Both Garanti and CNCB continued to perform well from January through September 2012. As a result, Eurasia had gross income of €1,624m, up 22.2% over the last 12 months, despite the drop in NTI over the quarter.

Operating expenses increased by 32.2% in the same period due to the investment projects undertaken, mainly in emerging countries. However, their growth rate slowed compared with previous quarters. Thus, operating income increased by 17.3% on the figure for the same date in 2011. Impairment losses on financial assets amounted €138m, and the net attributable profit in the area was €813m, 13.0% up on the figure for January-September 2011.

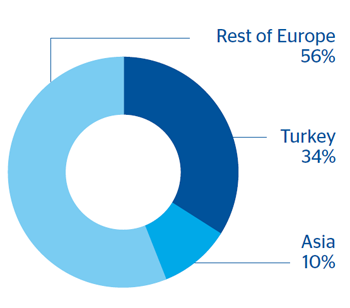

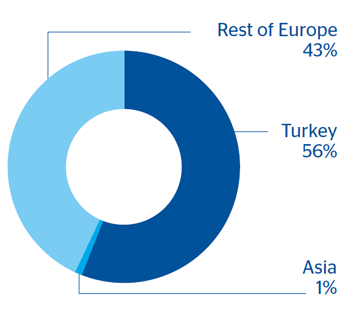

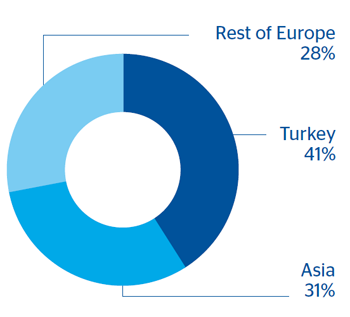

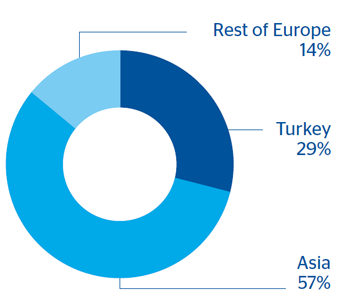

Europe generated 42.4% of the net attributable profit in the area, at €345m (up 1.4% year-on-year). Of particular note in the area is the continued excellent performance of Turkey, whose cumulative earnings of €233m were over twice the figure for the first nine months of the previous year (partly because Garanti has contributed for the nine months in 2012, while in 2011 it began to contribute at the end of March). In the rest of Europe, the reduced activity and market turbulence of the previous quarters continued. This had a negative impact on the net attributable profit, with a cumulative figure of €112m.

The following are worth highlighting with respect to Garanti Bank:

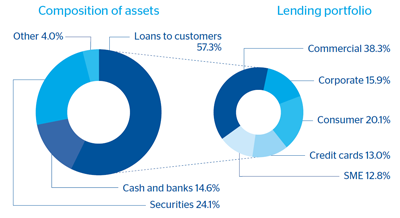

- Lending has continued the trend seen in previous quarters and rose by 9.6% on September 2011. Of particular note is the selective growth in higher yield portfolios, basically in local currency, with the emphasis on profitability rather than volume. Thus, Garanti continued its superior increase in mortgage lending (up 13% year-on-year compared with the figure of 9.5% for the sector as a whole), auto-finance (up 15.2% compared with the sector figure of 10.7%) and personal loans (up 17.2% compared with 16.9% for the sector).

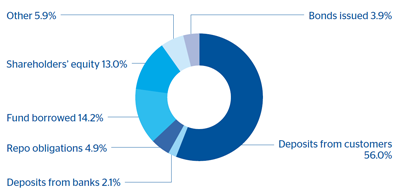

- Adequate mix of well diversified and actively managed liabilities, with customer deposits up 10.6% over the last 12 months. The increased growth continues to be focused on lower-cost products, such as local-currency customer deposits, in which Garanti has performed notably better than the sector.

- In the third quarter, there was also a significant reduction in the cost of liabilities, both in deposits and repos. As a result, the spread between the yield on assets and the cost of liabilities has increased.

- With respect to liquidity, Garanti has a loan-to-deposit ratio of under 100%.

- In terms of solvency, the Garanti Group maintains its position as one of the soundest in the country, with a capital ratio of 16.4% according to Basel II criteria. In the transition to Basel II, Garanti has increased its capital ratio, while it fell in the industry as a whole.

- In terms of productivity per employee and branch, Garanti leads the ranking for the sector in Turkey.

- In earnings, it has outstandingly sound recurring revenue. Net interest income grew at a year-on-year rate of 23% thanks to excellent price management and growth in activity. Income from fees and commissions, appropriately diversified between different products and segments, fell by 1% due largely to the coming into force of a new regulation that stipulates new loans must be recognized on an accrual basis. The above, together with a high level of discipline in expenses, high asset quality and the lack of one-off earnings, led to a €1,129m profit of the Garanti Group for the first nine months of 2012, a year-on-year rise of 5.6%. Thus, Garanti remains as the biggest bank in Turkey by earnings.

Finally, Asia recorded a cumulative net attributable profit of €468m, 23.3% up on the figure 12 months earlier thanks to the excellent performance of CNCB. According to data for the first half of 2012, the bank in China earned 28.9% more than in the same period in 2011. This is due to increased recurring revenue (net interest income plus fees and commissions) as a result of strong activity, and the positive performance of the intermediation business. Operating expenses rose less than gross income, and as a result efficiency improved. Loan-loss provisions increased with the aim of raising the coverage ratio. Among the highlights of activity was the increase in deposits, which grew more than the loan book (17% and 13% in year-on-year terms, respectively). Finally, CNCB improved its solvency ratio, which stood at 13.4% at the close of June 2012, using local criteria.