Banking activity in Spain

Highlights

- Activity growth in high profitable segments.

- Good performance of net fees and commissions.

- Operating expenses decline during all quarters.

- Solid asset-quality indicators: lower impairments and provisions.

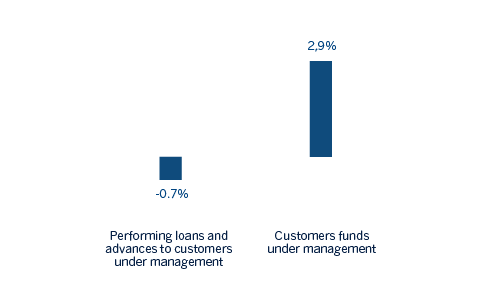

Business activity (1)

(Year-on-year change. Data as of 31-12-2018)

(1) Excluding repos.

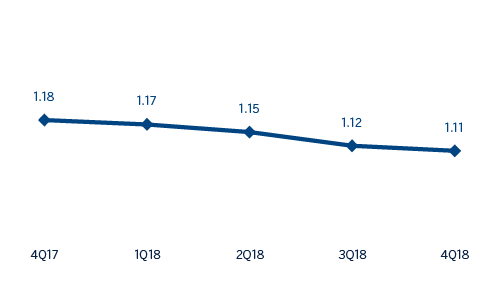

Net interest income/ATAs

(Percentage)

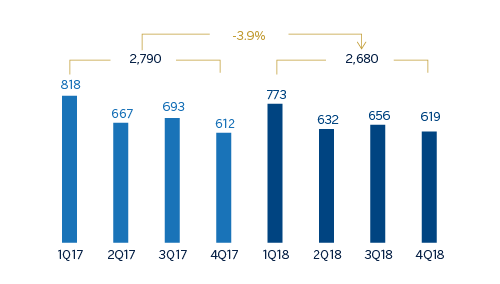

Operating income (Millions of Euros)

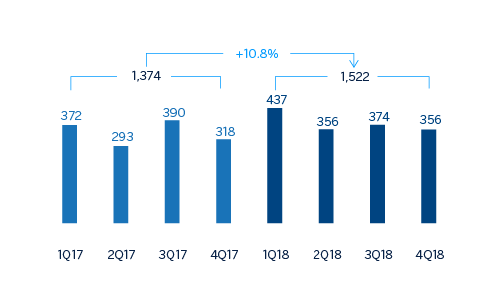

Net attributable profit (Millions of Euros)

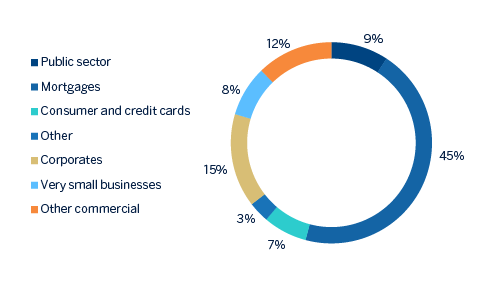

Breakdown of performing loans under management (1)

(31-12-2018)

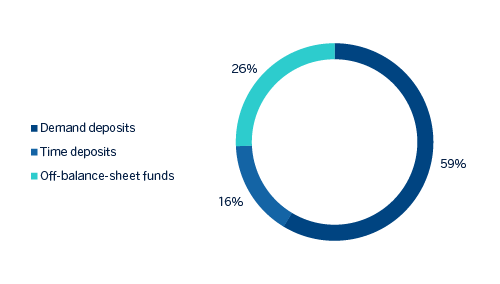

Breakdown of customer funds under management (1)

(31-12-2018)

(1) Excluding repos.

(1) Excluding repos.

Financial statements and relevant business indicators (Millions of Euros and percentage)

| IFRS 9 | IAS 39 | |||||

|---|---|---|---|---|---|---|

| Income statement | 2018 | ∆% | 2017 | |||

| Net interest income | 3,672 | (1.8) | 3,738 | |||

| Net fees and commissions | 1,681 | 7.7 | 1,561 | |||

| Net trading income | 466 | (16.1) | 555 | |||

| Other operating income and expenses | 124 | (62.0) | 327 | |||

| of which Insurance activities (1) | 485 | 12.0 | 433 | |||

| Gross income | 5,943 | (3.8) | 6,180 | |||

| Operating expenses | (3,262) | (3.8) | (3,390) | |||

| Personnel expenses | (1,862) | (2.9) | (1,917) | |||

| Other administrative expenses | (1,113) | (3.6) | (1,154) | |||

| Depreciation | (288) | (9.8) | (319) | |||

| Operating income | 2,680 | (3.9) | 2,790 | |||

| Impairment on financial assets not measured at fair value through profit or loss | (371) | (34.6) | (567) | |||

| Provisions or reversal of provisions and other results | (292) | (20.9) | (369) | |||

| Profit/(loss) before tax | 2,017 | 8.8 | 1,854 | |||

| Income tax | (492) | 3.1 | (477) | |||

| Profit/(loss) for the year | 1,525 | 10.8 | 1,377 | |||

| Non-controlling interests | (3) | 7.1 | (3) | |||

| Net attributable profit | 1,522 | 10.8 | 1,374 | |||

- (1) Includes premiums received net of estimated technical insurance reserves.

| IFRS 9 | IAS 39 | |||||

|---|---|---|---|---|---|---|

| Balance sheets | 31-12-18 | ∆% | 31-12-17 | |||

| Cash, cash balances at central banks and other demand deposits | 27,841 | 106.8 | 13,463 | |||

| Financial assets designated at fair value | 100,094 | 25.9 | 79,501 | |||

| of which loans and advances | 28,451 | n.s. | 1,312 | |||

| Financial assets at amortized cost | 193,936 | (12.4) | 221,391 | |||

| of which loans and advances to customers | 169,856 | (7.3) | 183,172 | |||

| Inter-area positions | 7,314 | n.s. | 1,806 | |||

| Tangible assets | 1,263 | 44.1 | 877 | |||

| Other assets | 4,846 | 103.6 | 2,380 | |||

| Total assets/liabilities and equity | 335,294 | 5.0 | 319,417 | |||

| Financial liabilities held for trading and designated at fair value through profit or loss | 66,255 | 80.0 | 36,817 | |||

| Deposits from central banks and credit institutions | 44,043 | (29,2) | 62.226 | |||

| Deposits from customers | 180,891 | 1.8 | 177,763 | |||

| Debt certificates | 30,451 | (8.6) | 33,301 | |||

| Inter-area positions | - | - | - | |||

| Other liabilities | 5,756 | n.s. | 391 | |||

| Economic capital allocated | 7,898 | (11.5) | 8,920 | |||

| Relevant business indicators | 31-12-18 | ∆% | 31-12-17 |

|---|---|---|---|

| Performing loans and advances to customers under management (1) | 166,131 | (0.7) | 167,291 |

| Non-performing loans | 9,101 | (16.0) | 10,833 |

| Customer deposits under management (1) | 181,119 | 3.6 | 174,822 |

| Off-balance sheet funds (2) | 62,557 | 0.8 | 62,054 |

| Risk-weighted assets | 100,950 | (6.6) | 108,141 |

| Efficiency ratio (%) | 54.9 | - | 54.9 |

| NPL ratio (%) | 4.6 | - | 5.5 |

| NPL coverage ratio (%) | 57 | - | 50 |

| Cost of risk (%) | 0.21 | - | 0.32 |

- (1) Excluding repos.

- (2) Includes mutual funds. pension funds and other off-balance-sheet funds.

Macro and industry trends

According to the latest information from the National Institute of Statistics (INE for its acronym in Spanish), the Spanish economy grew 0.6% on a quarterly basis during the the third quarter of 2018, consolidating a solid growth throughout the year but at a more moderate pace than the two previous years. The most recent indicators show that this progress of the GDP has continued in the last quarter of 2018, supported by robust domestic factors related to the improvement of the labor market and favorable financial conditions. Both monetary and fiscal policy continue to support growth, while the depreciation of the euro and demand in the euro zone must continue to support exports. All in all, the economy could have grown around 2.5% in 2018.

Regarding the Spanish banking system and according to October 2018 data from the Bank of Spain (latest published data), the total volume of lending to the private sector (household and corporate) continued to decline year-on-year (down 3.0%). Non-performing loans in the sector decreased significantly (down 28.2% year-on-year as of October 2018) driven by the completion of several transactions of non-performing loans and real-estate assets during 2018. At the end of October, the sector’s NPL ratio was 6.08%, that is 26.0% below the figure registered in the previous year.

Activity

The most relevant aspects related to the area’s activity during 2018 were:

- Lending (performing loans under management) closed in line with the figure at the end of December 2017 (down 0.7% year-on-year), mainly due to the reduction in the mortgage portfolio (down 3.6%) and other commercial portfolios (-11.2%). In contrast, consumer financing and credit cards maintained a very positive performance (during the course of the year up 21.9%), which, together with the good evolution of the SME portfolio (+6.5%), offset the reduction of mortgage loans. In the last three months of 2018 there has been a transfer of outstanding portfolio of performing loans from Non Core Real Estate to Banking Activity in Spain, amounting to €60m, which, in addition to the e one completed in the first semester amounts to a total of €260m in the year.

- In asset quality, the non-performing loans balance showed a downward trend over the year that positively affected the area’s NPL ratio, which reduced to 4.6% from the 5.5% as of 31-December-2017. The NPL coverage ratio closed at 57%, 660 basis points above the closing of 2017.

- Customer deposits under management grew by 3.6% compared to the close of December 2017 (up 3.5% in the last quarter of 2018). By products, there was a decline in time deposits (down 20.4% year-on-date), that has by far offset by the increase in demand deposits (up 12.7%), which as of December represent approximately 80% of total liabilities.

- The off-balance-sheet funds funds showed a slight increase with respect to the figure registered twelve months before (+0.8%), despite of the unfavorable evolution of the markets, especially in the last quarter.

Results

The net attributable profit generated by the Banking Activity in Spain in 2018 reached €1,522m, which represents a year-on-year increase of 10.8%, strongly supported by the favorable performance of commissions, a strict control of operating expenses and provisions. The highlights of the area’s income statement are:

- Net interest income a decline of 1.8% year-on-year although it increased slightly in the fourth quarter of 2018 (+1.2%). The smaller contribution from targeted longer-term refinancing operations (TLTRO) explained most of this evolution.

- Positive performance of net fees and commissions (up 7.7% year-on-year), which offset by far the decline in net interest income. There was a significant contribution from asset management fees and banking commissions.

- Lower contribution from NTI compared to the same period of previous year (down 16.1%), associated with lower ALCO portfolio sales in 2018.

- Reduction in other income/expenses (down 62.0% year-on-year). One of the aspects explaining this is the greater contribution made to the DGF and SRF compared to 2017. Also, net earnings from the insurance business showed an increase of 12.0%.

- Operating expenses declined by 3.8% and the efficiency ratio closed at 54.9%, in line with the figure registered at the close of 2017.

- Decline in impairment losses on financial assets (down 34.6% year-on-year) explained by lower gross additions to NPLs and loan-loss provisions for large customers. As a result, the cumulative cost of risk stood at 0.21% as of December 31, 2018.

- Lastly, provisions (net) and other gains (losses) showed a year-on-year decline of 20.9%, mainly favoured by lower restructuring costs.