The BBVA Group’s income statement for the third quarter of 2012 continues to show a high level of recurring revenue, which has enabled it to absorb the impairment on assets related to the real estate sector in Spain. In addition, the incorporation of Unnim has generated badwill of €320m.

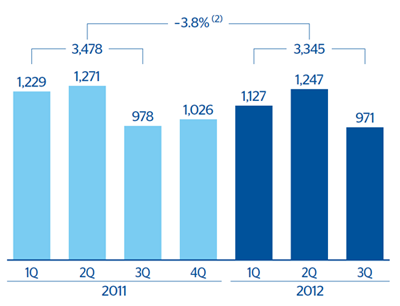

The Group’s quarterly profit stands at €146m, which brings the cumulative figure through September 30, 2012 to €1,656m. Excluding the charge for the aforementioned impairment of assets related to the real estate sector in Spain and Unnim’s badwill, the adjusted net attributable profit amounts to €971m over the quarter, with a cumulative figure through September of €3,345m.

Consolidated income statement: quarterly evolution

(Million euros)

|

2012 |

2011 |

|

3Q |

2Q |

1Q |

4Q |

3Q |

2Q |

1Q |

| Net interest income |

3,880 |

3,744 |

3,597 |

3,485 |

3,286 |

3,215 |

3,175 |

| Net fees and commissions |

1,259 |

1,215 |

1,216 |

1,136 |

1,143 |

1,167 |

1,114 |

| Net trading income |

337 |

462 |

367 |

416 |

(25) |

336 |

752 |

| Dividend income |

35 |

311 |

27 |

230 |

50 |

259 |

23 |

| Income by the equity method |

172 |

178 |

193 |

207 |

150 |

123 |

121 |

| Other operating income and expenses |

13 |

51 |

47 |

42 |

22 |

62 |

79 |

| Gross income |

5,697 |

5,960 |

5,447 |

5,515 |

4,627 |

5,162 |

5,263 |

| Operating Costs |

(2,831) |

(2,688) |

(2,585) |

(2,652) |

(2,461) |

(2,479) |

(2,359) |

| Personnel expenses |

(1,483) |

(1,429) |

(1,379) |

(1,404) |

(1,325) |

(1,306) |

(1,276) |

| General and administrative expenses |

(1,086) |

(1,021) |

(974) |

(1,021) |

(920) |

(964) |

(887) |

| Depreciation and amortization |

(262) |

(238) |

(232) |

(227) |

(216) |

(208) |

(196) |

| Operating income |

2,866 |

3,272 |

2,862 |

2,863 |

2,166 |

2,683 |

2,904 |

| Impairment on financial assets (net) |

(2,038) |

(2,182) |

(1,085) |

(1,337) |

(904) |

(962) |

(1,023) |

| Provisions (net) |

(197) |

(99) |

(131) |

(182) |

(94) |

(83) |

(150) |

| Other gains (losses) |

(561) |

(311) |

(222) |

(1,718) |

(166) |

(154) |

(71) |

| Income before tax |

69 |

680 |

1,423 |

(375) |

1,002 |

1,484 |

1,659 |

| Income tax |

236 |

(21) |

(250) |

368 |

(95) |

(189) |

(369) |

| Net income |

305 |

659 |

1,173 |

(7) |

907 |

1,295 |

1,290 |

| Non-controlling interests |

(159) |

(154) |

(168) |

(132) |

(103) |

(106) |

(141) |

| Net attributable profit |

146 |

505 |

1,005 |

(139) |

804 |

1,189 |

1,150 |

| Adjusted (1) |

(825) |

742 |

122 |

1,166 |

173 |

82 |

80 |

| Net attributable profit (adjusted) (1) |

971 |

1,247 |

1,127 |

1,026 |

978 |

1,271 |

1,229 |

| Basic earnings per share (euros) |

0.03 |

0.10 |

0.19 |

-0.03 |

0.16 |

0.24 |

0.24 |

| Basic earnings per share adjusted (euros) (1) |

0.18 |

0.23 |

0.22 |

0.21 |

0.20 |

0.26 |

0.25 |

(1) In 2011, during the fourth quarter, US goodwill imparment charge. In 2011 and 2012, impairment charge related to the deterioration of the real estate sector in Spain. And in the third quarter of 2012, impact of Unnim badwill.

Consolidated income statement

(Million euros)

|

January-Sep.12 |

Δ % |

Δ% at constant

exchange rate |

January-Sep. 11 |

| Net interest income |

11,220 |

16.0 |

12.3 |

9,676 |

| Net fees and commissions |

3,690 |

7.8 |

4.5 |

3,424 |

| Net trading income |

1,167 |

9.8 |

5.9 |

1,063 |

| Dividend income |

373 |

12.2 |

11.6 |

332 |

| Income by the equity method |

543 |

37.9 |

37.8 |

394 |

| Other operating income and expenses |

112 |

(31.6) |

(14.1) |

163 |

| Gross income |

17,103 |

13.6 |

10.5 |

15,052 |

| Operating Costs |

(8,103) |

11.0 |

7.9 |

(7,299) |

| Personnel expenses |

(4,290) |

9.8 |

6.8 |

(3,907) |

| General and administrative expenses |

(3,081) |

11.2 |

8.0 |

(2,771) |

| Depreciation and amortization |

(732) |

17.9 |

13.8 |

(620) |

| Operating income |

9,000 |

16.1 |

13.0 |

7,753 |

| Impairment on financial assets (net) |

(5,305) |

83.6 |

80.0 |

(2,890) |

| Provisions (net) |

(427) |

30.4 |

28.1 |

(328) |

| Other gains (losses) |

(1,095) |

180.0 |

179.9 |

(391) |

| Income before tax |

2,173 |

(47.6) |

(49.4) |

4,145 |

| Income tax |

(36) |

(94.5) |

(94.8) |

(652) |

| Net income |

2,137 |

(38.8) |

(40.8) |

3,492 |

| Non-controlling interests |

(481) |

37.6 |

25.4 |

(349) |

| Net attributable profit |

1,656 |

(47.3) |

(48.7) |

3,143 |

| Adjusted (1) |

(1,688) |

- |

- |

(335) |

| Net attributable profit (adjusted) (1) |

3,345 |

(3.8) |

(6.1) |

3,478 |

| Basic earnings per share (euros) |

0.32 |

|

|

0.64 |

| Basic earnings per share adjusted (euros) (1) |

0.63 |

|

|

0.71 |

(1) In 2011, during the fourth quarter, US goodwill imparment charge. In 2011 and 2012, impairment charge related to the deterioration of the real estate sector in Spain. And in the third quarter of 2012, impact of Unnim badwill.

Net attributable profit (1)

(Million euros)

(1) Adjusted.

(2) At constant exchange rates: –6.1%.