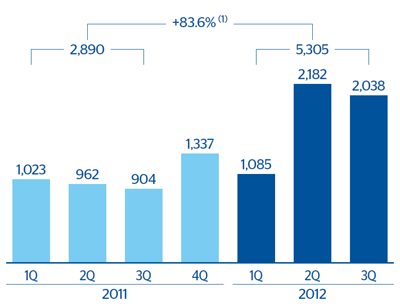

The strong generation of operating income has enabled the Group to absorb a significant increase in its loan-loss provisions in Spain in order to cover the ongoing impairment of its real estate portfolios and assets. Impairment losses on financial assets to September totaled €5,305m, up 83.6% on the figure recorded 12 months earlier.

Provisions in the same period amounted to –€427m (–€328m 12 months earlier). They basically cover early retirement costs and, to a lesser extent, transfers to provisions for contingent liabilities, allocations to pension funds and other commitments with the staff.

The other gains (losses) heading nearly tripled between January and September 2012 compared with the amount reported for the same period in 2011, at a negative €1,095m. This heading includes provisions made for real estate and foreclosed and acquired assets in Spain and the badwill generated by the Unnim deal.

In conclusion, adding the provisions made to cover the impairment of the assets related to the real estate sector in Spain (accounted both as impairment losses on financial assets and other gains (losses)), the total amount charged by BBVA year to date totals €2.9 billion (€1.6 billion in the third quarter).

Finally, as in the last quarter, the level of income tax was low for the same reasons mentioned then: revenue with low or no tax rate (mainly dividends and income by the equity method) and the growing weight of the earnings from Mexico, South America and Turkey, where effective tax rates are low.