a number of key metrics have been established that characterize the objective of the entity behavior and are enforced across the organization. These metrics are related to the solvency, liquidity and recurrence of results; and depending on the circumstances prevailing in each case, determine the risk in the Group and allow to reach the desired objectives.

Tolerance levels for key metrics are proposed by the GRM and approved by the Executive Committee. These metrics define the risks that the group is willing to assume. They defined the Group’s Risk Appetite and therefore are considered permanent save for exceptions.

Also, on an annual basis, the Executive Committee establishes, after a proposal from GRM and favorable report of the Risk Committee, limits for the main types of risks present in the Group, such as credit, liquidity, funding and market. The compliance with these limits is monitored periodically through Risk committees. For credit risk, limits are defined at portfolio and/or sector level for each operating segment. In credit risk limits defined portfolio level and / or sector and for each operating segment. These thresholds are the maximum exposure to lending for the BBVA Group for a time horizon of one year.

The Group's objective is not to eliminate all risks, but to take a prudent level of risk that will generate results while maintaining adequate levels of capital and funding in order to generate recurring profits.

Corporate Scheme of Risk Management

Corporate Scheme of Risk Management includes macro processes as detailed below:

- Regulatory enhancement process for the Risk area. GRM has established a set of principles, policies and procedures that serve as foundation to the regulatory structure of the risk function. The objectives are:

- Consistency of all policies of the Group, Holding and local level, with the guiding principles of risk appetite and within themselves.

- Uniformity between the operating segments in the implementation of risk policies, avoiding disparities in the risks taken based on the operating segment.

- Framework of action, establishing the general lines of action for the operating segments, respecting the autonomy of these units.

- Annual Planning Process: Planning is done taking into account the risk appetite and establishes a series of limits by type of asset that ensure consistency with the global objective profile of the Group's risk.

- Management of the main risks which are faced by the Group are the following:

- Credit risk:

This arises from the probability that one party to a financial instrument will fail to meet its contractual obligations for reasons of insolvency or inability to pay and cause a financial loss for the other party. This includes management of counterparty risk, issuer credit risk, liquidation risk and country risk.

Management of credit risk covers the analytic process before decisions have been taken, decision making, instrumentation, monitoring formalized and recovery operations, as well as the entire process of control and reporting at customer level, segment, industry, operating segment or subsidiary. The main principles on which decision-making should be supported within credit risk are: a sufficient customer generation of resources and capital solvency and the existence of adequate and effective collateral. The management of credit risk in the Group has a comprehensive structure that allows all functions making decisions objectively and independently throughout the life cycle risk.

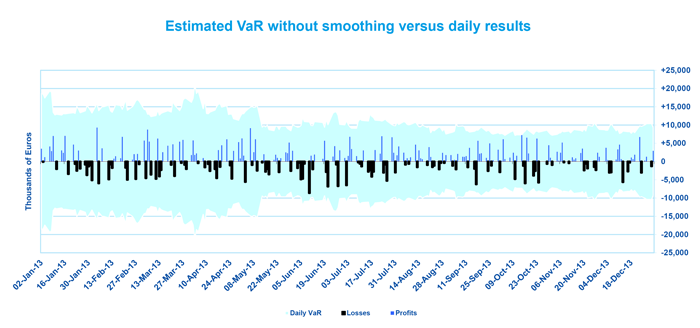

- Market risk:

This is originated by the likelihood of losses in the value of the positions held as a result of changes in the market prices of financial instruments. The BBVA Group manages this risk in terms of probability of VaR (Value at Risk). It includes three types of risks:

- Interest-rate risk: This arises from variations in market interest rates.

- Exchange Rate risk: This is the risk resulting from variations in foreign-currency exchange rates.

-

Price risk: This is the risk resulting from variations in market prices, either due to factors specific to the instrument itself, or alternatively to factors which affect all the instruments traded on a specific market.

- Liquidity risk

Control, monitoring and management of liquidity risk and funding aims in the short term, ensuring compliance with payment obligations of the BBVA Group in the time and manner provided, without the need to obtain funds under unfavorable conditions. In the mid-term it aims to ensure the adequacy of the Group's financial structure and its evolution in the context of the economic, market and regulatory changes.

- Structural risk, includes the following:

- Interest rate structural risk: The management of this kind of risk seeks to maintain exposure levels for the BBVA Group in line with its strategy and risk profile to address changes in market interest rates. For this aim, ALCO carries out an active balance sheet management through operations intended to optimize the level of risk in relation to the expected results and with respect to the maximum tolerable risk levels. The activity of the ALCO uses the interest rate risk measurements performed by the Corporate Area GRM.

- Exchange rate structural risk: This risk arises primarily from exposure to changes in exchange rates arising from foreign companies to the BBVA Group and endowment funds to branches abroad financed in a different currency the investment. Managing this risk is based on a simulation model of scenarios to quantify the changes in value that can be produced with a given confidence level and a horizon predetermined, and ALCO is the responsible for arranging hedging transactions, to restrict the equity impact due to the changes in exchange rates according to their projected trend.

-

Structural equity risk: This risk arises due to the possible negative impact due to the impairment value of its investments in Industrial and Financial entities with medium and long horizons. The Corporate area GRM is responsible for measurement and effective monitoring of the structural risk of equity, estimating for this reason the sensitivity and the capital required to cover any unexpected losses arising from changes in value of the companies comprising the investment portfolio of the Group, with a confidence level in accordance with the target entity rating, taking into account liquidity positions and the statistical behavior of the assets under consideration.

- Operational risk:

This arises from the possibility of human error, inadequate or faulty internal processes, system failures or external events. This definition includes the legal risk and excludes strategic and/or business risk and reputational risk The operational risk management in the Group is based on the levers of value that generates advanced AMA (advanced measurement approach): knowledge, identification, prioritization and management of potential and actual risks, supported by indicators to analyze the evolution, define alerts and check the controls.

Framework for identifying, analyzing and monitoring risk

The process of identification, assessment and monitoring / reporting have the following objectives:

- Evaluate the performance of risk appetite in the present moment.

- Identified and evaluate risk situation that may compromise the performance of the risk appetite.

- Evaluate the performance of risk appetite to future under basis and stress scenario.

Infrastructure: Technology, Culture and Risk Methodologies

- Technology: assessing the adequacy of information systems and technology necessary for the performance of the functions within the framework of integrated risk management of the Group.

- The BBVA Group’s main activities with respect to the management and control of its risks are as follows:

- Calculation of exposure to risks of the different portfolios, taking into account any possible mitigating factors (guarantees, balance netting, collaterals, etc.).

- Calculation of the probabilities of default (hereinafter, “PD”).

- Estimation of the foreseeable losses in each portfolio, assigning a PD to new operations (rating and scoring).

- Measurement of the risk values of the portfolios in different scenarios through historical simulations.

- Establishment of limits to potential losses according to the different risks incurred.

- Determination of the possible impacts of structural risks on the BBVA Group’s consolidated income statement.

- Identification and quantification of operational risks, by operating segments, to facilitate mitigation through appropriate corrective actions.

- Risk Culture

In accordance with best practice and in line with recent regulatory recommendations, BBVA has implemented a robust risk culture that spreads all levels of the organization so that principles of risk management could be unique, and known throughout the group.

Global Risk Management Risk Culture diffuses as a value and as a fundamental part of its management model, with the aim to strengthening the direction of the risk management, emphasizing that this culture could be communicated, understood, accepted and controlled throughout the organization.

Risk Culture has opted for three different areas:

- Communication, which aims to spread understanding of the Risk Management Framework of the Group consistently and integrated throughout the organization through the most appropriate channels of communication.

- Training, in which specific formats have been developed to raise awareness of risks in the organization and ensure certain standards in skills and knowledge of Risk Management

- Compensation, area where it is intended that the financial and non-financial incentives could support the values and culture of risk at all levels and for which they have been established mechanisms based on the risk management, in accordance with the objectives established by the Group.

It has been established continuously monitored to verify proper implementation of these areas and their development.

7.1 Credit risk

7.1.1 Credit risk exposure

In accordance with IFRS 7, the BBVA Group’s maximum credit risk exposure (see definition below) by headings in the balance sheet as of December 31, 2013, 2012 and 2011 is provided below. It does not consider the availability of collateral or other credit enhancements to guarantee compliance with payment obligations. The details are broken down by financial instruments and counterparties.

Download Excel

Download Excel

| Maximum Credit Risk Exposure | Millions of Euros | |||

|---|---|---|---|---|

| Notes | 2013 | 2012 | 2011 | |

| Financial assets held for trading |

|

29,708 | 28,265 | 20,946 |

| Debt securities | 10 | 29,602 | 28,020 | 20,946 |

| Government |

|

24,696 | 23,370 | 17,955 |

| Credit institutions |

|

2,734 | 2,545 | 1,889 |

| Other sectors |

|

2,172 | 2,106 | 1,102 |

| Customer lending |

|

106 | 244 | - |

| Other financial assets designated at fair value through profit or loss |

|

664 | 753 | 708 |

| Debt securities | 11 | 664 | 753 | 708 |

| Government |

|

142 | 174 | 129 |

| Credit institutions |

|

16 | 45 | 44 |

| Other sectors |

|

506 | 534 | 535 |

| Available-for-sale financial assets |

|

71,439 | 62,615 | 48,507 |

| Debt securities | 12 | 71,439 | 62,615 | 48,507 |

| Government |

|

48,728 | 38,926 | 32,476 |

| Credit institutions |

|

10,431 | 13,157 | 7,067 |

| Other sectors |

|

12,280 | 10,532 | 8,964 |

| Loans and receivables |

|

364,030 | 384,097 | 377,519 |

| Loans and advances to credit institutions | 13.1 | 22,792 | 25,372 | 24,400 |

| Loans and advances to customers | 13.2 | 336,759 | 354,973 | 350,239 |

| Government |

|

32,400 | 34,917 | 34,941 |

| Agriculture |

|

4,982 | 4,738 | 4,697 |

| Industry |

|

28,679 | 30,731 | 34,834 |

| Real estate and construction |

|

40,486 | 47,223 | 49,418 |

| Trade and finance |

|

47,169 | 51,912 | 54,736 |

| Loans to individuals |

|

149,891 | 151,244 | 137,437 |

| Other |

|

33,151 | 34,208 | 34,176 |

| Debt securities | 13.3 | 4,481 | 3,751 | 2,880 |

| Government |

|

3,175 | 2,375 | 2,128 |

| Credit institutions |

|

297 | 453 | 461 |

| Other sectors |

|

1,009 | 923 | 291 |

| Held-to-maturity investments | 14 | - | 10,163 | 10,955 |

| Government |

|

- | 9,210 | 9,896 |

| Credit institutions |

|

- | 393 | 451 |

| Other sectors |

|

- | 560 | 608 |

| Derivatives (trading and hedging) |

|

41,294 | 49,208 | 53,561 |

| Subtotal |

|

507,135 | 535,101 | 512,196 |

| Valuation adjustments |

|

1,068 | 338 | 530 |

| Total Financial Assets Risk |

|

508,203 | 535,439 | 512,726 |

|

|

|

|

|

|

| Financial guarantees (Bank guarantees, letter of credits,..) |

|

33,543 | 37,019 | 37,629 |

| Drawable by third parties |

|

87,542 | 83,519 | 86,375 |

| Government |

|

4,354 | 1,360 | 3,143 |

| Credit institutions |

|

1,583 | 1,946 | 2,417 |

| Other sectors |

|

81,605 | 80,213 | 80,815 |

| Other contingent commitments |

|

6,628 | 6,624 | 4,313 |

| Total Contingent Risks and Commitments | 34 | 127,713 | 127,161 | 128,317 |

| Total Maximum Credit Exposure |

|

635,916 | 662,601 | 641,043 |

The maximum credit exposure of the table above is determined by type of financial asset as explained below:

- In the case of financial assets recognized in the consolidated balance sheets, exposure to credit risk is considered equal to its gross accounting value, not including certain valuation adjustments (impairment losses, derivatives and others), with the sole exception of trading and hedging derivatives.

- The maximum credit risk exposure on financial guarantees granted is the maximum that the Group would be liable for if these guarantees were called in, and that is their carrying amount.

- Our calculation of risk exposure for derivatives is based on the sum of two factors: the derivatives market value and their potential risk (or "add-on").

The first factor, market value, reflects the difference between original commitments and market values on the reporting date (mark-to-market). As indicated in Note 2.2.1 to the consolidated financial statements, derivatives are accounted for as of each reporting date at fair value in accordance with IAS 39.

The second factor, potential risk (‘add-on’), is an estimate (using internal models) of the maximum increase to be expected on risk exposure over a derivative market value (at a given statistical confidence level) as a result of future changes in the fair value over the remaining term of the derivatives.

The consideration of the potential risk ("add-on") relates the risk exposure to the exposure level at the time of a customer’s default. The exposure level will depend on the customer’s credit quality and the type of transaction with such customer. Given the fact that default is an uncertain event which might occur any time during the life of a contract, the BBVA Group has to consider not only the credit exposure of the derivatives on the reporting date, but also the potential changes in exposure during the life of the contract. This is especially important for derivatives, whose valuation changes substantially throughout their terms, depending on the fluctuation of market prices.

7.1.2 Mitigation of credit risk, collateralized credit risk and other credit enhancements

In most cases, maximum credit risk exposure is reduced by collateral, credit enhancements and other actions which mitigate the Group’s exposure. The BBVA Group applies a credit risk hedging and mitigation policy deriving from a banking approach focused on relationship banking. The existence of guarantees could be a necessary but not sufficient instrument for accepting risks, as the assumption of risks by the Group requires prior evaluation of the debtor’s capacity for repayment, or that the debtor can generate sufficient resources to allow the amortization of the risk incurred under the agreed terms.

The policy of accepting risks is therefore organized into three different levels in the BBVA Group:

- Analysis of the financial risk of the operation, based on the debtor’s capacity for repayment or generation of funds;

- The constitution of guarantees that are adequate, or at any rate generally accepted, for the risk assumed, in any of the generally accepted forms: monetary, secured, personal or hedge guarantees; and finally,

- Assessment of the repayment risk (asset liquidity) of the guarantees received.

The procedures for the management and valuation of collaterals are set out in the Internal Manuals on Credit Risk Management Policies and Procedures (retail and wholesale), which establish the basic principles for credit risk management, including the management of collaterals assigned in transactions with customers.

The methods used to value the collateral are in line with the best market practices and imply the use of appraisal of real-estate collateral, the market price in market securities, the trading price of shares in mutual funds, etc. All the collaterals assigned must be properly drawn up and entered in the corresponding register. They must also have the approval of the Group’s legal units.

The following is a description of the main types of collateral for each financial instrument class:

- Financial instruments held for trading: The guarantees or credit enhancements obtained directly from the issuer or counterparty are implicit in the clauses of the instrument.

- Trading and hedging derivatives: In derivatives, credit risk is minimized through contractual netting agreements, where positive- and negative-value derivatives with the same counterparty are offset for their net balance. There may likewise be other kinds of guarantees, depending on counterparty solvency and the nature of the transaction.

The Group uses credit derivatives to mitigate credit risk in its loan portfolio and other cash positions and to hedge risks assumed in market transactions with other clients and counterparties. Credit risk originating from the derivatives in which the Group operates is mitigated through the contractual rights existing for offsetting accounts at the time of their settlement. This has reduced the Group’s exposure to credit risk to €25,475 million as of December 31, 2013, €32,586 million as of December 31, 2012 and €34,770 million as of December 31, 2011.

Derivatives may follow different settlement and netting agreements, under the rules of the International Swaps and Derivatives Association (ISDA). The most common types of settlement triggers include bankruptcy of the reference credit institution, acceleration of indebtedness, failure to pay, restructuring, repudiation and dissolution of the entity. Since the Group typically confirms over 99% of the credit derivative transactions in the Depository Trust & Clearing Corporation (DTCC), substantially the entire credit derivatives portfolio is registered and matched against BBVA’s counterparties.

- Other financial assets designated at fair value through profit or loss and Available-for-sale financial assets: The guarantees or credit enhancements obtained directly from the issuer or counterparty are inherent to the structure of the instrument.

- Loans and receivables:

- Loans and advances to credit institutions: These usually only have the counterparty’s personal guarantee.

- Loans and advances to customers: Most of these operations are backed by personal guarantees extended by the counterparty. There may also be collateral to secure loans and advances to customers (such as mortgages, cash guarantees, pledged securities and other collateral), or to obtain other credit enhancements (bonds, hedging, etc.).

- Debt securities: The guarantees or credit enhancements obtained directly from the issuer or counterparty are inherent to the structure of the instrument.

Collateralized loans granted by the Group as of December 31, 2013, 2012 and 2011, excluding balances deemed impaired, is broken down in the table below:

Download Excel

Download Excel

| Collateralized Credit Risk | Millions of Euros | ||

|---|---|---|---|

| 2013 | 2012 | 2011 | |

| Mortgage loans | 125,564 | 137,870 | 129,536 |

| Operating assets mortgage loans | 3,778 | 3,897 | 3,574 |

| Home mortgages | 108,745 | 119,235 | 108,190 |

| Rest of mortgages (1) | 13,041 | 14,739 | 17,772 |

| Secured loans, except mortgage | 23,660 | 23,125 | 23,915 |

| Cash guarantees | 300 | 377 | 286 |

| Secured loan (pledged securities) | 570 | 997 | 589 |

| Rest of secured loans (2) | 22,790 | 21,751 | 23,041 |

| Total | 149,224 | 160,995 | 153,451 |

- Financial guarantees, other contingent risks and drawable by third parties: These have the counterparty’s personal guarantee.

7.1.3 Policies for preventing excessive risk concentration

In order to prevent the build-up of excessive concentrations of credit risk at the individual, country and sector levels, the BBVA Group maintains maximum permitted risk concentration indices updated at individual and portfolio sector levels tied to the various observable variables within the field of credit risk management. The limit on the Group’s exposure or financial commitment to a specific customer therefore depends on the customer’s credit rating, the nature of the risks involved, and the Group’s presence in a given market, based on the following guidelines:

- The aim is, as far as possible, to combine the customer’s credit needs (commercial/financial, short-term/long-term, etc.) with the interests of the Group.

- Any legal limits that may exist concerning risk concentration are taken into account (relationship between risks with a customer and the capital of the entity that assumes them), the markets, the macroeconomic situation, etc.

- To properly management risk exposures of transactions over 2.5% of the Group’s Net Equity any transactions over this threshold will be authorized by the Risk Committee of the Bank’s Board of Directors.

Risk concentrations by geography

Below is a breakdown of the balances of financial instruments registered in the accompanying consolidated balance sheets by their concentration in geographical areas and according to the residence of the customer or counterparty. It does not take into account valuation adjustments, impairment losses or loan-loss provisions:

Download Excel

Download Excel

| Risks by Geographical Areas 2013 |

Millions of Euros | ||||||

|---|---|---|---|---|---|---|---|

| Spain | Europe, Excluding Spain |

Mexico | USA | South America |

Other | Total | |

| Financial assets - |

|

|

|

|

|

|

|

| Financial assets held for trading | 14,882 | 33,091 | 15,707 | 2,677 | 3,412 | 2,345 | 72,114 |

| Loans and advances to customers | - | - | - | 107 | - | - | 107 |

| Debt securities | 6,320 | 5,838 | 13,410 | 424 | 2,608 | 1,002 | 29,602 |

| Equity instruments | 2,752 | 953 | 632 | 118 | 148 | 163 | 4,766 |

| Derivatives | 5,810 | 26,300 | 1,665 | 2,028 | 656 | 1,180 | 37,639 |

| Other financial assets designated at fair value through profit or loss |

211 | 106 | 1,591 | 503 | 2 | - | 2,413 |

| Loans and advances to credit institutions | - | - | - | - | - | - | - |

| Debt securities | 107 | 54 | 5 | 497 | - | - | 663 |

| Equity instruments | 104 | 52 | 1,586 | 6 | 2 | - | 1,750 |

| Available-for-sale portfolio | 42,074 | 8,587 | 10,380 | 7,729 | 5,626 | 3,011 | 77,407 |

| Debt securities | 38,732 | 8,453 | 10,329 | 7,247 | 5,535 | 1,143 | 71,439 |

| Equity instruments | 3,342 | 134 | 51 | 482 | 91 | 1,868 | 5,968 |

| Loans and receivables | 194,383 | 26,712 | 44,414 | 39,650 | 53,886 | 4,984 | 364,031 |

| Loans and advances to credit institutions | 5,224 | 9,171 | 2,366 | 2,707 | 1,909 | 1,415 | 22,792 |

| Loans and advances to customers | 187,400 | 17,519 | 42,048 | 36,047 | 50,173 | 3,569 | 336,759 |

| Debt securities | 1,759 | 22 | - | 896 | 1,804 | - | 4,481 |

| Held-to-maturity investments | - | - | - | - | - | - | - |

| Hedging derivatives | 434 | 2,113 | 8 | 60 | 10 | 4 | 2,629 |

| Total Risk in Financial Assets | 251,984 | 70,609 | 72,100 | 50,618 | 62,935 | 10,344 | 518,591 |

| Contingent risks and liabilities |

|

|

|

|

|

|

|

| Contingent risks | 15,172 | 9,038 | 767 | 2,344 | 5,292 | 929 | 33,542 |

| Contingent liabilities | 28,096 | 17,675 | 16,109 | 24,485 | 7,002 | 803 | 94,170 |

| Total Contingent Risk | 43,268 | 26,713 | 16,876 | 26,829 | 12,294 | 1,732 | 127,712 |

| Total Risks in Financial Instruments | 295,252 | 97,322 | 88,976 | 77,447 | 75,229 | 12,076 | 646,303 |

Download Excel

Download Excel

| Risks by Geographical Areas 2012 |

Millions of Euros | ||||||

|---|---|---|---|---|---|---|---|

| Spain | Europe Excluding Spain |

Mexico | USA | South America |

Other | Total | |

| Financial assets - |

|

|

|

|

|

|

|

| Financial assets held for trading | 13,768 | 39,360 | 15,035 | 4,751 | 3,643 | 3,272 | 79,830 |

| Loans and advances to customers | - | - | - | 244 | - | - | 244 |

| Debt securities | 5,726 | 5,155 | 12,960 | 577 | 2,805 | 796 | 28,020 |

| Equity instruments | 1,270 | 519 | 101 | 543 | 239 | 243 | 2,915 |

| Derivatives | 6,772 | 33,686 | 1,973 | 3,387 | 599 | 2,233 | 48,651 |

| Other financial assets designated at fair value through profit or loss |

296 | 87 | 13 | 2,134 | - | - | 2,531 |

| Loans and advances to credit institutions | - | - | - | - | - | - | - |

| Debt securities | 190 | 42 | 9 | 512 | - | - | 753 |

| Equity instruments | 106 | 45 | 4 | 1,622 | - | - | 1,777 |

| Available-for-sale portfolio | 36,109 | 6,480 | 9,601 | 7,163 | 6,128 | 1,085 | 66,567 |

| Debt securities | 33,107 | 6,267 | 9,035 | 7,112 | 6,053 | 1,040 | 62,615 |

| Equity instruments | 3,002 | 213 | 566 | 51 | 75 | 45 | 3,952 |

| Loans and receivables | 209,786 | 31,375 | 46,384 | 40,259 | 51,978 | 4,314 | 384,096 |

| Loans and advances to credit institutions | 3,220 | 11,042 | 4,549 | 3,338 | 2,065 | 1,157 | 25,372 |

| Loans and advances to customers | 205,216 | 19,979 | 41,835 | 36,040 | 48,753 | 3,151 | 354,973 |

| Debt securities | 1,350 | 354 | - | 880 | 1,160 | 6 | 3,751 |

| Held-to-maturity investments | 7,279 | 2,884 | - | - | - | - | 10,162 |

| Hedging derivatives | 914 | 3,798 | 159 | 226 | 5 | 18 | 5,120 |

| Total Risk in Financial Assets | 268,151 | 83,984 | 71,192 | 54,532 | 61,754 | 8,691 | 548,305 |

| Contingent risks and liabilities |

|

|

|

|

|

|

|

| Contingent risks | 16,164 | 10,074 | 872 | 3,159 | 5,858 | 891 | 37,019 |

| Contingent liabilities | 26,514 | 19,678 | 13,564 | 22,027 | 7,097 | 1,264 | 90,142 |

| Total Contingent Risk | 42,678 | 29,752 | 14,435 | 25,186 | 12,955 | 2,155 | 127,161 |

| Total Risks in Financial Instruments | 310,829 | 113,736 | 85,627 | 79,718 | 74,709 | 10,846 | 675,466 |

Download Excel

Download Excel

| Risks by Geographical Areas 2011 |

Millions of Euros | ||||||

|---|---|---|---|---|---|---|---|

| Spain | Europe, Excluding Spain |

Mexico | USA | South America |

Other | Total | |

| Financial assets - |

|

|

|

|

|

|

|

| Financial assets held for trading | 12,955 | 33,187 | 11,676 | 4,664 | 5,452 | 2,538 | 70,472 |

| Debt securities | 5,075 | 2,039 | 10,933 | 565 | 2,030 | 304 | 20,946 |

| Equity instruments | 662 | 357 | 741 | 69 | 125 | 238 | 2,192 |

| Derivatives | 7,218 | 30,791 | 2 | 4,030 | 3,297 | 1,996 | 47,334 |

| Other financial assets designated at fair value through profit or loss |

234 | 107 | 1,470 | 509 | 454 | - | 2,774 |

| Debt securities | 117 | 77 | 6 | 508 | 1 | - | 709 |

| Equity instruments | 117 | 30 | 1,464 | 1 | 453 | - | 2,065 |

| Available-for-sale portfolio | 26,546 | 5,390 | 7,825 | 8,151 | 5,164 | 654 | 53,730 |

| Debt securities | 22,371 | 5,184 | 7,764 | 7,518 | 5,068 | 601 | 48,506 |

| Equity instruments | 4,175 | 206 | 61 | 633 | 96 | 53 | 5,224 |

| Loans and receivables | 207,858 | 32,598 | 42,489 | 42,646 | 44,535 | 7,397 | 377,523 |

| Loans and advances to credit institutions | 3,034 | 10,079 | 4,877 | 2,570 | 2,195 | 1,647 | 24,402 |

| Loans and advances to customers | 203,459 | 22,392 | 37,612 | 39,384 | 41,650 | 5,744 | 350,241 |

| Debt securities | 1,365 | 127 | - | 692 | 690 | 6 | 2,880 |

| Held-to-maturity investments | 7,374 | 3,582 | - | - | - | - | 10,956 |

| Debt securities | 395 | 3,489 | 485 | 244 | 16 | 56 | 4,685 |

| Total Risk in Financial Assets | 255,362 | 78,353 | 63,945 | 56,214 | 55,621 | 10,645 | 520,140 |

| Contingent risks and liabilities |

|

|

|

|

|

|

|

| Contingent risks | 16,149 | 10,169 | 1,098 | 3,986 | 4,733 | 1,494 | 37,629 |

| Contingent liabilities | 30,848 | 18,429 | 11,929 | 22,002 | 6,192 | 1,288 | 90,688 |

| Total Contingent Risk | 46,997 | 28,598 | 13,027 | 25,988 | 10,925 | 2,782 | 128,317 |

| Total Risks in Financial Instruments | 302,359 | 106,951 | 76,972 | 82,202 | 66,546 | 13,427 | 648,457 |

The breakdown of the main figures in the most significant foreign currencies in the accompanying consolidated balance sheets is set forth in Appendix VII.

Sovereign risk concentration

Sovereign risk management

The risk associated with the transactions involving sovereign risk is identified, measured, controlled and tracked by a centralized unit integrated in the BBVA Group’s Risk Area. Its basic functions involve the preparation of reports in the countries where sovereign risk exists (called “financial programs”), tracking such risks, assigning ratings to these countries and, in general, supporting the Group in terms of reporting requirements for any transactions involving sovereign risk. The risk policies established in the financial programs are approved by the relevant risk committees.

The country risk unit tracks the evolution of the risks associated with the various countries to which the Group are exposed (including sovereign risk) on an ongoing basis in order to adapt its risk and mitigation policies to any macroeconomic and political changes that may occur. Moreover, it regularly updates its internal ratings and forecasts for these countries. The internal rating assignment methodology is based on the assessment of quantitative and qualitative parameters which are in line with those used by certain multilateral organizations such as the International Monetary Fund (IMF) and the World Bank (WB), rating agencies and export credit organizations.

Sovereign risk exposure

The table below provides a breakdown of exposure to financial instruments, as of December 31, 2013, 2012 and 2011, by type of counterparty and the country of residence of such counterparty. The below figures do not take into account valuation adjustments, impairment losses or loan-loss provisions:

Download Excel

Download Excel

| Risk Exposure by countries | Millions of Euros | ||||

|---|---|---|---|---|---|

| 2013 | |||||

| Sovereign Risk (*) |

Financial Institutions | Other Sectors | Total | % | |

| Spain | 59,114 | 11,870 | 166,677 | 237,661 | 51.1% |

| United Kingdom | 3 | 5,405 | 4,377 | 9,785 | 2.1% |

| Italy | 3,888 | 422 | 2,617 | 6,927 | 1.5% |

| France | 942 | 2,640 | 2,316 | 5,898 | 1.3% |

| Portugal | 385 | 238 | 5,179 | 5,802 | 1.2% |

| Germany | 1,081 | 1,338 | 1,206 | 3,625 | 0.8% |

| Ireland | - | 221 | 487 | 708 | 0.2% |

| Turkey | 10 | 65 | 163 | 238 | 0.1% |

| Greece | - | - | 72 | 72 | 0.0% |

| Rest of Europe | 2,608 | 2,552 | 4,239 | 9,399 | 2.0% |

| Europe | 68,031 | 24,751 | 187,333 | 280,115 | 60.2% |

| Mexico | 26,629 | 2,810 | 38,312 | 67,751 | 14.6% |

| The United States | 5,224 | 3,203 | 41,872 | 50,299 | 10.8% |

| Rest of countries | 7,790 | 5,480 | 53,649 | 66,919 | 14.4% |

| Total Rest of Countries | 39,643 | 11,493 | 133,833 | 184,969 | 39.8% |

| Total Exposure to Financial Instruments | 107,674 | 36,244 | 321,166 | 465,084 | 100.0% |

Download Excel

Download Excel

| Risk Exposure by countries | Millions of Euros | ||||

|---|---|---|---|---|---|

| 2012 | |||||

| Sovereign Risk (*) |

Financial Institutions | Other Sectors | Total | % | |

| Spain | 62,558 | 11,839 | 182,785 | 257,182 | 52.9% |

| United Kingdom | 13 | 159 | 400 | 572 | 0.1% |

| Italy | 2 | 7,095 | 2,336 | 9,433 | 1.9% |

| France | 4,203 | 405 | 3,288 | 7,896 | 1.6% |

| Portugal | 443 | 590 | 5,763 | 6,796 | 1.4% |

| Germany | 1,739 | 3,291 | 2,631 | 7,661 | 1.6% |

| Ireland | 1,298 | 1,025 | 734 | 3,057 | 0.6% |

| Turkey | - | 280 | 456 | 736 | 0.2% |

| Greece | - | - | 99 | 99 | 0.0% |

| Rest of Europe | 1,664 | 2,484 | 5,256 | 9,404 | 1.9% |

| Europe | 71,920 | 27,168 | 203,748 | 302,836 | 62.3% |

| Mexico | 25,059 | 5,492 | 36,133 | 66,684 | 13.7% |

| The United States | 3,942 | 3,768 | 42,157 | 49,867 | 10.3% |

| Rest of countries | 7,521 | 5,484 | 53,481 | 66,486 | 13.7% |

| Total Rest of Countries | 36,523 | 14,744 | 131,771 | 183,037 | 37.7% |

| Total Exposure to Financial Instruments | 108,443 | 41,912 | 335,519 | 485,873 | 100.0% |

Download Excel

Download Excel

|

|

Millions of Euros | ||||

|---|---|---|---|---|---|

|

|

2011 | ||||

| Risk Exposure by countries | Sovereign Risk (*) |

Financial Institutions | Other Sectors | Total | % |

| Spain | 56,473 | 6,883 | 178,065 | 241,420 | 52.7% |

| United Kingdom | 120 | 6,547 | 3,498 | 10,164 | 2.2% |

| Italy | 4,301 | 487 | 4,704 | 9,493 | 2.1% |

| France | 279 | 829 | 6,715 | 7,824 | 1.7% |

| Portugal | 619 | 1,653 | 3,038 | 5,310 | 1.2% |

| Germany | 582 | 902 | 908 | 2,392 | 0.5% |

| Ireland | 0 | 182 | 212 | 394 | 0.1% |

| Turkey | 17 | 42 | 291 | 350 | 0.1% |

| Greece | 109 | 0 | 32 | 141 | 0.0% |

| Rest of Europe | 647 | 4,319 | 5,549 | 10,515 | 2.3% |

| Europe | 63,147 | 21,844 | 203,011 | 288,002 | 62.8% |

| Mexico | 22,875 | 5,508 | 31,110 | 59,493 | 13.0% |

| The United States | 3,501 | 3,254 | 42,550 | 49,305 | 10.8% |

| Rest of countries | 7,281 | 3,800 | 50,386 | 61,467 | 13.4% |

| Total Rest of Countries | 33,657 | 12,562 | 124,046 | 170,266 | 37.2% |

| Total Exposure to Financial Instruments | 96,805 | 34,405 | 327,058 | 458,268 | 100.0% |

The exposure to sovereign risk set out in the above table includes positions held in government debt securities in countries where the Group operates. They are used for ALCO’s management of the interest-rate risk on the balance sheets of the Group’s entities in these countries, as well as for hedging of pension and insurance commitments by insurance entities within the BBVA Group.

Sovereign risk exposure in Europe

In December 2013, sovereign risk exposure in Europe data was published by Group’s credit entities as of June 30, 2013 and December 31, 2012. This publication was made under the European Banking Authority (hereinafter "EBA" acronym for "European Banking Authority") scheme.

The table below provides a breakdown of the exposure of the Group’s credit institutions to European sovereign risk as of December 31, 2013, 2012 and 2011, by type of financial instrument and the country of residence of the counterparty, under EBA requirements:

Download Excel

Download Excel

| Exposure to Sovereign Risk by European Union Countries (1) | Millions of Euros | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2013 | |||||||||

| Debt securities | Loans and Receivables | Derivatives (2) | Total (2) |

Contingent risks and commitments | % | ||||

| Financial Assets Held-for-Trading | Available-for-Sale Financial Assets | Held-to-Maturity Investments | Direct Exposure | Indirect Exposure | |||||

| Spain | 5,251 | 24,339 | - | 23,430 | 258 | (25) | 53,253 | 1,924 | 82.8% |

| Italy | 733 | 2,691 | - | 90 | - | (6) | 3,508 | - | 5.5% |

| France | 874 | - | - | - | - | (1) | 873 | - | 1.4% |

| Germany | 1,064 | - | - | - | - | (1) | 1,063 | - | 1.7% |

| Portugal | 64 | 19 | - | 302 | - | - | 385 | 17 | 0.6% |

| United Kingdom | - | - | - | - | (13) | 3 | (10) | 1 | - |

| Greece | - | - | - | - | - | - | - | - | - |

| Hungary | - | 65 | - | - | - | - | 65 | - | 0.1% |

| Ireland | - | - | - | - | - | - | - | - | - |

| Rest of European Union | 2,100 | 3,038 | - | 38 | - | 10 | 5,186 | - | 8.1% |

| Total Exposure to Sovereign Counterparties (European Union) | 10,086 | 30,152 | - | 23,860 | 245 | (20) | 64,323 | 1,942 | 100.0% |

Download Excel

Download Excel

| Exposure to Sovereign Risk by European Union Countries (1) | Millions of Euros | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2012 | |||||||||

| Debt securities | Loans and Receivables | Derivatives (2) | Total (2) |

Contingent risks and commitments | % | ||||

| Financial Assets Held-for-Trading | Available-for-Sale Financial Assets | Held-to-Maturity Investments | Direct Exposure | Indirect Exposure | |||||

| Spain | 5,022 | 19,751 | 6,469 | 26,624 | 285 | 5 | 58,156 | 1,595 | 86.6% |

| Italy | 610 | 811 | 2,448 | 97 | - | (3) | 3,963 | - | 5.9% |

| France | 1,445 | - | 254 | - | - | (2) | 1,697 | - | 2.5% |

| Germany | 1,291 | - | - | - | (4) | (1) | 1,286 | - | 1.9% |

| Portugal | 51 | 18 | 15 | 359 | - | - | 443 | 17 | 0.7% |

| United Kingdom | - | - | - | - | (19) | - | (19) | 1 | - |

| Greece | - | - | - | - | - | - | - | - | - |

| Hungary | - | 66 | - | - | - | - | 66 | - | 0.1% |

| Ireland | - | - | - | - | - | - | - | - | - |

| Rest of European Union | 1,066 | 379 | 24 | 78 | - | 1 | 1,548 | - | 2.3% |

| Total Exposure to Sovereign Counterparties (European Union) | 9,485 | 21,025 | 9,210 | 27,158 | 262 | - | 67,140 | 1,613 | 100.0% |

Download Excel

Download Excel

| Exposure to Sovereign Risk by European Union Countries (1) | Millions of Euros | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2011 | |||||||||

| Debt securities | Loans and Receivables | Derivatives (2) | Total (2) |

Contingent risks and commitments | % | ||||

| Financial Assets Held-for-Trading | Available-for-Sale Financial Assets | Held-to-Maturity Investments | Direct Exposure | Indirect Exposure | |||||

| Spain | 4,366 | 15,225 | 6,520 | 26,637 | 96 | - | 52,844 | 3,455 | 89.1% |

| Italy | 350 | 634 | 2,956 | 184 | - | (23) | 4,101 | - | 6.9% |

| France | 513 | 6 | 69 | - | (3) | (2) | 583 | - | 1.0% |

| Germany | 338 | 12 | 254 | - | - | (3) | 601 | - | 1.0% |

| Portugal | 39 | 11 | 13 | 216 | - | (1) | 278 | 65 | 0.5% |

| United Kingdom | - | 120 | - | - | (3) | - | 117 | 1 | 0.2% |

| Greece | - | 10 | 84 | 15 | - | (8) | 101 | - | 0.2% |

| Hungary | - | 53 | - | - | - | - | 53 | - | 0.1% |

| Ireland | - | 7 | - | - | - | 1 | 8 | - | 0.0% |

| Rest of European Union | 155 | 351 | - | 130 | - | 2 | 638 | 4 | 1.1% |

| Total Exposure to Sovereign Counterparties (European Union) | 5,761 | 16,429 | 9,896 | 27,182 | 89 | (34) | 59,323 | 3,525 | 100.0% |

The following table provides a breakdown of the notional value of the CDS in which the Group’s credit institutions act as sellers or buyers of protection against the sovereign risk of European countries:

Download Excel

Download Excel

| Exposure to Sovereign Risk by European Countries | Millions of Euros | |||

|---|---|---|---|---|

| 2013 | ||||

| Credit derivatives (CDS) and other contracts in which the Group act as a protection seller | Credit derivatives (CDS) and other contracts in which the Group act as a protection buyer | |||

| Notional value | Fair value | Notional value | Fair value | |

| Spain | 14 | - | 62 | (25) |

| Italy | 622 | (15) | 595 | 9 |

| Germany | 205 | - | 200 | (1) |

| France | 204 | - | 149 | (1) |

| Portugal | 75 | (3) | 75 | 3 |

| Poland | - | - | - | - |

| Belgium | - | - | - | - |

| United Kingdom | 135 | 3 | 126 | - |

| Greece | 14 | - | 14 | - |

| Hungary | 1 | - | - | - |

| Ireland | 21 | - | 21 | - |

| Rest of European Union | 591 | 12 | 478 | (2) |

| Total exposure to Sovereign Counterparties | 1,882 | (3) | 1,720 | (17) |

Download Excel

Download Excel

| Exposure to Sovereign Risk by European Countries | Millions of Euros | |||

|---|---|---|---|---|

| 2012 | ||||

| Credit derivatives (CDS) and other contracts in which the Group act as a protection seller | Credit derivatives (CDS) and other contracts in which the Group act as a protection buyer | |||

| Notional value | Fair value | Notional value | Fair value | |

| Spain | 68 | 14 | 97 | (9) |

| Italy | 518 | (22) | 444 | 19 |

| Germany | 216 | (1) | 219 | - |

| France | 196 | (1) | 134 | (1) |

| Portugal | 91 | (6) | 89 | 6 |

| Poland | - | - | - | - |

| Belgium | 281 | (4) | 232 | 5 |

| United Kingdom | 56 | 1 | 64 | (1) |

| Greece | 18 | - | 18 | - |

| Hungary | 2 | - | - | - |

| Ireland | 82 | - | 82 | - |

| Rest of European Union | 149 | 2 | 155 | (2) |

| Total exposure to Sovereign Counterparties | 1,677 | (17) | 1,534 | 17 |

Download Excel

Download Excel

| Exposure to Sovereign Risk by European Countries | Millions of Euros | |||

|---|---|---|---|---|

| 2011 | ||||

| Credit derivatives (CDS) and other contracts in which the Group act as a protection seller | Credit derivatives (CDS) and other contracts in which the Group act as a protection buyer | |||

| Notional value | Fair value | Notional value | Fair value | |

| Spain | 20 | 2 | 20 | (2) |

| Italy | 283 | 38 | 465 | (61) |

| Germany | 182 | 4 | 184 | (6) |

| France | 102 | 3 | 123 | (6) |

| Portugal | 85 | 21 | 93 | (22) |

| Poland | - | - | - | - |

| Belgium | - | - | - | - |

| United Kingdom | 20 | 2 | 20 | (2) |

| Greece | 53 | 25 | 66 | (33) |

| Hungary | - | - | 2 | - |

| Ireland | 82 | 10 | 82 | (9) |

| Rest of European Union | 294 | 31 | 329 | (29) |

| Total exposure to Sovereign Counterparties | 1,119 | 136 | 1,382 | (170) |

The main counterparties of these CDS are credit institutions with a high credit quality. The CDS contracts are standard in the market, with the usual clauses covering the events that would trigger payouts.

As it can be seen in the above tables, exposure to sovereign risk in Europe is concentrated in Spain. As of December 31, 2013, 2012 and 2011, the breakdown of total exposure faced by the Group’s credit institutions to Spain and other countries, by maturity of the financial instruments, is as follows:

Download Excel

Download Excel

| Maturities of sovereign risks European Union | Millions of Euros | |||||||

|---|---|---|---|---|---|---|---|---|

| 2013 | ||||||||

| Debt securities | Loans and Receivables | Derivatives | Total (*) | % | ||||

| Financial Assets Held-for-Trading | Available-for-Sale Financial Assets | Held-to-Maturity Investments | Direct Exposure | Indirect Exposure | ||||

| Spain |

|

|

|

|

|

|

|

|

| Up to 1 Year | 1,935 | 846 | - | 5,627 | 8 | - | 8,416 | 13.1% |

| 1 to 5 Years | 1,531 | 15,523 | - | 5,574 | 41 | - | 22,669 | 35.2% |

| Over 5 Years | 1,784 | 7,969 | - | 12,229 | 209 | (25) | 22,166 | 34.5% |

| Rest of Europe |

|

|

|

|

|

|

|

|

| Up to 1 Year | 3,198 | 645 | - | 311 | (13) | - | 4,141 | 6.4% |

| 1 to 5 Years | 847 | 3,016 | - | 8 | - | 4 | 3,875 | 6.0% |

| Over 5 Years | 791 | 2,153 | - | 111 | - | 1 | 3,056 | 4.8% |

| Total Exposure to European Union Sovereign Counterparties | 10,086 | 30,152 | - | 23,860 | 245 | (20) | 64,323 | 100.0% |

Download Excel

Download Excel

| Maturities of sovereign risks European Union | Millions of Euros | |||||||

|---|---|---|---|---|---|---|---|---|

| 2012 | ||||||||

| Debt securities | Loans and Receivables | Derivatives | Total (*) | % | ||||

| Financial Assets Held-for-Trading | Available-for-Sale Financial Assets | Held-to-Maturity Investments | Direct Exposure | Indirect Exposure | ||||

| Spain |

|

|

|

|

|

|

|

|

| Up to 1 Year | 2,183 | 1,944 | 2 | 10,267 | 35 | - | 14,431 | 21.5% |

| 1 to 5 Years | 1,832 | 12,304 | 1,239 | 4,409 | 26 | - | 19,810 | 29.5% |

| Over 5 Years | 1,007 | 5,503 | 5,228 | 11,948 | 224 | 5 | 23,915 | 35.6% |

| Rest of Europe |

|

|

|

|

|

|

|

|

| Up to 1 Year | 2,564 | 46 | 33 | 367 | 7 | - | 3,019 | 4.5% |

| 1 to 5 Years | 952 | 190 | 1,927 | 34 | (19) | (5) | 3,079 | 4.6% |

| Over 5 Years | 947 | 1,038 | 781 | 131 | (11) | - | 2,886 | 4.3% |

| Total Exposure to European Union Sovereign Counterparties | 9,485 | 21,025 | 9,210 | 27,158 | 262 | - | 67,140 | 100.0% |

Download Excel

Download Excel

| Maturities of sovereign risks European Union | Millions of Euros | |||||||

|---|---|---|---|---|---|---|---|---|

| 2011 | ||||||||

| Debt securities | Loans and Receivables | Derivatives | Total (*) | % | ||||

| Financial Assets Held-for-Trading | Available-for-Sale Financial Assets | Held-to-Maturity Investments | Direct Exposure | Indirect Exposure | ||||

| Spain |

|

|

|

|

|

|

|

|

| Up to 1 Year | 2,737 | 779 | 36 | 9,168 | 1 | - | 12,721 | 21.4% |

| 1 to 5 Years | 1,025 | 11,630 | 1,078 | 4,265 | 67 | - | 18,065 | 30.5% |

| Over 5 Years | 604 | 2,816 | 5,406 | 13,204 | 27 | - | 22,057 | 37.2% |

| Rest of Europe |

|

|

|

|

|

|

|

|

| Up to 1 Year | 684 | 219 | 72 | 370 | 3 | (1) | 1,347 | 2.3% |

| 1 to 5 Years | 297 | 267 | 2,439 | 38 | (1) | (17) | 3,023 | 5.1% |

| Over 5 Years | 414 | 718 | 865 | 137 | (8) | (15) | 2,111 | 3.6% |

| Total Exposure to European Union Sovereign Counterparties | 5,761 | 16,429 | 9,896 | 27,182 | 89 | (33) | 59,324 | 100.0% |

Valuation and impairment methods

The valuation methods used to assess the instruments that are subject to sovereign risks are the same ones used for other instruments included in the relevant portfolios and are detailed in Note 8 to these consolidated financial statements. They take into account the exceptional circumstances that have taken place over the last two years in connection with the sovereign debt crisis in Europe.

Specifically, the fair value of sovereign debt securities of European countries has been considered equivalent to their listed price in active markets (Level 1 as defined in Note 8).

Risks related to the developer and real-estate sector in Spain

One of the main Group activities of the Group in Spain is focused on developer and mortgage loans. The policies and strategies established by the Group to deal with risks related to the developer and real-estate sector are explained below:

Policies and strategies established by the Group to deal with risks related to the developer and real-estate sector

BBVA has teams specializing in the management of the Real-Estate Sector risk, given its economic importance and specific technical component. This specialization is not only in the Risk-Acceptance teams, but throughout the handling, commercial, problem risks and legal, etc. It also includes the research department (BBVA Research), which helps determine the medium/long-term vision needed to manage this portfolio. Specialization has been increased and the management teams in the areas of recovery and the Real Estate Unit itself have been reinforced.

The policies established to address the risks related to the developer and real-estate sector, aim to accomplish, among others, the following objectives: to avoid concentration in terms of customers, products and regions; to estimate the risk profile for the portfolio; and to anticipate possible worsening of the portfolio.

Specific policies for analysis and admission of new developer risk transactions

In the analysis of new operations, the assessment of the commercial operation in terms of the economic and financial viability of the project has been one of the constant points that have helped ensure the success and transformation of construction land operations for customers’ developments.

As regards the participation of the Risk Acceptance teams, they have a direct link and participate in the committees of areas such as Recoveries and the Real Estate Unit. This guarantees coordination and exchange of information in all the processes.

The following strategies have been implemented with customers in the developer sector: avoidance of large corporate transactions, which had already reduced their share in the years of greatest market growth; non active participation in the second-home market; commitment to public housing financing; and participation in land operations with a high level of urban development security, giving priority to land open to urban development.

Risk monitoring policies

The base information for analyzing the real estate portfolios is updated monthly. The tools used include the so-called “watch-list”, which is updated monthly with the progress of each client under watch, and the different strategic plans for management of special groups. There are plans that involve an intensification of the review of the portfolio for financing land, while, in the case of ongoing promotions, they are classified based on the rate of progress of the projects.

These actions have enabled BBVA to identify possible impairment situations, by always keeping an eye on BBVA’s position with each customer (whether or not as first creditor). In this regard, key aspects include management of the risk policy to be followed with each customer, contract review, deadline extension, improved collateral, rate review (repricing) and asset purchase.

Proper management of the relationship with each customer requires knowledge of various aspects such as the identification of the source of payment difficulties, an analysis of the company’s future viability, the updating of the information on the debtor and the guarantors (their current situation and business course, economic-financial information, debt analysis and generation of funds), and the updating of the appraisal of the assets offered as collateral.

BBVA has a classification of debtors in accordance with legislation in force in each country, usually categorizing each one’s level of difficulty for each risk.

Based on the information above, a decision is made whether to use the refinancing tool, whose objective is to adjust the structure of the maturity of the debt to the generation of funds and the customer’s payment capacity.

As for the policies relating to risk refinancing with the developer and real-estate sector, they are the same as the general policies used for all of the Group’s risks (see Note7.1.8). In the developer and real estate sector, they are based on clear solvency and viability criteria for projects, with demanding terms for additional guarantees and legal compliance, given a refinancing tool that standardizes criteria and variables when considering any refinancing operation.

In the case of refinancing, the tools used for enhancing the Bank’s position are: the search for new intervening parties with proven solvency and initial payment to reduce the principal debt or outstanding interest; the improvement of the debt bond in order to facilitate the procedure in the event of default; the provision of new or additional collateral; and making refinancing viable with new conditions (period, rate and repayments), adapted to a credible and sufficiently verified business plan.

Policies applied in the management of real estate assets in Spain

The policy applied for managing these assets depends on the type of real-estate asset, as detailed below.

In the case of completed homes, the final aim is the sale of these homes to private individuals, thus diluting the risk and beginning a new business cycle. Here, the strategy has been to help subrogation (the default rate in this channel of business is notably lower than in any other channel of residential mortgages) and to support customers’ sales directly, using BBVA’s own channel (BBVA Services and our branches), creating incentives for sale and including sale orders for BBVA. In exceptional case we have even accepted partial haircuts, with the aim of making the sale easier.

In the case of ongoing construction work, the strategy has been to help and promote the completion of the works in order to transfer the investment to completed homes. The whole developer Works in Progress portfolio has been reviewed and classified into different stages with the aim of using different tools to support the strategy. This includes the use of developer accounts-payable financing as a form of payment control, the use of project monitoring supported by the Real Estate Unit itself, and the management of direct suppliers for the works as a complement to the developer’s own management.

With respect to land, the fact that the vast majority of the risk is urban land simplifies the management. Urban management and liquidity control to tackle urban planning costs are also subject to special monitoring.

Quantitative information on activities in the real-estate market in Spain

The following quantitative information on real-estate activities in Spain has been prepared using the reporting models required by Bank of Spain Circular 5/2011, of November 30.

As of December 31, 2013, 2012 and 2011, exposure to the construction sector and real-estate activities in Spain stood at €22,760, €23,656 and €28,287 million, respectively. Of that amount, risk from loans to construction and real-estate development activities accounted for €13,505, €15,358 and€14,158 million, representing 8.8%, 8.7% and 8.1% of loans and advances to customers of the balance of business in Spain (excluding the government and other government agencies) and 2.3%, 2.4% and 2.4% of the total assets of the Consolidated Group.

Lending for real estate development according to the purpose of the loans as of December 31, 2013, 2012 and 2011 is shown below:

Download Excel

Download Excel

| December 2013 Financing allocated to construction and real estate development and its coverage |

Millions of Euros | ||

|---|---|---|---|

| Gross Amount | Drawn Over the Guarantee Value |

Specific coverage | |

| Loans recorded by the Group’s credit institutions (Business in Spain) |

13,505 | 5,723 | 5,237 |

| Of which: Impaired assets | 8,838 | 4,152 | 4,735 |

| Of which: Potential problem assets | 1,445 | 501 | 502 |

| Memorandum item: |

|

|

|

| Write-offs | 692 |

|

|

Download Excel

Download Excel

| December 2012 Financing allocated to construction and real estate development and its coverage |

Millions of Euros | ||

|---|---|---|---|

| Gross Amount | Drawn Over the Guarantee Value |

Specific coverage | |

| Loans recorded by the Group’s credit institutions (Business in Spain) |

15,358 | 6,164 | 5,642 |

| Of which: Impaired assets | 6,814 | 3,193 | 3,123 |

| Of which: Potential problem assets | 2,092 | 911 | 731 |

| Memorandum item: |

|

|

|

| Write-offs | 347 |

|

|

Download Excel

Download Excel

| December 2011 Financing allocated to construction and real estate development and its coverage |

Millions of Euros | ||

|---|---|---|---|

| Gross Amount | Drawn Over the Guarantee Value |

Specific coverage | |

| Loans recorded by the Group’s credit institutions (Business in Spain) |

14,158 | 4,846 | 1,441 |

| Of which: Impaired assets | 3,743 | 1,725 | 1,123 |

| Of which: Potential problem assets | 2,052 | 911 | 318 |

| Memorandum item: |

|

|

|

| Write-offs | 182 |

|

|

Download Excel

Download Excel

| Memorandum item: Consolidated Group Data (carrying amount) |

Millions of Euros | ||

|---|---|---|---|

| December 2013 | December 2012 | December 2011 | |

| Total loans and advances to customers, excluding the Public Sector (Business in Spain) | 152,836 | 176,123 | 174,467 |

| Total consolidated assets (total business) | 582,575 | 621,072 | 582,838 |

| Impairment losses determined collectively (total business) | 2,698 | 3,279 | 3,027 |

The following is a description of the real estate credit risk based on the types of associated guarantees:

Download Excel

Download Excel

| Credit: Gross amount (Business in Spain) | Millions of Euros | ||

|---|---|---|---|

| December 2013 | December 2012 | December 2011 | |

| Without secured loan | 1,303 | 1,441 | 1,105 |

| With secured loan | 12,202 | 13,917 | 13,053 |

| Terminated buildings | 7,270 | 8,167 | 6,930 |

| Homes | 6,468 | 7,148 | 6,431 |

| Other | 802 | 1,019 | 499 |

| Buildings under construction | 1,238 | 1,716 | 2,448 |

| Homes | 1,202 | 1,663 | 2,374 |

| Other | 36 | 53 | 74 |

| Land | 3,694 | 4,034 | 3,675 |

| Urbanized land | 2,120 | 2,449 | 2,404 |

| Rest of land | 1,574 | 1,585 | 1,271 |

| Total | 13,505 | 15,358 | 14,158 |

As of December 31, 2013, 2012 and 2011, 63%, 64.3% and 66% of loans to developers were guaranteed with buildings (90.1%, 89.1% and 94% are homes), and only 27.4%, 26.3% and 26% by land, of which 57.4%, 60.7% and 65% is urbanized, respectively.

The information on the retail mortgage portfolio risk (housing mortgage) as of December 31, 2013, 2012 and 2011, is as follows:

Download Excel

Download Excel

| Housing-acquisition loans to households (Business in Spain) |

Millions of Euros | ||

|---|---|---|---|

| December 2013 | December 2012 | December 2011 | |

| With secured loan (gross amount) | 82,680 | 87,224 | 79,043 |

| of which: Impaired loans | 5,088 | 3,163 | 2,371 |

| Total | 82,680 | 87,224 | 79,043 |

The loan to value (LTV) ratio of the above portfolio is as follows:

Download Excel

Download Excel

| December 2013 LTV Breakdown of secured loans to households for the purchase of a home (Business in Spain) |

Millions of Euros | |||||

|---|---|---|---|---|---|---|

| Total risk over the amount of the last valuation available (Loan To Value-LTV) | ||||||

| Less than or equal to 40% | Over 40% but less than or equal to 60% | Over 60% but less than or equal to 80% | Over 80% but less than or equal to 100% | Over 100% | Total | |

| Gross amount | 14,481 | 22,558 | 31,767 | 8,975 | 4,899 | 82,680 |

| of which: Impaired loans | 262 | 339 | 618 | 1,011 | 2,858 | 5,088 |

Download Excel

Download Excel

| December 2012 LTV Breakdown of secured loans to households for the purchase of a home (Business in Spain) |

Millions of Euros | |||||

|---|---|---|---|---|---|---|

| Total risk over the amount of the last valuation available (Loan To Value-LTV) | ||||||

| Less than or equal to 40% | Over 40% but less than or equal to 60% | Over 60% but less than or equal to 80% | Over 80% but less than or equal to 100% | Over 100% | Total | |

| Gross amount | 14,942 | 22,967 | 35,722 | 11,704 | 1,889 | 87,224 |

| of which: Impaired loans | 312 | 386 | 1,089 | 1,005 | 371 | 3,163 |

Download Excel

Download Excel

| December 2011 LTV Breakdown of secured loans to households for the purchase of a home (Business in Spain) |

Millions of Euros | |||||

|---|---|---|---|---|---|---|

| Less than or equal to 40% | Over 40% but less than or equal to 60% | Over 60% but less than or equal to 80% | Over 80% but less than or equal to 100% | Over 100% | Total | |

| Gross amount | 12, 408 | 19,654 | 32,887 | 12,870 | 1,224 | 79,043 |

| of which: Impaired loans | 276 | 218 | 695 | 922 | 260 | 2,371 |

Outstanding home mortgage loans as of December 31, 2013, 2012 and 2011 had an average LTV of 50%, 51% and 50% respectively.

As of December 31, 2013, the Group also had a balance of €853 million in non-mortgage loans for the purchase of housing (of which €36 million, respectively, were NPA).

The breakdown of foreclosed, acquired, purchased or exchanged assets from debt from loans relating to business in Spain, as well as the holdings and financing to non-consolidated entities holding such assets is as follows:

Download Excel

Download Excel

| Information about assets received in payment of debts (Business in Spain) | Millions of Euros | ||

|---|---|---|---|

| Gross Value |

Provisions | Carrying Amount | |

| Real estate assets from loans to the construction and real estate development sectors in Spain. | 9,173 | 5,088 | 4,085 |

| Terminated buildings | 3,038 | 1,379 | 1,659 |

| Homes | 2,059 | 925 | 1,134 |

| Other | 979 | 454 | 525 |

| Buildings under construction | 845 | 439 | 406 |

| Homes | 819 | 423 | 396 |

| Other | 26 | 16 | 10 |

| Land | 5,290 | 3,270 | 2,020 |

| Urbanized land | 3,517 | 2,198 | 1,319 |

| Rest of land | 1,773 | 1,072 | 701 |

| Real estate assets from mortgage financing for households for the purchase of a home | 2,874 | 1,164 | 1,710 |

| Rest of foreclosed real estate assets | 918 | 411 | 507 |

| Equity instruments, investments and financing to non-consolidated companies holding said assets | 730 | 408 | 322 |

| Total | 13,695 | 7,071 | 6,624 |

Download Excel

Download Excel

| Information about assets received in payment of debts (Business in Spain) | Millions of Euros | ||

|---|---|---|---|

| Gross Value |

Provisions | Carrying Amount | |

| Real estate assets from loans to the construction and real estate development sectors in Spain. | 8,894 | 4,893 | 4,001 |

| Terminated buildings | 3,021 | 1,273 | 1,748 |

| Homes | 2,146 | 877 | 1,269 |

| Other | 875 | 396 | 479 |

| Buildings under construction | 908 | 528 | 380 |

| Homes | 881 | 512 | 369 |

| Other | 27 | 16 | 11 |

| Land | 4,965 | 3,092 | 1,873 |

| Urbanized land | 3,247 | 2,048 | 1,199 |

| Rest of land | 1,718 | 1,044 | 674 |

| Real estate assets from mortgage financing for households for the purchase of a home | 2,512 | 1,020 | 1,492 |

| Rest of foreclosed real estate assets | 653 | 273 | 380 |