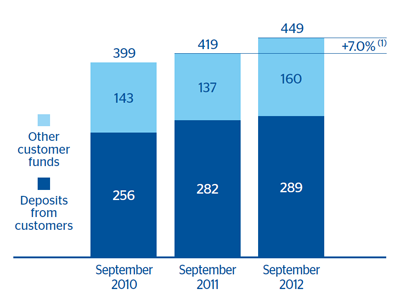

Total customer funds amounted to €449 billion as of 30-Sep-2012, a year-on-year increase of 7.0% (up 4.8% since 30-Jun-2012).

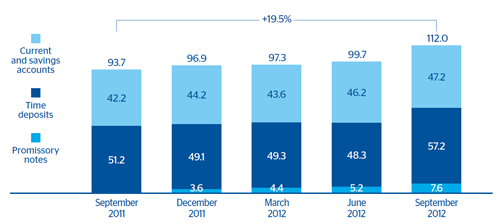

With respect to on-balance-sheet customer funds, BBVA managed a volume of customer deposits, excluding promissory notes, of €289 billion as of 30-Sep-2012, up 2.4% since September 2011 and 5.3% on 30-Jun-2012. As can be seen in the accompanying table showing customer funds, there has been a significant growth over the quarter in the domestic sector as a result of the incorporation of Unnim and the growth in customer funds (including promissory notes) over the quarter. In the non-domestic sector, volumes have been maintained at very similar levels to the close of June 2012. The fall in deposits linked to wholesale customers has thus been offset by the positive trend in balances from the retail segment in practically all the geographical areas, as shown on the following sections dedicated to each of the Group’s business areas.

All in all, BBVA maintains intact its high capacity to gather deposits and the capillarity of its commercial network, as retail deposits (including promissory notes) grew in both the domestic and non-domestic sectors.

Off-balance-sheet customer funds closed September at €160 billion, up 16.7% year-on-year and 4.0% quarter-on-quarter. In contrast with other quarters, there was a slight year-on-year increase in Spain, due to the positive performance of pension funds and customer portfolios. BBVA is the biggest pension fund manager in Spain and the only one of the top five to increase its market share between June 2011 and June 2012. As of 30-Jun-2012, its market share was 19.1%, 81 basis points higher than the figure for the previous year.

In the non-domestic sector, assets under management in mutual funds and pensions funds, as well as customer portfolios, have continued to grow.