Following the agreement reached with Oriental Financial Group to sell the Puerto Rico business, the assets of this unit have been classified as non-current assets held for sale. Practically all the information mentioned below, unless otherwise indicated (and as in the previous quarter) therefore refers to BBVA Compass which, as of September 30, 2012 accounted for 94% of the business volume in the area (meaning the sum of gross lending to customers plus total customer funds) and 83% of the net attributable profit.

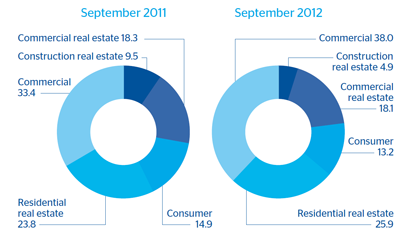

BBVA Compass continued to see sustained growth in its loan book over the quarter, with gross lending to customers of €34,383m as of 30-Sep-2012, up 4.5% year-on-year and 0.8% over the quarter. Loans to the commercial and residential real estate segment continue to drive growth in the bank’s lending activity, with year-on-year increases of 25.5% and 20.3%, respectively. Specifically, commercial loans are benefiting from the good performance of lending to the healthcare sector, public-sector finance and asset-based lending. The strategic plan of BBVA Compass includes a reduction in lending to the construction real estate industry, with a fall of 41.3% year-on-year and 8.7% quarter-on-quarter.

With respect to asset quality indicators in the area, the NPA ratio dropped to 2.4% at the close of September 2012, while the coverage ratio rose to 94%. At the end of the first half of 2012, the NPA ratio was 2.8% and the coverage ratio was 82%.

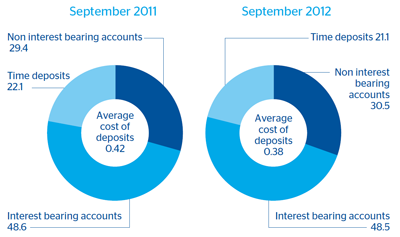

Customer deposits in BBVA Compass also grew by 4.6% in the quarter (up 9.5% over the last twelve months) thanks to recent campaigns to win new customers. Both demand and time deposits grew, although most of this increase was due to the continued rise in lower-cost liabilities (current and savings accounts).